cemagraphics

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on September 16th, 2022.

Blackstone Inc. (NYSE:BX) is an asset manager focusing on alternative asset classes. They offer several choices in real estate, private equity, hedge fund solutions and credit & insurance. Some of these are private funds, but some are also publicly traded, where access is available for a larger pool of investors. Like many investments this year, the shares have been under pressure. That isn’t to be unexpected, as an asset manager is even more sensitive to overall market valuations.

With $941 billion in assets under management, they are a sizeable company in the space. BlackRock (BLK) had touched around $10 trillion in AUM (assets under management) earlier in 2022; then, they slipped to around $8.5 trillion with the latest market pressures. I’ll be taking a look at how BX compares to BLK on several occasions. I’m a current shareholder of BLK, and it is the asset manager I’m most familiar with because of that.

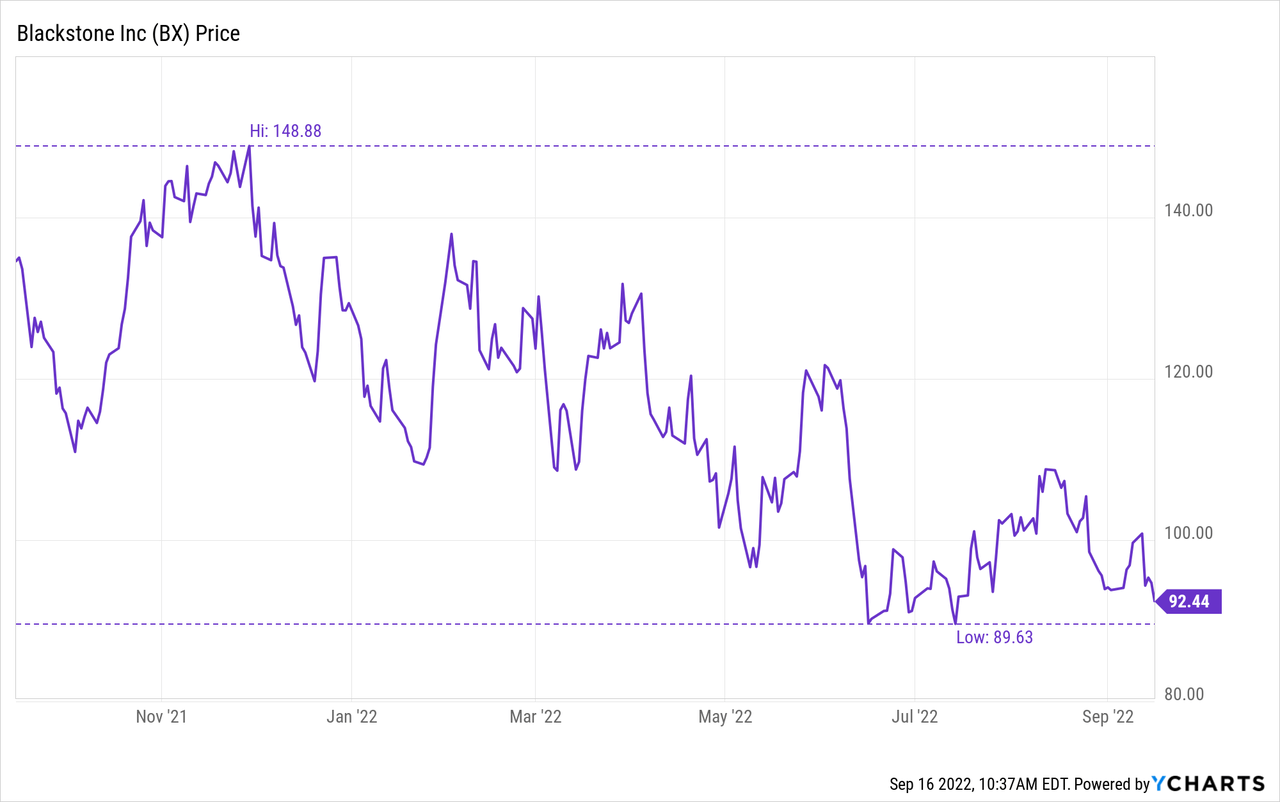

With continued headwinds, I believe that BX could probably continue to fall along with the rest of the market. That being said, after some drastic moves lower than we’ve already seen, we could start nibbling at this level. The stock is down just over 38% from the 52-week high.

