Chesky_W

Investment thesis

Innoviz (NASDAQ:INVZ) continues to execute beyond expectations, better than competitors as it looks to differentiate itself in the long-term. The company has one of the most impressive order books from large automotive OEMs, with a strong pipeline for the next 2 years. Furthermore, the recent Asian automotive OEM win brings new markets to Innoviz as it looks to expand into the fast-growing markets of Asia. The company is on track to moving into series production in 2023 for its BMW and European shuttle programs, which will mark a new milestone for Innoviz. The company is well positioned with its strong technological offering, along with its platform partners, to provide the best LiDAR solution to the market.

Solid new win with an Asian auto OEM

Innoviz’s target for 2022 was to achieve 1 automotive win for the year. That was already achieved with its announcement with Volkswagen (OTCPK:VWAGY) last quarter. While the management did state from the last quarter that there were another 2 to 3 OEMs that could be making a decision on who they will choose as their LiDAR supplier, I was cautiously optimistic that Innoviz was still able to achieve another design win with one of these OEMs by the end of 2022.

As Innoviz has announced in their most recent 3Q22 quarter, it has managed to achieve a new customer win, this time with a customer based in Asia. This adds up to the 4th production win for Innoviz and its second as a Tier 1 supplier.

Firstly, one of the big positives of this recent win is the speed at which the customer is expected to contribute to revenues. With this recent design win, production revenues are expected to come in 2024 as the customer is targeting a fast ramp up of installation of LiDAR in 2 of its models and expects a quick turnaround to SOP.

Second, as highlighted earlier, the expectation and target for the year was not just met early but also surpassed in the current quarter with the additional automotive design win in 2022. This highlights the strong ability for Innoviz to attract and bring in the production wins from customers, which is of course testament to its technology, capabilities and partnership ecosystem. Also, I think that this also illustrates to me rather clearly the direction that large automotive OEMs are taking, bringing further momentum to Innoviz’s business in 2023, in my view.

Third, while Innoviz did not disclose who this Asian OEM was, it did highlight that this company looked to become a leader in the electric vehicle industry globally. Furthermore, the management shared that the company was a technology focused OEM and the fact that this customer chose Innoviz over other competitors as its Tier 1 direct supplier does show the strong technological capabilities of Innoviz and its platform partners.

Expanding geographically and driving unit cost down

Innoviz is successful because of the large deals that it has announced, first with its BMW, Volkswagen announcements and now the announcement with the Asian automotive OEM. This enables Innoviz to be able to scale up volumes quickly which will drive better margins through better unit economics.

This new automotive win with the customer based in Asia is the first step for Innoviz into a new and rapidly growing market. With this new win, it expands the company’s reach geographically and I would expect more new Asia customers in the future as further progress is made in the region.

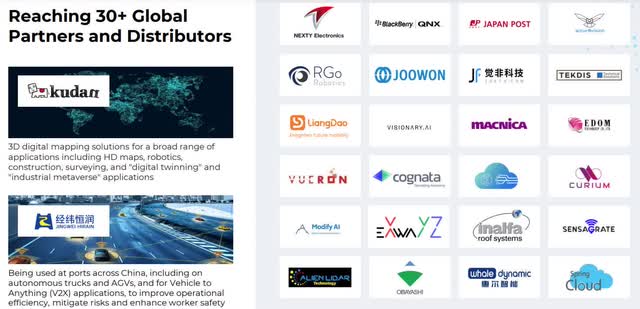

Asia is also an interesting market for Innoviz also due to the strong progress that the company has on the non-automotive segment in Asia. For example, Innoviz went into a distribution agreement with Joowon Industrial to focus on accelerating the development of LiDAR in South Korea. As can be highlighted below, Innoviz has more than 30 global partners and distributors that enables the company to have a global reach and extends its presence in the fast growing Asia region.

Innoviz’s new partners and distributors (Innoviz IR)

Strong platform partners driving wins

One of the key points highlighted by management in the 3Q22 earnings call was the importance of its technology partners. There are currently 3 autonomous driving platforms that are considered as a leading technology player in the automotive industry as a result of their hardware and software stack that integrates input from sensing and perception derived from components like LiDARs.

These 3 leading companies are Qualcomm (QCOM), NVIDIA (NVDA) and Mobileye (MBLY). Innoviz has production awards with 2 of these 3 platforms and while management did not highlight exactly which ones the company is integrated with, management did mention earlier about partnerships with Qualcomm, which leaves the other one to be either NVIDIA or Mobileye.

The key thing about Innoviz integrating these platforms is that its potential customers are actually more likely to outcompete peers for customers since Innoviz has a strong relationship with the technology partner. This has created a form of a barrier to entry for other players that do not have such strong integration with these technology partners.

As an example, the current automotive design win with the Asian customer announced this quarter was also contributed by this. To highlight further, a number of the current RFQs that Innoviz is competing on are using the technology partners that Innoviz is integrated with, which brings higher probabilities of future wins for these RFQs.

Next step: Series production

In the current quarter, Innoviz started shipping D-Samples, which are what will ultimately move into full production. It is already automotive grade, and this is the final stage before Innoviz moves towards series production.

