Spencer Platt/Getty Images News

This has been a torrid year for Intercontinental Exchange (NYSE:ICE). Its share price declined from $133.95 at the beginning to the year, to $101.28 as of Sep. 3, 2022. I have no doubt that all that ICE is a fantastic business operating in a fantastic industry. So for me the exam question is: Is $101.28 an attractive price at which to buy its shares, given that most probably a recession is about to come?

I believe ICE is materially undervalued at the present, that it had a consistently excellent track record in the past, and that its long-term future prospects are brilliant. In this article I explain why.

Company profile

ICE operates three lines of businesses: Exchanges; Fixed Income and Data Services; and Mortgage Technologies. In the Exchanges segment, ICE operates a number of regulated marketplaces for trading and clearing financial instruments, such as shares and derivatives (think the New York Stock Exchange, which it owns). In the Fixed Income and Data Services, ICE provides services such as fixed income pricing, reference data, indices, and analytics. In the Mortgage Technologies segment, ICE uses machine learning algorithms to provide streamlined and simplified solutions for mortgage lenders, which allow them to originate loans more efficiently.

They have minority stakes in subsidiary companies. Among them the point of interest is Bakkt, the black sheep of the family. I will touch on it briefly later.

Their main competitors are other exchanges based in the US, such as Nasdaq (NDAQ) and the CME Group (CME). They also compete against exchanges worldwide, such as the London Stock Exchange Group (LSEG) and Euronext (OTCPK:EUXTF).

Some statistics at a glance, as of close of business on Sep. 3, 2022:

- Share price: $101.28

- Market cap: $57.0 billion

- P/E ratio: 17.0

- Debt / EBITDA ratio: 2.4

- Operating margin: 38.2%

- Profit margin: 23.5%

Upside case

In this section I describe why I believe ICE shares are undervalued.

DCF Valuation

I use the discounted cash flow method to estimate a fair value for ICE, and I find that the fair value of an ICE share is around 45% above its current price. I consider DCF appropriate to use for the valuation because in the last 10 years DS Smith has been profitable every year, and has paid out dividends in every year.

Moreover, the amount of dividends paid has increased steadily over time. In 2021, each share paid $1.32 in dividends; in 2014, the first full year when ICE paid dividends every quarter, that was $0.13: a highly attractive CAGR of 14.2%.

The DCF method gives the fair present value of a share as:

V0 = D1 / (r – g)

Calculating g

I estimate g, the sustainable growth rate for ICE, as:

g = RR x ROE

My review of sell-side analyst reports suggests that the median forward-looking return on equity (ROE) for ICE is slightly below 14%. For simplicity, I round this down and set ROE as 13%.

On a trailing twelve months basis (for the avoidance of doubt, from Q3 2021 through to Q2 2022), ICE has earnings per share of $5.97, and paid a dividend of $1.42. The retention ratio is calculated as retained earnings divided by earnings per share. In this case, I find that the retention ratio is 76.2%.

This yields a sustainable dividend growth rate of 9.9%. I note that this is materially above the S&P 500’s historical dividend CAGR of 6.5%, but it is materially below ICE’s historical dividend CAGR (14.2%), as well as its net profit CAGR (15.2%)–not only are exchanges profitable businesses, ICE is also nursing a number of promising ventures in the wings. Therefore, I consider 9.9% a conservative estimate of ICE’s dividend growth rate.

Calculating D1

ICE pays dividends quarterly. Therefore, I set D1 as the sum of the four dividend payments in the next twelve months, which will occur in Sep. and Dec. 2022, and Mar. and Jun. 2023.

ICE has already declared a dividend of $1.52 for the year 2022. Of this amount, they have paid half in March and June, and they will pay the other half in September and December. Therefore, I set $0.76 as first half of D1.

I assume the dividend payments in March and June 2023 will grow at the sustainable growth rate of 9.9%. Therefore, I set $0.84 as second half of D1.

In this case, I set D1 as $1.60.

Calculating r

I estimate r, my required rate of return for ICE, as:

r = RFR + beta * (TMR – RFR)

Since the inception of the S&P 500 in 1957, it has provided investors with an annualised total return of 11.88%. I use the most recent Effective Fed Funds Rate for which data is available (as of August 2022) of 2.33% as the risk free rate. I note that ICE’s 5-year monthly equity beta is around 0.90.

Therefore, I calculate the required rate of return for ICE as

r = 2.44% + 0.9 * (11.88% – 2.33%) = 10.93%.

For simplicity, I round up my required rate of return to 11%.

Calculating V0

In this case, the estimated fair value of a share is $1.60 / (11% – 9.9%) = $146.50. This is 45% above its current price of $101.28 as of Sep. 2, 2022: a substantial margin of safety.

I show my work in Table 1 below.