Ycharts

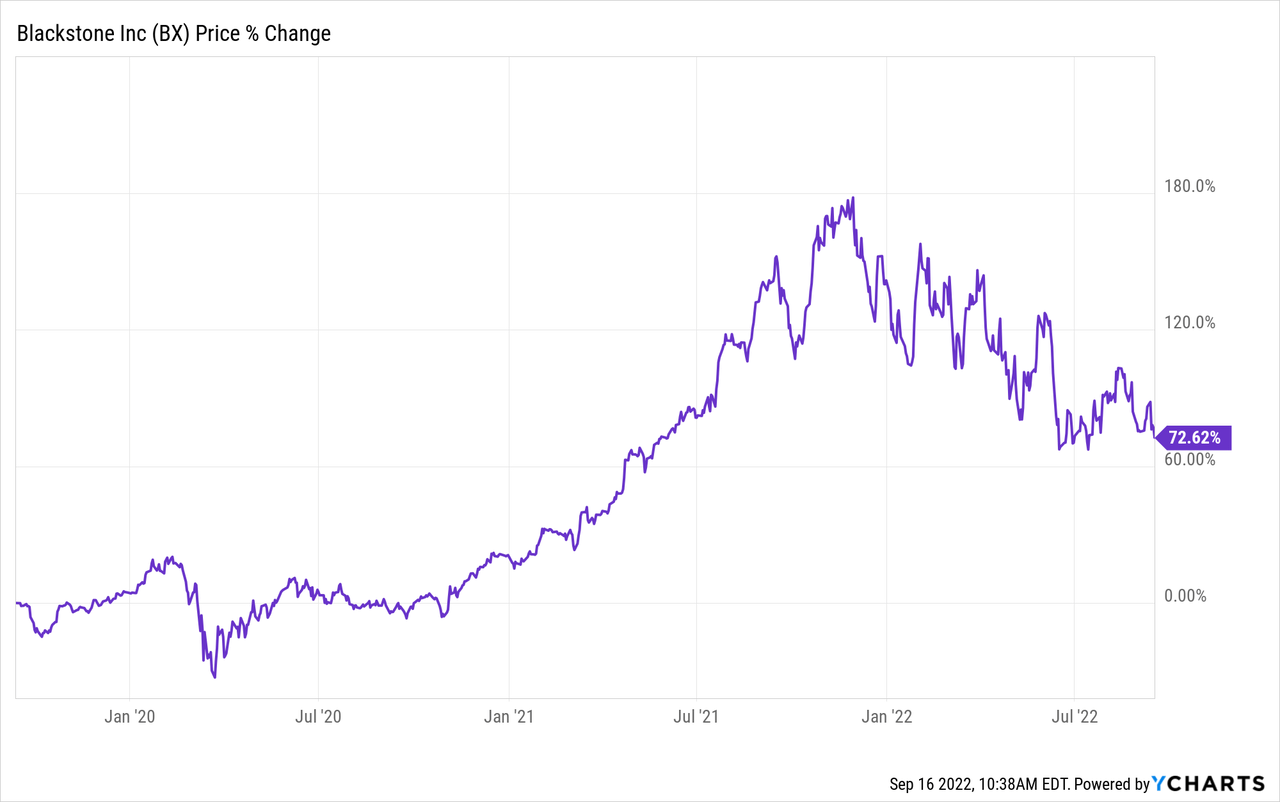

That being said, the stock is still up quite massively from just a few years ago. As asset prices were rapidly rising after the COVID lows in 2020, BX certainly benefited.

Ycharts

Blackstone Earnings Outlook And Valuation

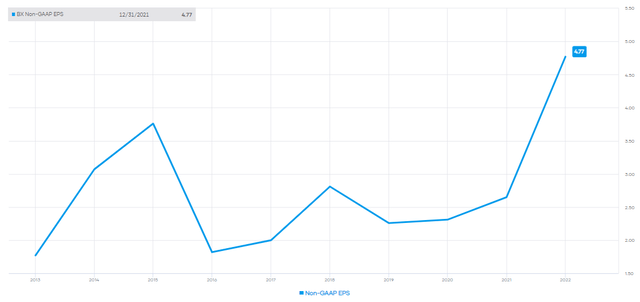

One of the reasons that I believe BX could still be presenting an opportunity at this time is that they are still expected to increase earnings in the coming years. It might not be as aggressive as EPS was rising during the aftermath of the COVID crash, though.

