Chainarong Prasertthai/iStock via Getty Images

A Quick Take On Intapp

Intapp (NASDAQ:INTA) reported its FQ1 2023 financial results on November 7, 2022, beating revenue and EPS estimates.

The firm provides an enterprise information platform for professional and financial service firms.

Intapp has produced solid growth as it expands its total addressable market, but operating losses remain heavy in a punishing market.

I’m on Hold for INTA but interested investors could make a case for nibbling on an up-and-coming prospect.

Intapp’s Overview And Market

Palo Alto, California-based Intapp was founded to develop a cloud-based platform of solutions for professional and financial services firms.

Management is headed by Chief Executive Officer John Hall, who has been with the firm since 2007 and was previously an early senior executive at VA Linux Systems.

The company’s primary offerings include:

-

DealCloud – Financial service firm solution

-

OnePlace – Law firm client and engagement management

According to a 2019 market research report by Grand View Research, the global market for professional service firm software is expected to reach $16 billion by 2025.

This represents a forecast CAGR of 11.7% from 2020 to 2025.

The main drivers for this expected growth are continuing need to improve operational efficiency by financial and professional service firms in order to improve profitability.

Also, cloud-based solutions have become more popular among many customers due to their low up-front cost. The regions of North America and Europe are expected to retain their lead in demand through 2025.

Major competitive or other industry participants include:

-

Projector PSA

-

ChangePoint

-

NetSuite OpenAir

-

Appirio

-

Microsoft (MSFT)

