anatoliy_gleb

Installed Building Products (NYSE:IBP) continues to perform well on the tail-end of a US housing boom. Markets are valuing it at quite a low multiple. The concern is around longer-term pricing, as the industry is cyclical. Volumes should be fine thanks to strong secular tailwinds in US housing. Still, housing markets aren’t doing that well. We think there’s upside here because a soft-landing is likely, but it’s all a balancing act. It’s not clear cut, but it’s a solid company and it’s not expensive, but the housing play can be made in a safer way in different markets.

Q3 Salient Points

Let’s list out some of the key points from Q3:

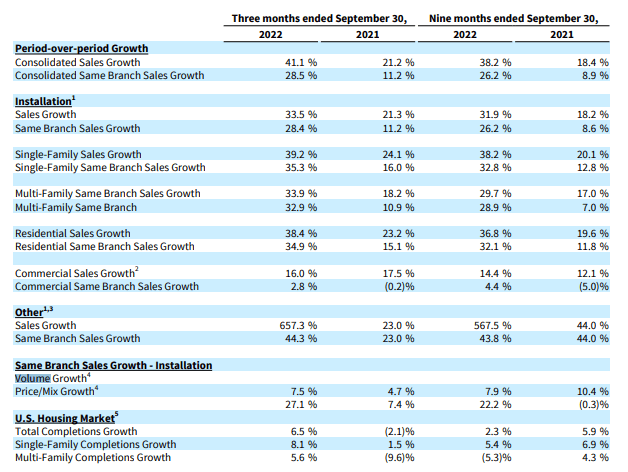

- The sales growth comprehensively was 41%. The same branch sales growth, accounting for inorganic growth was 30%. Residential segments were growing much faster than commercial segments. Volume growth was 7.5% and pricing growth was 27%, so clearly pricing was what was driving revenue growth this quarter. Operating profit growth was 72% thanks to scale effects and also pricing drawing up the unit margin.

IS (Q3 Pres)

- Some inputs are apparently undergoing quite meaningful repricing. Fiberglass prices, which go into some of the insulation products that IBP sells, are going to go up in price but the effects won’t be seen till next quarter. Markets have already had to absorb substantial repricing coming from higher logistic and general input prices and exceptional strain on the housing supply chain. There’s no guarantee that markets will tolerate more pricing action in insulation, which represents 64% of the company’s markets.

- Markets are still in a state where unfinished inventory needs to get finished, and the inventory on unfinished houses has been quite high. The need to work through backlog and the desperation around supply chain are the key reasons why IBP has been able to execute such meaningful price increases.

Bottom Line

In the end, IBP is about 60:40 in commodities versus more specialised products. Insulation is going to be a more volatile market compared to waterproofing as an example, which has a degree of recurring, renovation style revenue. Moreover, products like garage doors and finishing for houses tend to have more pricing power for the producer, and those products typically display less cyclicality.

The issue is of course around the cycle. Metrics for housing aren’t great. Starts are really coming down even in residential markets which has secular tailwinds, and this is in spite of supply chain shortages seemingly easing with peaking CPI. Moreover, homes are coming off the market quite quickly as sellers aren’t finding good exit points in price, so the economics of developing property are clearly going to come under some heavy fire. There was a good deal of buying of unfinished inventory, and that’s part of where the pricing sink for companies like IBP has come from, but this is finite and overall there are good reasons to be concerned about US housing.

Volumes may see some incremental improvement over the next couple of years since there is still a housing shortage in the US, the issue is whether prices are going to equilibrate a lot lower for that demand to be cleared by markets. For now, they have to be high since inflation lingers, but as Europe goes deeper into a recession, the demand-push factors that IBP and others have been pricing ahead will start dissipating, and their own markets are going to start seeing demand pressure. With development economics worsening, it’s quite likely we get deflation in this market over the next couple of years.

Markets understand that there is a balance to be had here, and they’re valuing IBP between 7-8x EV/EBITDA. While IBP may not be a bad deal at these prices, because regionally the US market is going to fare pretty well economically despite dislocation in energy markets, we think there are better deals in companies with better economics and the same price. Nordic Waterproofing has less cyclical markets and much better recurring economics. IBP also has waterproofing revenue, but for NWG it’s the vast majority of their business. They trade for the same EV/EBITDA, and a very similar PE too. While European markets may not be as robust, the more robust market than insulation more than compensates.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment