Chip Somodevilla/Getty Images News

Investment Thesis

In a previous analysis for Intel Corporation (NASDAQ:INTC), I have extensively elaborated on the USA-Asia fight for technological hegemony and dominance in the semiconductor space. I have also touched on how the CEO’s turnaround plan with heavy capital investments of $200 billion over the next decade is feasible, but it will take a few years before Intel sees meaningful results.

In today’s analysis, I assess Pat Gelsinger’s performance after a year with the firm, and I explore the company’s historic capital allocation performance. The encouraging signs and progress reaffirm my initial strong buy rating for INTC with a medium-term investment horizon of at least three years through 2025. Thus, while the market focuses on the energy, material, and commodity stocks, the pullback on the tech sector creates a tactical allocation opportunity in the short term for investors to grab beaten-down market leaders such as Intel.

Overview Of Pat Gelsinger’s Performance

It’s been a little over a year since Pat Gelsinger took over as Intel CEO, and he’s already made some significant changes at the company. He has refocused Intel’s roadmap, slashed costs, and started making some ambitious promises for the future. On Gelsinger’s appointment, he laid out a roadmap for the company that would focus on innovation and reversing the decline in recent years. In addition, the roadmap includes significant research and development (R&D) investments and re-engaging with the developer community. While it will take time to execute these plans, Gelsinger is confident that they will regain dominance in the market by focusing on manufacturing excellence and customer satisfaction.

Gelsinger’s ultimate goal is to restructure Intel’s business model by expanding its Intel Foundry Services (IFS) and opening its fabs for fabless clients. Favorably, the recent acquisition of Tower Semiconductor demonstrates Gelsinger’s vision and materialization of his promises. Another great addition to the company’s leadership is David Zinsner, the new CFO since January 2022. He brings to the table valuable experience from his previous tenure as CFO of Micron. During his career, he assisted Micron in making sound decisions to improve its financial position and invest in the right memory technologies. I consider both Gelsinger and Zinsner a great combination as they bring to the table a strong mix of technical and financial experiences in the sector.

Perhaps the most notable change since Gelsinger has taken over as the company’s CEO has been Intel’s business model restructure with a renewed focus on manufacturing chips. Intel had outsourced a significant portion of its manufacturing to third-party foundries like Taiwan Semiconductor Manufacturing Company Limited (TSM) and Samsung Electronics Co., Ltd. (OTC:SSNLF). Still, now under the IDM 2.0 plan, Gelsinger has committed to bringing manufacturing back in-house while keeping some portion with TSMC.

Intel Investor Meeting CEO 2022 (Intel.com/newsroom)

Undoubtedly, this is a significant shift for the company and will considerably impact the semiconductor industry. One of the biggest milestones that Gelsinger has checked off so far has been the unveiling of Intel’s decision to construct two semiconductor fabrication plants on 1,000 acres of land in New Albany, Ohio.

Since Intel’s launch in 1968, the company has been an integrated device manufacturer or IDM. That’s a company that both designs and builds its own semiconductor chips. The CEO introduced IDM 2.0, which involves the company significantly undertaking manufacturing expansions, expanding its use of external foundries to make chips, and launching its own foundry services business to serve customers globally. The company’s CEO termed the IDM 2.0 strategy a ‘big evolution’ of Intel’s integrated device manufacturing model.

Despite the challenges faced by the company, Gelsinger is widely seen as having done an excellent job in his first year as CEO. He has won praise for his aggressive plans to invest billions of dollars in Intel’s manufacturing infrastructure and has also been credited with making the company more open and transparent.

Sound Capital Allocation Decision-Making

The underinvestment in technological innovations, especially under Bob Swan’s tenure, has created a technological hole in the past years. Gelsinger’s turnaround plan to catch up and restore Intel’s dominance is underway, with early signs of meaningful progress. Still, investors should remain alert and closely follow the company’s developments and milestones.

