David Paul Morris/Getty Images News

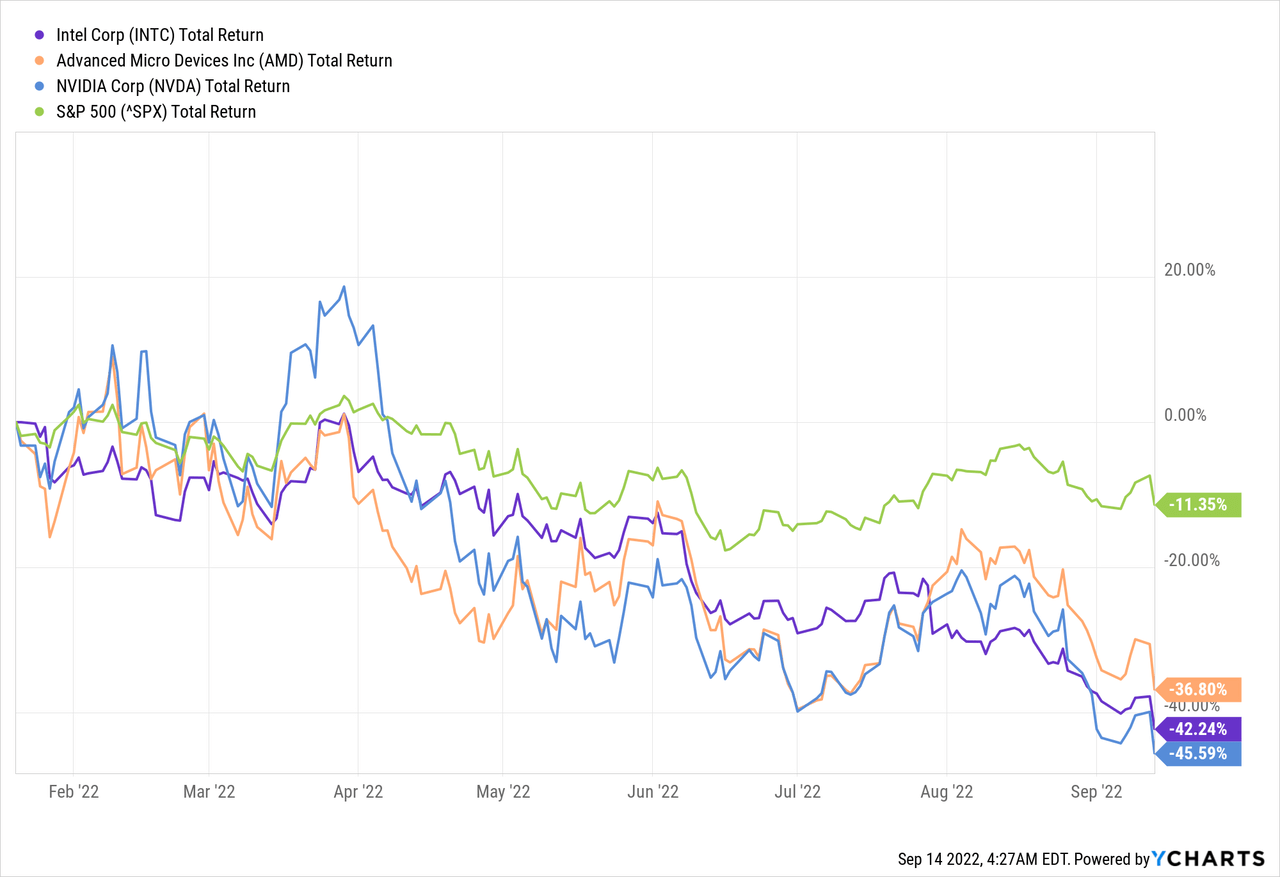

So far it has been a tough year for Intel (NASDAQ:NASDAQ:INTC), which was in a tough spot for most of 2022. As I wrote back in January, Intel is well-positioned to deliver on its strategy over the long-run, but the share price was unlikely to perform in the short term.

Seeking Alpha

Back then I warned of the risks associated with the cyclical nature of the cyclical industry and also cautioned that Intel’s ambitious investment program and intensifying competition will likely lead to short-term pressures:

Competition in the semiconductor space is bound to increase even further, which would likely take its toll on the profitability of all players within the industry. The costly and ambitious plan of Intel will also likely be accompanied by a decrease in free cash flow over the coming years and the highly cyclical nature of the industry does not help.

Source: Seeking Alpha

Unfortunately, all of these risks have now materialized and both Intel and the rest of its peers fell precipitously.

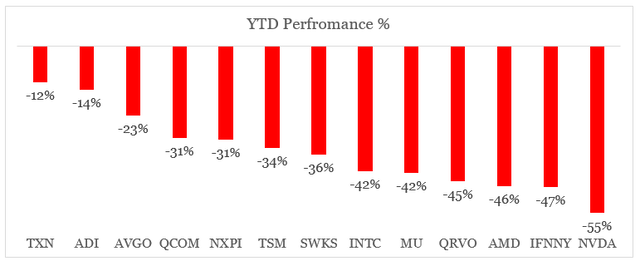

As a matter of fact the whole extended semiconductors peer group has been decimated since the start of 2022.

Total Return (prepared by the author, using data from Seeking Alpha)

Only Texas Instruments (TXN) has been largely tracking the broader market and was the best performing stock in the group above. TXN has also been the only stock in the semiconductors space that I have initiated with a Buy rating earlier this year.

Seeking Alpha

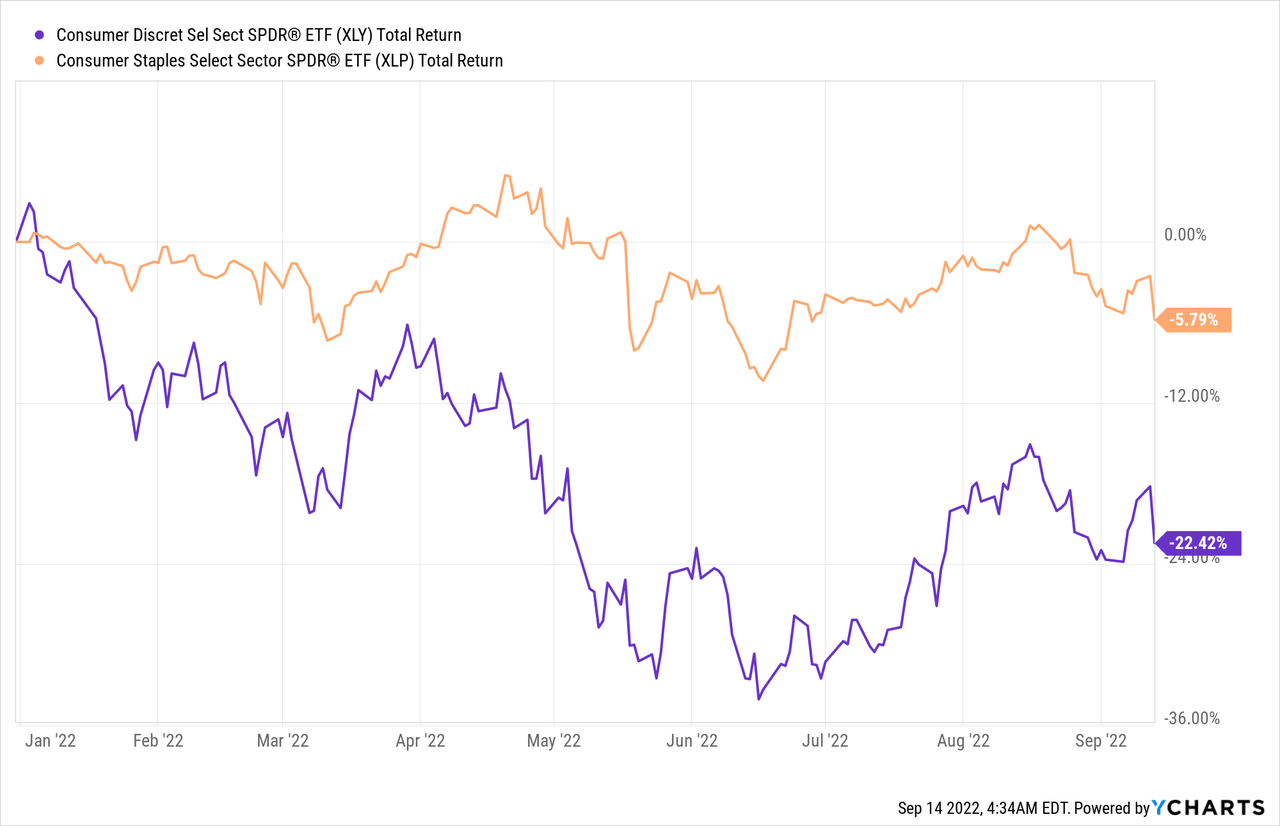

Having said all that, this disastrous performance of the whole sector has not been driven by broader market movements, but rather due to normal and expected changes in the business cycle.

