serts

Due to concerns regarding the impact that higher inflation and interest rates will have on the economy, most anything associated with the infrastructure market is considered taboo. There are many players in this space that look cheap. But concerns exist over just how much more strong demand there is and when the shoe will drop and these companies will no longer look fundamentally appealing. Although I also expect for this to eventually come to pass, I also have to ask myself how cheap a company can get for an extended time frame before the value it creates prior to a drop in market conditions leads to true and permanent value created for its investors. One company that I feel embodies that is Insteel Industries (NYSE:IIIN). This producer of steel wire reinforcing products that are used for concrete construction applications has seen its share price plummet in recent months. This comes even as the fundamental performance of the company remains robust. Although I fully expect market conditions to eventually weaken, I do think that the stock is cheap enough and has remained that way long enough that the value it’s creating for its investors might well be worth buying in now.

A fundamental disconnect

On April 22nd of this year, I published an article about Insteel Industries wherein I said how impressed I was by the strong growth the company’s top and bottom lines had exhibited in the most recent financial periods. At that time, I said that shares of the company looked attractive. But I also made sure to say that this only held true for as long as current market conditions persisted. In the event that the company saw a step back in fundamental performance, shares would go from looking attractive to looking very pricey very quickly. This concern was further strengthened by management’s own warnings about the state of the market in which it operates. Because of all of this, I ultimately rated the enterprise a ‘hold’, reflecting my belief that shares of the company would likely perform along the lines of what the broader market would for the foreseeable future. Since then, things have not gone quite so well. Shares have tanked by 29.5% compared to the 6% decline experienced by the S&P 500.

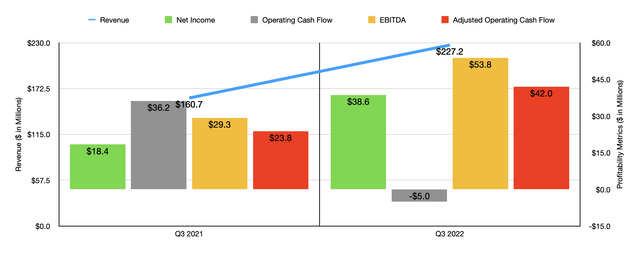

Author – SEC EDGAR Data

Given this return disparity, you might expect the firm’s fundamental condition to have worsened. But the fact of the matter is that its fundamentals remain very strong. During the third quarter of the company’s 2022 fiscal year, the only quarter for which data is now available that was not available previously, revenue came in at $227.2 million. That represents an increase of 41.4% over the $160.7 million generated just one year earlier. This rise was driven by a 53.9% increase in the average selling prices of the products it produces. Time, the company was hurt by an 8.2% decrease in shipments. This is not unexpected when you consider that the rise in price would deter customers from buying some products.

As revenue increased, profitability followed suit. Net income in the latest quarter came in at $38.6 million. That’s roughly double the $18.4 million generated the same quarter one year earlier. Other profitability metrics also followed suit. Although operating cash flow fell from $36.2 million in the third quarter of 2021 to negative $5 million the same quarter this year, that picture changes when you adjust for changes in working capital. After doing that, the metric would have risen from $23.8 million to $42 million. Meanwhile, EBITDA surged from $29.3 million to $53.8 million.

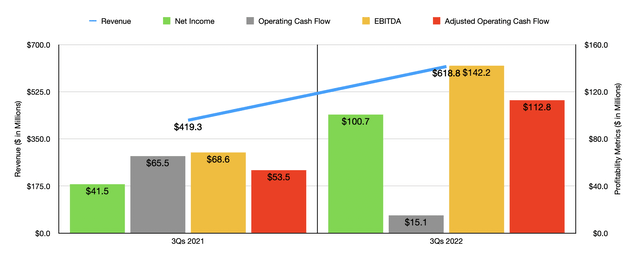

Author – SEC EDGAR Data

As the chart above illustrates, this strong third quarter performance has only strengthened the company’s performance for the entirety of its 2022 fiscal year so far. Revenue of $618.8 million implies a year-over-year increase of 47.6% compared to the $419.3 million achieved just one year earlier. Net income has risen from $41.5 million to $100.7 million. Operating cash flow dropped from $65.5 million to $15.1 million. But if we adjust for changes in working capital, it would have more than doubled from $53.5 million to $112.8 million. And over that same window of time, EBITDA surged from $68.6 million to $142.2 million.

