PeopleImages

International Game Technology PLC (NYSE:IGT) recently delivered beneficial guidance, and noted that its figures are usually not that affected by global recessions. Considering the amount of money invested in product development and new jurisdictions accepting online gaming, revenue growth is likely. I also believe that the separation of the Digital & Betting business segment could be very beneficial for the company’s valuation. Yes, there are risks, but the IGT stock price is not at all expensive.

IGT

International Game Technology PLC is a global leader in gaming products like gaming machines and lotteries to sports betting.

Source: Company’s Website

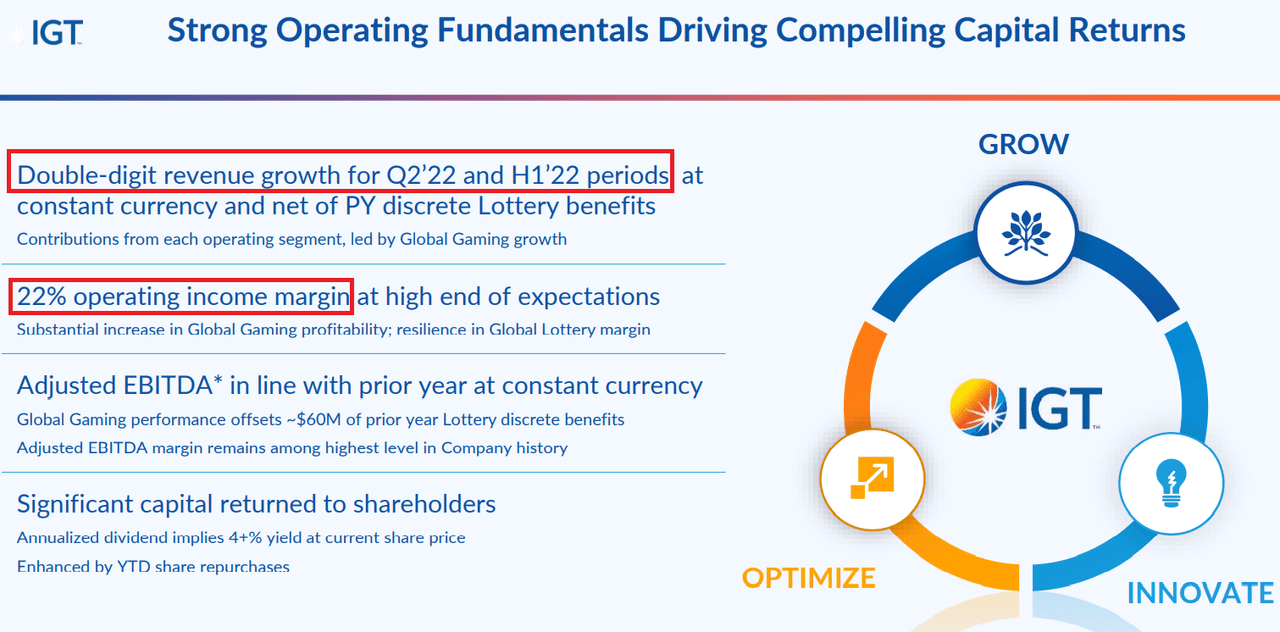

I became very interested in IGT’s business profile after reviewing the company’s most recent figures. With global gaming growth leading other business segments, IGT reported double-digit sales growth for Q2 2022 and the first half of 2022. Management also reported an impressive 22% operating income margin.