Table 1: DCF valuation

| EPS | $ | [a] | 5.97 |

| Dividend in Year 0 | $ | [b] | 1.42 |

| Retention ratio | % | [c] = 1- [a]/[b] | 76.2 |

| ROE | % | [d] | 13 |

| Sustainable growth | % | [e] = [c]*[d] | 9.9 |

| Required rate of return | % | [f] | 11.0 |

| Dividend in Year 1 | $ | [g] | 1.60 |

| Fair value in Year 0 | $ | [h] = [g]/([f]-[e]) | 146.50 |

| Share price at valuation date | $ | [i] | 101.28 |

| Implied upside | % | [j] = [h] / [i] – 1 | 45 |

EV/EBITDA Valuation

As a cross-check, I use the EV/EBITDA valuation method to estimate a fair value for ICE, and I find that the fair value of an ICE share is around 47% above its current price. I favour the DCF approach (when it is feasible) over the EV/EBITDA approach, as the method of finding suitable comparables is, in my view, neither exactly a science nor an art, but something close to black magic–highly subjective and sensitive to manipulation.

Nevertheless, EV/EBITDA can be useful as a sense-check to the DCF approach. Let’s take a look.

I select five comparables for ICE: NASDAQ, CME, Cboe (CBOE), the London Stock Exchange Group (LSEG) and the Japan Exchange Group (JPX). In Table 2 below I note the values for their EVs, EBITDAs, and the corresponding ratios, as well as the average of their EV/EBITDA ratio of 16.9x. (Note that I cannot use Euronext, because it has negative EV.)

Table 2: EV / EBITDA ratios

| Comparators | EV | EBITDA | EV / EBITDA | |

| NASDAQ | $ b | 35.0 | 1.9 | 18.9 |

| Cboe | $ b | 14.5 | 0.6 | 25.6 |

| CME Group | $ b | 73.1 | 4.2 | 17.3 |

| LSEG | $ b | 60.6 | 4.4 | 13.9 |

| JPX | $ b | 6.8 | 0.8 | 8.8 |

| Average | 16.9 |

I apply the average ratio of 16.9x to estimate the fair value of ICE’s EV. I note that EV is the sum of market capitalisation and total debt, less cash and cash equivalents. Therefore, I subtract, from my estimate of the fair value of ICE’s EV, the total debt, and then add back cash and cash equivalents, to arrive at a fair estimate of ICE’s market capitalisation.

In this case, the estimated fair value of a share is $148.70. This is 47% above its current price of $101.28 as of Sep. 2, 2022: a substantial margin of safety.

I show my calculations in Table 3 below.

Table 3: EV / EBITDA valuation

| EBITDA | $ b | [a] | 6.0 |

| Fair value EV | $ b | [b] = [a] x 16.9 | 101.2 |

| Total debt | $ b | [c] | 18.4 |

| Cash and cash equivalents | $ b | [d] | 0.8 |

| Fair value market cap | $ b | [e] = [b]-[c]+[d] | 83.7 |

| Actual market cap | $ b | [f] | 57.0 |

| Implied upside | [g] = [e]/[f]-1 | 47% | |

| Share price at valuation date | $ | [h] | 101.28 |

| Implied fair value of share price | $ | [i] = [h]*(1+[g]) | 148.70 |

Excellent track record and brilliant prospects

ICE has been expanding steadily over the last 10 years. They have been consistently profitable, and their profits have been growing. For me, this is one of the main selling points for the company.

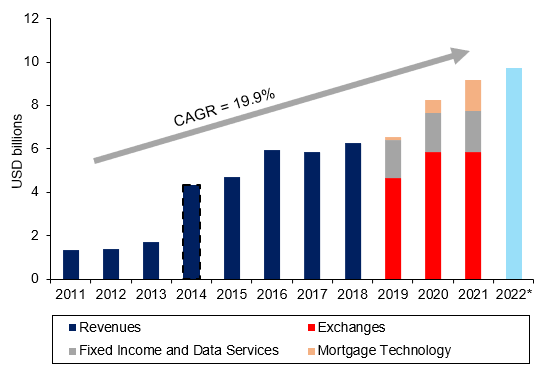

ICE has experienced a 19.9% CAGR for revenues since 2011. The breakthrough came in November 2013, when ICE completed its acquisition of what is now its flagship, the New York Stock Exchange. Revenues surged from $1.7 billion in 2013 to $4.4 billion in 2014, and never looked back–in 2021, ICE booked $9.2 billion in revenue. I show this in Figure 1.

Figure 1: Historical revenue growth

I pro-rate 2022 revenue by multiplying revenues in the first two quarters by two. (My analysis, based ICE financial statements)

While ICE’s flagship Exchanges segment is doing very well, the exponential growth of its Mortgage Technology is especially exciting. ICE aims to streamline and automate the mortgage lending procedure by using machine learning algorithms to train over its data (of which it has voluminous amounts) to find and match the optimal mortgage to the optimal applicant. This can improve the accuracy, and cut down the salary costs and human errors, of using human employees for the same work.

If they successfully corner this part of the market, I expect this segment to do very well indeed–ICE has a comparative advantage not just in its scale and financial resources, but also the amount of data it has to train its algorithms with. That’s why I believe ICE’s Mortgage Technology is a promising venture with a strong potential of earning rapid growth in sales and profits.

