Justin Sullivan

The Intel story is changing but the stock is still cheap

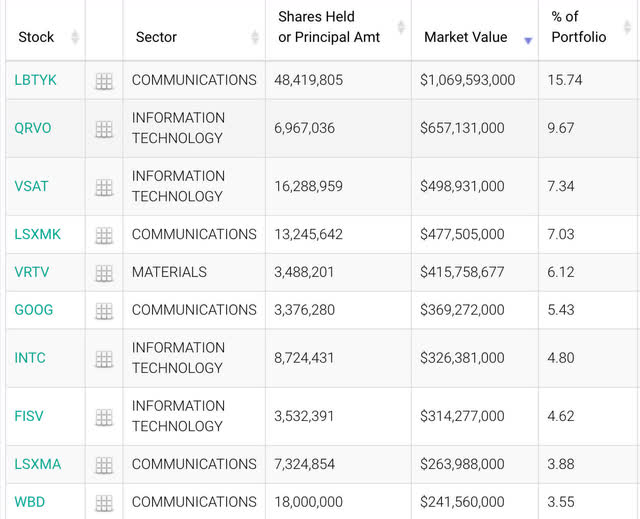

Intel Corporation (NASDAQ:INTC) has been considered both a value stock and a value trap for quite some time. The Dow Jones component is the largest U.S.-based semiconductor company by revenue, but not by market cap. For the longest time, the story has been about solid free cash flow and a cheap multiple based on that. This has been a holding in one notable hedge fund, value investment legend Seth Klarman’s Baupost Group’s fund, since Q4 2020, which can be seen in its 13-F:

Baupost Group LLC (whalewisdom)

This holding has been reduced since the initial purchase, but Klarman is still holding on even though cash flow is being eaten up by future investments in R&D. Looking at this stock from a trailing PEG ratio basis and price to free cash flow basis (looking at average 5-year cash flow), the stock is cheap and a buy, as are some of its peers. The cyclical nature of semiconductors has also changed the story a bit. We can no longer rely on increasing free cash flow, healthy buybacks, and a nice dividend to save the day. The writing on the wall is telling us that the buy thesis has to change. Mine has, and it is simple: they have to succeed to save the entire U.S. semiconductor industry.

Intel is “FAB”ulous

Intel’s largest R&D initiatives have to do with building foundry fabrication plants, or “Fabs.” The industry can be seen in two segments, those that operate fabs, and those that design chips to be produced in fabs “fabless.” The initiative is called IDM 2.0 and is laid out in their most recent 10-K filing:

On March 23, 2021, we announced our “IDM 2.0” strategy, the next evolution of our IDM model. Our IDM 2.0 strategy combines our internal factory network, strategic use of external foundries, and our new IFS business to position us to drive technology and product leadership. To accelerate this strategy, we announced plans to invest $20 billion to build two new fabs in Arizona, which we broke ground on in September, and we recently announced plans to invest more than $20 billion in the construction of two new leading-edge fabs in Ohio. We also announced approximately $10.5 billion total investment to equip our Rio Rancho, New Mexico and Malaysia sites for advanced packaging manufacturing. In August, the US Department of Defense announced that IFS will lead the first phase of its multiphase RAMP-C program to facilitate the use of a domestic commercial foundry infrastructure.

All told, that’s $55.5 Billion in planned capital expenditures and R&D. They are taking the bull by the horns and aiming to become the go-to resource for fabricating chips to order. R&D increases from 2020 to 2021 were allocated to the following areas:

2021 vs. 2020 R&D spending increased by $1.6 billion, or 12.1%, driven by the following: + Investments in DCG, CCG, and Mobileye + Investments in our process technology + Incentive-based cash compensation.