Source: Quarterly Presentation

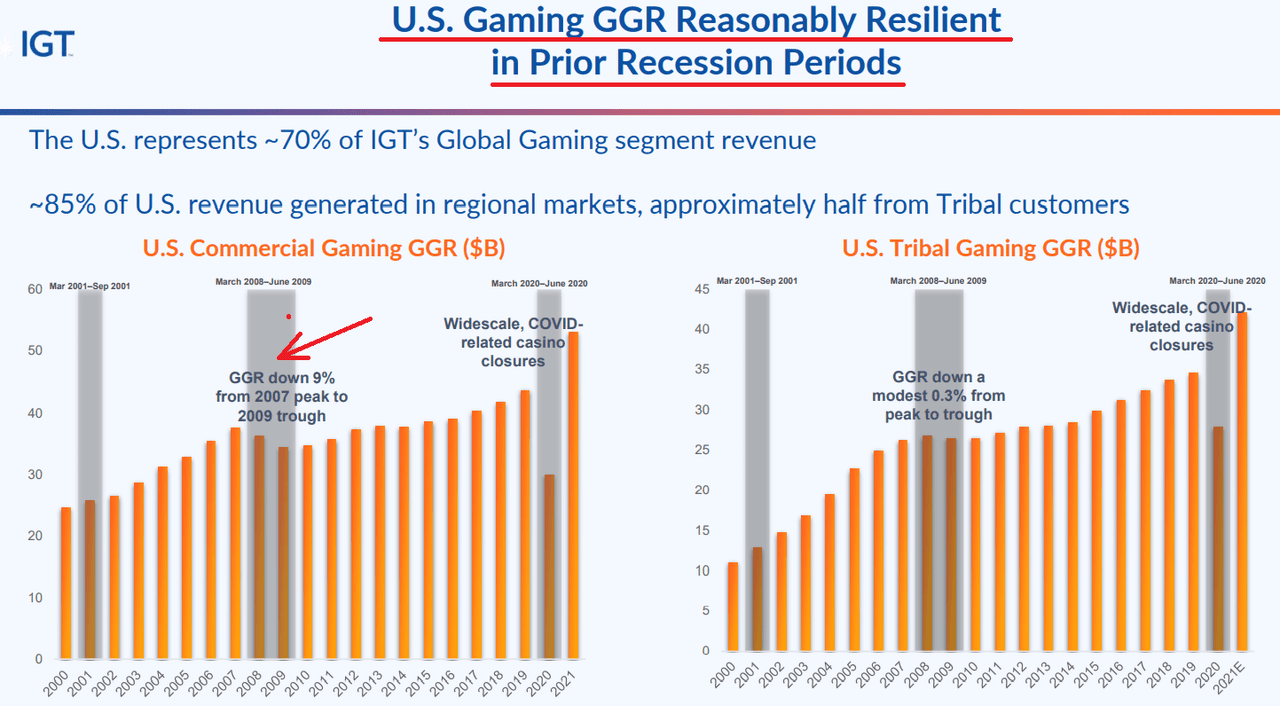

With many economists out there noting that a recession could occur, a position in IGT is worth consideration. Keep in mind that the company’s business model, in the past, behaved quite well during recessions.

