Lemon_tm/iStock via Getty Images

Article Thesis

I’ve been a bull on Intel (NASDAQ:INTC) for some time, mainly due to its above-average income yield and inexpensive valuation. But the company’s most recent quarterly results were disastrous, as more or less every metric moved in the wrong direction. Business is deteriorating a lot faster than what we are seeing from Intel’s peers, which isn’t a good sign. The long-term future could still be positive, but in the here and now, Intel seems to have huge problems.

The Headline Numbers

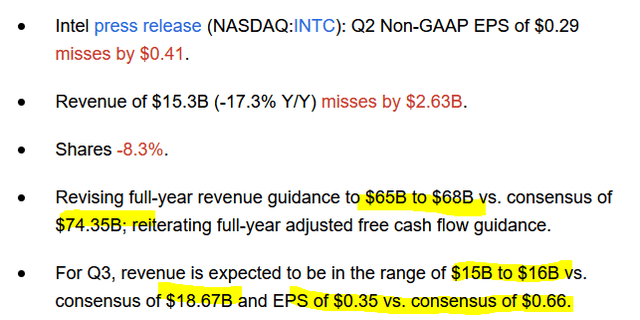

The following screenshot taken from Seeking Alpha shows a couple of metrics from Intel’s most recent quarter:

Intel’s top line number missed estimates by around 15% and was down by 17% year over year. Earnings, meanwhile, came in at less than half the forecasted level.

The outlook for both the current year as well as the current quarter was disastrous, as revenue is forecasted $8 billion and $3 billion below the analyst consensus estimate.

Major Problems And Underperformance Versus Peers

Intel had a really bad quarter, and it does not look like things will improve much during the remainder of the year. That came as a huge surprise to the market and most investors. After all, Intel’s peers did not perform nearly as badly in the recent past. NVIDIA (NVDA) reported its most recent quarterly results around two months ago, showcasing a massive 40% revenue gain compared to the previous year’s quarter. Its fiscal first quarter ended before Intel’s second quarter ended, so NVIDIA’s numbers are somewhat dated. But still, there is a massive difference between what NVIDIA reported recently and what Intel reported just now. AMD (AMD) also has performed way better than Intel in the recent past, reporting organic sales growth of 55% for the most recent quarter and guiding towards revenue growth of around 50% on an organic basis for the second quarter, where we didn’t see the report yet. If AMD’s guidance came anywhere near what the company actually delivered, then there is a 60%+ difference between Intel’s Q2 growth rate and AMD’s Q2 growth rate.

Many other semiconductor stocks have done well during the most recent quarter, too, such as Texas Instruments (TXN), which came out with a 14% revenue increase. Broadcom (AVGO) also was able to generate a 23% revenue increase in its most recent quarter. Potentially most telling, Taiwan Semiconductor Manufacturing Company (TSM) has reported a 37% revenue increase in July. Since TSM is a foundry that manufactures chips for many different semiconductor companies, including Intel’s peers AMD and NVIDIA, its excellent recent results can be seen as a sign that semiconductor demand is not at all falling off a cliff. Instead, TSM’s strong results, as well as the gains reported by other semiconductor companies, suggest that chip demand is still very healthy and that customers are willing to pay premium prices — otherwise the huge revenue gains from TSM and others wouldn’t be possible. In fact, TSM’s guidance for its current quarter (Q3) implies another 10% sequential revenue gain (40%+ annualized), thus demand by customers seems to remain very strong.

In that environment, Intel’s falling revenues are a major outlier. The company clearly has company-specific issues — otherwise, it would not underperform its peers this much.

Deteriorating macro, inventory and supply disruptions, and competitive pressures are cited as issues that impacted Intel’s profit and revenue negatively. I believe that deteriorating macro wasn’t the most important factor here. Otherwise, other semiconductor companies, and especially foundries such as TSM, would be feeling the pressure, too. But since those companies are performing very well and upping their guidance, beating estimates, and so on, the macro environment for the overall semiconductor industry can’t be too bad. Instead, it looks like the macro environment is pretty healthy.

Of course, Intel’s product lineup isn’t identical to that of other chip companies, and it’s possible that other companies are less exposed to markets that are having problems. It does indeed look like this is the case, at least to some degree, as the PC market has slowed down, and since Intel has above-average exposure to this market. But still, macro issues do not and cannot fully explain Intel’s weak performance at a time when many other semiconductor companies are hitting records.