The Smart Capital Strategy

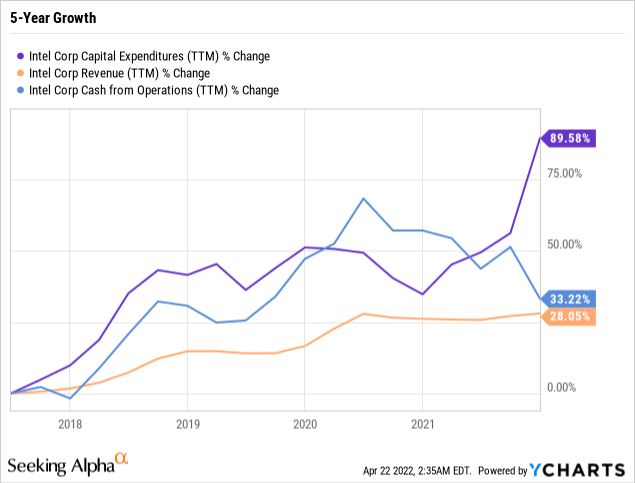

During the Investors Meeting held earlier in February, the company laid out a net capital expenditures target of approximately $27 billion for 2022. Intel has a well-defined framework under its Smart Capital Strategy for CAPEX investments. The investing strategy under the framework revolves around the company taking a disciplined approach to CAPEX investments while leveraging government support (CHIPS Act) and developing other synergistic partnerships to offset capital spending. This approach will enable the firm to capitalize on the market opportunities and increase its market share while keeping its margin structure and capital spending under control.

Intel’s increased capital spending under the smart capital strategy will drive free cash flows for the company in the future, and the management has targeted adjusted Free Cashflow (FCF) to be at 20% of revenues by 2026. Despite falling short of expectations by roughly $1 billion, Intel generated $11.3 billion in FCF for 2021, and the growth in FCF will derive from four pillars; revenue growth, Gross Profit margins expansion, operating expense leverage, and working capital. As per management’s guidance, the net capital intensity will remain elevated for 2023-2024 at around 35% levels, but it will decrease to 25% for 2025-2026 under a 10% offset assumption due to a smart capital strategy with effective use of capital.

In addition, in line with its smart capital strategy, the company has recently announced plans to invest €80 billion in its semiconductor value chain in the European Union. The heavy investment will be directed towards R&D, manufacturing, and foundry services, with the company investing an initial €17 billion in a Semiconductor fabrication mega-site in Germany. With a major expansion of Intel’s manufacturing facilities in Europe, the investment program aims to balance the worldwide semiconductor supply chain to benefit Intel’s customers and partners worldwide.

Acquisition Growth Strategy

On Feb 15, 2022, Intel and Tower Semiconductor announced a deal. The former will acquire the latter for $53 per share in cash, advancing the company’s strategic imperative to be in the $140 billion foundry market. The acquisition significantly advances Intel’s IDM 2.0 strategy by expanding its manufacturing capacity, global footprint, and technology portfolio to address demand but also drives synergies with IFS/Intel.

As a result, Intel can now kickstart its Foundry business through Tower Semiconductor. The giant now has access to leading-edge technology, new fab production, fabless customers, and intellectual property necessary to take off the foundry business compete on a global scale. Last but not least, in the current low valuation environment, the company, with a massive $28.4 billion in cash and cash equivalents, is well-positioned to engage in M&A activity and make effective use of its cash by reinvesting in its core competencies.

Mobileye’s IPO Will Unlock Tremendous Value

Intel’s value-creating capital deployment is reflected in the company’s acquisition of Mobileye in 2017, an Israeli-based and leading autonomous car driving technology company acquired by Intel for $15.3bn. Earlier this year, Intel’s self-driving car unit Mobileye submitted an S-1 Draft Registration Statement, filling for an initial public offering with the SEC. The acquisition has been a great success for the company as the unit has seen significant growth in the revenues since the acquisition; the top line was up 43% YoY to $1.4 billion in 2021.

Intel’s plan to take Mobileye public is part of the broader business strategy of turning around the company’s core business ever since the new CEO has taken over command. Gelsinger has indicated that the company will be retaining a majority stake in Mobileye after the IPO, and a portion of the funds raised from the public sale will be utilized to build more chip plants. It has been widely reported that Mobileye could be valued at more than $50 billion in the IPO, however, the current volatile environment of the market may result in the market giving a more depressed valuation to the company. Nevertheless, if everything goes according to plan, Intel will generate an ROI of over 3x within a 5-year timeframe.