Quarterly Presentation

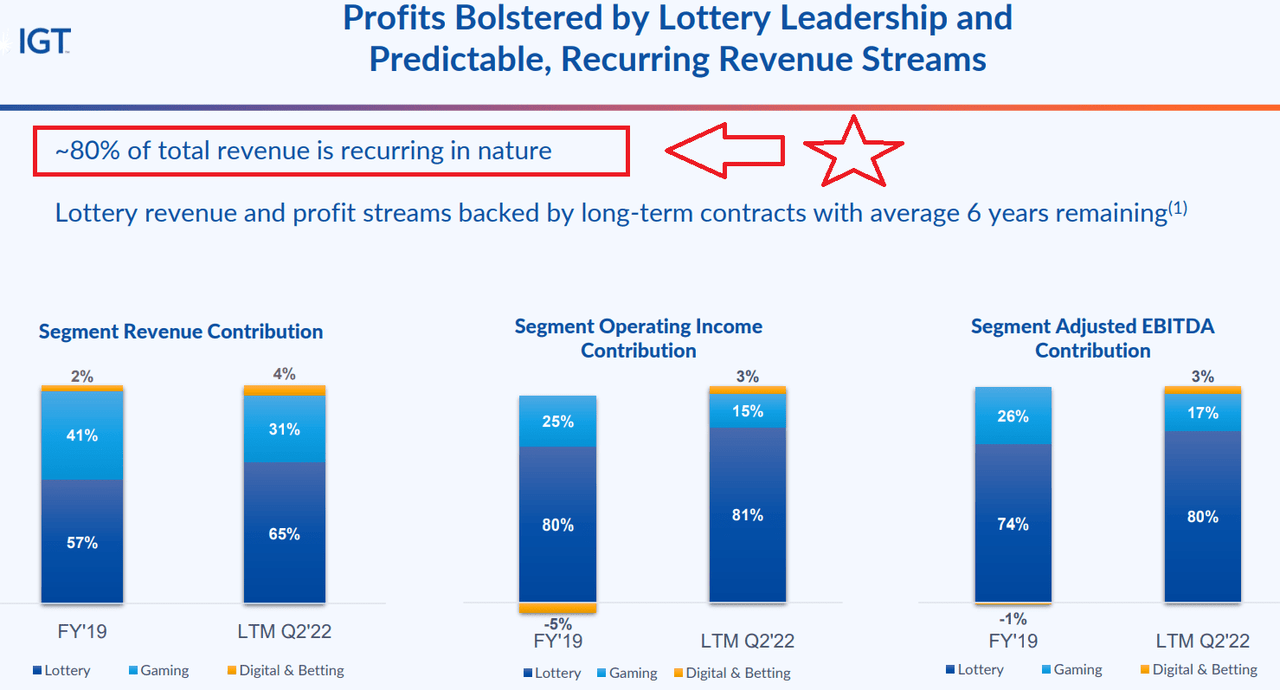

It is also quite beneficial that IGT reports an impressive 80% recurrent revenue mainly thanks to the company’s lottery business segment and gaming. Recurrent revenue is like music for my ears, as free cash flow forecasting is easy.

Quarterly Presentation

Expectations Include Sales Growth, Free Cash Flow Growth, And A Small Increase In Capex

