Sergio Delle Vedove/iStock Editorial via Getty Images

Introduction

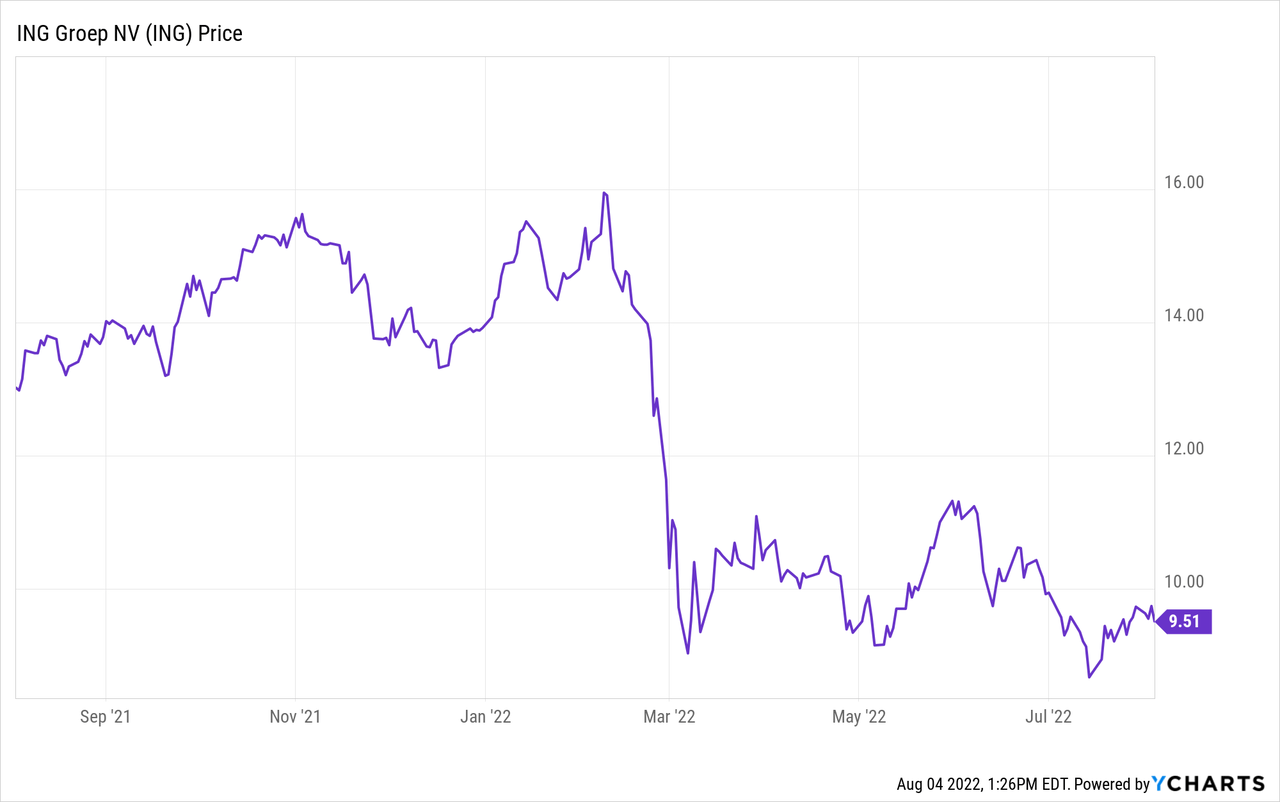

I started building an initially small long position in the Dutch bank ING (NYSE:ING) after the correction in February and March. The bank had exposure to both Ukraine and Russia and caution was warranted. The H1 results have now been published and I am glad to see three things: A) the Russia exposure has been reduced, B) the normalized earnings are okay and C) an interim dividend of 17 eurocents (1/3 payout ratio of the H1 ‘resilient’ income) was declared.

I will use the Euro as base currency throughout this article. All documentation can be found here (unfortunately the website contains download-only links).

