Olivier Le Moal

By Kieran Kirwan

How can investors power through the rising inflation, low real yields and sluggish profits in today’s volatile markets? The answer may be pure-play infrastructure companies. By owning critical products and services, these companies can raise prices to offset inflation, pay reasonable dividends, and maintain consistent operating margins.

Fight Inflation Fears with Infrastructure

Inflation, as measured by the consumer price index (CPI), is at the highest level in 40 years,1 and New York Fed data on one‑year inflation expectations suggests that price increases could persist. Inflation can have an adverse impact on growth and profitability across many sectors, but owners of real, essential service assets like energy and water may buck the trend by increasing prices during inflationary times.

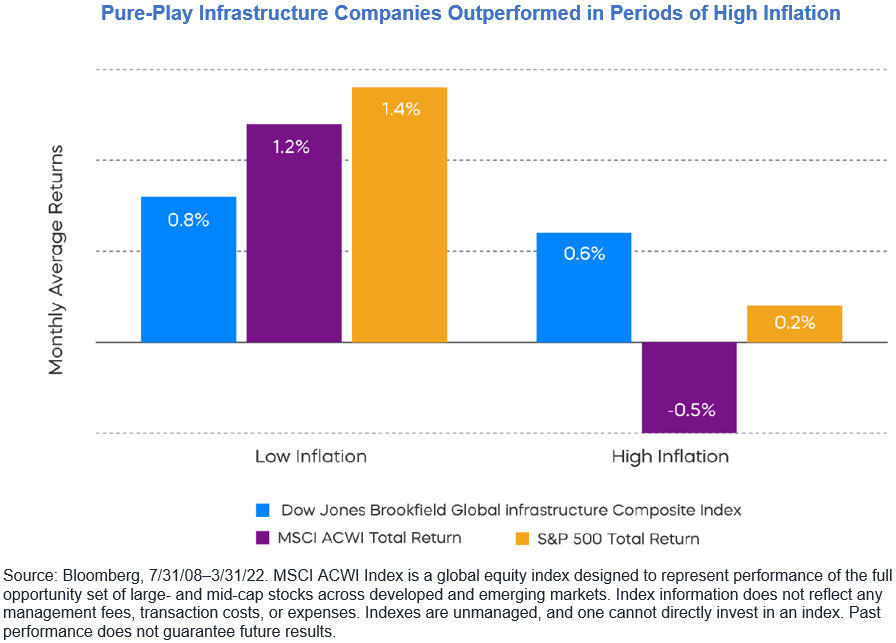

Going back to 2008, pure-play infrastructure has outperformed the S&P 500 in inflationary periods. When year-over-year inflation exceeded the average of 2.25%, 25 bps above the Fed target rate, the Dow Jones Brookfield Global Infrastructure Composite Index outperformed the MSCI ACWI Index by 1.1% and the S&P 500 by 0.4% monthly and 13% annually, on average.

Bloomberg

Hungry for Yield

Finding yield has been challenging in the low interest rate environment since 2008. The addition of inflation has made this even more acute. Investors looking for yield may be skeptical of fixed income as the Fed starts increasing rates, since loss of principal could easily offset gains from interest. Further, high inflation erodes real rates of return. While fixed income is principal protected, there is no participation in economic growth.

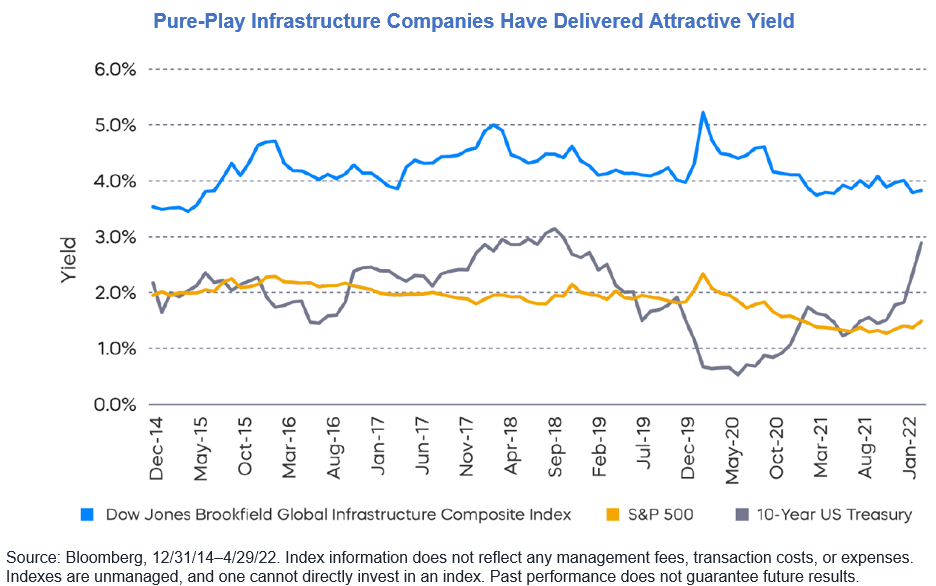

Infrastructure companies often offer attractive yield and potential capital appreciation. Since 2014, infrastructure owners and operators have provided higher yield than the S&P 500 and the 10-year U.S. Treasury.

Bloomberg

Consistent Performance Amidst Uncertainty

Uncertainty is rising as markets grapple with multiple headwinds. Many companies are facing margin compression and recent earnings results showed sales growing faster than earnings, reflecting pressure on operations.

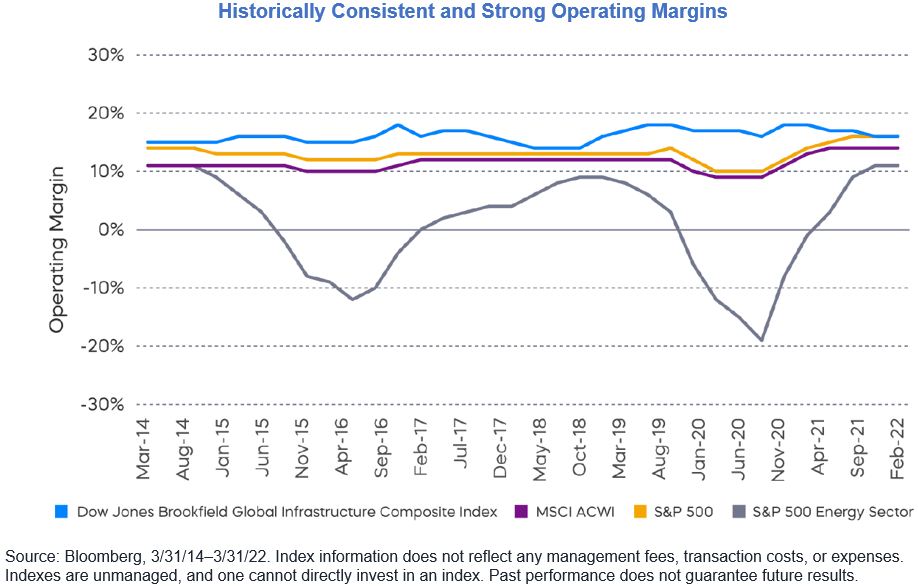

Against this backdrop, investors may put a premium on consistency and stability. Infrastructure owners and operators typically have long-term agreements that help deliver consistent fundamental results. Operating margins are historically less volatile than the MSCI ACWI Index, S&P 500 and the S&P 500 Energy Index, providing some stability in uncertain times.

Bloomberg

1 Source: U.S. Bureau of Labor and Statistics, “Consumer Price Index,” April 2022.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Be the first to comment