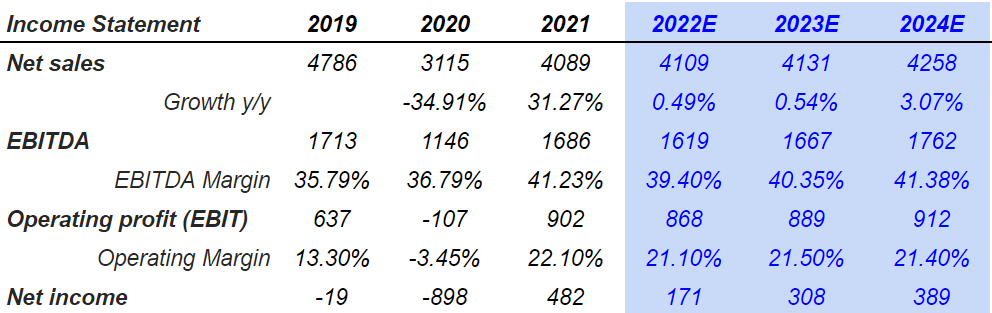

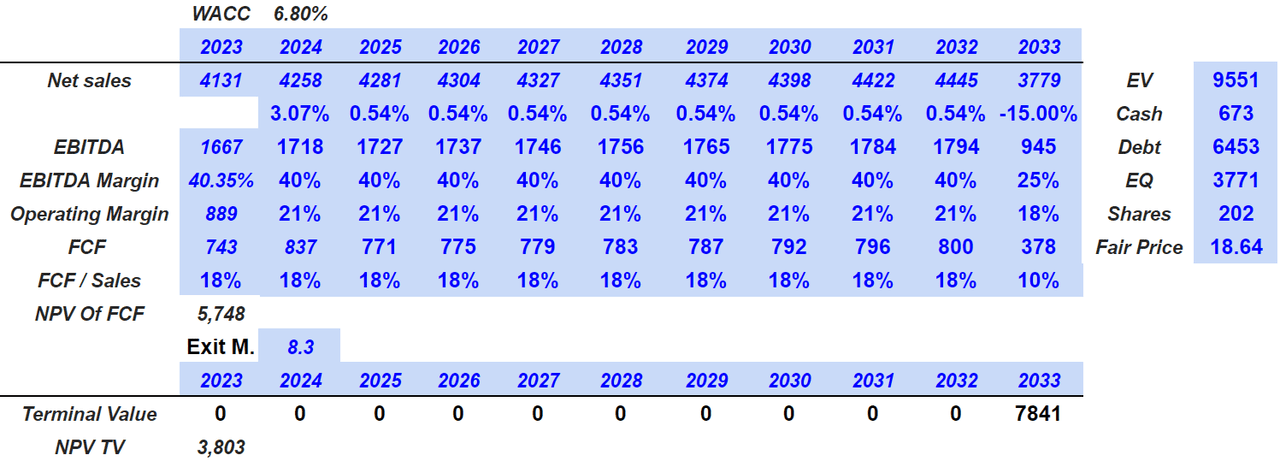

In my view, investors will most likely have a look at the expectations of other analysts before having a look at my numbers. Market estimates include 2022 sales growth of 0.49% and 2023 sales growth of 0.54%. EBITDA margin for 2022 and 2023 would also stay at around 39% and 40% respectively, and net income would most likely remain positive in 2022, 2023, and 2024.

Source: Marketscreener.com

With respect to the cash flow statement, there is a lot to like. Analysts believe that the FCF will grow from $557 million in 2022 to $743 million in 2023 and $837 million in 2024. It is worth noting that capex is not expected to decrease from 2022 to 2024. The increase in free cash flow will not be caused by a decrease in capex.

Source: Marketscreener.com

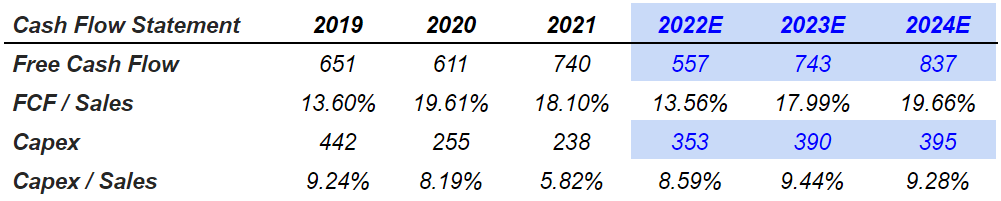

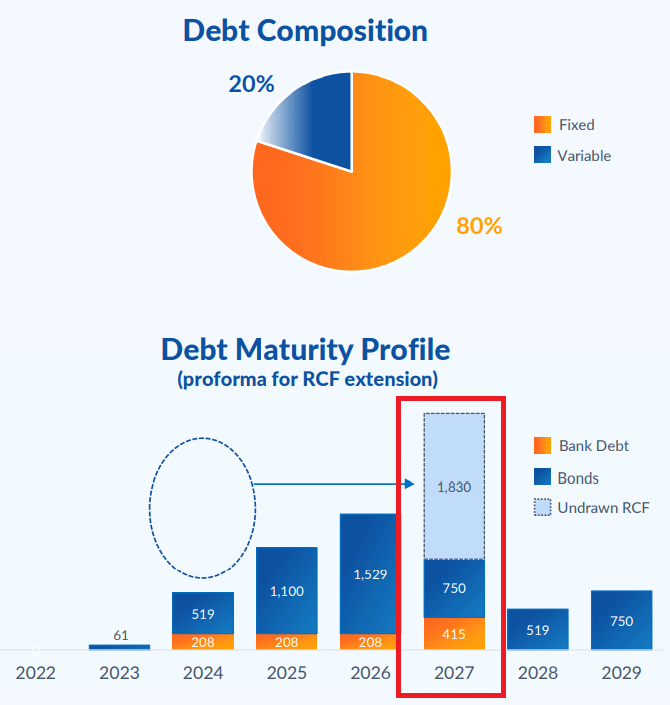

I tried to obtain a few figures from the numbers delivered by investment analysts. Median figures include net sales growth around 0.54%, EBITDA margin of 40%, and FCF/Sales of 18%.

Author’s Compilations

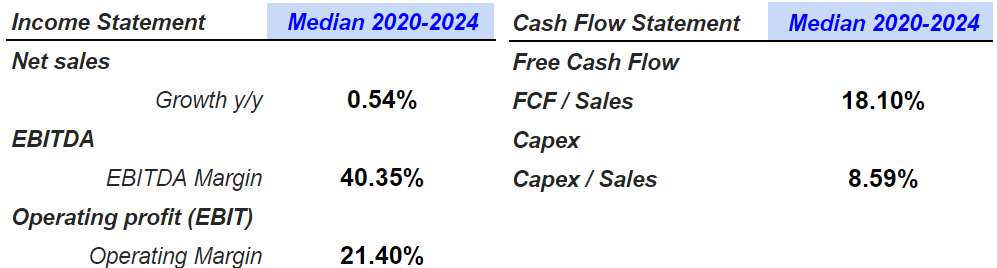

The outlook delivered by management is also optimistic. Forward revenue is expected to be close to $4.1 billion with an operating income margin of 20% and capex around $350 million. In my view, the figures of management are not very different from that of other financial advisors.