Satisfying Q2 results pave the way for an interim dividend

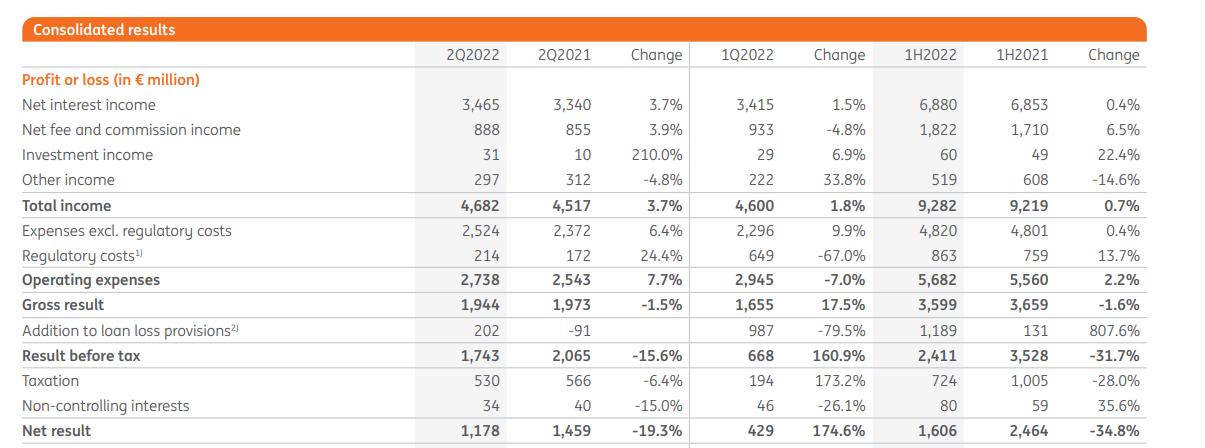

Looking at the Q2 results, we see ING’s net interest income continues to trend in the right direction: there was a small 1.5% increase on a QoQ basis while there was a more noticeable 3.7% increase compared to the second quarter of last year. The net fee and commission income decreased a little bit compared to Q1 (there were fewer prepayments on mortgages which reduced the non-recurring income related to early repayment penalties) but all things considered, the 1.8% total income increase was very welcome.

ING Investor Relations

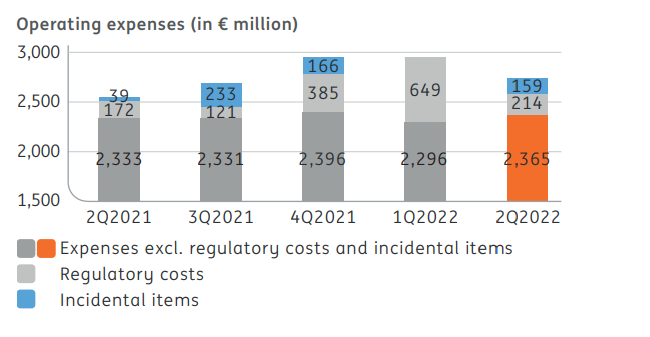

The expenses increased by almost 10% though and that’s definitely a point of concern. It doesn’t matter that regulatory costs decreased on a QoQ basis as that’s mainly related to a seasonal bank tax (payable in Q1). What matters are the expenses excluding the regulatory costs. Fortunately ING has included certain non-recurring items in these operating expenses. As you can see below, there was a 159M EUR charge related to ‘incidental items’. The bulk of this additional expense was related to the 97M EUR restructuring cost in Belgium and 18M EUR restructuring in the Philippines while an additional 43M EUR was recorded as impact of the hyperinflationary environment and the impairment of goodwill in Turkey.

ING Investor Relations

Excluding these incidental items, the ‘normalized’ operating expenses were just 3% higher on a QoQ basis which seems to be very normal and acceptable given the inflationary environment. The net income came in at 1.18B EUR and this includes 202M EUR in loan loss provisions (on top of the almost 1B EUR recorded in the first quarter of the year). Divided over 3.743B shares outstanding as of the end of June, the EPS was 31 cents. However, on an adjusted basis, the ‘resilient’ net income was higher as ING disregarded about 277M EUR in non-recurring items. This means the 1.6B EUR in H1 net income (for a 0.43 EUR reported EPS) was boosted by an additional 7 cents per share. So the ‘resilient’ EPS in the first half of the year was approximately 0.50 EUR per share.

What about the exposure to Russia?

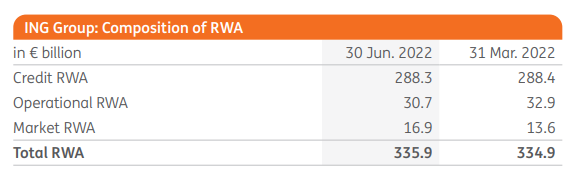

Before focusing on the Russia operations, it’s perhaps useful to first analyze the RWA evolution in the second quarter. The total amount of Risk-Weighted Assets increased by 1B EUR to 335.9B EUR but there are some simple explanations for this. At first I was a bit surprised the credit RWA hadn’t decreased by that much. In the footnotes, ING explained the total amount of RWA increased by 3.1B EUR due to higher lending volumes and 4.5B EUR due to FX changes (USD related), offset by an 8.3B EUR advantage due to the better quality of the loan book and model impacts. So on a constant exchange rate, the RWA would actually have decreased by 4.5B EUR and this would have boosted the CET1 ratio by approximately 20bp.

ING Investor Relations

The CET1 ratio of 14.7% is substantially higher than the 12.5% used by the bank as its own minimum target and expressed in euros, there is a 7.4B EUR in CET1 capital ‘surplus’. And this surplus will help to cover the shocks from the Russia-Ukraine fallout.