Industry R&D

A popular value investing classic, Common Stocks and Uncommon Profits, by Phillip Fisher, advises one way to find a company on the verge of technological breakthroughs is by comparing its R&D as a percentage of its revenue to its peers. For those unfamiliar with Fisher, he was considered to be one of the original growth stock / Silicon Valley tech investors. He was renowned for his “scuttlebutt” method, where one does due diligence by speaking with company employees and individuals familiar with the firm being targeted. Warren Buffett has touted the book and considers Fisher to be one of his influences. Fisher’s son, Kenneth Fisher, also runs a large fund today called Fisher Investments.

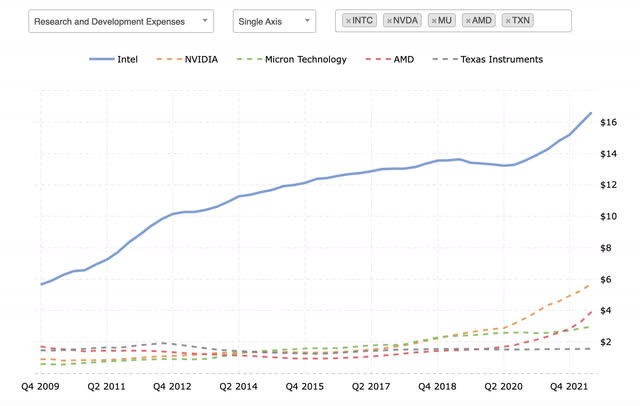

Semiconductor R&D spend (macrotrends.com)

This was much more of a task in Phil Fisher’s days, but now we can quickly draw up comparative analysis with the click of a button. Above, we see Intel leads all U.S. semiconductor companies in R&D spend by a wide margin.

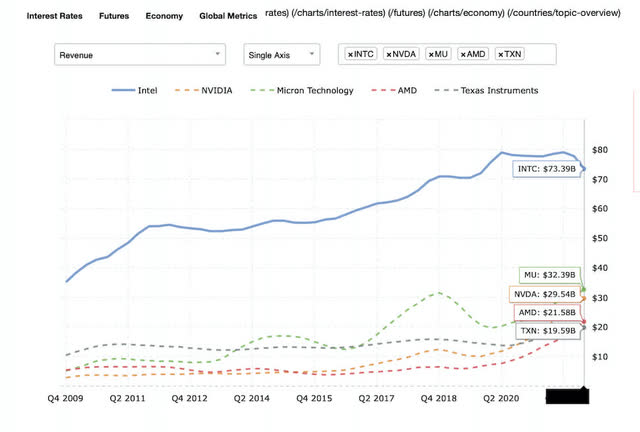

semiconductor revenue (macrotrends.com)

I have chosen 4 rivals as a comparison: Micron (MU), NVIDIA (NVDA), Advanced Micro Devices (AMD), and Texas Instruments (TXN). Although Intel does not have the largest market cap in the group, it does have the highest revenue and R&D spend. Percentage-wise for R&D/Revenue, Intel edges NVIDIA 21 to 20 %. AMD is next with 19% R&D/Revenue, Texas Instruments at 13%, and last is Micron at 10.9%. Although the industry standard seems to fall somewhere in the neighborhood of 16.98% R&D/Revenue, Intel’s total spending on R&D is 2.6 X greater than its next competitor in NVIDIA.

The total amount Intel has been spending on R&D makes it one of the biggest spenders on this item in the world. They have the goal of being an alternative to Taiwan Semiconductor (TSM), and the opportunity is right in front of them if they can execute. The macro trends in the Pacific surrounding Taiwan are very tense. Even if Taiwan is not overtaken by China, every fabless chip designer will need to consider their options and risk tolerance when choosing a manufacturer to work with. Even if Intel can only find a way to become 90% as efficient as Taiwan Semiconductor, I believe they would still absorb a lot of business to their fabs by companies that will discount efficiencies for risk mitigation.