BX Non-GAAP EPS (Portfolio Insight)

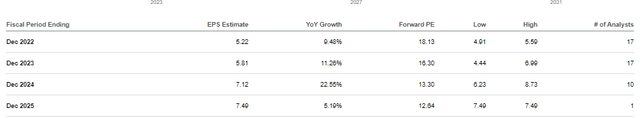

The earnings expectations over the next three years are still rising at a fairly healthy clip.

BX EPS Estimates (Seeking Alpha)

With continued rising earnings, that P/E ratio would continue to decrease. Thus, what often propels a stock to rise in the first place, that is a basic fundamental principle, of course.

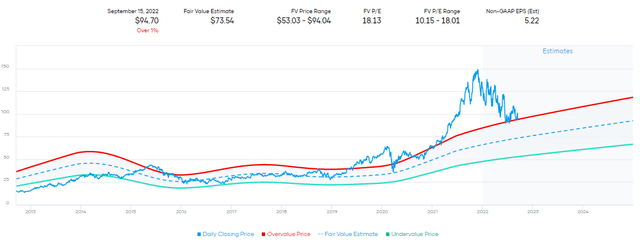

What is quite interesting is how much things have changed in more recent years. When we look at the longer-term 10-year P/E average, we see a stock that is currently above fair value by quite a bit.

BX 10-Year P/E Average Valuation (Portfolio Insight)

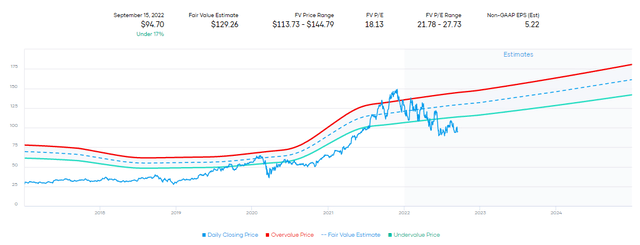

However, shifting to a more narrow look at just the last 5 years instead, we see just the opposite. Instead, it would put the fair value estimate at over $129.

BX 5-Year P/E Average Valuation (Portfolio Insight)

In my opinion, it would lie somewhere in between. That being said, Wall Street analysts also have a fairly aggressive average price target on the stock of $122.14. Notably, the lowest price target for BX is $102 (a high of $153.) That’s still higher than where we are trading now. They are also firmly in “Buy” rating territory at a 4 on a scale of 1 to 5, according to Seeking Alpha.

The latest earnings report for the company was a beat on both the top and bottom lines. The company generated a nearly 96% increase in revenue year-over-year, with a 38% climb in AUM. That was despite the challenges that every asset manager was going through in this difficult environment.

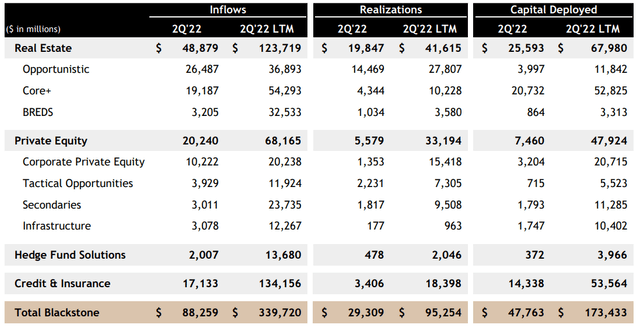

The company experienced inflows of $88.3 billion in the quarter—the second highest quarter of inflows in their 36-year history. In comparison, BLK experienced $90 billion in inflows last quarter. Given the tremendous difference in AUM and the reach of BLK, that’s quite a noteworthy accomplishment for BX.

The revenue increase for BX was driven by a massive 45% increase year-over-year in fee-related earnings. Additionally, distributable earnings were up 86% year-over-year.

This optimism for generating further fee-related earnings in the future is echoed by management, here’s from the latest conference call.

Turning to the outlook. Similar to the road map we provided four years ago, we believe the combination of the firm’s latest drawdown fundraising cycle and the ongoing expansion and scaling of our perpetual capital platform will lead to a structural step-up in the firm’s FRE over the next several years.