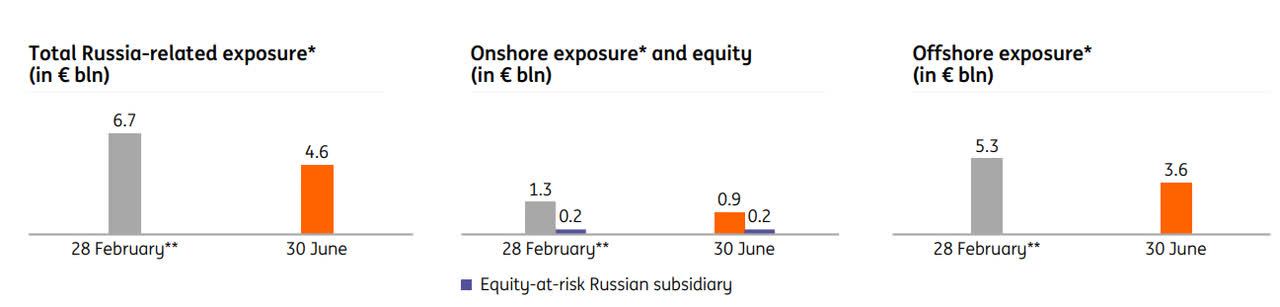

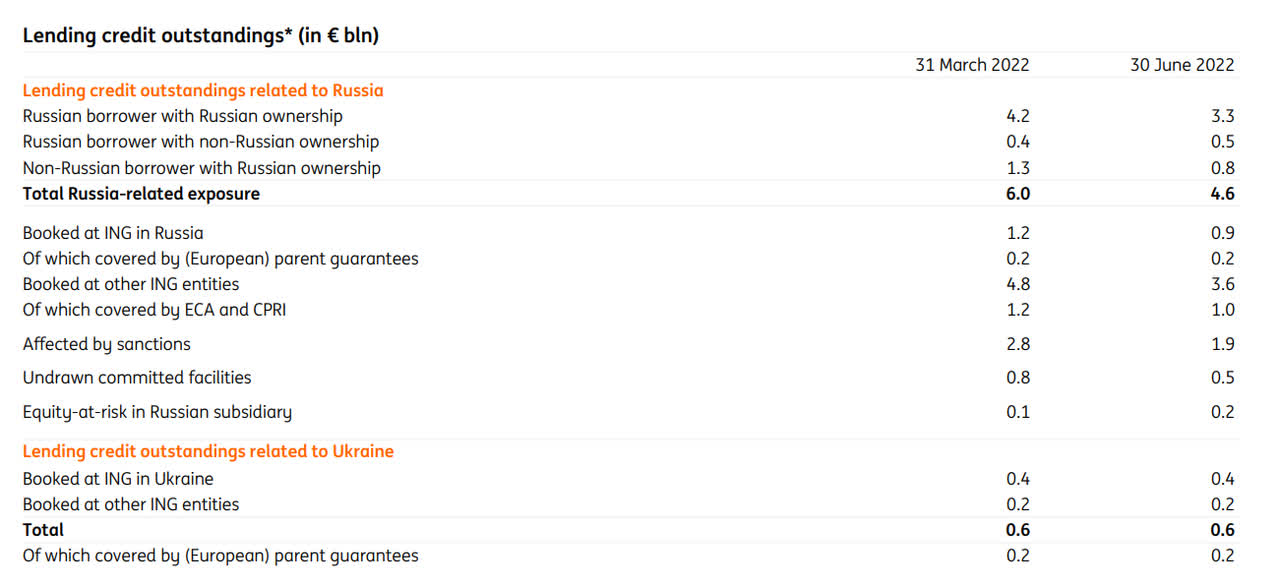

One of the main elements that was discussed leading up to the Q2 results was ING’s lack of guidance on how it was reducing its exposure to Russia. The bank did provide an update in the Q2 presentation and although progress has been made, the total Russia-related exposure decreased by just 2.1B EUR to 4.6B EUR.

ING Investor Relations

That sounds underwhelming but keep in mind that while the exposure decreased, ING has stepped up its provisions: as of the end of Q2, ING’s CET1 capital already includes 700M EUR in loan loss provisions on Russia-related exposure. The bank also provided a breakdown to explain the difference between onshore exposure and offshore exposure.

ING Investor Relations

Of interest is that the 0.9B EUR in onshore exposure 0.2B EUR is covered by parent guarantees. So the net onshore exposure is likely around 0.7B EUR. Of the 3.6B EUR in offshore exposure, 1B EUR is covered by ECA and CPRI (state-provided trade insurance). So a good chunk of the 4.6B EUR is covered by either parent guarantees (outside of Russia) and/or government guarantees.

Investment thesis

Although I would have liked to see ING reduce its Russia exposure a little bit faster, I don’t think it poses any risk to the balance sheet at this time. The 4.6B EUR exposure is really just a 3.4B EUR net exposure after taking guarantees and insurance into account and considering the CET1 capital exceeds the internal target by 7B EUR and the regulatory minimum by approximately 15B EUR, ING should be able to deal with the slow unwinding of the Russia exposure without having to resort to a fire-sale liquidation like other banks with a more substantial exposure had to do.

Be the first to comment