Jonathan Kitchen

It’s been about three months since I wrote my latest article on Innoviva, Inc. (NASDAQ:INVA), and in that time the shares are up about 6.4% against a gain of 2.45% for the S&P 500. I recommended eschewing the shares back then, and I thought I’d check in again to see if it makes sense to bite the bullet and buy, or remain on the sidelines. I’ll make this determination by looking at the most recent financial performance here, and by looking at the stock as a thing distinct from the underlying business. Also, the options that I wrote a few months ago are about to expire, and I’m absolutely champing at the bit to write about that trade. I sold 10 deep out of the money puts for $200. It’s not a spectacular return, but it’s not bad in my view. On a risk adjusted basis, I think it was the best trade available at the time, actually.

Making the lives of my readers slightly better is the last thing I think of before I fall asleep, and the first thing I think of when I wake up. You people matter to me as much as I matter to you. One of the ways I try to improve your lives is by offering a “thesis statement” at the beginning of my articles. In this way, you can get the “gist” of my thesis while minimizing your exposure to my admittedly sometimes labyrinthine prose. You’re very welcome. Anyway, in my previous article I went into some detail about what the company said during the Morgan Stanley 20th Annual Global Healthcare Conference. One of the boxes that they wanted to “check” was a cleanup of the capital structure. Total liabilities are today higher by about 74% or $291 million than they were this time last year. Additionally, I think it’s fairly obvious that the most recent financial results are a “mixed bag” at best. The shares are not unambiguously cheap. For that reason, I’m going to remain on the sidelines. Finally, although I did well by selling puts a few months back, the market has shifted, and the premia on offer for decent strike prices are way too thin in my view. That written, if you’re not familiar with the strategy of selling deep out of the money put options, I’d recommend you become so. These instruments offer very decent risk adjusted returns under the right circumstances.

Before getting into the most recent financial results, I want to review a claim that the company made during the recent Morgan Stanley 20th Annual Global Healthcare Conference. Unfortunately, that conference is no longer available to link to, but feel free to peruse my prior article on this name for the highlights. I go over the outlook for Relvar/Breo and Anoro, for instance, and wrote briefly about the Entasis and La Jolla acquisitions, for instance. Anyway, during that conference, the company suggested that they’d be cleaning up the capital structure. I want to circle back to see how well they achieved this goal.

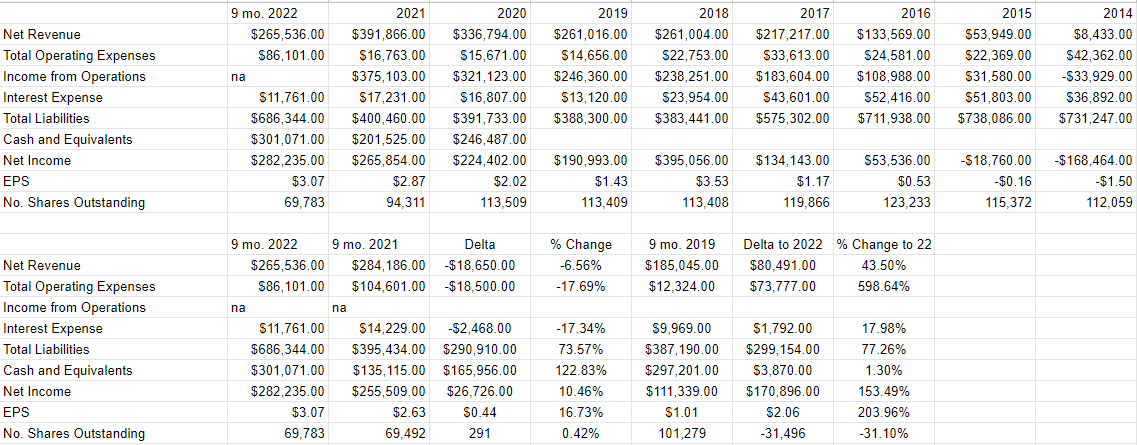

Financial Snapshot

I think there’s something for everyone in the most recent financial statements. If you’re in the mood to be pessimistic, you can focus on the reduction in revenue. If you’re in the mood to be optimistic, you can focus on the fact that the company did a good job of containing expenses.

Specifically, revenue was down by about 6.5% in 2022 relative to the same period a year ago, but operating expenses were down by over 17.5%, resulting in a nice $26.7 million uptick in profits. Interest expenses have declined by just under $2.5 million, or 17%.

The problem is that total liabilities have exploded higher by 74%, or $291 million. At the same time, though, cash and equivalents also increased by ~$166 million. I don’t know about you, but this capital structure doesn’t seem to have been “cleaned up.” by much.

That written, the company remains profitable, and it has an enormous cash hoard, so I’d be comfortable buying, but it’d have to be at the right price.

