JasonDoiy

One of the nice things about writing on Seeking Alpha is the reader engagement/comments on articles. Many times, readers not only discuss the stock or the topic in question but also offer useful suggestions about other stocks. In our recent article about selling puts on Tesla (TSLA), one of the readers mentioned Intel (NASDAQ:INTC) as a stock to consider selling puts on.

Intel is definitely an interesting name to consider on selling puts. The stock has been range bound for almost two decades at this point. Long term investors may recall the infamous three musketeers Microsoft (MSFT), Cisco (CSCO) and Intel being range bound forever. Only Microsoft has managed to break this shackles for good while one can argue that Intel lags behind Cisco too in both 1-year and 5-year timeframes.

What has gone wrong for Intel? Quite a bit. Economic worries and China worries especially have had a large impact on earnings expectations. To put that into context, the expected forward EPS of $2.24 is less than half the trailing twelve months EPS of $4.67. And we can be sure there will be more revisions to the downside.

In hindsight, it is undeniable that people in general and some stocks as a result, went over-board during the peak of the pandemic. Demand for PCs, Phones, Gaming devices, and Cars to name a few went to crazy levels with the expectation that people are never stepping out of their house or returning to workspace. Well, reality has spanked us all and very few industries have been as badly hit as the semiconductors. But, it is not just optimism that can go overboard. Pessimism can too and in our view, it already has shot into the extremes. Don’t believe it? See below:

- Intel’s dividend yield is half of its forward PE. You may think that is an Apples to Oranges comparison but it highlights the skewness between what the stock offers and how it is valued.

- Intel has lost more than 50% of its value YTD. This by itself doesn’t make it a buy but unless you believe the World will never need more chips ever than what is projected now, this is a compelling risk-reward.

- Even darling competitors like NVIDIA (NVDA) that could do no wrong for many years are suddenly plagues. So, this is not Intel specific.

If you are worried about buying Intel at this price but are interested in acquiring it lower, then consider selling puts as shown/explained below.

Key data points

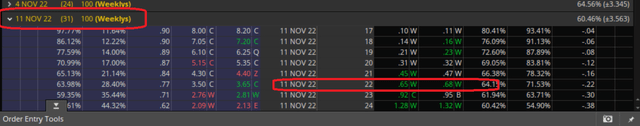

- Strike Price: $22

- Expiration Date: November 11th, 2022, exactly a month from today.

- Premium: $.67/share, for a total of $67.

In simple words, the put seller collects $67 immediately to buy 100 shares of Intel at $22 if the stock reaches $22 or below by November 11th, 2022.

What’s the expected return and possible outcomes?

Return: The premium collected ($67) for setting aside $2,200 represents a 3% return for a month. This is a handy return anytime and even more so in the current market environment. At this time, the market assigns at 72% probability that Intel remains above $22 by expiration on November 11th.

Outcome #1: If Intel stays above $22 by the expiration date, the option seller just retains the premium mentioned above. The option seller will not be obligated to buy the shares.

Outcome #2: If Intel goes below $22 by the expiration date, the option seller will be forced to buy 100 shares at $22, irrespective of where the stock trades at that time. Keeping the premium netted in mind, the average cost, in this case, will be $21.33 ($22 minus $0.67).

Outcome #3: As an option seller, one can “buy to close” anytime instead of waiting till the expiration date. That may be appealing to those who have the time and patience to play short-dated options many times over. But we typically let the option expire before choosing another chain (or another stock).

Outcome #4: Let’s say the stock price plummets below $22 before the expiration. In this scenario, the premium you got paid when selling the put will be lower than the price you’d need to pay to “Buy to close” in outcome #3. Let’s say you don’t want to get assigned yet but at the same would like to remain in the game to acquire Intel lower. Then “rolling” your cash secured put is an option. We have not executed this put on Intel yet and are not able to share a screenshot from our own account. But, this article explains the steps and the scenarios very well.

Why $22 Looks attractive?

- Yield: In the current rising rate environment, investors tend to look down on dividend stocks with low yield but an undervalued stock yielding twice the 10 year offers a compelling opportunity in our view. At $22, Intel will yield nearly 7%, which is almost twice the 10-year yield at this point.

- Looking darker than the current darkness: If things look dark now, they’d look even darker at $22, which means the reward for sticking around is likely greater. In an irony of sorts, the semiconductor industry helps with “memory” issues on your devices but seems to suffer from investors having a memory problem. Advanced Micro Devices (AMD) and Nvidia were trading in single digits as recently as 2016 before reaching $150 and $330 respectively. We are not saying Intel will turn out to be a 10 bagger from $22 but neither will it be going out of business nor continue trading at such depressed valuation forever. Intel is a cyclical and should be treated/traded accordingly.

- Generational Lows: As shown in the chart below, since Intel first crossed $20 per share in 1997, the stock has traded below $20 only twice in the last 25 years. And no prizes for guessing the two instances: dot com bubble and financial crisis. Do you believe things are so bad right now? We don’t think so. This is an economy adjusting to various excesses including liquidity, supply, and demand.

Be aware of your risks and choices

- Since many readers were confused in the previous article about this, this exercise is cash-secured. We do not recommend margins for most retail investors.

- The market is really choppy and is looking for reasons to sell off. Your strike price may be reached quicker than usual, so before you execute this put or anything else for that matter, be very sure of a few things: (a) you like owning the underlying stock (b) you are okay with being assigned at the strike price.

- Please note that Intel is about to report earnings on October 27th and things tend to get more volatile around earnings.

Conclusion

It is dark out there for the market in general. Semiconductors are darker. Specific stocks like Intel may soon be trading at pitch black valuations. Unless you believe the pitch black will be eternal, getting in the game through selling puts for lower strike price offers the middle ground in our opinion. What do you think about this strategy in general and Intel in specific at this strike price? Please leave your comments below.

Be the first to comment