RobsonPL/iStock Editorial via Getty Images

Introduction

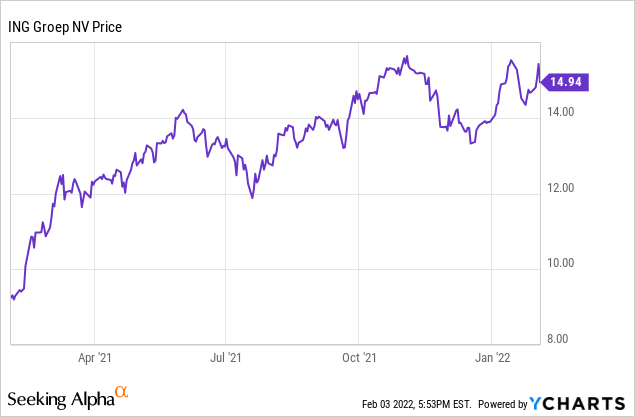

The ING Groep (ING) is a Dutch Bank with The Netherlands and Belgium as its core markets. While the bank barely survived the 2008 Global Financial Crisis, it is now one of the best capitalized banks in the Eurozone and the FY2021 results seem to indicate the bank has almost 11B EUR in excess capital above its internal capitalization requirement (which is already more strict than the regulatory requirement).

ING has a liquid US listing with an average daily volume of almost 4M shares but as the bank reports its financial results in EUR, I will refer to its Amsterdam listing where it’s trading with INGA as its ticker symbol. The average daily volume in Amsterdam is just under 15M shares.

The FY 2021 results are good

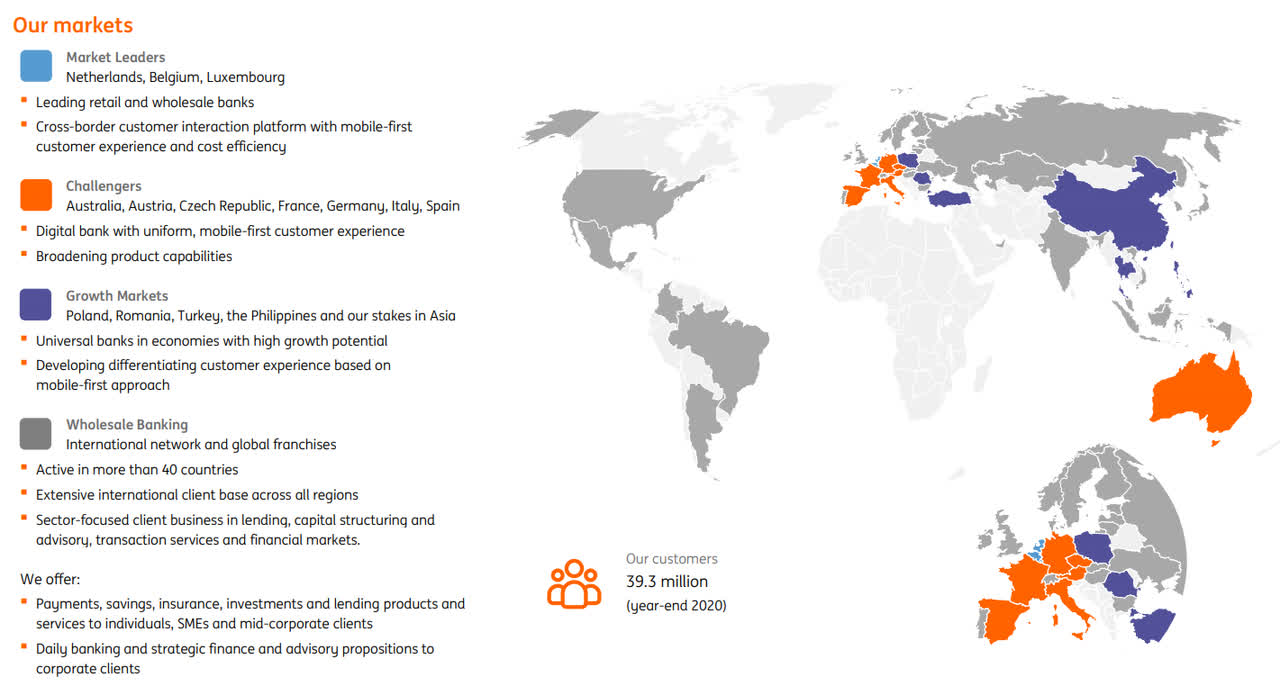

ING Groep is mainly known as a Dutch bank, but it is active in several regions. The core focus is on The Netherlands and Belgium where the bank has a dominant position.

