MEDITERRANEAN/E+ via Getty Images

In my last article about International Flavors & Fragrances Inc. (NYSE:IFF), published in February 2022, I argued that the stock was still a hold. Back then, the stock was trading for $127, and now the stock is trading for only $100 – about 20% lower. And this begs the question if IFF is a good investment right now.

Quarterly Results

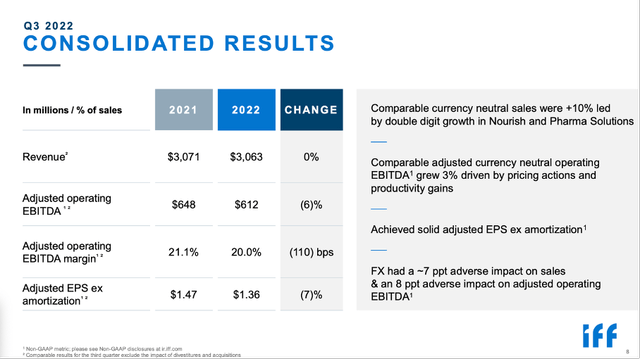

To answer the question, we can look at the last quarterly results. At the beginning of November 2022, IFF reported third quarter results and at best we can call the numbers mediocre. When looking at the top line, net sales declined slightly from $3,071 million in the same quarter last year to $3,063 million this quarter. While sales were at least stable, instead of an operating income of $298 million (which IFF could report in Q3/21), the company had to report an operating loss of $1,985 million in Q3/22. And instead of $0.76 in earnings per share in Q3/21 the company had to report a loss of $8.60 per share in Q3/22.

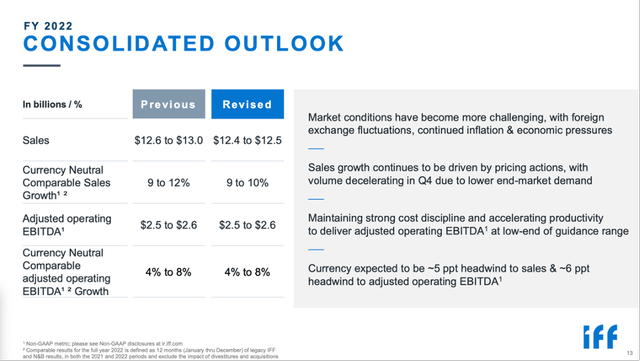

IFF also had to lower its guidance for the full year of fiscal 2022. Compared to a range of $12.6 billion to $13.0 billion in the previous guidance, IFF is now expecting sales to be between $12.4 billion and $12.5 billion. And while the company is expecting sales growth to be driven by pricing actions, a lower end-market demand will have a negative impact on volume. But adjusted operating EBITDA is still expected to be between $2.5 billion and $2.6 billion (the same as in previous guidance).

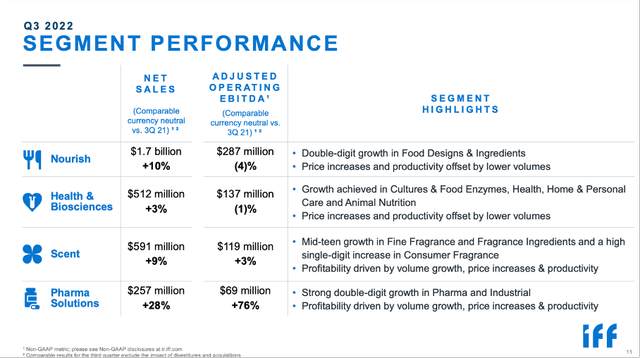

When looking for reasons for the mediocre results, we can start by looking at the top line, which was clearly impacted by currency effects in a negative way. Currency neutral sales increased 10% year-over-year, which is a solid growth rate. And when looking at the different segments, all four contributed to revenue growth in comparable currency neutral numbers – especially Pharma Solutions could report high growth rates for net sales as well as adjusted operating EBITDA.