On one hand this is evident by the massive change in performance of semiconductor stocks, which usually have betas of slightly above one. On the other hand, we also see it through the wide gap that has opened by the Consumer Discretionary Select Sector SPDR ETF (XLY) and Consumer Staples Select Sector SPDR ETF (XLP).

Business Performance

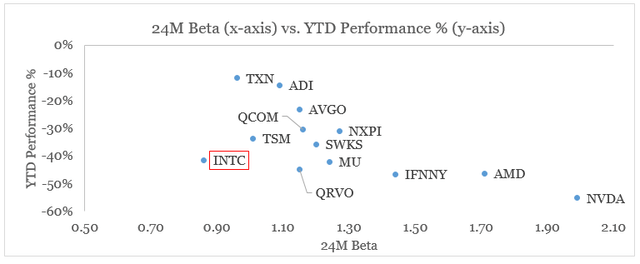

If we look at year to date performance, however, and compare that to each company’s 24-month beta, we see that Intel still comes as an outlier within its peer set.

prepared by the author, using data from Seeking Alpha

Given the company’s low beta, year-to-date performance should have been in single digit numbers, but instead it has dropped 42% so far. Therefore, more than most of this decline must be attributed to Intel’s Q1 and Q2 2022 results.

Indeed, the last reports were very disappointing and it seems that even the management couldn’t blame it entirely on the cyclical slowdown.

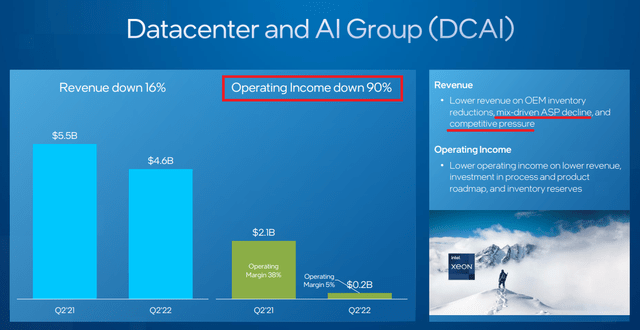

While we continue to make solid progress on our strategy, Q2 results were disappointing, below the standards we have set for the company and below the commitments we have made to you, our shareholders. The sudden and rapid decline in economic activity was the largest driver of the shortfall, but Q2 also reflected our own execution issues in areas like product design, DCAI, and the ramp of AXG offerings.

Pat Gelsinger – Chief Executive Officer

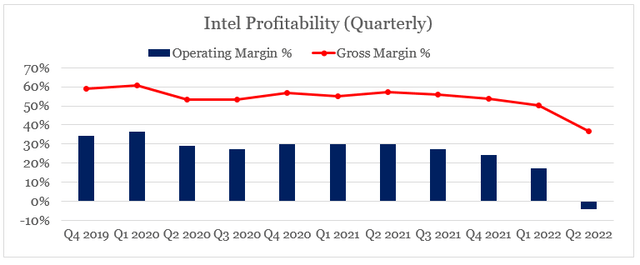

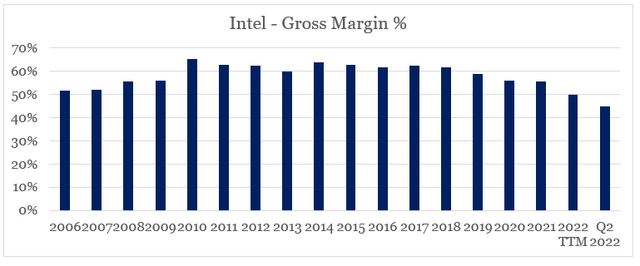

As profitability and revenue declined across all of Intel’s major segments – Client Computing Group (CCG), Datacenter and AI Group (DCAI), Network and Edge Group (NEX), this dragged the overall margins to their lowest levels in a very long time.

prepared by the author, using data from Seeking Alpha

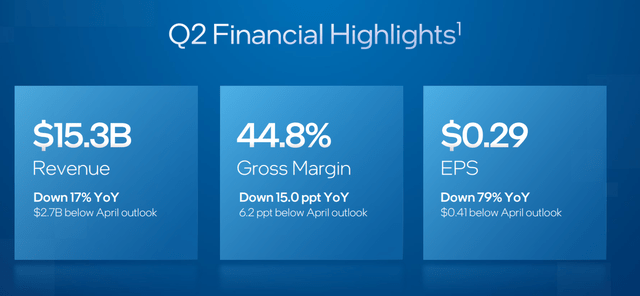

During the first quarter for the year, Intel provided the following outlook for revenue, gross margin and earnings per share.

