MF3d

Investment Thesis

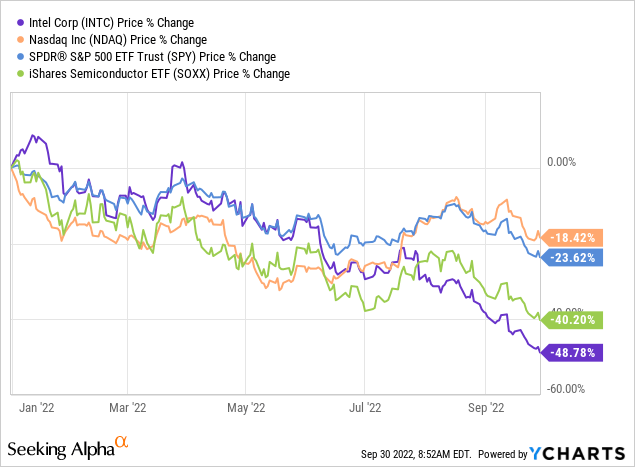

It is hard to stomach a value investment such as Intel (NASDAQ:INTC) that keeps falling to all-time lows; the big question is, where does it end? The company’s stock has crashed, underperforming by far the NDAQ and SOXX index, and most investors are still waiting for a few catalysts in the next 1-2 years before they buy the stock. Nobody knows when it will turn around. In today’s analysis, I explain why I remain invested with INTC, utilizing the bear market to maximize my long-term returns.

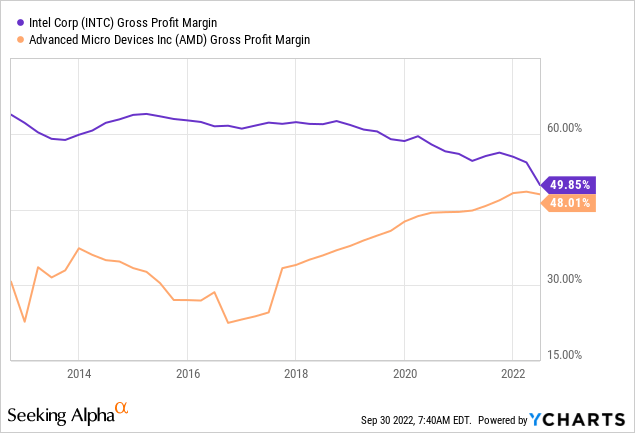

Undoubtedly, Advanced Micro Devices, Inc. (AMD) has taken significant market share from Intel, and AMD’s momentum will likely persist in the foreseeable future. However, on a longer-term horizon, Intel’s foundry business and turnaround efforts will prove fruitful. As a result, patient investors can now scoop up Intel shares at bargain prices close to book value, with a wide margin of safety to minimize risk.

Semiconductor Market Outlook

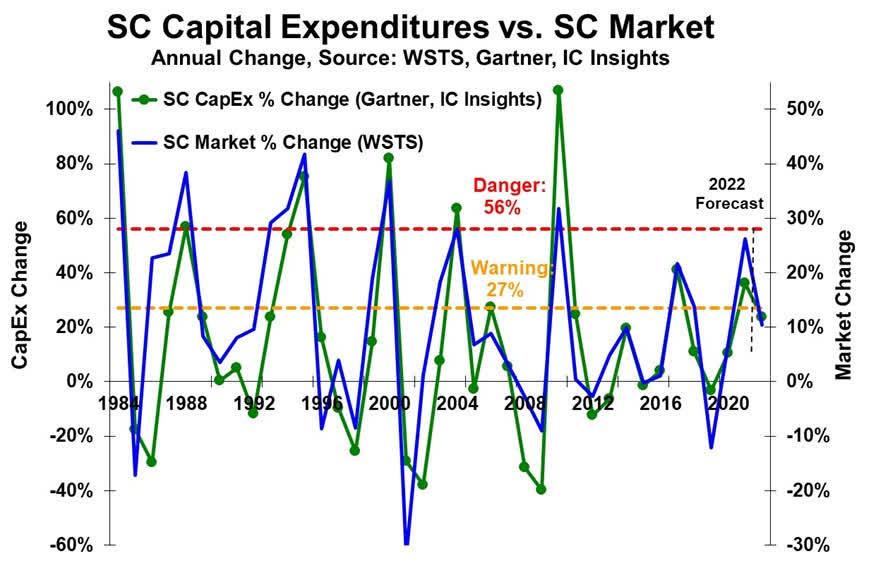

The semiconductor industry is currently dealing with several concurrent global economic shocks and a decrease in market demand as we approach the year’s end. Moreover, unit shipments are currently around 20% over their long-term average, and once lead times start to shrink, and excess inventory is cleared, a downward correction is unavoidable.