Although management had previously expressed some concerns about the state of the industry, they did come out in the latest quarter and say that they expect a strong final quarter of the year. They clarified that they still saw weakness in the standard weld wire market. But in all other markets, they said that customer optimism was ‘nearly unprecedented’. The company did not go so far as to give specific items for the year. But if we annualize results experienced for the first three quarters, we should anticipate net income for the year of roughly $161.6 million. Operating cash flow should come in at around $175.2 million on an adjusted basis, while EBITDA should be somewhere around $222 million.

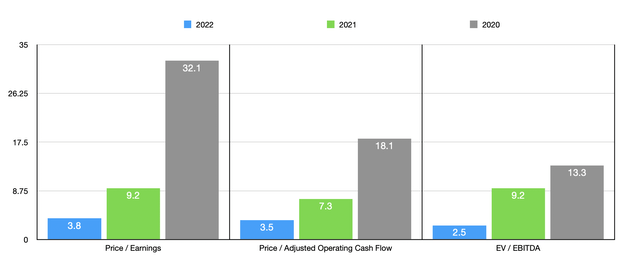

Author – SEC EDGAR Data

If management achieves these figures, shares of the business look very cheap. The forward price to earnings multiple would be 3.8. That compares to the 9.2 reading that we get if we use 2021 figures and is down from the 32.1 that we get if we use 2020 results. The price to adjusted operating cash flow multiple should be 3.5. That compares to the 7.3 that we get if we use 2021 figures and with the 18.1 reading that we get if we use 2020 data. And when it comes to the EV to EBITDA approach, the multiple is even lower at 2.5. That’s thanks to the fact that the company has zero debt and cash on hand of $63 million. By comparison, the multiple using 2021 figures is 5.1, while for the 2020 figures it would be 13.3. To put the pricing of the company into perspective, I compared it to five similar firms. On a price-to-earnings basis, these companies range from a low of 5.9 to a high of 21.2. The price to operating cash flow approach ranges between 5 and 36.4, while the EV to EBITDA multiples should be between 4.8 and 12. In all three scenarios, Insteel Industries was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Insteel Industries | 3.8 | 3.5 | 2.5 |

| Builders FirstSource (BLDR) | 5.9 | 5.5 | 4.8 |

| A. O. Smith (AOS) | 21.2 | 36.4 | 12.0 |

| Tecnoglass (TGLS) | 10.1 | 7.8 | 6.1 |

| Apogee Enterprises (APOG) | 11.4 | 7.3 | 7.5 |

| Owens Corning (OC) | 7.5 | 5.0 | 5.0 |

Takeaway

Don’t get me wrong. At some point in time, I fully suspect that profitability for Insteel Industries will plunge rather materially. Elevated pricing cannot hold up in perpetuity. At some point, market conditions will adjust. If the firm had any meaningful amount of debt on its books, I would be particularly concerned since a return to even 2020 levels would leave shares of the company looking fairly valued at best and potentially even slightly overpriced. But the fact of the matter is that shares look incredibly cheap right now, both on an absolute basis and relative to other firms. And the question I have to ask myself is how long a company can generate adjusted operating cash flow of $175.2 million while having an enterprise value of justice $547.5 million before the cash it’s generating can go into either rapid expansion, significant share buybacks, or some other value-creating approach that is responsible for enduring value even if market conditions worsen considerably. Overall, I feel like now might be a good time to consider buying in, leading me to change my rating on the firm from ‘hold’ to ‘buy’.

Be the first to comment