Innoviva Financials (Innoviva investor relations)

The Stock

One of the most important, and most painful, lessons I ever learned is that a company is different from the stock that supposedly represents it. The stock is, in fact, often a poor proxy for the underlying business. I’ve told and written this story a few times, but I think it’s worth repeating because it highlights a mistake that less experienced investors often make. It was the late 1990s, I had bought an irresponsibly large amount of Nokia because I knew the company was going to report rapid growth. They did as I expected, and the stock dropped about 9% in early trading hours. The company delivered very good results, but the market expected very, very good results. Since the company didn’t meet the market’s expectations, the stock was punished. I learned more from this painful, expensive lesson than I did from every one of my accounting and finance classes in business school. It’s not about how the company does, it’s about the extent to which the company meets, exceeds, or falls short of expectations.

Just because a company delivers great financial results doesn’t mean that the stock will go up. If there was that tight a relationship between the two, investing well would be much, much simpler. Ever since this incident, I’ve drawn a distinction between “stock” and “company”, and have realized that a great company can be a terrible investment if you buy it for the wrong price. This is why I insist on only ever buying cheap stocks, and getting out of stocks when I perceive the risk of capital loss is too high. This obviously doesn’t always work out perfectly, but it’s the approach that I try to take. When a stock is cheap, that’s a clear sign that the market’s not too optimistic about its future, so the stock is far less likely to hit the painful air pocket that Nokia did many, many years ago.

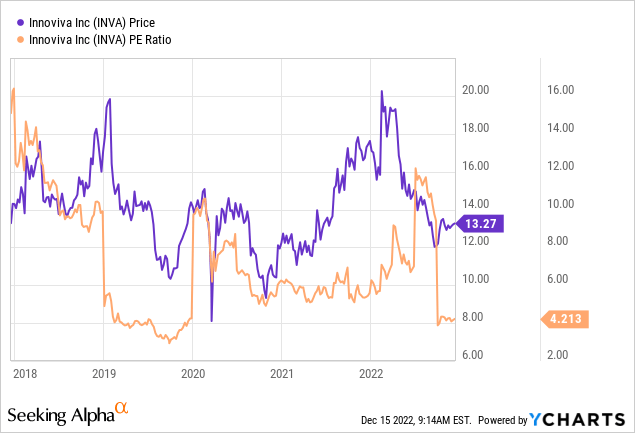

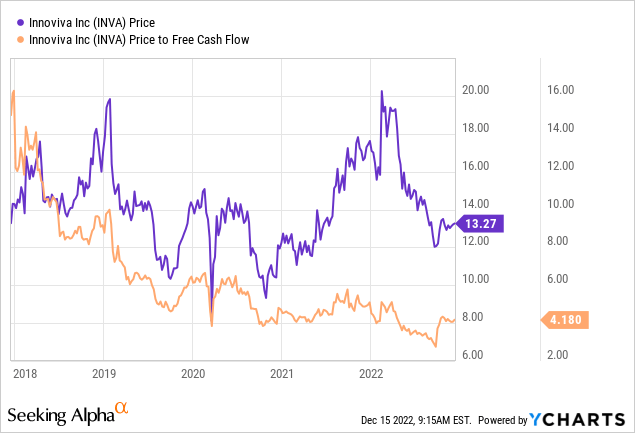

My regular readers know that I measure whether or not a stock is cheap in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of stock price to some measure of economic value, like earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both the overall market and its own history. When I last reviewed Innoviva, the PE was sitting around 9.9, and the shares were trading hands at about 3 times free cash flow. At the moment, shares are about 58% cheaper, or about 38% more expensive, per the following:

This puts me on the horns of the same sort of dilemma I found myself in previously. The shares are neither cheap, nor are they particularly expensive. Given that I’m more skeptical of stocks as an asset class than usual at the moment, my initial reaction is to continue to remain on the sidelines.

My regulars know that I think ratios can be instructive, but I want to confirm (or not) what they’re “saying” by trying to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future.

Applying this approach to Innoviva at the moment suggests the market is assuming that this company will grow earnings at a rate of ~3.7% in perpetuity. I consider that to be a very optimistic forecast given the perennial choppiness of results here. Given the above, I can’t recommend buying at current levels. I think there are safer investments out there, and I’d rather forego a few more dollars of an upside than buy at current levels and risk losing capital.

Options Update

I’ve done well selling put options on Innoviva over the years, and I continued that record recently by selling puts that are going to expire worthless tomorrow. Specifically, way back in September I sold 10 December puts with a strike of $10 for $.20 each. The yield may not have been spectacular, but the risk adjusted return was great in my view, given that the strike price was about 20% out of the money at the time. I think this experience is relevant to all investors, not just those interested in Innoviva. Deep out of the money put options, with strikes that you’d be happy to buy at, are “win-win” trades in some sense because the outcome is very favorable regardless of what happens in the wider world. If the puts expire worthless, as these are about to, you collect some premia. If the shares fall in price, you’ll be obliged to buy, but you’ll do so at a price that you find attractive. Additionally, if the puts are deep out of the money and you’re subsequently obliged to buy, at least you’ve done better than the people who simply bought on the day you wrote your puts. If you’re not yet selling put options, I recommend you at least look into it.

While I normally like to try to repeat success, I think the premia on offer for puts isn’t worth it at the moment. For example, the March 2023 puts with a strike of $10 are currently bid at $0. Thus, I’m going to just wait for shares to fall in price before selling more puts and/or buying the stock.

Be the first to comment