In addition, CapEx spending as a percentage of semiconductor sales is at a 20-year high. Therefore, a downturn or severe slowdown in the semiconductor sector in 2023 or 2024 is indicated in the chart below. Notably, a sector slowdown is expected when there is a considerable CapEx increase. Not surprisingly, the negative outlook and uncertainty have already factored in the semis’ stock prices.

Relationship between CapEx spending and Semiconductor Market (semiwiki.com/semiconductor-services/semiconductor-intelligence/312167-semiconductor-capex-warning/)

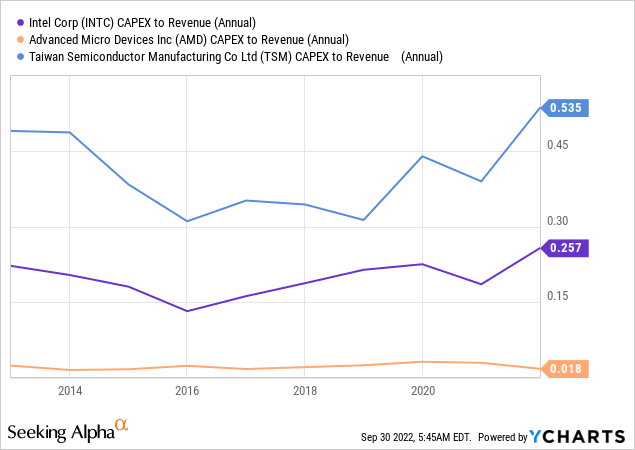

Turning to Intel’s situation, the company has extensively increased its CapEx in the last year. However, it remains far below Taiwan Semiconductor Manufacturing Company Limited’s (TSM) profoundly elevated figures, which account for nearly 54% of its revenues. Thus, the above phenomenon is broadly reflected in leading semis and justifies the recent brutal sell-off in the semi stocks.

The Worst Is Nearly Priced In For INTC

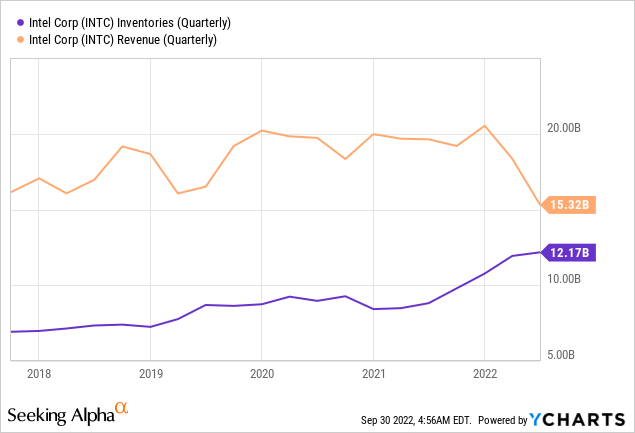

In Q2 2022, INTC posted results well below the market’s expectations and guidance. The company reported Q2 2022 revenue of $15.3 billion, a decline of 17.3% YoY, missing the market consensus by $2.6 billion. In addition, the gross margins came in at 44.8%, adversely impacted by higher costs and inventory reserves, yielding Q2 2022 EPS of $0.29, well below the market consensus.

The primary drivers for the miss were within the company’s Client Computing Group, down 25% YoY, being negatively impacted by customer inventory burn, and Data Center and AI Group, revenues down 16% YoY, impacted by ASP decline, inventory burn, and macro headwinds.

For the next quarter, INTC guided revenues to be $15 to $16 billion, leading to an 11% YoY decline from the previous +2% YoY growth guidance for the entire year. Though the company expects gross margins to improve by year-end, due to the reversal of inventory headwinds and price increases, the structural headwinds for semis are expected to persist. Hence the gross margins could remain under pressure in the near term.