-

FinancialForce

-

ConnectWise

-

Tenrox

-

Others

Intapp’s Recent Financial Performance

-

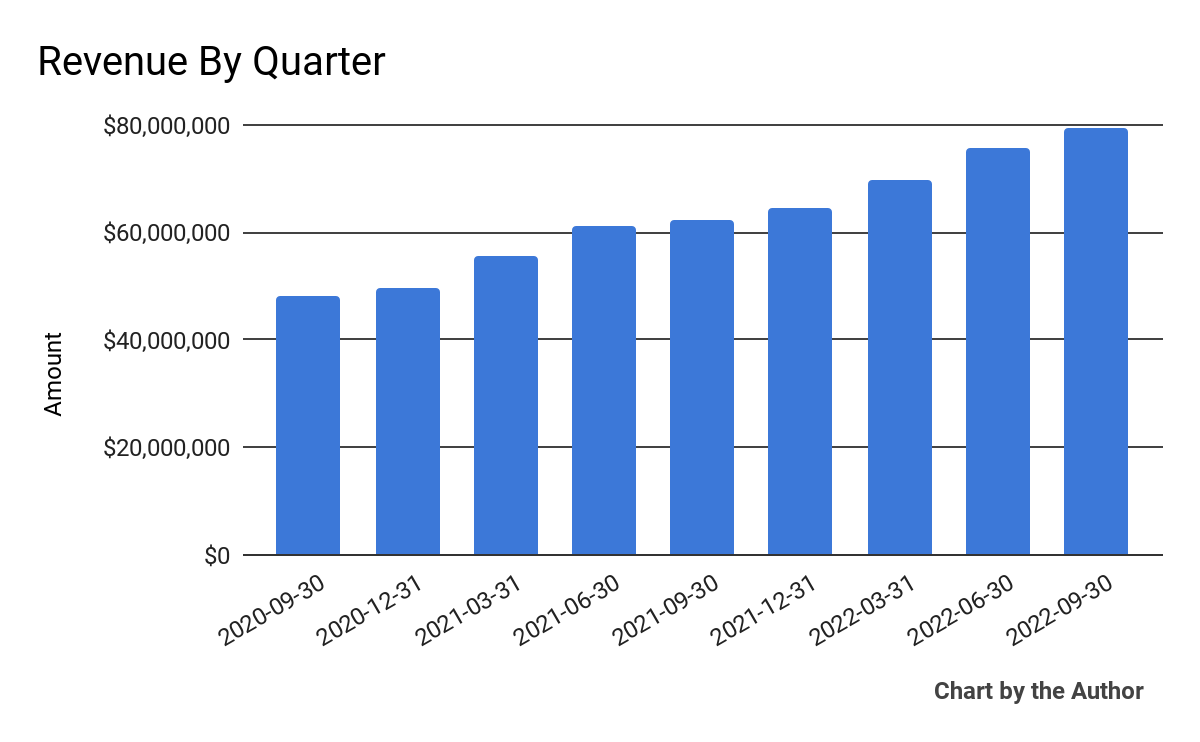

Total revenue by quarter has risen per the following chart:

9 Quarter Total Revenue (Financial Modeling Prep)

-

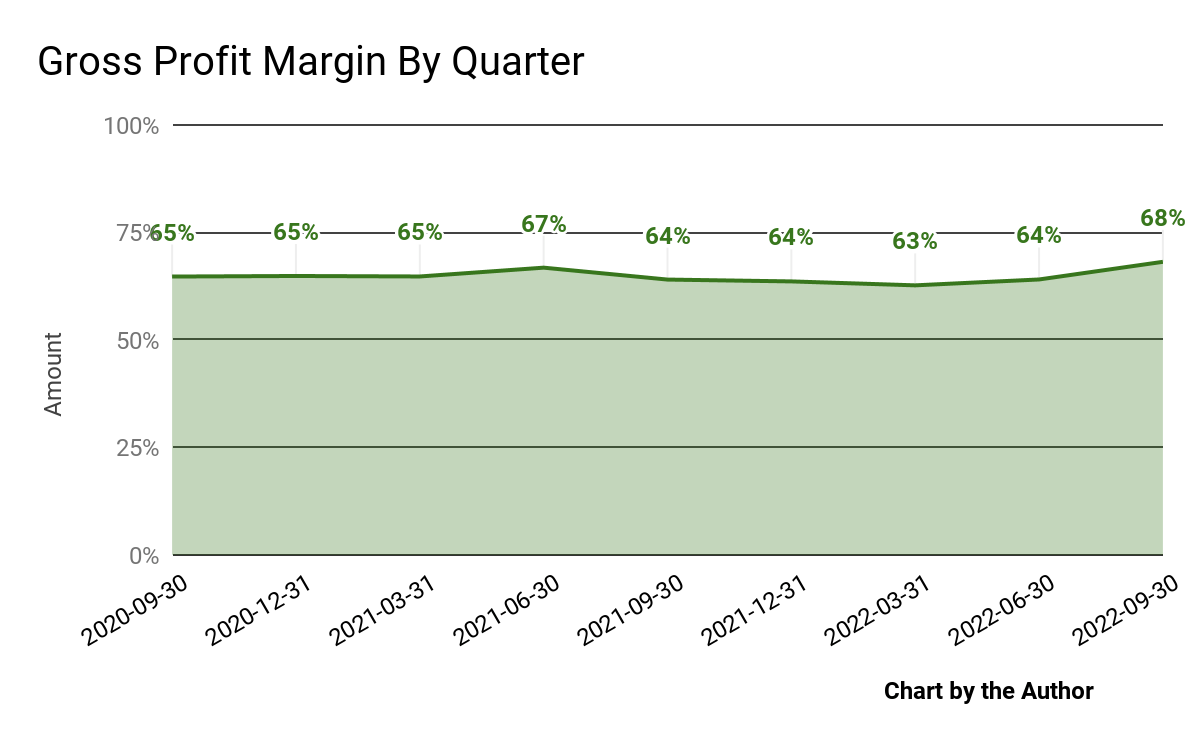

Gross profit margin by quarter has risen in the most recent reporting period:

9 Quarter Gross Profit (Financial Modeling Prep)

-

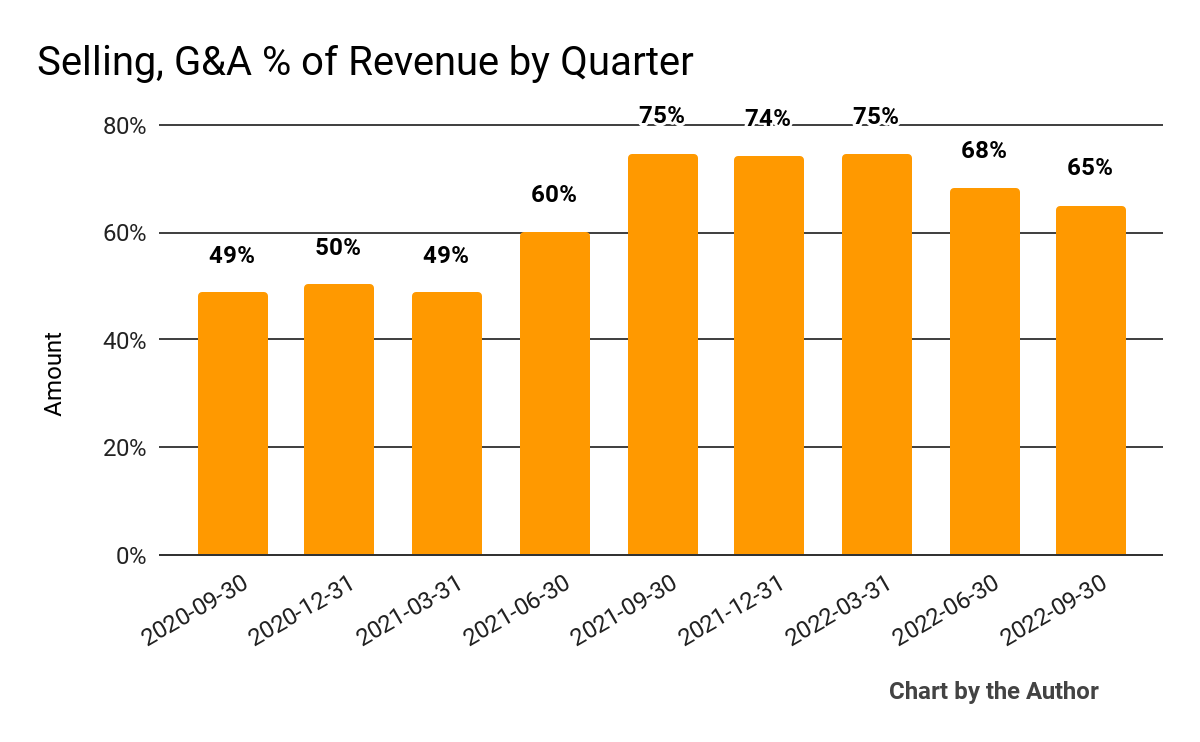

Selling, G&A expenses as a percentage of total revenue by quarter have varied per the chart below:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

