Chip Somodevilla

Thesis

Intel Corporation (NASDAQ:INTC) has arguably seen the worst decline from its 2021 all-time highs since the collapse during the heights of the dot-com bust. Despite its relatively “cheap” valuations, INTC has fallen more than 60% from its April 2021 highs.

As a result, it reminded investors why the market remains unconvinced about CEO Pat Gelsinger’s ambitious turnaround strategy, as the market sent INTC crashing back toward its August 2015 lows. Moreover, the steep sell down picked up pace since March, as the market digested more than seven years of gains. Accordingly, we believe long-term investors who couldn’t tolerate the massive downside volatility have likely thrown in the towel to prevent further damage to their portfolios.

Our assessment suggests that any opportunity in INTC remains speculative. Accordingly, investors considering our rating should size their exposure appropriately with robust risk management strategies to prevent unforeseen outsized losses. Therefore, we urge investors to apply suitable stop-loss risk management plans to move to the sidelines if the market moves against their strategy.

However, we gleaned that the massive battering in INTC could be near completion, with another subsequent selloff to re-test its August 2015 lows before consolidating. As a result, investors who have been biding their time should find the current levels relatively attractive as a speculative mean-reversion opportunity.

As such, we reiterate our Speculative Buy rating on INTC.

AMD Spooked The Market With Its Q3 Prelim Release

AMD’s (AMD) prelim Q3 release led to a massive 14% single-day drop in its stock on Friday, as the market digested its valuation further to account for its poor performance. Therefore, even AMD CEO Dr. Lisa Su couldn’t do much to mitigate the inventory adjustment in its consumer PC downstream customers amid much weaker-than-anticipated spending on consumer electronics.

Therefore, the bad news for the semi industry has been coming one after another, in sharp contrast to the buoyant mood among Wall Street analysts just 12 months ago. Back then, Street analysts were championing the sustainability of the PC growth drivers, with supply chain lead time often used as a barometer in highlighting sell-through strength. How times have changed in a year, as these analysts have turned bearish abruptly in the face of a significant semi downturn.

Therefore, we believe the critical question that investors need to ask is whether the battering in INTC is subsiding, with valuations in the semi industry slashed remarkably.

Intel’s Disastrous Year Could Turn around in FY23

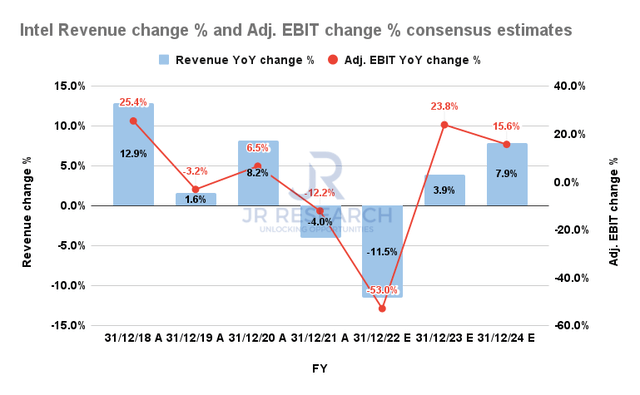

Intel Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (neutral) suggest that Intel could have easier comps in FY23 to lap, given the disastrous year in 2022, as its adjusted EBIT is projected to fall by 53% YoY.

Notably, Street analysts expect Intel’s revenue and adjusted EBIT growth to recover through FY24, which should undergird its valuation at the current levels. So, are these estimates reliable? As the Street has turned neutral on INTC, we surmise that it seems reasonable that a reasonable level of pessimism has been applied to Intel’s execution risks over the next two years.

Therefore, it should help alleviate the concerns of investors thinking that further steep writedowns could be necessary. Furthermore, the leading logic and memory chipmakers have already released their respective profit warnings.

As a result, the list now counts NVIDIA (NVDA), Micron (MU), Samsung (OTCPK:SSNLF), and AMD. As such, we believe a massive level of pessimism has been factored into the semi industry’s valuations at the current levels, including INTC.

INTC’s Valuation Remains At 2015 Lows

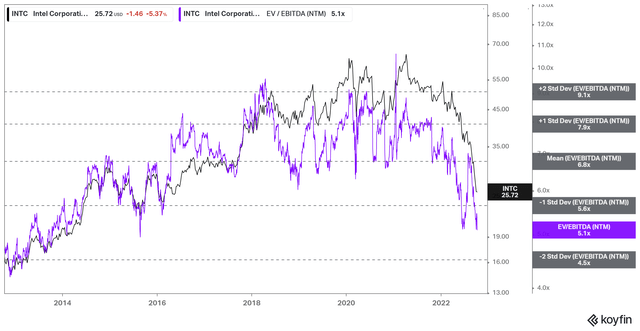

INTC NTM EBITDA multiples valuation trend (Koyfin)

INTC’s NTM EBITDA multiples fell to the one standard deviation zone under its 10Y mean in June before it surged back up in August, as its forward estimates were cut.

Therefore, we were confident in our previous article, postulating that INTC’s valuation has likely bottomed in June, given the battering it received.

Notwithstanding, the series of profit warnings by the leading chipmakers heaped more misery on the semi industry, and there was no way Intel could be immune to the selloff.

As a result, the market sent INTC spiraling rapidly down toward that zone again. Hence, investors are given another opportunity to observe whether its valuation can be sustained at the current levels without further significant cuts in its forward estimates.

We maintain our conviction that the current zone should help underpin a consolidation for INTC moving forward if the company can maintain its execution through H2’22.

Is INTC Stock A Buy, Sell, Or Hold?

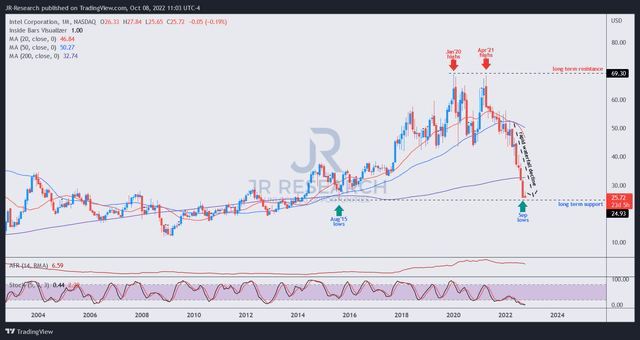

INTC price chart (monthly) (TradingView)

We gleaned that INTC has continued its massive capitulation move through last week. However, last week’s price action indicates a possible consolidation thesis, as it ended the week close to its September lows.

Therefore, the price action over the next three to four months is critical to our thesis. Notwithstanding, we deduce that a further selloff to break August 2015 lows is still possible to create a bear trap opportunity. Hence, investors are encouraged to keep some additional ammo to capitalize on potential downside volatility to force more INTC holders out.

We reiterate our Speculative Buy rating on INTC.

Be the first to comment