Ibrahim Akcengiz

If you think we here in the U.S. have a problem with inflation, just consider those poor souls in Zimbabwe. Their “monetary policy committee more than doubled the key rate to 200% from 80%, Governor John Mangudya said in a statement on Monday. That brings the cumulative increase this year to 14,000 basis points.” So far this year, our key rate has increased by about 150 basis points to 1.57%.

Zimbabwe’s inflation rate jumped to 192% in June and the cost of food tripled. Inflation in the U.S. was last reported to be 8.6%. We do not know what real suffering feels like. The next three quotes are from wsj.com.

There is no doubt that the increased demand for goods and services were initially caused by pent up demand resulting from the pandemic and federal stimulus checks. The pent-up demand is continuing but much of the stimulus has been spent. Another source of rising demand has come from millions of millennials receiving significant pay raises and becoming full-fledged consumers. That last source of demand is not going to go away for a while.

Inflation is Global

The war in Ukraine could continue well into next year unless Russia decides to declare victory after gaining full control of the Donbas region. But peace may not come so easily if Ukraine decides to not give up territory again (as it did in 2014 when it relinquished Crimea). If conflict does continue longer term, it will add to inflationary pressures.

If China continues with its no tolerance policy for Covid-19, we could see more supply chain disruption. Again, this would put added inflationary pressure on the global economy.

|

“It’s going to take months and months and maybe two years to bring inflation back down.” |

|

— World Bank President David Malpass, speaking on CBS’s “Face the Nation” |

The realistic view is that a food crisis could last up to 3 years. The real problem is the shortage of fertilizer to grow crops. It is dependent on natural gas as a feedstock and with the war in Russia, there is a global shortage of natural gas. For as long as sanctions on Russia continue to be imposed on energy products and the related supply chain, that shortage will persist.

|

“We may be reaching a tipping point, beyond which an inflationary psychology spreads and becomes entrenched.” |

|

— The Bank for International Settlements, in its annual report |

The point made by the Bank for International Settlements is one that was also emphasized in a report from the NBER (National Bureau of Economic Research).

“ Markets expect the Fed to cut rates later next year.” – wsj.com

But, if inflation stays elevated, will that happen? Or will the Fed be forced to keep raising rates to over 4%, or even 5%? These are profoundly significant questions that will only be answered in time. It will probably require a coordinated effort by central banks to bring inflation down. Currently, the Bank of Japan, the European Central Banks, the Bank of England and other are not being as aggressive as our Federal Reserve Bank. This may be another reason that inflation lingers longer.

Inflation is being felt globally and is not likely to be cured in the U.S. while it rages on everywhere else. Our U.S. dollar strength has insulated us somewhat from inflationary pressures because imports paid for in dollars cost less as our currency strengthens against other currencies. But it cannot do much to help in areas such as food or energy, most of which we produce at home. Still, if inflation continues to rise overseas, even a strong dollar won’t keep domestic inflation at bay when imported goods keep rising in price .

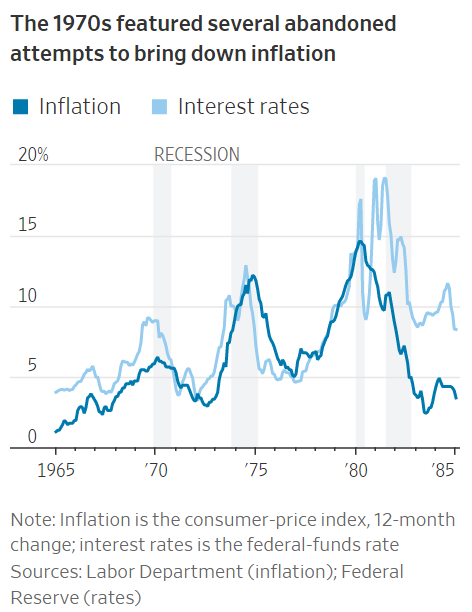

1970s De Ja Vu

As I mentioned in an earlier article, a major demographic shift is afoot and causing higher demand for goods and services on a broad basis. It is like the demographic shift that occurred during the 1970s as the baby boomer generation became full-fledged consumers and began driving the economy. This time it is the millennials that are coming into their own and they are greater in number than the boomers. The shift in the 1970s created capacity issues that took nearly a decade to fix. The market has not priced-in Interest rates at those levels, and I don’t think we’ll see interest rates in double digits this time around, but we may be further from the top than economists, the Fed and investors think. If so, the market will need to fall further.

wsj.com

I am not alone in believing that inflationary pressures are worse than investors expect. As I mentioned in that earlier article which deserves repeating:

A recent study from the National Bureau of Economic Research, “Comparing Past and Present Inflation,” indicates that we could be in for a reenactment of the 1970s and early 1980s. In it, the authors suggest that for the Fed to get inflation back down to its target of 2% will “require nearly the same amount of disinflation as achieved under Chairman Volcker.”

Conclusion

Scary stuff! But the Fed started raising rates from much lower levels and has a bulging balance sheet of assets. These two differences should enable the Fed to bring inflation down in a few years if it remains aggressive enough. The result is a likely recession, but the potential economic damage of elevated inflation for too long would be far more painful than an economic downturn from which the economy will recover. The longer inflation is allowed to become entrenched in the economy, the harder it will be to overcome.

The June Consumer Price Index report is coming out on Wednesday this week, so we will find out if actions taken by the Fed have had the desired effect or if more extreme measures will be needed. If the CPI (Consumer Price Index) is below 7%, it may be interpreted by markets that the Fed is on the right track. However, if the headline number is above that level, it could mean the Fed will need to continue taking aggressive measures for longer than investors expect. Anything above 7% should be concerning; above 8% would be disastrous. The report on Wednesday will be a big tell, one way or the other.

Be the first to comment