Khanchit Khirisutchalual

Article Thesis

Consumer inflation came in higher than expected for the month of August, and there are many concerning trends when we take a closer look at the data. This increases the likelihood of more steep rate increases by the Fed, as the market now thinks that it’s possible that the upcoming rate increase will come in at 100 base points. Persistently high inflation remains a big issue for the transitory narrative, and further rate hikes, coupled with an ongoing economic downturn, increases the risk of stagflation. In this article, we’ll look at some important data points and show where investors might find resolve.

August Inflation Data Was Abysmal

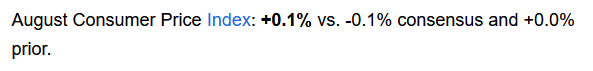

Markets, media, and politicians had hoped for inflationary pressures to ease in August, relative to the previous month. A negative month-over-month print was expected, but that did not materialize. Despite a decline in oil prices in the recent past, August inflation came in well above expectations, and prices were up from July:

Seeking Alpha

But the headline print isn’t even the worst item in the report. Instead, bigger issues materialize when we take a closer look. Core CPI, which backs out moves in volatile categories such as energy and food, came in well above expectations:

Seeking Alpha

This directly contradicts the thesis that inflation is being driven by high energy prices primarily. Instead, the contrary was true in August: Core CPI was significantly higher than the headline number on a month-over-month basis, thus underlying inflation (backing out the impact of energy prices) seems to be accelerating. Not surprisingly, Core CPI also came in higher than expected on a year-over-year basis, at 6.3%, versus expectations of a 6.1% print.

When we look at some of the categories that make up overall consumer price inflation, there’s little reason to believe that inflation will cease to be an issue in the near term, I believe.

The following chart shows the CPI impact of rent of shelter:

Bloomberg

We see that the impact of growing rents has been dramatic in recent months. The CPI impact has been growing and has not slowed down at all. In fact, it looks like the impact has even worsened in recent months, which suggests that rising rents will continue to put upwards pressure on the overall CPI print. The fact that this slower-moving item is well above historic norms right now suggests to me that inflation could be a persistent macro issue for a prolonged period of time.

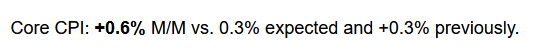

The following chart shows the contribution of different categories on overall inflation:

Twitter

We see that overall CPI prints have declined over the last two months, but that can be entirely ascribed to easing pressures from the energy category. Oil prices have pulled back from this year’s multi-year highs, which has had an easing effect on headline CPI prints. But excluding energy, things are actually getting worse: The sum of all other categories outside of energy has hit a new high in August, driven in part by a steep increase in service costs. This does not fit to the transitory narrative, I believe — if inflation was transitory, non-energy items would be where they stood historically, and that does not seem to be the case.

Due to these reasons, I believe that inflation will remain well above the 2% level for the foreseeable future. Headline numbers should ease further in the coming months as long as energy prices do not rise from current levels, but with core inflation at more than 6%, there’s little to be happy about. The producer price index also remains high, at 9.8% as of the most recent month, which aligns with my belief that consumer inflation will remain elevated.

The Fed Is Forced To Hike Further: Will This Cause Stagflation?

Persistently high inflation forces the Fed to become more and more hawkish. The central bank has raised rates considerably this year, but real yields are still deeply negative. It is thus very likely that the Fed will continue to increase rates meaningfully in upcoming meetings.

Markets are now pricing in a 20%+ chance of a hefty 100 base point increase this month, and if there is no 100 base point increase, a 75 base point increase seems almost guaranteed. That would be the third such 75 base point increase in a row, which would be a historic event — and according to the market, that’s not the most hawkish scenario, as an even larger 100 base point increase is possible, although not the most likely scenario (for now).

Following September’s upcoming rate increase, interest rates will most likely get increased further later this year. This will naturally cause a range of effects, some of them unwanted. A further increase in rates is bound to put pressure on the housing market, for example, that has already been experiencing a slowdown in recent months on the back of a massive increase in mortgage rates that has made houses less affordable.

Rising interest rates will also slow down investments by corporations, and consumers will likely spend less on discretionary items such as house upgrades, new vehicles, and so on.

The US already was in a technical recession during the first half of the current year, as Q1 and Q2 GDP both were negative. But the economic slowdown could worsen in the coming months, as further interest rate increases put additional pressure on the US economy and the global economy at the same time. Macro issues such as lockdowns in China and transportation issues in the US are not helping, either, and could accelerate an economic downturn further.