But not only currency effects had a negative impact on results – the biggest reason for the operating loss and negative net income was a $2,250 million in impairment of goodwill in the third quarter of fiscal 2022. On an adjusted, non-GAAP basis, earnings per share still declined but only from $0.88 in the same quarter last year to $0.82 this quarter.

Goodwill and Balance Sheet

Let’s look at the company’s goodwill and the balance sheet in more detail. IFF has determined that the carrying value of the Health & Biosciences reporting unit exceeded its fair value and recorded a goodwill impairment charge of $2.25 billion. Management also commented on the situation during the last earnings call:

Before moving on, I want to share that we recorded a non-cash goodwill impairment charge of $2.25 billion for the third quarter related to our Health & Biosciences business. The primary drivers of the goodwill impairment are related to increases in interest rates and lower business projections due to adverse macroeconomic impacts on volume, continued cost inflation and unfavorable foreign exchange rate variations.

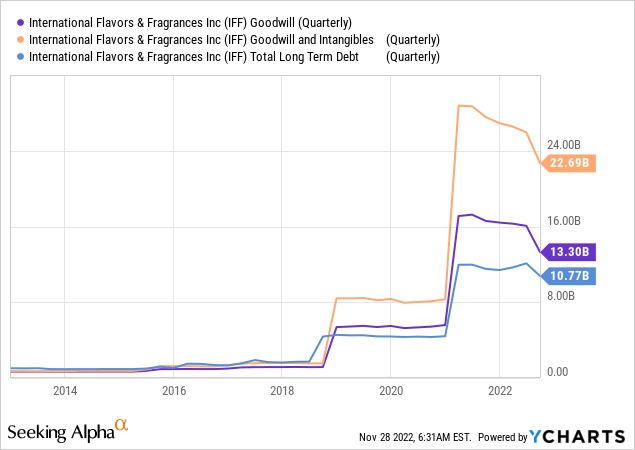

This reduced goodwill and other intangible assets from $26,920 million on December 31, 2021, to $22,691 million on September 30, 2022. And when just looking on goodwill, the amount decreased from $16,416 million on December 31, 2021, to $13,305 million on September 30, 2022.

Until 2018, IFF actually had a solid balance sheet with low levels of goodwill and low levels of debt. But in the years following 2018, both metrics constantly increased, and the balance sheet got worse over the years. And in the last few quarters, several key metrics worsened again: while goodwill and intangible assets decreased (which is good), total assets also declined from $39,658 million on December 31, 2021, to $34,537 million on September 30, 2022, and shareholder’s equity also declined from $21,117 million to $16,921 million in the same timeframe.

Right now, IFF has $512 million in short-term borrowings as well as $10,260 million in long-term debt. When comparing the total debt of $10,772 million to the shareholder’s equity of $16,921 million, we get an acceptable D/E ratio of 0.64. However, this metric is misleading and painting a false picture as the biggest part of the company’s equity is stemming from goodwill. Instead, we should compare the total debt to the operating income IFF can generate per year. In the last four quarters, operating income was $1,388 million, and when being even more optimistic we can take the highest reported TTM number of the last few years (which was $1,605 million). But even when taking the higher amount, it would take 6.7 times the annual operating income to repay the outstanding debt – and $538 million in cash and cash equivalents are not really helpful.

During the earnings call, one analyst also asked about the other segments and potential goodwill impairments (as it was especially the Health & Biosciences segment which was affected). And while the answer of CFO Glenn Richter did not imply that investors must fear further goodwill impairments, the amount of goodwill remaining on the balance sheet is still rather high. I certainly would not rule out further impairments of goodwill, which would once again have a negative effect on earnings per share.