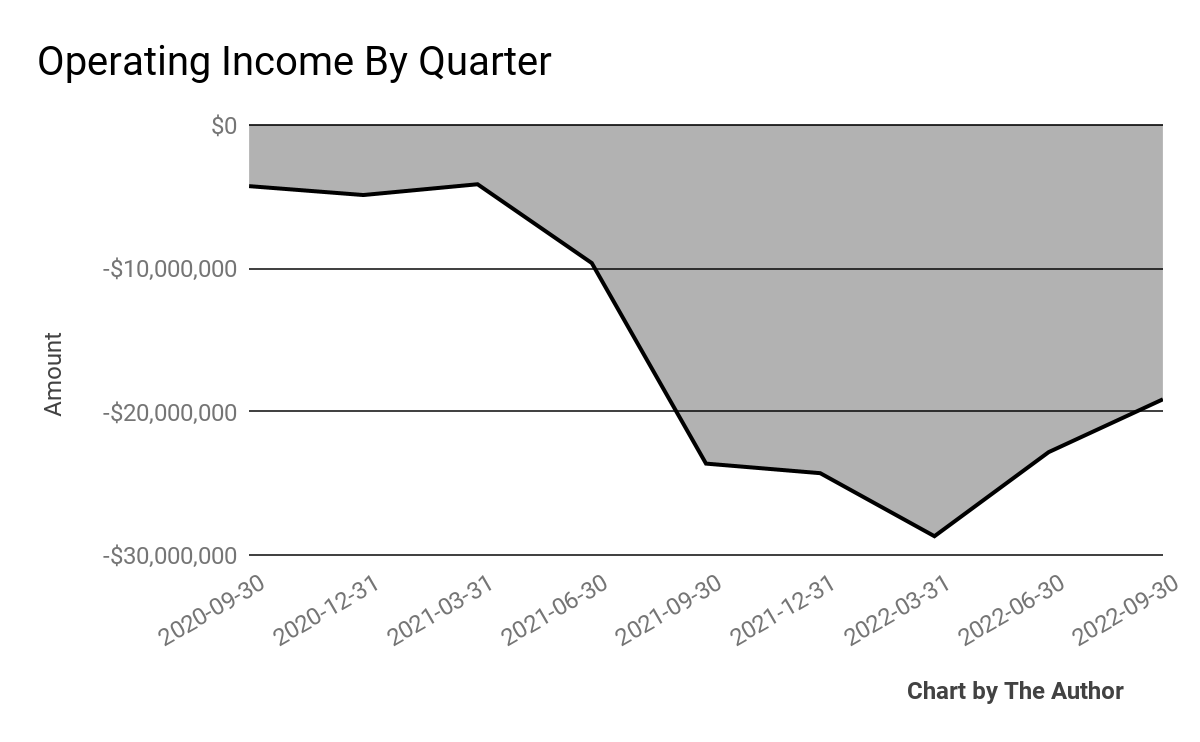

Operating income by quarter has worsened sharply in the past six quarters:

9 Quarter Operating Income (Financial Modeling Prep)

-

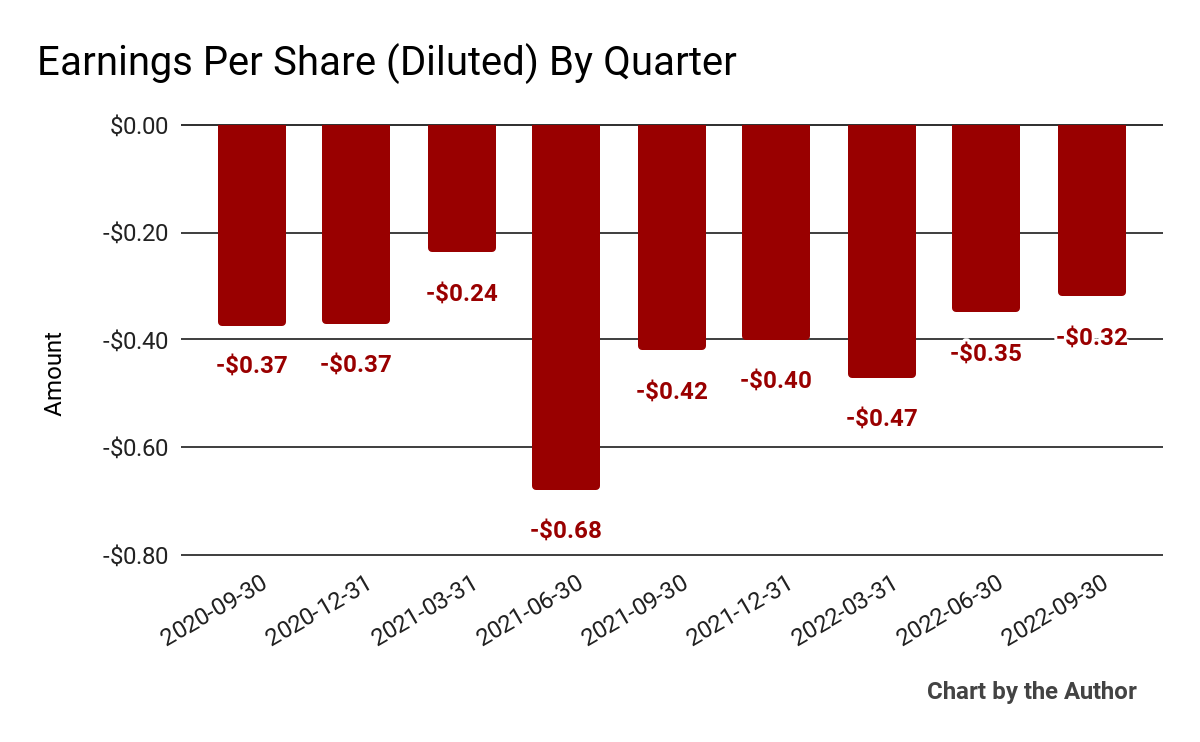

Earnings per share (Diluted) have also remained heavily negative:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

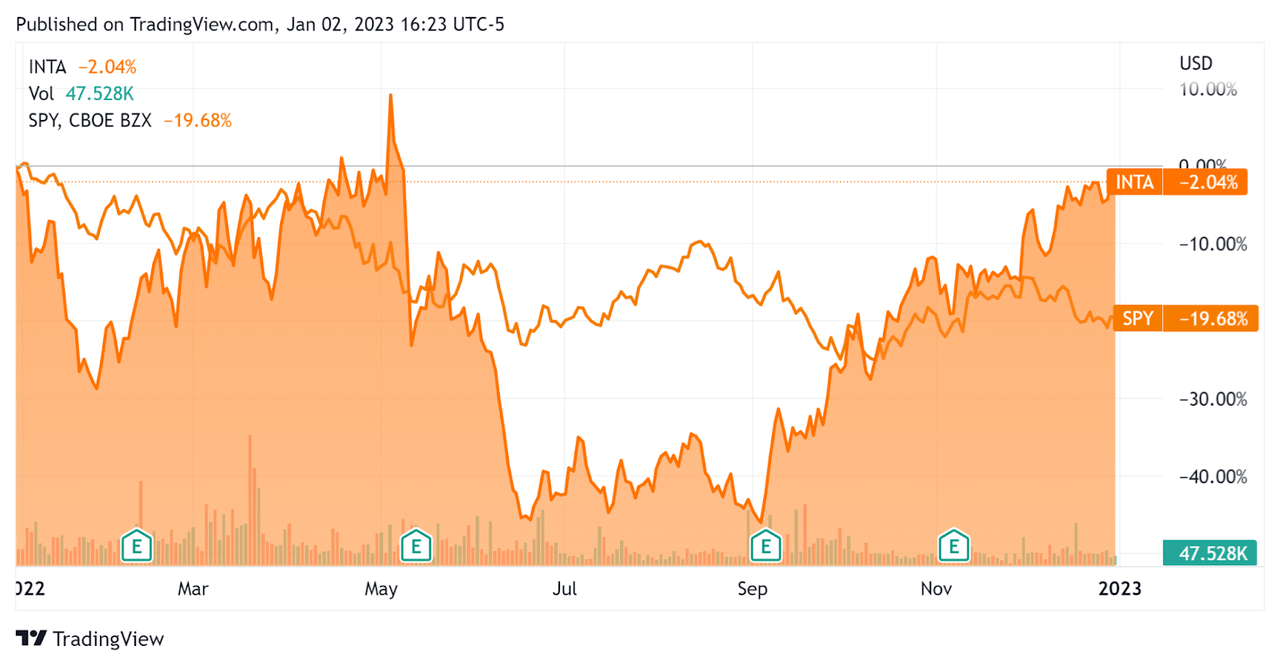

In the past 12 months, INTA’s stock price has fallen only 2% vs. the U.S. S&P 500 index’s drop of around 19.7%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Intapp