Instead, market share losses seem to be a key problem for Intel. Data center revenue was down 16% during Intel’s most recent quarter, almost in line with the company-wide revenue decrease. And that can’t be explained by market weakness, as other data center players are reporting huge gains. Instead, Intel has lost further market share to NVIDIA and AMD, a trend that has been in place for some time. But in the past, market share losses by Intel were not very pronounced, and the company was able to still grow its data center revenue in most quarters thanks to the market’s strong growth. But market growth didn’t save Intel during the most recent quarter, as market share losses were so large that revenues dropped by double-digits. Even worse, Intel’s operating income in the data center business declined by an outrageous 90% year over year, dropping to just $0.2 billion from $2.1 billion one year ago.

Not everything was bad during the quarter, as there were some positives as well. Intel’s Mobileye division, for example, reported a revenue gain of 40% year over year and also saw its margins expand. That’s good news, and the longer-term growth potential for Mobileye is great, of course, as autonomous driving is still only starting up. But despite the high relative growth rate for this business unit, the absolute growth of $130 million wasn’t anywhere close to making up for the $900 million of lost revenue in the data center business, for example. Unfortunately, Intel is doing better in its small business units while it fares worse in its larger businesses — overall, the decline in the major business units outweighs the growth from smaller units.

Intel also argued that supply disruptions had a negative impact during the most recent quarter. I do not doubt that this is true, but it still is a bad sign. After all, most peers do not seem to be negatively impacted by supply disruptions to the same degree. In fact, one of Intel’s advantages should be that it is less dependent on foundries, as it can manufacture its own chips. If fabless companies that are fully dependent on foundries for their supply of chips are doing better in that regard compared to Intel with its own fabrics, then Intel must be managing its supply chains pretty badly. When Intel spends large amounts of cash on capital expenditures to own its own production, and when it still has worse supply chain issues than peers that are operating without any production capacity, then it seems questionable whether Intel’s own plants are a great strategic choice.

Rethinking My Stance On Intel

I’ve been positive on Intel for some time, as it traded at one of the lowest valuations in the industry and since it offered an above-average yield. But Q2 results were so weak that I am rethinking my stance on Intel.

Based on the company’s current guidance, its earnings multiple is 16, as the company is now forecasting that it will earn just $2.30 per share this year — at the beginning of the year, Intel was forecasted to earn $3.80 per share in 2022. In other words, EPS estimates have now dropped by 40%, while Intel’s shares have declined by only 30% over the same time frame. Despite the share price drop, Intel has thus actually become more expensive, at least when we focus on 2022’s earnings per share.

The weak results from Q2 and the sub-par guidance for H2 also bring up some questions about the sustainability of Intel’s dividend. The company is forecasting that free cash flow will be negative at $1 billion to $2 billion in 2022, as operating cash flows will seemingly not be enough to pay for Intel’s planned capital expenditures of $23 billion. Intel’s dividend costs around $6 billion a year — there is no guarantee that the company will continue to make these payments when its free cash flow is negative. Intel has a strong balance sheet, so a temporary cash shortfall is not necessarily a disaster. But still, the dividend isn’t looking as safe as it did a year ago when Intel was still covering its dividend more than twice with its free cash flows.

Intel still isn’t an expensive company today. But considering its problems, I currently feel more bullish about AMD and TSM, which are trading at 14x and 21x net profits while reporting way better growth. On top of that, both companies are taking market share and are clearly better at avoiding supply chain issues.

Takeaway

Intel’s Q2 was horrendous. Profits came in at less than half the expected amount, revenues dropped by double-digits at a time when peers are growing their revenue by 20%, 30%, or even more. Intel will not have any positive free cash flow this year, which is why the dividend might not be safe.

Intel might very well be able to right the ship over the coming years, but for now, it doesn’t look like it is well-positioned for the near term. I currently feel way better about my TSM position than my INTC position. I might replace my (small) Intel stake with AMD, although it naturally hurts to sell close to a 52-week low. For new money, Intel doesn’t look like a great pick until management proves it can tackle the company’s major issues successfully.

Be the first to comment