Intel Investor Presentation

Just three months later, all these numbers came in vastly different from initial expectations.

Intel Investor Presentation

Is such a decline justified?

With such a drastic change in business fundamentals, Intel was indeed an outlier in the most recent quarter as most of its peers continued to grow on a year-on-year basis.

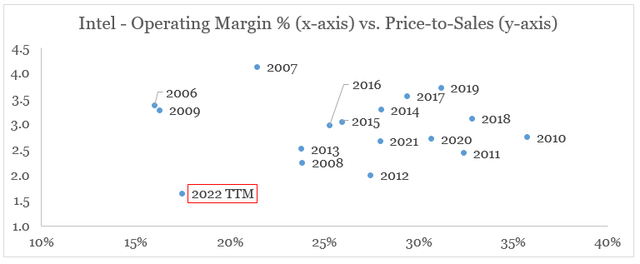

On a historical basis, however, the current drop in Intel’s price-to-sales multiple was unprecedented. Even during the 2006-09 period as operating margins fell to similar levels, Intel’s P/S multiple was about twice as high as it is today.

prepared by the author, using data from Seeking Alpha and SEC Filings

This is partly due to the sharp reversal in Intel’s profitability and the execution issues during the most recent quarter. As we see below, Intel’s gross margins are now at lower levels than the 2006-09 period, which naturally led most market participants to price a much more pessimistic scenario for Intel’s future when compared to the Global Financial Crisis.

prepared by the author, using data from Seeking Alpha and SEC Filings

During such sharp market downturns, revenue and margin guidance is to be taken with a grain of salt, however, after taking into account the most recent developments management now guides for gross margins to return to levels similar of the 2006-09 period.

Full year gross margin we’re guiding to 49% at the midpoint of revenue guidance with the expectation that gross margin will return to the low end of our target range of 51% to 53% in Q4 as revenue increases, we achieve scale on new product ramps and cost continue to improve.

Dave Zinsner – Chief Financial Officer

Source: Intel Q2 2022 Earnings Transcript

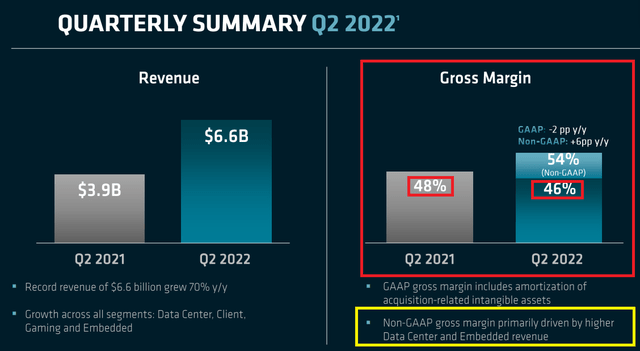

Intel’s major peer, AMD (AMD), also was not immune to the recent downturn in the cycle, with its gross margin declining from 48% in Q2 2021 to 46% in Q2 2022.

AMD Investor Presentation

The Non-GAAP reporting, however, makes it look like it’s the other way around, when in reality excluding amortization of intangibles is a practice that is not sustainable over the long term.

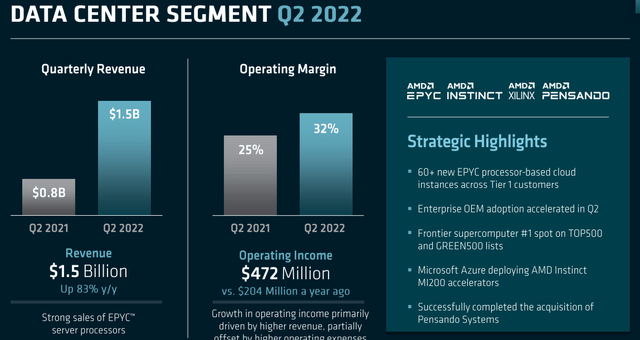

Having said that, we should also recognize the strength of AMD’s roadmap in the data center segment, which so far continues to deliver excellent results.