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.3 |

|

Enterprise Value / EBITDA |

-19.7 |

|

Revenue Growth Rate |

26.6% |

|

Net Income Margin |

-32.7% |

|

GAAP EBITDA % |

-27.1% |

|

Market Capitalization |

$1,571,297,408 |

|

Enterprise Value |

$1,543,908,160 |

|

Operating Cash Flow |

$12,802,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.54 |

(Source – Financial Modeling Prep)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

INTA’s most recent GAAP Rule of 40 calculation was negative (0.5%) as of FQ1 2023, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP [TTM] |

Calculation |

|

Recent Rev. Growth % |

26.6% |

|

GAAP EBITDA % |

-27.1% |

|

Total |

-0.5% |

(Source – Financial Modeling Prep)

Commentary On Intapp

In its last earnings call (Source – Seeking Alpha), covering FQ1 2023’s results, management highlighted the expanded application of machine learning [AI] technologies in its system ‘to solve additional compliance challenges specific to the industries we serve.’

The firm also continues to invest in growing its capabilities within its Microsoft strategic partnership, enabling employees from firms subject to significant compliance requirements to share documents with the Microsoft Teams system.

Leadership also noted a recent win in the consulting industry, which the firm is seeking to grow its business within.

As to its financial results, total revenue rose by 28% year-over-year, while gross profit margin grew due to an increase in its services gross margin and the reassignment of a part of its client success team to sales & marketing.

The company’s trailing twelve-month net retention rate was 114%, indicating increasing sales & marketing efficiency.

However, the firm’s Rule of 40 results have been in need of significant improvement, with good revenue growth but poor operating results.

SG&A as a percentage of revenue has come down from several quarters ago, but still remains historically high.

Operating losses also remain very high as do negative earnings per share.

For the balance sheet, the firm finished the quarter with $40.3 million in cash and equivalents and no long-term debt.

Over the trailing twelve months, free cash flow was $10.6 million, of which capital expenditures accounted for $2.2 million. INTA paid a very hefty $74.3 million in stock-based compensation over the previous year.

Looking ahead, management expects full fiscal year 2023 revenue to be $334 million at the midpoint of the range.

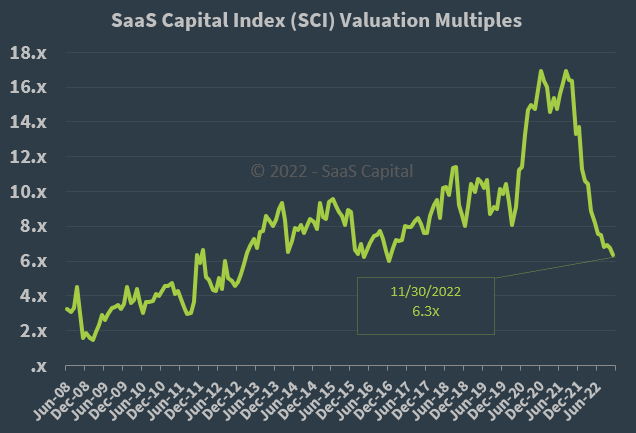

Regarding valuation, the market is valuing INTA at an EV/Sales multiple of around 5.3x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x on November 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, INTA is currently valued by the market at a discount to the broader SaaS Capital Index, at least as of November 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may accelerate new customer discounting, produce slower sales cycles and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include a ‘short and shallow’ slowdown or a pause in the rise of cost of capital, leading to less downward pressure on valuation multiples.

Intapp shows promise, especially through its recent partnership announcements with Microsoft and KPMG, so it is still early days there.

While the company has ample resources, it is still generating significant operating losses in a market that punishes such firms.

The stock has performed well in recent quarters, bucking the S&P 500 trendline, so perhaps the market knows a winner is in the making here.

I’m more cautious, so my outlook is a Hold on INTA; however, interested investors could begin to pick away here as desired.

Be the first to comment