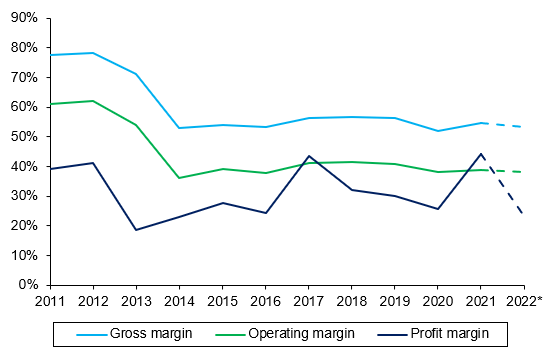

Next, I show in Figure 2 the gross, operating, and net profit margins for ICE.

Figure 2: Historical margins

I use Q2 margins for 2022, and end-of-year margins for all other years (My analysis, based on ICE financial statements)

As Figure 2 shows, ICE does not have much in the way of margins growth historically. But I do not think that is an issue, because their margins are already excellent. ICE has a deep and, in my view, impregnable “economic moat” beloved of Warren Buffett, with which it safeguards its business and its lucrative returns.

Because for companies that want to list shares, and for investors who want to trade them, where can they turn to if not ICE? There is, of course, NASDAQ, but it focuses on tech and is not suitable for much of America’s “traditional” economy such as oil and gas, automotive manufacturing, and banks. CME and Cboe come next, but the first is predominantly commodities and the second predominantly options. All of them compete in the same markets that ICE operates in, of course; but for equity shares, and especially American ones, the New York Stock Exchange and its owner ICE reign supreme.

Potential risks

I consider three main risks to ICE.

The coming recession

The first, and the most significant, is the looming recession. Obviously, recessions are bad for business, but they could be extremely damaging to the business of exchanges. In economic booms people have lots of money and even more self-confidence, and everyone thinks they can get rich by trading. And every silly loss-making idea with a baby-faced smooth talker can make billions floating their business on exchanges like ICE.

That is fair enough–it generates a great deal of business activities and transaction fees for ICE. But in recessions, people stop trading. They stop doing IPOs and they certainly stop doing SPACs. They begin getting defensive and start hoarding cash. If there comes a recession, and I think it will come, ICE’s revenue will dry up. Or, in their words: “A stagnation or a decline in the initial public offering, or IPO, market… could have an adverse effect on our revenues.” (p. 22)

In the last recession, ICE’s share price collapsed from about $38 in Dec. 28, 2007 to $12 in Mar. 6, 2009–a 68% decline. It’s not just ICE: comparable exchanges, like the LSEG, experienced similarly sharp declines, from about £18 in Dec. 28, 2007 to £4 in Mar. 6, 2009–a 78% decline.

With the benefit of hindsight, we can all see that the market was grossly undervaluing their shares during a recession. Sure, but how good are your nerves? Can you endure a 70% share price decline for over a year?

Regulatory risks

One of the previous articles on Seeking Alpha characterised ICE as a company that “operates quietly in the background”. I do not know what gave that author such an impression, but ICE is a magnet for regulatory attention. Aside from the FTC’s review of its proposed merger with Black Knight, I am also aware that CMA may be considering to begin a preliminary abuse-of-domination review of ICE. Meanwhile, ICE also has to deal with the vortex of changing financial regulations, with eagle-eyed regulators waiting on all sides for the slightest slip-up to pounce.

ICE is a hugely successful, very profitable company with strong market power and high margins: exactly the kind of company that governments, journalists, and voters (especially in the UK and Europe, but also sadly increasingly in the US) love to hate. For competition regulators, taking on high-profile companies like ICE is a quick and sure way to win plaudits and favourable media attention.

Bakkt rekt

Bakkt Holdings is a technology platform for the management of digital assets. That’s well and good, but recently people have trouble buying gas to heat their homes and drive to work. They certainly don’t want digital assets as much as before. ICE owns a 68% stake in Bakkt. When the company listed in late 2021, ICE booked a substantial income in capital gains from that stake on its income statement: in their 2021 financial statement they noted, with smug self-satisfaction, that ‘We recorded a pre-tax gain on the (Bakkt) transaction of $1.4 billion’ (p. 105). It’s also the main reason why, as you may have noticed on Figure 2, that ICE has higher net profit margin than operating margin (the Bakkt gain is classified as a non-operating income).

So what gives? Bakkt’s share price, which plunged from a high of $42.56 to $2.56 as of Sep. 2, 2022. How did ICE put it, also in their 2021 FS? “We may not realize the expected benefits of our majority investment in Bakkt and the investment may introduce additional risks to our business due to its evolving business model.” (p. 20) No, they may not. Cryptos aren’t trendy anymore, for the foreseeable future at least. Look forward for some material non-operating losses in 2022.

Conclusion

I rate ICE a buy because, given what we are certain of now, I believe the fair value of ICE shares is around 45% above the current market value of their shares. But I do not rate it a strong buy, because in my view ICE is far more sensitive than other firms to prolonged economic downturns, and I worry that one is coming soon. If you are a long-term investor, I do not believe you will regret having ICE in your portfolio; and I believe $101.28 is an attractive price to buy more ICE shares.

But would it be smarter to wait for a recession to hit first, and then buy the market bottom? I don’t know. I don’t know! Perhaps.

Be the first to comment