Alternatives Matter

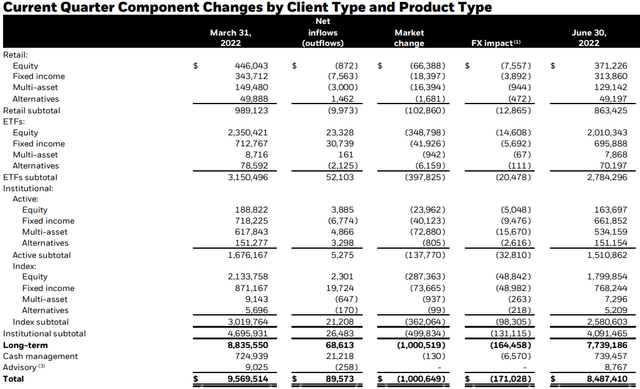

The increase in earnings and revenue for BX is consistent with what we have seen in the alternative asset space. BLK’s inflows pointed to alternatives being a strong component. On the retail and institutional active side, the amount of alternative inflows was one of the relatively strongest contributors.

On the retail side of the equation, inflows for equity, fixed-income and multi-asset were actually all negative. It was only alternatives that had positive inflows. Here is the breakdown for BLK.

Here is the breakdown of inflows for BX. For BX, they had the largest inflows coming in for their “opportunistic” real estate.

Blackstone Inflows (Blackstone)

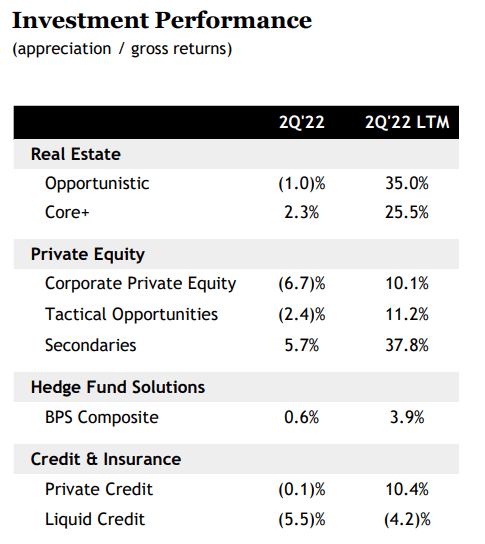

When looking at the AUM, investment performance is also playing a key role. We can see above that the market change was negative in every single category for BLK. They largely invest in more traditional means; however, even their alternatives produced negative results for their operations.

This was different for BX, where they had some positive performances or at least not as negative in some cases. Since fees are based on AUM and performance, better performance can result in better earnings at the end of the day. Thus, why we see an asset manager like BX still being able to provide growing EPS despite the headwinds. BLK, on the other hand, had EPS drop year-over-year.

BX Investment Performance (BlackStone)

Alternatives provide diversification for investors, which I think is why they’ve been growing in popularity recently. When the market zigs, they can zag. This seems to reflect in the fundamentals of BX with its alternative asset focus. That’s why I believe BX is in a really interesting place at this time. Yet, the stock’s price hasn’t seemed to reflect that they are actually benefiting from this shifting market.

BX Dividend

Of course, one important component of companies that I look at is the dividend. For BX, they operate a bit differently. They pay a variable dividend based on the earnings or what is the distributable earnings. We can see that the latest dividends have been quite massive.

While the 5.38% yield might seem impressive based on the latest payout, it has been trending lower. This is despite the distributable earnings being one of the two best quarters in the company’s history. Perhaps strengthening the balance sheet while the outlook remains uncertain isn’t a terrible idea, though.

BX Dividend History (Seeking Alpha)

The latest boost in fee-related earnings naturally contributed to a sharp increase in distributable earnings.

Despite these hostile conditions, Blackstone again delivered outstanding results for our investors. Distributable earnings in Q2 nearly doubled year-over-year to $2 billion, one of the two best quarters in our history, driven by 45% growth in fee-related earnings and record realizations.

Record realizations also contributed to this, too.

The value of our assets is further highlighted by our record realization activity in the second quarter. The firm’s largest realizations in the quarter and among the largest in our history was a $23 billion recapitalization of last-mile logistics platform Mileway and the $5.7 billion sale of the Cosmopolitan Hotel in Las Vegas in two of our favorite secular neighborhoods

Conclusion

BX is in an interesting space that is growing in popularity. Strong inflows and relatively better underlying performance set them up to weather the current economic conditions better than other asset managers. At the same time, the market has still discarded these stronger results sending the shares lower with the overall market. I believe better consistency in the dividend payout would make it even more attractive. Although, some investors don’t mind the variable payouts. I think the market could continue to pressure shares of BX, but at the current levels, shares are worth considering.

Be the first to comment