Jonathan Kitchen/DigitalVision via Getty Images

It’s been about 3 ½ months since I wrote my “hold” piece on InterDigital, Inc. (NASDAQ:IDCC), and in that time the shares are basically flat against a loss of about 10.4% for the S&P 500. In case you were about to start wailing and gnashing your teeth on my behalf because I missed out on a relative outperformance, please save your pity. I did sell some puts, and I am absolutely champing at the bit to write about those. Anyway, I want to try to determine whether or not it makes sense to buy the shares now, or not. I’ll make this determination by looking at the most recent financial history, and by looking at the stock as a thing quite distinct from the underlying business. As I threatened earlier, I’m also going to write about options, because, as the expression goes, “a scorpion’s gotta sting.”

Welcome to the “thesis statement” paragraph of the article. It’s here where I share my thoughts in a few sentences so those who aren’t in the mood to put up with my silliness can get into the article, and get out without too much fuss. I think the most recent financial results have been spectacular. I also think I overstated the debt problem in my earlier work fairly massively. Taken out of context, the growth in debt is a problem. In fairness, though, cash and short-term investments are over twice the size of the debt, so I clutched my pearls prematurely in my previous article. I swear that’s the first time that’s ever happened. Anyway, my problem isn’t with the company, it’s with the stock. If the stock were as compelling as the business, this would be a perfect investment and I would plow into it. The problem is that much of the strong performance is already priced in, so the shares remain vexingly too expensive in my estimation. That aside, I did well on the puts I wrote previously and I recommend a similar trade today. While I can’t enter that trade until my current crop of short puts expires worthless (or not), I recommend it for people who are just joining us. In my view, these offer great, risk-adjusted returns.

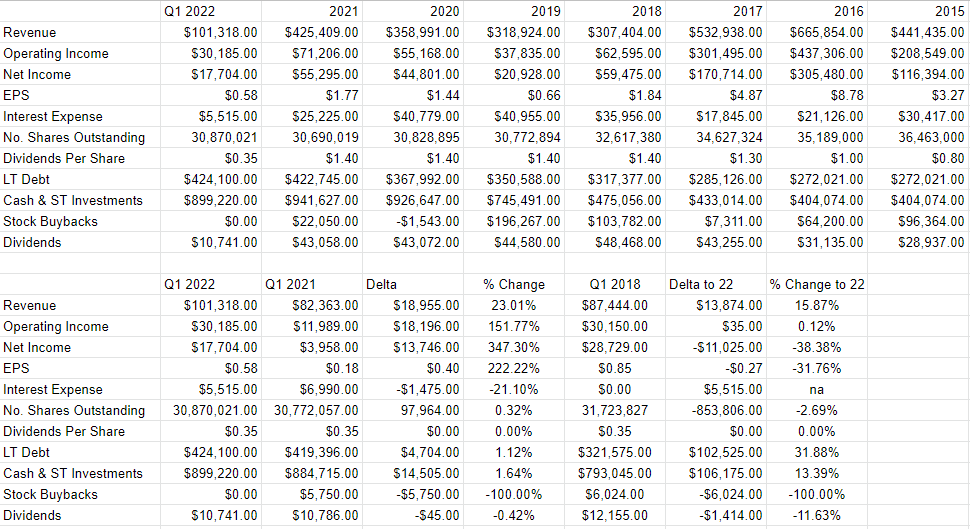

Financial Snapshot

The first three months of this year have been rather good in my estimation, as evidenced by the fact that revenue and net income are up by 23% and 347% respectively. At the same time, interest expense has collapsed relative to the same period last year, down fully 21.1%. In my experience, income growth of this nature is often caused by some sort of one-off event, but not so here. The net income is higher because operating income was up dramatically. InterDigital sold more, controlled expenses as best they could, and the result is a massive uptick in profitability.