Quarterly Presentation

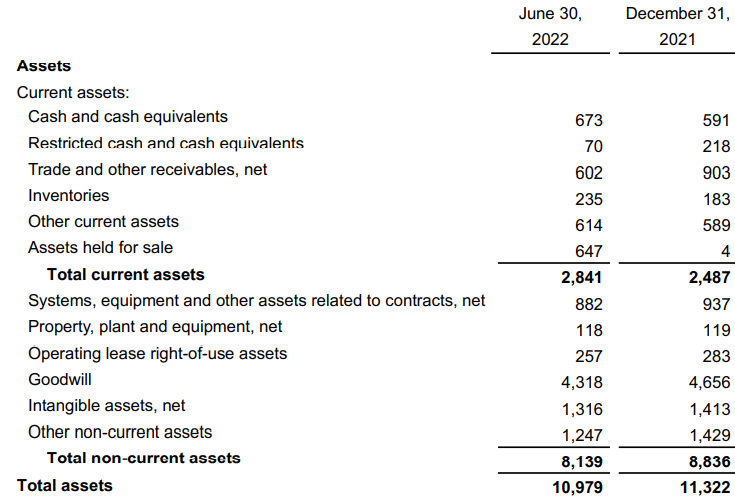

Balance Sheet

As of June 30, 2022, IGT has $673 million in cash and an asset/liability ratio close to 1x. Goodwill and intangible assets represent close to 51% of the total amount of assets. Hence, I believe that impairment of intangibles may have meaningful consequences for the company’s balance sheet.

10-Q

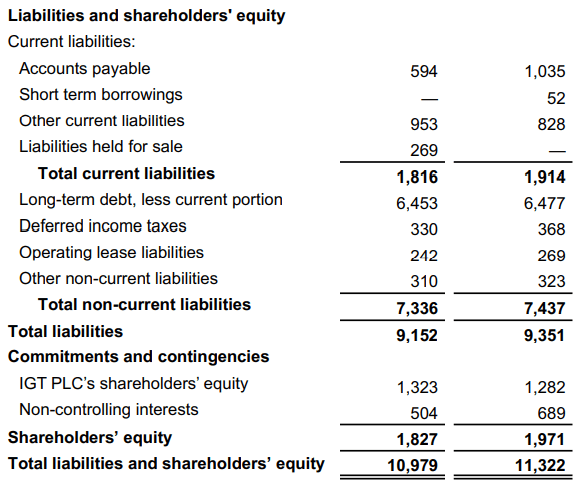

Long-term debt stands at $6.45 billion, which is not at all small. However, the company will have to pay most of its debts in 2027. I believe that in the future, IGT may generate sufficient free cash flow to renegotiate its debts with bankers.

10-Q Quarterly Presentation

Further Product Development, New Mobile Phone Apps, And The Separation Of The Digital & Betting Business Segment Could Mean A Valuation Of $18.64 Per Share

In my view, if growth in sports wagering across the U.S. continues thanks to regulation in new states, IGT will most likely profit. I also believe that larger efforts to develop new mobile phone apps for each state will likely enhance revenue generation. There is no reason to believe that new mobile apps and gaming products will not be successful. Keep in mind that the company uses a significant amount of dollars in R&D expenses and product development.