ING Investor Relations

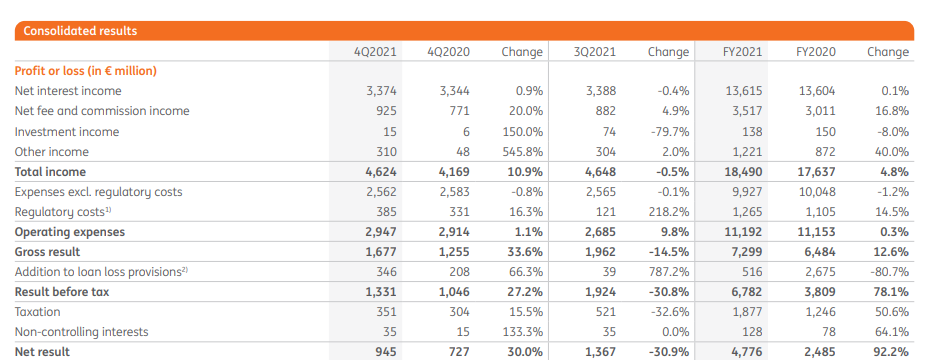

The total net interest income in 2021 remained almost unchanged and ING’s profit was boosted by higher fee and commission income which helped to boost the total income by 4.8% to 18.5B EUR. Surprisingly and interestingly, the operating expenses actually decreased by 1.2% in 2021 but that’s barely noticeable as the bank taxes increased. ING is booking those bank taxes (both local taxes as well as European taxes) as “regulatory costs” and this makes it clear European banks are still somewhat being punished for the Global Financial Crisis and subsequent smaller issues within the European Union.

ING Investor Relations

The gross result increased by 12.6% to 7.3B EUR and after deducting the 516M EUR that has been added to the loan loss provisions, the pre-tax income increased by 78.1%. Indeed, ING only had to record 516M EUR in provisions in 2021 compared to almost 2.7B EUR in 2020 and while 516M EUR is rather low, keep in mind ING recorded just 1.8B EUR in loan loss provisions in the pre-COVID years 2018 and 2019 combined. So can we expect the loan loss provisions to increase in 2021? Very likely, yes. But I hope an increasing interest rate environment may balance that out.

The bottom line shows a net income of 4.78B EUR which represents an EPS of 1.27 EUR per share based on the current share count (including the impact of the share buyback program completed by ING during the quarter, which explains the difference with the 3.85B average share count used by the bank).

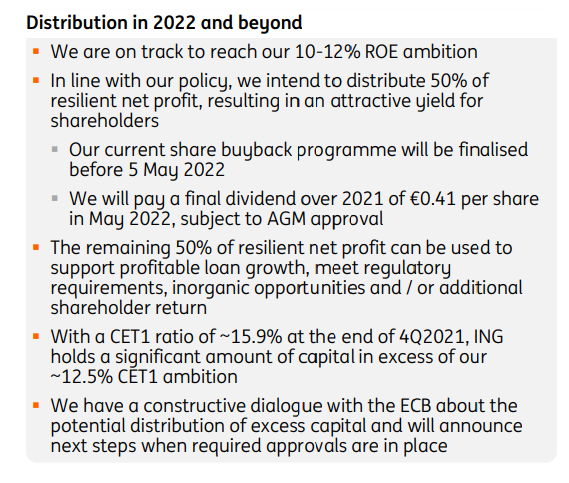

ING will pay a final dividend of 0.41 EUR per share.