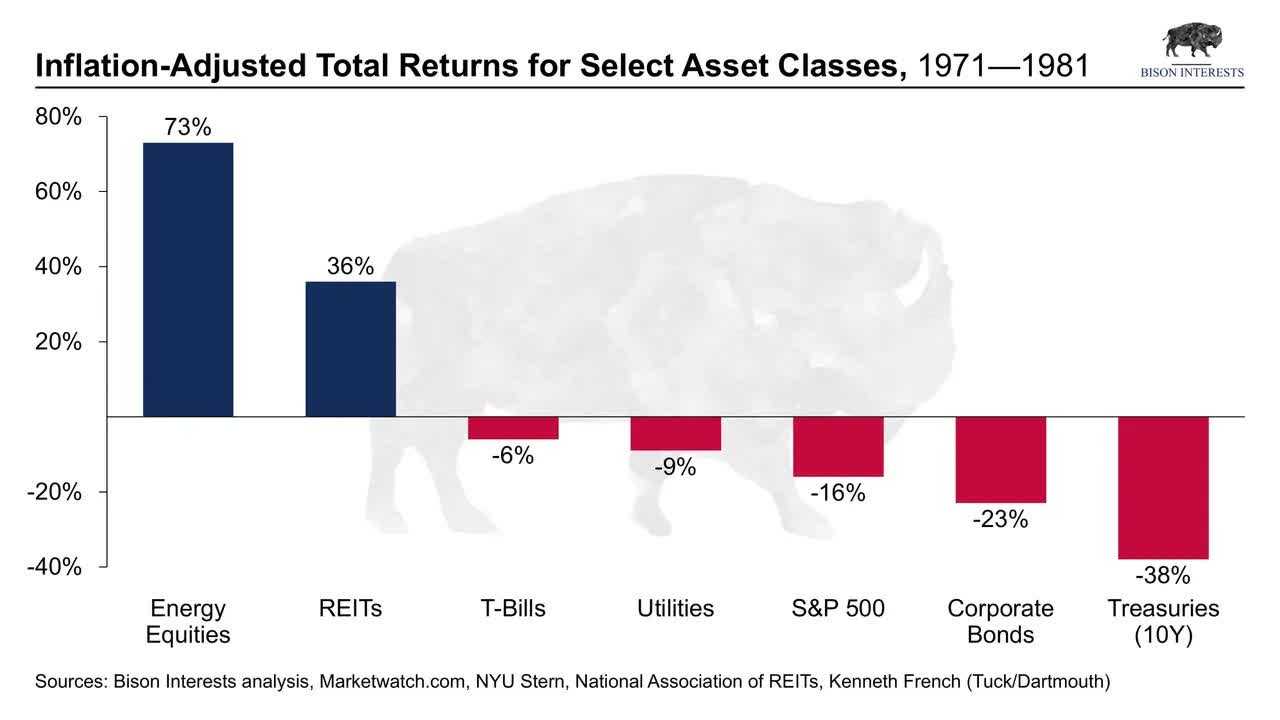

Stagflation is defined as a period of time during which economies are stagnant while prices increase. The term has been made popular during the 1970s, when the oil crisis led to an economic slowdown and high CPI prints at the same time. The same could happen this year, as global energy supply is disrupted (although this is more of a European problem than a US problem), while inflation is running at multi-decade highs. And yet, at the same time, the economy is not really in a strong spot. In order to prepare for a potential stagflationary environment, it could make sense to look at what worked during the 1970s, when the macro environment was not too different. The following chart shows the real returns of a range of asset classes during the 1970s (or, more precisely, in the ten years starting 1971):

Bison Interest as seen on Twitter

Energy equities (XLE) and REITs (VNQ) have been asset classes with a clear positive return in real terms — investors made more money than they lost to inflation. The broad equity market, treasuries, etc. all were generating negative returns in real terms.

Being long real assets seems like a sensible approach in a high-inflation environment. Especially when those benefit from inflation, which is the case for energy and real estate. Both require heavy investment for properties in the case of real estate and for oil producing assets, pipelines, etc. in the case of energy stocks. Those investments were paid with yesterday’s dollars and were partially financed with debt. That debt is being inflated away, and these assets generate substantially higher revenues and cash flow in a high-inflation world, due to higher energy prices and higher rents. Not too surprisingly, we have written about the benefits of owning energy and real estate in past articles that centered around inflation, such as here and here — when many politicians and central bankers were still talking about inflation being transitory.