Valuation

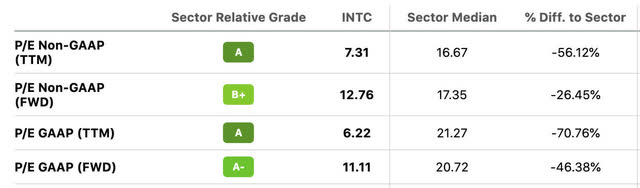

Sector multiples (seeking alpha)

Just based on earnings alone, we can see that Intel is trading at a discount to its sector peers. This stock has been irrationally beaten down after poor guidance. That being said, wise investors should see this as an opportunity. Intel is attempting a major change in its future business model. They could be in the right place at the right time. They are certainly the first mover towards becoming a fab-centric company in this sector.

Intel is a stock that has been generating a lot of free cash flow for years, and is one of the chief bull theses out there. Top line revenue was declining, but cash flow kept chugging upwards. This allowed Intel to pull off some solid financial engineering, buying back lots of shares and making the forward EPS guidance very predictable. The average trailing 5 years free cash flow stands at about $14.26 Billion. At today’s market capitalization of $119 Billion, that’s a price to free cash flow (“FCF”) multiple of only 8.3 X. 10 X free cash flow would be considered a cheap multiple. Intel has 4.07 Billion shares outstanding, that would give us an average of $3.55 in FCF per share. Using 10 as our multiple, $35 a share would be more than fair using this metric.

A second way to look at the price would be according to the Graham number, popularized by Benjamin Graham from “The Intelligent Investor.” This is effective when a company has a lot of tangible assets on its balance sheet as it also incorporates the book value of a company. Many don’t realize that Intel is currently trading at one of its lowest price-to-book values on record, at 1.19 X. The Graham number is quite simple, it is the square root of: 22.5 × (Earnings Per Share) × (Book Value Per Share). Our inputs are SQRT 22.5 X (4.66) X (24.65) = $50.83. As Intel looks to plunk a larger and larger portion of its cash flow into tangible fabrication facilities, this is becoming more and more of a valid price target valuation.

If we use the standard PEG ratio, looking at the trailing 5 years of EPS growth, we see that Intel has grown earnings per share from $2.04 to $4.89 a share from 2017 to 2021. That is a CAGR of 19% in earnings, although the earnings did plateau from 2018 to 2021. For those unfamiliar, Peter Lynch popularized this formula by taking the trailing 5-year EPS growth, dropping the percent sign, and using that as our multiplier. The TTM EPS becomes our multiplicand. If we use 19 as our multiple (the growth rate in EPS) and multiply that by a TTM EPS of 4.66, we get an upper end of $88 a share based on this metric. If I currently had to choose my price target, I would be more inclined to go with the free cash flow story at $35 a share, as growth in earnings should falter with management’s decision to curb buybacks. The Graham number is compelling if you believe their assets would have significant value in the private market.

The cyclical nature of the semiconductor industry should also curb our enthusiasm as it pertains to earnings growth for any of the names in the sector. The best thing we can put our thumb on for growth is that large R&D expense, which is optional. With R&D being an optional expense, you can assume that a portion of the $16 Billion could be given back to shareholders at a later date once their growth initiatives subside.

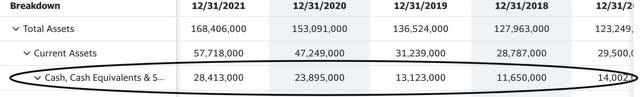

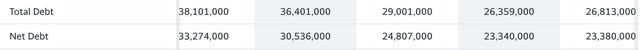

Debt

At $35 Billion in debt and $27 Billion in cash on hand, the company’s debt management is still very conservative. The debt to equity ratio stands at 35% with a current ratio of 1.86 X, all very healthy numbers. Intel still seems more prone to using its free cash flow to engage in CAPEX and R&D versus financing it largely with debt. However, that will most likely begin to change with a downturn in cash flow and an increase in interest rates which will be pertinent to increasing construction costs. The $55 Billion in planned PPE expense on the horizon will most likely lead to increased debt burdens.