Even though the acquisition of Mobileye and McAfee deviates from Intel’s core competencies, the company’s acquisition strategy has now shifted towards its core business for expanding its manufacturing, design, data centers, and other AI solutions. Nevertheless, Intel has a solid history of creating shareholder value through the efficient deployment of its capital, with a ten-year average ROIC of 16.57%, way above its WACC of 6.79%, proving its unique shareholder value creation ability. Therefore, I remain confident that under Gelsinger’s leadership and vision, the company’s investments will produce superior returns compared to its historic averages.

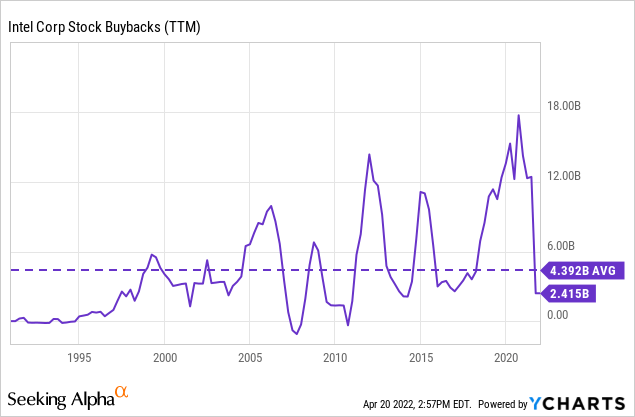

Share Repurchases Will Ease From Now On

Share repurchases are another way Intel returns cash to shareholders, especially at its current suppressed share price levels. From 2017 to 2021, the company repurchased $44.6 billion in stock. The company has had in place an ongoing buyback authorization since 2005, and currently, $7.2 billion remain available for repurchase. At the current market cap of nearly $196 billion, the buybacks will generate an annual yield of around 3.7%. However, despite the favorable long-term effect, Intel’s buybacks will remain at historically low levels since most of its financial resources will be directed towards its core competencies.

Catalysts For The Near Future

In a turnaround story like Intel, I would emphasize specific catalysts for estimating its future direction rather than historical financials. To that effect, I consider the below milestones the key to the company’s fair valuation and the share’s upward price trajectory.

- Mobileye IPO: Its IPO will improve the sentiment in the market and provide Intel with ample financial flexibility to deliver on its promises and support the capital-intensive turnaround plan.

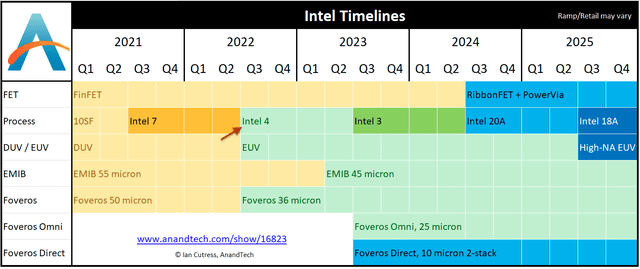

- Intel 4nm (end of 2022): All eyes are on Intel 4 production by the end of the year. Bringing a 7nm chip into production remains the top priority and catalyst for Intel’s competitiveness and future path. Favorably, the company now has a high probability of getting its manufacturing back on track after several delays that plunged the share price from all-time highs. In addition, the use of EUV lithography in Intel 4 (7nm) will significantly improve the manufacturing process and produce a 20% performance improvement. Favorably, Gelsinger has noted a positive update in the latest earning call:

And as I was able to say last quarter and can reaffirm today, we remain on or ahead of schedule for Intel 4, 3, 20A and 18A against the time lines we laid out in July.

Intel Timelines (www.anandtech.com)

Concluding Thoughts

Undoubtedly, the plan to turn around the business, start up the new fabs, and attract top engineering talent is challenging and will take a few years to materialize. This long and uncertain path probably scares most investors. Moreover, assessing capital allocation decisions in a capital-intensive industry is vital for resonating any investment, and Intel checks the box under this test.

Therefore, it is reasonable to expect that the company is well-positioned to continue to provide reasonable returns to shareholders with the development of the lower margin foundry business and efficient deployment of capital under the recently announced smart capital framework.

Finally, under Gelsinger’s leadership, Intel seems to be on track to deliver on its promises. Therefore, I remain invested in Intel for the medium term, but I will remain alert to reassessing my investment thesis depending on the outcome of the major milestones.

Be the first to comment