Intrinsic Value Calculation

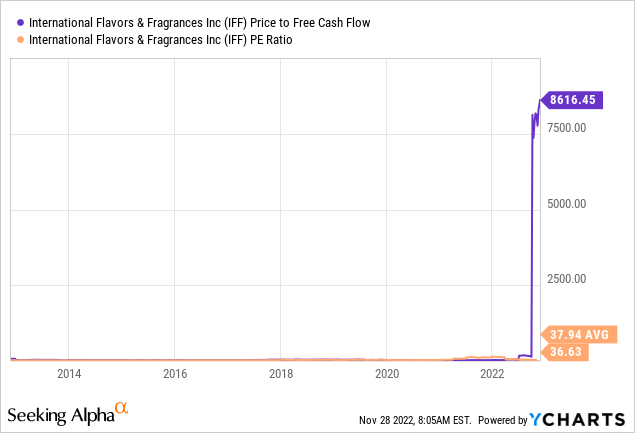

In my last article, I considered IFF as too expensive to be a great investment. With the price declining about 20% we can take another look and try to determine if the stock is a good investment right now. For starters, we could look at simple valuation metrics. Usually, I consider the price-free-cash-flow ratio being the best metric among these simple valuation metrics to determine if a stock could be a buy or not. But in the case of IFF, the P/FCF ratio is completely useless right now as the stock is trading exactly for 8,616 times free cash flow (at the time of writing; it might be different in a few hours).

Aside from the P/FCF ratio, we can look at the P/E ratio. And while that metric is in a more reasonable price range, 37 times earnings is still expensive for a business. And it doesn’t help that IFF is trading for one of the lower P/E ratios of the last few years and below the 10-year average (which is 37.94). To justify a P/E ratio above 30, a company must grow at a high pace. And for that calculation it was already an adjusted earnings per share amount that was used. Earnings per share (according to GAAP) are negative right now. And a valuation multiple close to 40 is not a number I like to see on the eve of a potential global recession.

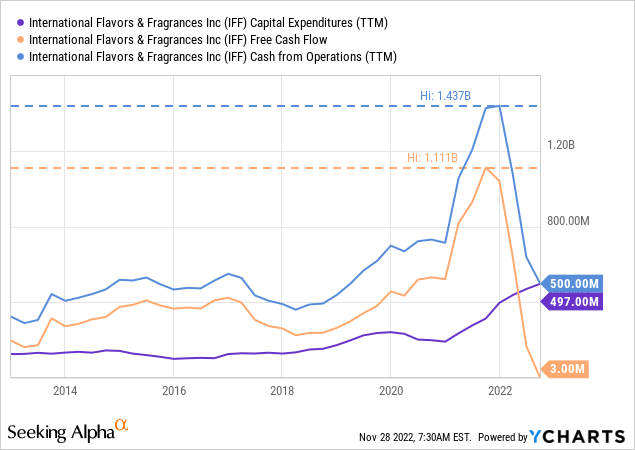

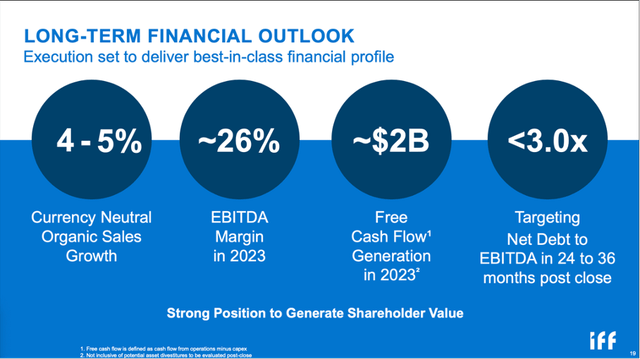

Instead, we can use a discount cash flow calculate to determine an intrinsic value for the stock. During its last year’s CAGNY presentation, the company had ambitious targets of 26% EBITDA margin in 2023 as well as $2 billion in free cash flow generation. Right now, the company is generating only a few million in free cash flow – not billions – and the operating income margin is 11%.

IFF would not be the first company that is over-promising and has high expectations for synergies after an acquisition or merger – only to find out after that it did not materialize. And I don’t want to rule out positive surprises by IFF next year, but right now I neither see IFF achieving the EBITDA margin of 26% nor $2 billion in free cash flow. Only 4% to 5% growth could be a realistic assumption for long-term growth.