AMD Investor Presentation

This clearly illustrates what I mentioned back in January, that competition in the sector is only going to intensify further.

Turmoil in equity markets also had an impact on Intel’s upcoming IPO of Mobileye, its autonomous driving technologies group. Potential valuation of the group was recently rumored to have been lowered to $30bn, from a previously hoped valuation of $50bn.

Seeking Alpha

As big of a drop as this might sound, this is still about twice the $15.3bn Intel paid for Mobileye about five years ago.

While all these quarterly movements seem to be reflected in Intel’s valuation, the company seems to be looking beyond the short-term.

For example, under Gelsinger, Intel is showing very good capital allocation as the company has already exited a large number of non-core businesses which helps to allocate more resources to major business units.

In total, we have now exited six businesses since my return providing roughly $1.5 billion for investments aligned with our IDM 2.0 strategy. We are also lowering core expenses in calendar year 2022, and will look to take additional actions in the second half of the year, which Dave will address later. Importantly, expense discipline is not impacting the strategy and we remain firmly on track to achieve process performance parity in 2024 and unquestioned leadership in 2025.

Pat Gelsinger – Chief Executive Officer

Source: Intel Q2 2022 Earnings Transcript

Another key aspect for Intel, is the company’s innovation which is clearly illustrated by Alder Lake’s strong performance, in spite of it being at a disadvantage to competitor’s offerings that utilize TSMC (TSM) leading technology.

In our client business, Alder Lake momentum continues. We have the strongest PC lineup in 5-plus years, and we remain unapologetic about our growing leadership and share position. We are building on Alder Lake leadership with Raptor Lake in second half of this year and Meteor Lake in 2023 exemplifying how our innovative design decisions can drive leadership performance even before re-establishing best-in-class transistor technology.

Pat Gelsinger – Chief Executive Officer

Source: Intel Q2 2022 Earnings Transcript

As I showed in my January analysis of Intel, this competitive advantage of the fabless players seems to be slowly diminishing.

Datacenter and AI Group, will most likely continue to be the weak spot of Intel as large clients are reacting more slowly to changes. Of course, AMD will continue to put pressure in this segment and on top of that Intel is likely taking more aggressive pricing strategies to retain large customers.

Intel Investor Presentation

As increased investment in the product roadmap and Sapphire Rapids pre-production charges were also at play during the most recent quarter, the roadmap is sowing initial momentum with Intel expanding its partnerships with Meta (META) and AWS. At the same, Sapphire Rapids chips will also be used in Nvidia’s (NVDA) DGX-H100 AI platform.

Nvidia Website

In addition, NVIDIA announced the selection of Sapphire Rapids for use in their new DGX-H100, which will couple Sapphire Rapids with NVIDIA’s Hopper GPUs to deliver unprecedented AI performance.

Intel’s graphics processing unit (GPU) was also off to a rough start, however, the progress that was made in recent years is astounding and as I showed previously, Intel is well-positioned to compete with both AMD and Nvidia on this front.

Lastly, the Foundries business will also take its toll on short-term results of Intel as it will require increased investments in capacity.

In Q2, we also launched the IFS Cloud Alliance a partnership with leading cloud providers including Microsoft Azure and AWS and EDA tool providers, including Ansys, Cadence, Siemens EDA and Synopsys. The IFS Cloud Alliance is the next phase of our accelerator ecosystem program that will enable secure design environments in the cloud, improving foundry customer design efficiency and accelerating time-to-market.

Source: Intel Q2 2022 Earnings Transcript

The sole fact that Intel mostly relies on internal fabs is also the reason why the company will be at a disadvantage to the fabless players during the current cyclical downturn as this capital intensive business significantly increases the share of fixed costs. However, it will give Intel a significant competitive advantage over the coming years, once the cyclical downturn cools-off.

Conclusion

A 42% year-to-date return for Intel is hard to swallow, even when considering Nvidia’s abysmal 55% decline during the same period. Given Intel’s lower momentum and market exposure, the company was supposed to perform far better in 2022. However, execution issues weighed on margins and overall performance.

With all these issues in mind, Intel is unlikely to turn the corner in the next few months. Management’s long-term oriented strategy is also not prioritizing quarterly results at the expense of achieving long-term competitive advantages. Nevertheless, the market seems to be already pricing in an extremely pessimistic scenario for Intel’s future, which in my view makes the company’s proposition far more attractive now than it was back in January.

Be the first to comment