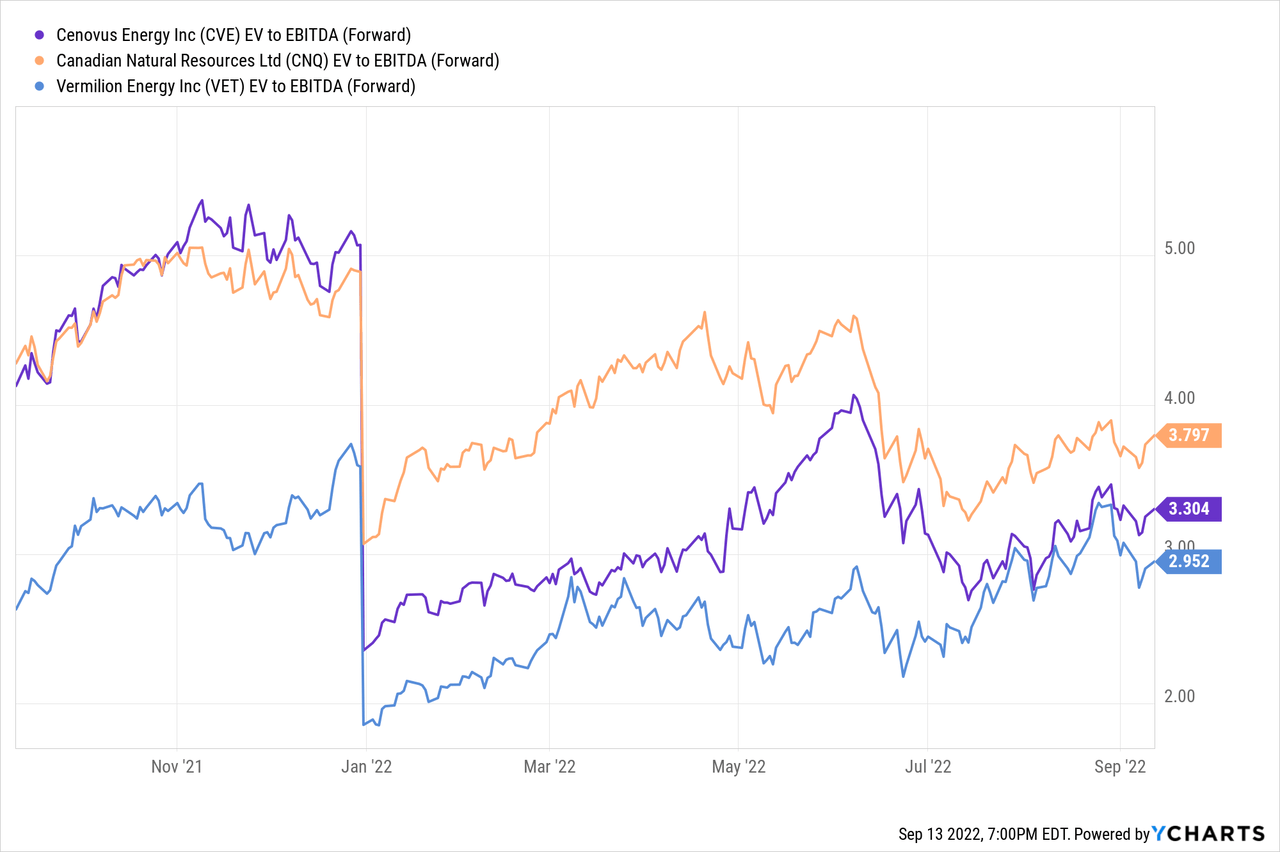

So what assets are particularly attractive right now? There’s a very large array of energy and real estate names. Some of our favorites include Canadian oil (sands) companies, as they generally have low production costs, long reserve lives, low decline rates, and shareholder-friendly management. And they are very cheap:

Cenovus Energy (CVE), Canadian Natural Resources (CNQ), and Vermillion Energy (VET) trade for 3.0 to 3.8x EBITDA. VET is particularly interesting due to its European natural gas assets that are extremely profitable in the current environment. But other oil equities could be attractive as well, including the supermajors such as Exxon Mobil (XOM) and BP (BP) that offer a combination of share price upside, dividends, and buybacks.

Energy infrastructure names are attractive as well, we believe. Pipeline companies such as Enterprise Products (EPD), Energy Transfer (ET), or MPLX (MPLX) offer hefty dividend yields and trade at inexpensive valuations. Their debt is being inflated away, and high CPI prints and commodity prices allow them to increase higher fees for transporting oil or gas from A to B. Their business models generally are more resilient versus oil producers, making them more suitable for risk-averse investors and buy-and-hold investing.

Among real estate names, there are many solid choices at current prices. Class A mall REIT Simon Property Group (SPG) offers a yield of 7% and is trading at a pretty inexpensive 8x FFO multiple, for example. Triple-net leased REITs such as Realty Income (O) or National Retail Properties (NNN) offer solid yields in the 4%-5% range and have fared well during all kinds of economic climates in the past — and they continued to increase their dividends, no matter what. Even apartment REITs such as AvalonBay Communities (AVB) could be solid investments as they trade at sizeable discounts to net asset value, making them way more attractive than direct real estate investments.

Takeaway

Many experts and politicians have underestimated inflationary pressures for a long period of time. Apparently, they still do so, as the August inflation report was bad across the board. Inflation is not an energy-driven issue any longer — instead, inflation is running high across all kinds of categories, including rent, services, food, and so on.

This will force the Fed to hike further, putting even more pressure on the economy that is battling several other macro headwinds on top of that. Overall, that makes for an uncompelling macro picture — stagflation seems like a possible scenario.

Investors should look at what worked the last time the US was in a similar situation — buying real assets, especially real estate and energy, worked well back then. It could make sense to look for investments in these sectors. At the same time, treasuries and other fixed-income investments don’t seem attractive due to their deeply negative yields. Long-duration equities, such as the oftentimes non-profitable growth stocks that ARK Investment (ARKK) owns, also seem like they aren’t a good choice for the current environment. It makes sense to be selective with equity investments, I believe.

Be the first to comment