There were some positives to the company’s last quarter’s results. First, Intel believes inventory burn at PC OEMs to be largely behind it and expects the combination of cleared inventories, seasonality, higher CPU pricing, and new product ramps (Raptor Lake, etc.) to drive growth in Q4 2022. The PC market continues to deteriorate, but Intel’s new Raptor Lake series will command a competitive advantage over AMD’s Ryzen, which will bode well for the company.

Moreover, Intel asserts that despite near-term issues, its technology and manufacturing roadmap remains on track (Intel 4, Intel 3/20A/18A, all tracking as per plan). Despite the healthy progress of these process technologies, Intel is taking the pain now, likely setting 2023 to be a growth year.

“Smart Capital” Strategy, A $30 Billion Co-investment With BAM

Intel recently announced that it has entered into a definitive agreement with Brookfield Asset Management Inc. (BAM) to jointly invest up to $30 billion to build and manage two leading-edge fabs at Intel’s Ocotillo campus in Chandler, AZ, with Intel contributing 51% and Brookfield funding 49% of the total project cost. The deal is expected to result in a $15 billion cumulative benefit to adjusted free cash flow over the next several years and be accretive to EPS during the construction/ramp phase of the project, after which Intel will make regular cash payments to Brookfield based on operating cash flows on wafer outs.

The Brookfield deal kicks off Intel’s Semiconductor Co-Investment Program (SCIP), which is just one part of its “Smart Capital” strategy to offset capital outlays through public-private partnerships, including Foundry Service customer pre-pays, government incentives (US/EU CHIPS Act), and SCIPs. As a result, the company believes it can conservatively offset gross CapEx by 10% but targets a 20-30% offset over the next five years.

The Brookfield partnership announcement is another good example of the new economic model based on public-private partnerships that deliver significant capital efficiency required for global manufacturing footprint expansion, given the enormous capital expenditures of a new wafer fab. The company expects similar SCIP deals to further its “Smart Capital” strategy toward its goal of 20-30% capital offsets.

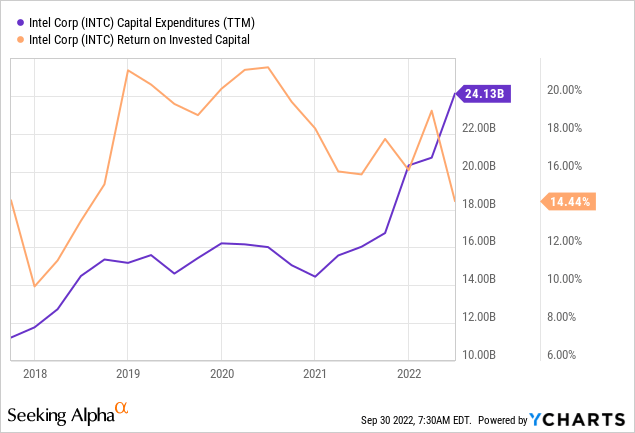

The Improved Capital Allocation Strategy Will Boost Long-term Gains & ROIC

Intel has revised the net CapEx guidance for 2022 to limit the prior free cash flow target to a negative range of $1 billion to $2 billion. Net CapEx has been reduced to $23 billion from $27 billion as the company looks to take advantage of the Smart Capital offsets and makes only modest capacity adjustments. In addition, the company remains committed to distributing dividends, which are unlikely to be cut, with the current yield being attractive.

Lastly, Intel has suffered diminishing ROIC returns recently due to bad capital allocation decisions before Pat Gelsinger’s tenure. Nevertheless, the current CapEx plan and a smart capital strategy seem financially sound and will drive long-term ROIC figures back to the 20% mark in the next 2-3 years.

Intel Remains Committed To Its Plans

Intel’s enhanced competitive position in cloud computing increases the likelihood of raising its average selling prices without significant share loss. As a result, price increases and higher revenue beginning in Q4 2022 will be a catalyst in improving the gross margins and bringing them to a normalized level in Q4 2022 and 2023. In addition, Sapphire Rapids, Intel’s 4th generation Xeon server processor, is expected to be out later this year, with a production volume ramp in 2023. Thus, the ever-delayed Intel’s new CPU line-up will enhance the company’s competitive position.

Intel has reiterated its commitment to the IDM 2.0 strategy, noting that it expects most of its 7nm products (Intel 4) in 2023 to be manufactured internally. Furthermore, I believe Intel will follow through with its plan to aggressively protect its data center group’s market share from AMD while regaining its technological leadership with 7nm.