Another update that Innoviz gave during the quarter was that they upgraded the production process, re-engineering it to maximize yields while minimizing downtime to ensure that any production bottlenecks are addressed before they move into series production.

As a result, Innoviz remains on track to begin series production for the European shuttle program and the BMW consumer ADAS program in 2023 and the adjustments made to the production process helps to increase the readiness of the company for mass production next year.

OEM share tracking shows potential for Innoviz

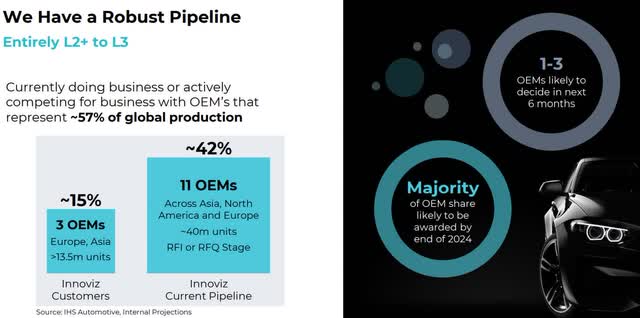

Innoviz OEM share (Innoviz IR)

Innoviz currently has 3 OEMs as its customers, representing 15% of the global automotive market, while there are 11 OEMs in its current pipeline, representing 42% of the global automotive market. For the 11 OEMs in the pipeline, these are all currently either in the RFI or RFQ stages.

For the OEMs that are currently Innoviz’s customers, I think that given that Innoviz has already passed the stringent criteria set out by these global automotive OEMs, Innoviz’s products are more likely to be subsequently introduced into other models and product lines.

As highlighted by Innoviz, the pipeline consists of the largest automotive OEMs in the world, with 6 of them producing more than 4 million units per year, and the average production level in the current pipeline stands at about 4 million units a year.

I think that Innoviz is well positioned in the industry at the current moment as most of these global automotive OEMs will be making their decisions in 2023 and 2024 for their plans to move towards greater autonomy. With this huge opportunity of global automotive players making decisions in these 1 to 2 years, this positions Innoviz well in the near-term as one of the strongest LiDAR suppliers with strong technological capabilities and integrated with leading technology partners, driving the company to success for the long-term.

Valuation

With Innoviz, there are a wide range of outcomes for the company given the extent of wins it might achieve in the next 1 to 2 years. As such, I value to company using a weighted valuation method using 3 scenarios, the base case, bull case and bear case scenarios.

For the base, bull and bear case scenarios, I assigned 80%, 10% and 10%, respectively. This skews the valuation more towards the base case while also accounting for the bear and bull case scenarios.

I assume a 3x EV/Sales multiple on 2025 revenues in my base case scenario revenue forecast. At the same time, I assume a 6x EV/Sales and 1x EV/Sales multiple for the bull and bear case scenarios, respectively, for reference. After discounting this back, my 1-year price target for Innoviz is $9.35, implying 72% upside from current levels.

Risks

Competition

I think that Innoviz has demonstrated since listing that it has been able to be successful in outcompeting and winning competitors in the industry and that it is in fact one of the leading players in the LiDAR space. That said, the industry is highly competitive with many players looking to develop better technologies or looking to penetrate into the market, I think that this could lead to competitors striving to either lower their prices or bring better performance through innovation. Peers like Luminar (LAZR) and Velodyne (VLDR) could compete meaningfully with Innoviz in the long-term and may lead to market share losses for Innoviz if they are able to become more competitive over time.

Concentration risk

Innoviz currently has two large customers, Volkswagen and BMW, that contribute a large portion of its order book, resulting on concentration risk that could bring a huge impact to the business if there were to be any issues with these 2 programs.

Cash flow risks

Innoviz currently has $218 million in cash and management states that the company has more than enough liquidity in the near-term while its cost structure has largely matured with operating cash outlays stable compared to the previous quarter, However, there is the risk that the company may face cash flow issues if there are unexpected difficulties with ramping up production, achieving a desired yield for production or any other problems that might result in further draining of cash flows in the near-term. As such, the company needs to continue to manage its liquidity position well to ensure long-term sustainability.

Conclusion

It is becoming increasingly clear that Innoviz has what it takes to compete against peers in the industry and emerge at the top. In a winner takes all LiDAR market, Innoviz has the early advantage in achieving the scale it needs to drive down unit economics and improve on cost and thus, price point. This is done with its advantages of strong technology and platform partners further cementing production wins with large global automotive players. The company’s foray into Asia is also an interesting one for both the automotive and non-automotive segments. I think we will continue to see great progress from Innoviz in terms of ramping up for series production as well as future production win and pipeline growth. My 1-year price target for Innoviz is $9.35, implying 72% upside from current levels.

Author’s note: I am starting a marketplace service, Outperforming the Market, which will be launching on 10 Jan 2023. Outperforming the Market aims to help investors identify high conviction growth and value stocks to form a barbell portfolio that outperforms the market.

Mark your calendars, because early subscribers can reserve a spot as a Legacy Discount Member, which gives you generous introductory prices. Thank you for reading and following my work. See you there!

Be the first to comment