In my previous work on this name, I admit that I complained about the increase in debt, and I may have been overstating the case somewhat. While debt has increased, a more balanced perspective would be to suggest that, while it’s troublesome, it’s not something to fret about at the moment because cash and short-term investments is about 2.1 times greater than debt. In short, the most recent quarter was spectacular in my judgment. This leads me to complain that the company could do us a favor and increase the dividend, but that’s a relatively minor complaint in context. Given all of this, I’d be very happy to buy the stock at the right price.

InterDigital Financials (InterDigital investor relations)

The Stock

I can imagine some of the regular readers rolling their eyes at the phrase “I’d be very happy to buy the stock at the right price.” This is because some of the people who’ve followed me for a while have noted that my insistence on not overpaying has talked me out of some great returns over the years. While that may be true, I need to remind readers that we’re seeking “risk-adjusted” returns, not simply returns. This is because the price returns we’ve generated from following the momentum of the crowd can be taken from us in a bad afternoon.

Anyway, my regulars also know that I consider the stock and the business to be very different things. If you’re new here, and you haven’t heard me drone on about this to the point of tedium, let me tell you now: I consider the stock and the business to be very different things. Specifically, every business buys a number of inputs, performs value-adding activities to those, and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets passed around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. Additionally, the stock can move around because “stocks” as a class move in and out of favor. Thus, there’s often a very strong disconnect between the price of the stock and what’s going on at the business. We all believe this, otherwise, we wouldn’t be on this platform. All of this can be frustrating, but also potentially profitable. We can make money if we spot the difference in expectations about the company embedded in the current price, and subsequent reality. So, if the market carries the stock of a company with poor results aloft because of “market up”, that discrepancy creates a potential profitable trade.

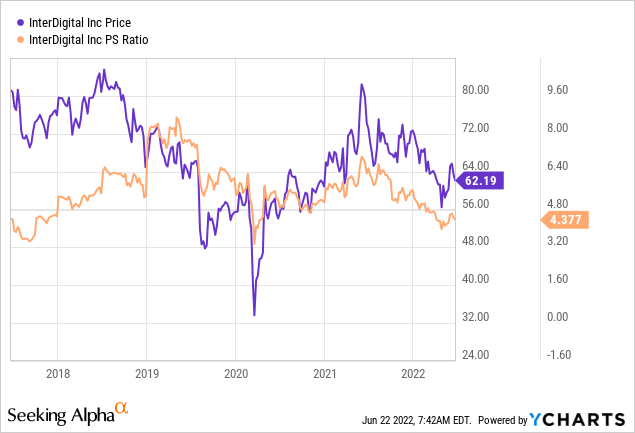

I should also point out that it’s typically the case that the lower the price paid for a given stock, the greater the investor’s returns over time. This idea shouldn’t need any explanation or elaboration. I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. In my previous diatribe on this name, I balked at the fact that the market was ~4.74 times. Price to sales is now about 7.8% cheaper, per the following:

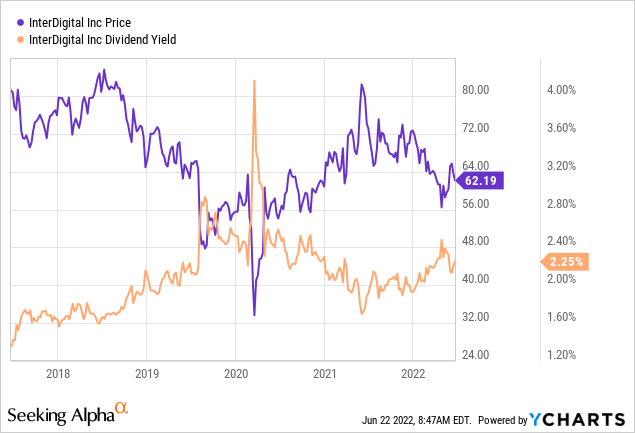

This is near the low end of the historical range for the firm. At the same time, we see that the dividend yield is currently very middle of the road, in neither “screaming buy” nor “screaming sell” territory.

Given the above, I can’t see my way to buying the stock. In my estimation, great returns come out of the market’s excessive despair or excessive optimism, and neither circumstance is in evidence today. Sure, the company has done spectacularly well recently, is in great shape financially, but the only way for investors to benefit from this is to buy these results at a relative discount. For that reason, I can’t buy the shares, and will only buy them if the stock price drops to the $50 range. Thankfully, the options market gives us an opportunity to make money from our willingness to buy this great business at an even greater price.

Options Update

It seems like I’m frequently refreshing people’s memories, presuming that they don’t study my every move, or have their “Doyle’s Trades Almanac” open on their desks at all times. Anyway, in case you’re one of the minority of readers who doesn’t follow my trades scrupulously, I’ll remind you again. I sold 10 of the September InterDigital puts with a strike of $50 for $2 each. My thinking was that this was a “win-win” trade because the outcome would be positive no matter the result. If the shares remained above $50, I reasoned, I’d pocket a decent premium. If the shares fell, I’d be “forced” to buy these shares at a price that lines up with a very generous dividend yield. This was also a great outcome. I’m happy to report that the “ask” price on these is currently $1.35, so they’ve lost about 32.5% of their value, which suggests the trade’s worked out well. While I won’t be entering a similar trade again until my puts expire (or not) in September, I think my experience here offers people a decent way to make a good risk-adjusted return. Either the investor pockets the premium, or they buy this decent business at an attractive price.

In terms of specifics, I’d recommend the December puts of the same strike price. These are currently bid at $1.40, which I consider a reasonable yield. If the shares remain above $50 over the next six months, the investor will simply pocket the premium and bike on. If the shares drop about 19% from here, the investor will be obliged to buy, but will do so at a price that is associated with a very decent dividend yield. This is why I characterize such trades as “win-win.”

Now, if you haven’t learned by now, you may not want to uncritically accept the word of some stranger on the internet when he describes something as a “win-win.” You want to understand that this might be a bit of rhetorical flourish and that you should investigate more fully before embarking on a trade. I happen to like the risk-reducing, yield-enhancing potential of put options, but they may not be for you necessarily. I’ll take the opportunity now to give your critical thinking a bit of a nudge by writing about the various risks associated with these. I generally break these down between emotional and economic risks.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts with the highest premia. In my view, that strategy would lead to disastrous results. Using InterDigital itself as an example, the December puts with a strike of $75 are currently bid at $13.40, and I think selling these would be silly. So my first bit of advice is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay. Take my word on this one, as it’s informed by painful history.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that InterDigital’s stock price goes parabolic and hits $100 per share between now and the third Friday of December. Obviously, my shares will do well, and my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upside in the stock price from the puts, though. So, short put returns are capped by the premium received. This is emotionally painful for some more hopeful souls than me.

Secondly, it can be emotionally painful when the shares crash below your strike price. So far, whenever this has happened to me, things have worked out well over the long term, because I insist on only ever writing puts at “screaming buy” strike prices. That said, it has been emotionally stressful in the short term on occasion. If you’re going to sell puts, please be aware of this phenomenon.

If you understand these risks and can tolerate them, I would recommend that you sell puts as they are the safest, most profitable option available to investors at this moment in my view. I think they are a great way to reduce risk while enhancing returns. Yes, it’s weird of me to conclude a discussion of risks by writing about how these reduce risk. If it hasn’t been made abundantly clear to you yet, I can be weird.

Conclusion

I think this is a wonderful business, and the investment would be perfect if the stock were just as wonderful. The problem is that it’s not. My insights about the strength of the business are hardly groundbreaking, and everybody else can see what I see. For that reason, I think all of the good news is “priced in.” That said, I think there is a way to make some decent risk-adjusted returns here. This trade’s worked out for me in the past, and I plan to re-enter it once my current crop of puts expires. For people who are just joining us, though, I think the puts I wrote about above are compelling because they offer very decent risk-adjusted returns. If the stock drops precipitously as I hope, I’ll reconsider, but for the moment, I recommend selling deep out-of-the-money puts while eschewing shares.

Be the first to comment