The Company devotes substantial resources to research and development and incurred $238 million, $191 million, and $266 million of related expenses in 2021, 2020, and 2019, respectively. Source: 20-F

I am also quite optimistic about the plans of management about its Digital & Betting business segment. If this business segment is really sold independently, in my view, the valuation of the business could be more significant than that right now. Keep in mind that the Digital & Betting business segment grows at a larger pace than the other business segments. If financial advisors execute a financial model of each business segment, the total valuation may be larger than assessing IGT’s business model as a whole. The company explained its plans in the most recent annual report:

As part of this process, the Company may evaluate a potential separate public listing of its Digital & Betting business segment to further enhance its strategic flexibility while maintaining a controlling interest following the consummation of any such potential separate public listing. There can be no assurances as to the form and timing of any separate public listing or other strategic activity that may result from this evaluation or if any such listing or activity will be consummated at all. Source: 20-F

With sales growth close to 0.54%, which is close to the median growth obtained earlier, I obtained sales growth around $4 billion. It is approximately the estimate given by management. If we also use an EBITDA margin of 40%, operating margin of 21%, and FCF/Sales around 18%, 2033 FCF would be $378 million. Now, summing future free cash flow from 2024 to 2033 with a discount of 6.8%, the net present value is equal to $5.74 billion.

For calculating the terminal value, I used an exit multiple of 8.3x, which implied a net present value of $3.8 billion. With $673 million in cash and debt around $6.45 billion, the equity valuation would stand at $3.7 billion, and the fair price would be $18.64.

Author’s DCF Model

Issues With Lottery Authorities, Changes In The Reputation Of The Industry, And Slow Changes In New Jurisdictions Could Lead To A Valuation Of $8.35 Per Share

Lottery authorities may terminate the contracts signed by IGT for a variety of reasons, including failure to approve the required budget appropriations or uncured breaches. Considering the total amount of revenue coming from the lottery segment, termination of contracts would destroy the company’s business model, and revenue would fall:

Many of these contracts in the U.S. permit the lottery authority to terminate the contract at will with limited notice and do not specify the compensation to which the Company would be entitled were such termination to occur. Source: 20-F

Customer changes, consumer confidence, and many other economic factors may also affect the company’s ability to generate revenue. Also, political conditions may modify the general perception that society has about the industry. As a result, IGT may suffer reputational damage, and may lose business partners.

Management is also expecting that changes in new jurisdictions could bring new markets and revenue growth. If these processes take longer than expected, revenue expectations could decline, which may lower the expectations of investors. In the worst case scenario, I believe that a decline in free cash flow expectations would lead to stock price decline.

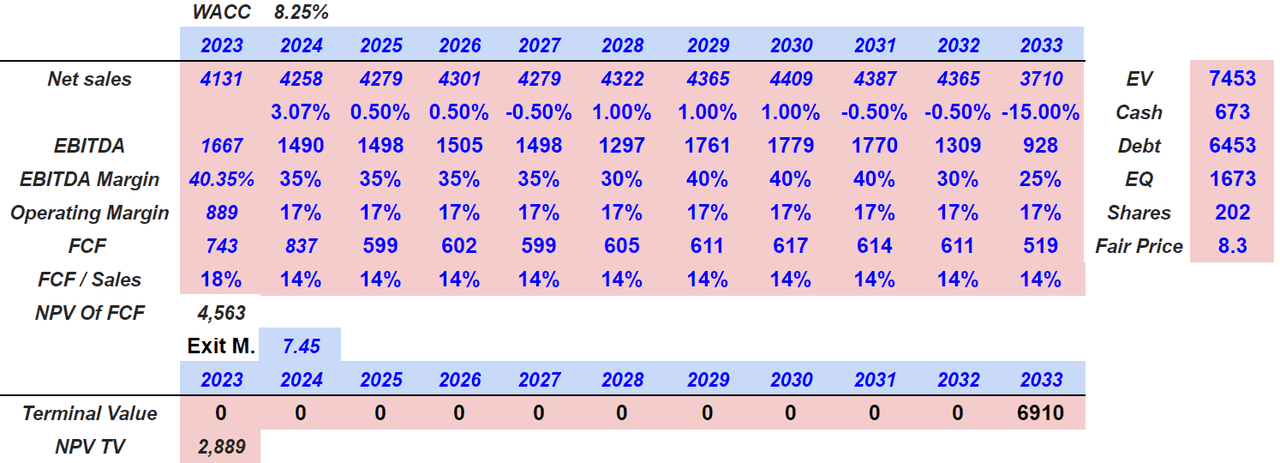

If we assume a case scenario with sales growth around 1% and -0.5%, operating margin close to 17.5%, and FCF/Sales of 14.5%, the sum of FCF would stand at $4.5 billion. Note that my margins are significantly lower than that in the previous case scenario. I also used a discount of 8.25%, which is more significant than that in the base case. In my view, a decrease in margins would lead to higher cost of equity as traders may sell some equity.

