SergeyChayko

The Federal Reserve System is fighting inflation in the United States.

But, one thing the investment community must be very aware of is that inflation is not just a United States affair.

The Bank of England is warning that the United Kingdom faces a rate of inflation of around 13.00 percent by the end of 2022.

And, by the third quarter of 2023, the rate will still be in double digits.

Only in 2024 will price increases come back down to reasonable levels, maybe even as low as 2.00 percent.

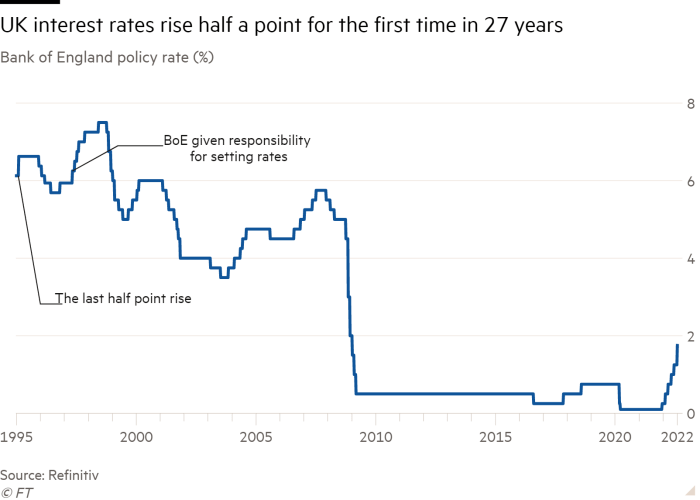

The British central bank stepped up to combat this picture by raising its policy rate of interest by 0.5 percent. The policy rate now stands at 1.75 percent.

This is the largest increase in the rate in 27 years.

The primary reason for this rise in prices is the war going on in Ukraine and the impact that this conflict is having on the price of energy.

Recession

This shock is also having a major effect on the economy as well.

The Bank of England is now expecting that post-tax personal income will decline in 2022 and 2023, showing a peak-to-trough decline of five percent.

Real GDP is expected to decline for five quarters in a row. This would show a peak-to-trough decline of 2.1 percent, which, according to the bank is the worst performance on record going back to the 1990s.

How does the Bank of England fight both these high rates of inflation and the declining output of the economy?

World Affair

Of course, the Bank of England is not the only central bank in the world facing such problems.

As we know, the Federal Reserve System is facing this twin-headed problem, as inflation in June 2022 came to around 9.1 percent, and the United States economy, in the second quarter of 2022 was shown to have its second straight quarter of negative growth in real GDP.

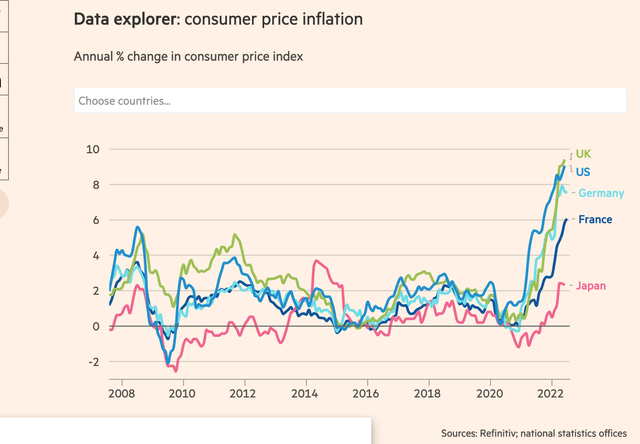

Consumer price inflation (Financial Times)

The European Central Bank also faces such pressures, as Germany is showing a rate of inflation of just under 8.0 percent and France is showing a rate of inflation of around 6.0 percent. Italy is also having inflation problems.

Even Asia is showing evidence that prices are rising there. These numbers have just started rising in recent months.

So, the current situation appears to be a worldwide affair.

And, central banks around the world have responded to the pressures.

Of course, these actions have raised concerns about individual countries or even the global economy entering into a state of stagflation, something like what happened in the 1970s.

How did the world get into such a condition?

Well, most central banks around the world responded to the Covid-19 pandemic by generating lots and lots of liquidity to protect economies from a financial or economic collapse. This movement was led by the Federal Reserve System in the United States but was also supported in most countries.

Money was readily available.

Now, that money is still mostly in existence and finding its way into spending streams. And, of course, that spending includes money going for higher prices.

Energy shortages, even before the Ukrainian affair, pushed up the prices of energy, and the supply chain problems just added to the disruptions that caused many, many adjustments to prices.

The general picture of the world today is one of general disequilibrium, yet one with lots and lots of money and debt floating around all over the place.

It is a world with lots and lots of inflation and increasing efforts on the part of central banks to fight off the inflation.

The leaders of central banks are facing an enormous amount of pressure.

It is also a world of radical uncertainty because of all the disequilibrium that currently exists in the world, but also because of the rapid transformation taking place due to the technological changes that are happening.

Countries cannot hold back the technological changes that are occurring, but they also face massive problems in dealing with the resource allocation problems that accompany the transformation going on.

In one way, we have seen a reduction in the world globalization that has been taking place over the past sixty years or so, but in another sense, a new globalization is taking place, one that we have very little understanding of at the current time. This change is mostly unknowable at the present time.

The Value Of The Pound

The value of the pound continues to fall.

Thursday, August 4, 2022, it costs about $1.22 to buy one British pound.

On December 30, 2021, it cost $1.35 to buy one British pound.

So, the Bank of England has raised its policy rate of interest this year.

But, the Federal Reserve System outdid it.

The British pound became weaker, even though the central bank authorities were moving to protect the pound earlier this year.

UK Interest Rate (Financial Times)

It seems as if the value of the pound will continue to decline for the time being, especially since the officials of the Federal Reserve System seem to be intent on moving the Fed’s policy rate of interest up aggressively.

World Inflation

Bottom line: how much of a role is world inflation going to play upon the inflation-fighting that is taking place in all these major countries around the world?

Furthermore, the Russian/Ukrainian conflict still continues.

The Covid-19 pandemic, in its many forms, is still around.

Energy problems remain and will not be resolved in the near future.

Supply chain issues abound.

And, there are political problems all over the place.

Disequilibrium pervades the scene and radical uncertainty clouds the future.

Wow! Double-digit inflation in England for the next year or so!

Not a very pretty picture.

Be the first to comment