Dividends

Intel provides a large dividend. The share price cratering has driven it upwards to 5.04%. This creates a $6.3 Billion forward dividend liability that is not currently being covered by free cash flow, which has dipped negative. The dividend coverage based on trailing 5 year average free cash flow is 2.25 X, a very good margin. If the chips act begins to assist in financing Intel’s fabrication facilities, we might see Intel return to healthy free cash flow coverage of its dividend. I believe the best case going forward is that Intel preserves the dividend at its current payout for the next 2 years, but there is a likelihood of it being cut if free cash flow trends in the same direction it is now.

R&D effect on cash flow

Intel Free Cash Flow (yahoo finance)

We can see from the above that Intel has gone from $14 Billion in free cash flow in 2018 to -$1.5 Billion TTM. This again is due to the cyclicality of the business in conjunction with the growth initiatives. If the trend of negative free cash flow continues, the company will need to borrow more to complete its fabrication facilities.

Chips Act

According to Bank of America (BAC) analyst Vivek Arya, Intel will be a big winner with the passing of the chips act:

Intel likely will be the biggest beneficiary of the CHIPS Act, BofA Securities analyst Vivek Arya said in a recent note to clients. He estimated Intel could see $10 billion to $15 billion worth of U.S. government subsidies over the next five years. Meanwhile, Intel is taking advantage of similar semiconductor re-shoring initiatives in Europe.

Intel CEO Pat Gelsinger has been pleading publicly that the U.S. Government needs to pass this bill since taking on the initiative to construct these new Fabs. He was aware that Intel’s free cash flow position was weakening, and the necessity to receive some of these subsidies might be the determining factor on whether or not these facilities are completed.

One positive note we can see with Intel is its cash and cash equivalents position. It has more than doubled since 2017 as they prepare for this upcoming construction bonanza. Even with this amount in the bank, they are still going to need subsidies to cover the full buildout of the Fabs and leave a margin of safety in bank reserves. As interest rates affect construction activities severely, borrowing more to finish this project could be an unwise decision.

We can also see above that total debt has increased by roughly $12 Billion from 2018 onward. Rates were lower during this period and we can assume a portion of this was socked away as cash. If this number continues to increase during and post 2022, we can also assume that interest expenses will increase at a faster clip than in the past 5 years due to rates rising.

Above we can also observe Intel’s financing cash flow activities. A more and more positive (or less and less negative) number would suggest that Intel is decreasing their repayment of debt while taking in more cash from borrowing. This trend is very noticeable in the most recent 2 years. They are certainly preserving more cash from borrowing activities, and rolling over or paying down far less debt. These are all indicative of growth initiatives that will be financed more and more by debt versus cash flow.

Catalysts

The entire semiconductor industry is lacking major catalysts due to cyclicality entering into a recession. We should be patient and accumulate here, not expecting big things in the short run. For Intel, the completion of even one of their Fabs could be a big catalyst. Proving they can produce chips that meet similar standards as Taiwan Semi’s fabs would be another. If they pull it off successfully, you will begin to see headlines of new fabrication contracts rolling in for Intel from fabless semiconductor firms. Nvidia has already expressed interest in working with Intel in the future.

Conclusion

Phil Fisher liked to identify the highest R&D spenders in an industry because he believed it gave him the highest probability of finding the company that would produce the next big product. While Intel has exciting R&D initiatives in mobileye and their graphics processor/DCG/ CCG units, the mass production fabs are where the money is. Becoming a global leader in chip production in a country protected by seas, friendly neighbors, and the most powerful military in the world should be a strong-enough selling point.

My price target is $35 on the low end (using 10 X trailing 5 years price to free cash flow) and $55 on the high end using the Graham number formula. The only question I would ask myself between the high and low end is how liquid are Intel’s assets if they needed to sell any PPE or divisions. Intel is a long holding of mine and is a buy. A great story with a high probability of initiative execution due to its industry-leading R&D spend.

Be the first to comment