If we include an exit multiple of 7.45x, which is below the sector median, the NPV of the terminal value stands at $2.895 billion. Finally, the enterprise value would stay close to $7.5 billion, and the equity valuation would be close to $1.65 billion. The fair price would be $8.35 per share.

Source: SA Author’s DCF Model

Best Case Scenario: IGT Signs Another Agreement In Italy, And Signs More Agreements In Europe

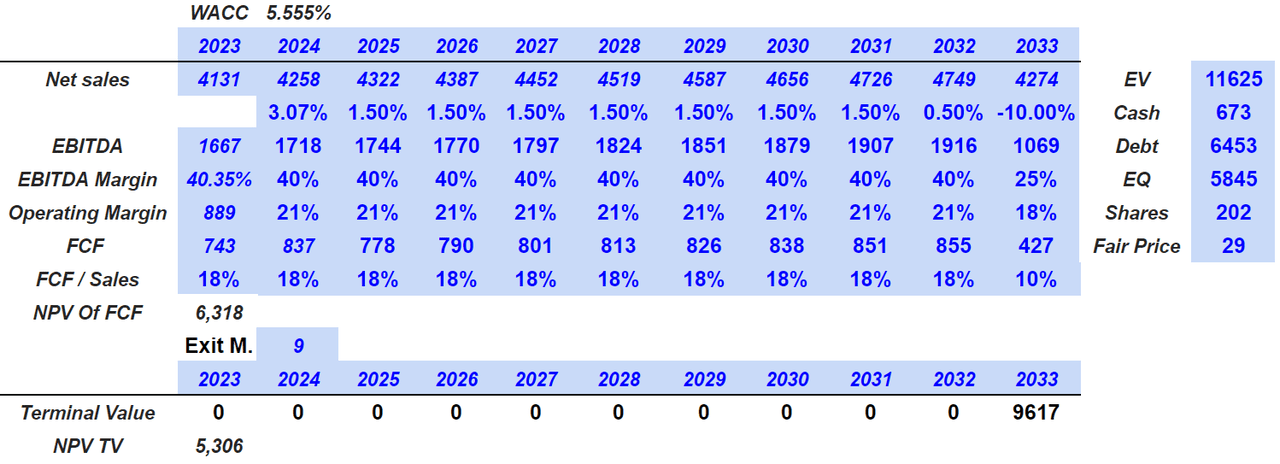

Under my best case scenario, I included two main assumptions. First, the company’s recent acquisitions would end up well. The company would not report any goodwill impairment, and future synergies will be realized. In addition, I assumed that the company would sign a new agreement in Italy, and perhaps many more in Europe. Under these optimistic conditions, some economies of scale would enhance the company’s EBITDA margins and FCF margins.

Since 1998, and for a term expiring in 2025, the Company has been the exclusive licensee for the Italian Lotto game. Beginning in November of 2016, the Company’s exclusive license for the Italian Lotto includes partners as part of a joint venture. Lottoitalia s.r.l., a joint venture company among IGT Lottery S.p.A., Italian Gaming Holding a.s Arianna 2001, and Novomatic Italia, is the exclusive manager of the Italian Lotto game. Source: 20-F

Under this case scenario, I used sales growth of 1.5%, an EBITDA margin around 40%, and FCF/Sales of 18.2%. With a WACC of 5.55% and an exit multiple close to 8.95, the implied enterprise value would be $11.625 billion. Now, if we subtract the debt and cash, the equity would stand at around 5.85 billion, and the fair price would be $29.1 per share.

Author’s DCF Model (Author’s DCF Model)

Conclusion

IGT delivered beneficial guidance. I believe that new mobile phone apps and new products can be expected. At the end of the day, management invests a significant amount of money in research and development. The potential corporate reorganization that would separate one of IGT’s business segments is also worth consideration. In my view, the total valuation could be larger after the separation of the Digital & Betting business segment. Even considering regulatory risks, in my opinion, IGT is worth more than the current price mark.

Be the first to comment