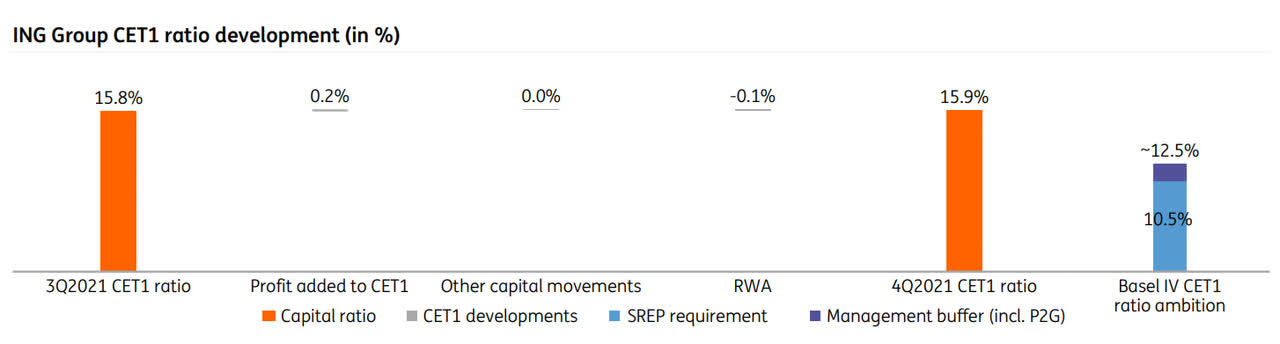

The dividend policy calls for a 50% payout ratio – but shareholders may see additional rewards

While the FY 2021 results are great and the company has confirmed its dividend policy going forward, there is one other item I’d like to discuss. ING has one of the healthiest balance sheets in the (European) banking space as it ended 2021 with a CET1 ratio of 15.9%. Not only is this way above the 10.71% required by the European regulators for 2022 (the image below shows the 10.5% requirement for 2021), it’s also substantially higher than the 12.5% internal target ING has set for itself.

ING Investor Relations

Figuring out what this could mean for the shareholders, we should perhaps first determine the amount of ‘excess capital’ in absolute numbers rather than a percentage of the total amount of risk-weighted assets.

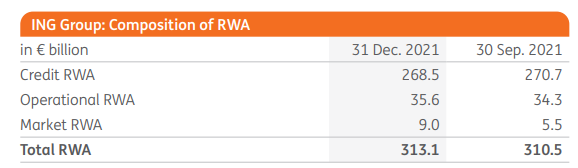

We know the total amount of risk-weighted assets (‘RWA’) was 313.1B EUR (as seen below in ING’s year-end update).

ING Investor Relations

This means the current CET1 ratio of 15.9% means the bank is maintaining a CET1 capital of just under 50B EUR (49.8B EUR to be precise). If I would now use the bank’s internal target to maintain a CET1 ratio of 12.5%, the total amount of CET1 capital required to cover this requirement based on the 313.1B EUR in RWA would be 39.1B EUR. This means the balance sheet contains about 10.7B EUR in capital above ING’s own CET1 target. And if we would assume the bank will generate a net income of almost 5B EUR in FY 2022, it will retain an additional 2.5B EUR in income which would further boost the amount of excess capital to in excess of 13B EUR.

Of course, there are several ways to “solve” this issue. ING could very easily expand its loan book by 100B EUR and still meet the CET1 ratio. It also could think about M&A where it could acquire an undercapitalized bank at a low price but that’s easier said than done and I wouldn’t want ING to pursue M&A just for the sake of putting its capital to work as that’s potentially a recipe for disaster.

The Q4 2021 presentation mentions the bank is talking to the ECB on how it can “use” its excess capital. And of course, a special dividend and/or a share buyback program are the easiest ways to deal with a surplus capital.

ING Investor Relations

That being said, considering the balance sheet already contains a substantial amount of excess capital, ING will basically be adding an additional 2-3B in annual capital by retaining the 50% of its net income it doesn’t distribute as a dividend. So perhaps ING should also consider hiking its dividend payout ratio to perhaps 60% or 70% and maybe make the higher payout ratio conditional on maintaining a certain level of CET1 capital.

Investment thesis

During the COVID-19 crash in March and April 2020 I wrote put options on ING but all my options (which were in the money and out of the money when they were written) expired out of the money. While I did well from a profit point of view, it means I currently (still) don’t have a long position in ING although I am now quite charmed by the bank’s focus on safety. Just like its Belgian colleague KBC Group (OTCPK:KBCSF) (OTCPK:KBCSY), it has a lot of excess capital on its balance sheet. KBC has been spending some of its income and excess capital on bolt-on M&A opportunities and I’m looking forward to seeing what ING decides to do.

With a CET1 ratio of almost 16% and adding 0.7% per year based on retaining 50% of the net income using a 4.5B EUR annual income going forward, ING will likely do something. I think a special dividend or a share buyback are quite likely and this makes ING a good buy on any weakness. I will likely start writing (out of the money) put options again.

Be the first to comment