For our intrinsic value calculation let’s assume IFF is able to generate $1.5 billion in free cash flow (higher amounts don’t seem justified by looking at results so far) and take this amount as basis (a realistic assumption in my opinion). For the years to come, let’s assume 5% growth. When using these assumptions as well as 255 million outstanding shares and 10% discount rate, we get an intrinsic value of $117.65.

Dividend

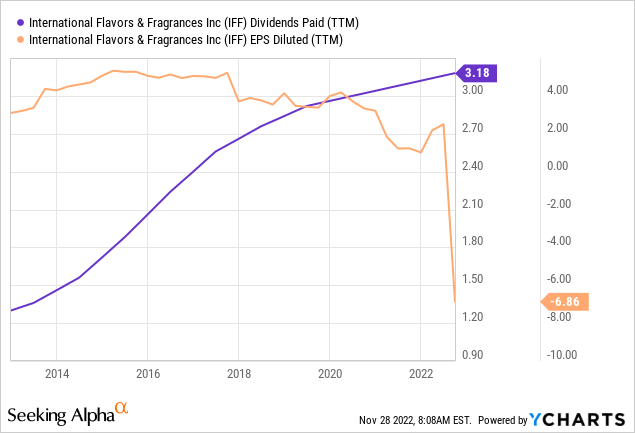

When trying to find something positive, we could mention the dividend and 19 years of consecutive dividend growth as well as a dividend yield of 3.2%. Of course, the situation has changed in the last few quarters, and a dividend yield of 3.2% is now also matched by most U.S. treasury bonds (and in many cases even exceeded) – but that is not a perfect comparison, as IFF is rewarding investors not only by dividends, but also by a potentially increasing stock price.

When talking about the dividend, another aspect is important – and concerning. Looking at the dividends paid and earnings per share generated in the last decade, we see dividend payments being easily covered by earnings per share 10 years ago. However, in the last few years, the company paid more in dividends than it generated in earnings per share. And while this is acceptable for a few quarters, it remains a problem when dividends exceed earnings per share (or generated cash). This especially true when the company already has high debt levels on its balance sheet.

And in case of IFF, we can look at many different EPS numbers – and depending on which number we are using, the picture is changing. For fiscal 2021, IFF reported $1.10 in earnings per share (on GAAP basis); on an adjusted non-GAAP basis, IFF reported $3.28 in earnings per share, and when also excluding amortization, earnings per share were $5.63.

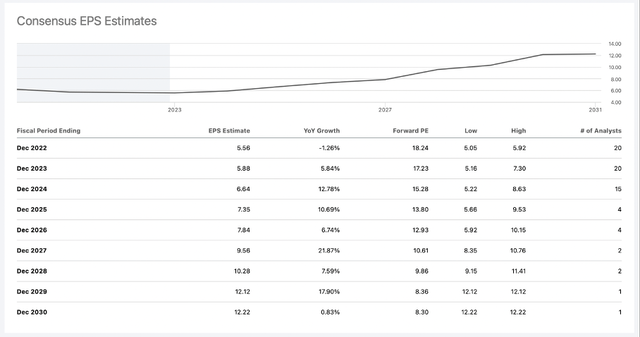

IFF Earnings Estimates (Seeking Alpha)

We can also point out that analysts (according to Seeking Alpha) are expecting high growth rates for earnings per share, and the current dividend would be more than covered in the coming years. I am not saying to always use GAAP numbers (as sometimes they just don’t make sense), but I am also a bit cautious about use non-GAAP numbers which are completely different from the GAAP numbers.

Conclusion

In case of International Flavors & Fragrances Inc., I remain cautious. One could make the argument that the stock is undervalued right now – and when using the company’s expectations for 2023 and beyond (or analysts’ estimates) the stock might even be deeply undervalued. However, I am still not convinced to bet on IFF as I don’t see a clear path to much higher free cash flow generation just yet. Next week – on December 7, 2022 – International Flavors & Fragrances will hold its next Investor Day and maybe could provide some further helpful information for investors.

Be the first to comment