While the company’s gross margins remain under pressure in the near term as it invests in regaining CPU design and process technology leadership, it is reasonable to expect margins to recover in the coming years as these investments lead to a stronger market position for the company.

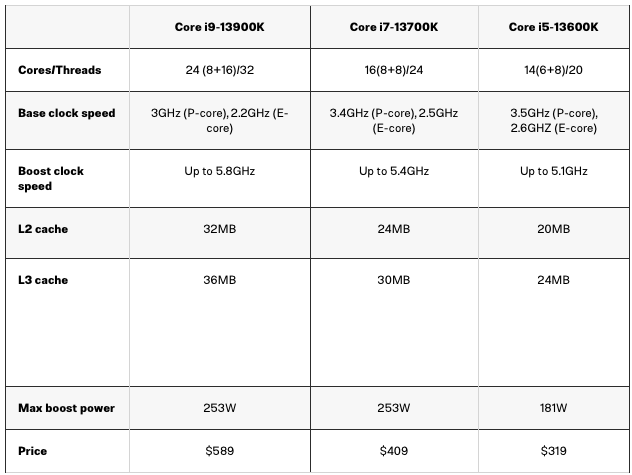

Intel’s Next-gen Raptor Lake Arrives In Time

On September 27th, during the Innovation 2022 event, Intel revealed its 13th-gen Raptor Lake processors, calling its flagship Core i9-13900k the “world’s fastest desktop processor”. The new chips boost higher clock speeds with frequencies up to 5.80 GHz, a record for regular desktop computing. However, one of the biggest changes in this generation remains the number of e-cores in the chips. The processors’ extra e-cores boost the overall count, giving INTC the core count lead in desktop computing for the first time since AMD’s Ryzen’s arrival in 2017.

Raptor Lake (www.digitaltrends.com/computing/intel-raptor-lake-launch-reveal/)

According to Intel, Raptor Lake processors provide 15% improved single-thread performance and 41% improved multi-threaded performance. The company also reports a 24% increase in gaming and a 34% increase in content-creation workloads. Intel claims that the Core i9-13900K gives a 58% increase in gaming performance in Marvel’s Spider-Man compared to AMD’s Ryzen 9 5950X.

Gaming Performance (www.digitaltrends.com/computing/intel-raptor-lake-launch-reveal/)

Similar to gaming, the new processors provide improved performance in content-creation workloads, with a 69% improvement in Autodesk Revit over the Ryzen 9 5950X and a 34% improvement in PugetBench for After Effects. Although the improvements are noteworthy, it remains to be seen how Intel’s newest processors stack up against AMD’s recently introduced Ryzen 9 7950X. Intel’s Raptor Lake and AMD’s Ryzen 7000 are vying for dominance in the next generation. Intel’s higher specs, including the boosted clock speeds, core counts, and additional cache, bode well for the processor to deliver improved performance over its rival.

Valuation Approaches Book Value

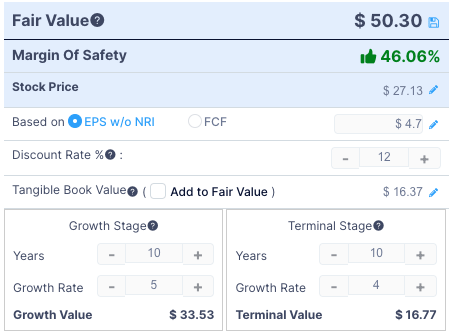

INTC has crashed to unprecedented lows close to its book value per share of $24.65. The drop makes it a bargain, and I maintain a strong buy rating with a target price of around $50 by 2025, based on an EPS of $4.7 and a medium growth rate of 5%. However, if Intel successfully delivers on all of its plans, I think the market would be willing to assign a higher P/E multiple in the range of 15-20x, suggesting a higher target price of at least $70.

Author’s calculation using GuruFocus (gurufocus.com)

Takeaway

Although Intel’s Q2 2022 results and updated full-year guidance were disappointing, I believe that the worst is already priced into the stock and the downside from the current levels remains limited. In addition, the company’s continued advancement in its smart capital strategy and on-time launch of new products will provide a catalyst for growth in the medium term.

Nevertheless, I do not expect any big jump for INTC in the near term. Instead, I see the current environment as an opportunity to accumulate shares in what will likely be its worst-performing quarter for many years to come.

Be the first to comment