DeanDrobot

There is a growing consensus that we are either already in a recession or will see one in the near future.

Billionaire Bridgewater Associates hedge fund founder Ray Dalio recently predicted that the Federal Reserve will be unable to successfully balance increasing interest rates to fight inflation with ensuring a soft landing for the economy. As a result, he said that equities are even “trashier” than cash in the current environment.

Some of the world’s richest men are also convinced we are headed for stormy economic waters, with both Elon Musk and Bill Gates recently making repeated statements to that effect.

Even Dr. Michael Burry of Big Short fame is back at it, predicting the mother-of-all crashes will befall us in the not-too-distant future.

While we are not macroeconomists or even macro-driven investors, we happen to agree that the evidence strongly suggests that we will see a recession sometime in the next year or two.

As a result, we believe it is a prudent time to weight our portfolio more heavily towards recession and inflation resistant stocks. In this article, we will look at two of the best undervalued high yielding inflation and recession-resistant Dividend Aristocrats available today.

#1. Enbridge (NYSE:ENB)

ENB is a Canada-based midstream infrastructure powerhouse with a 27-year dividend growth streak that makes it a Dividend Aristocrat. It boasts an industry-leading BBB+ credit rating and generates utility-like cash flows thanks to owning some of the largest and best-positioned portfolios across various aspects of the midstream value chain. For example, it owns the largest crude oil pipeline network in North America and its natural gas transmission pipeline network is the second largest in the United States. Perhaps most impressive is its status as the largest natural gas distributor in North America.

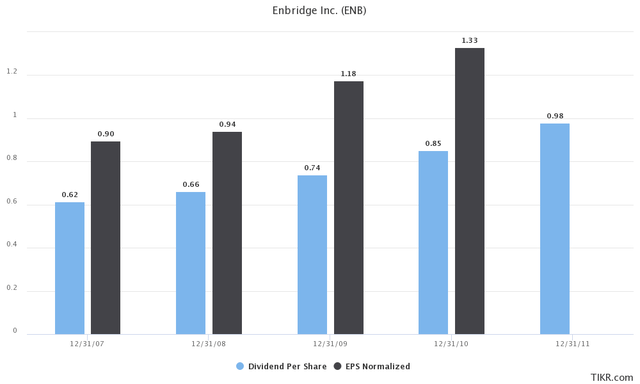

Meanwhile, 98% of its cash flow comes from either take-or-pay or fee-based contracts, while 95% of its counterparties are investment grade or equivalent. These contracts are also generally set for 10 years or longer, so its cash flow visibility and stability are exceptional, enabling it to weather recessions and energy market crashes quite well. As the chart below illustrates, ENB continues to grow its normalized earnings per share and dividends per share without disruption during the Great Recession:

Furthermore, a recent white paper by Brookfield Asset Management (BAM) makes the same point that:

Cash flow for midstream companies has generally been much more stable during periods of significant price volatility than the cash flows of other parts of the energy business. This is due to the midstream industry’s predominantly fee-based (instead of commodity price-based) cash flows and its diversity of cash flow sources across hydrocarbons (crude oil, natural gas and NGLs) and finished products… For investors worried about the next recession…we favor allocating that exposure to energy infrastructure rather than broader energy, given the midstream sector’s more stable cash flows, and we prefer an active approach that can maintain broad exposure to the midstream value chain in order to mitigate potential impacts from a slowdown on any single part of the industry.

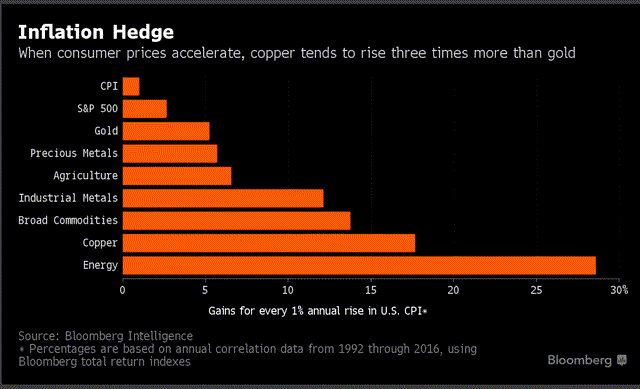

While its safety and downside protection are great, ENB’s finest qualities are its mouthwatering ~6.6% forward dividend yield that is well covered by cash flows, mid to high single digit expected annualized growth rate, and inflation protection thanks to energy’s strong performance during inflationary periods and the inflation-linked escalators attached to many of ENB’s contracts.

Energy As An Inflation Hedge (Bloomberg)

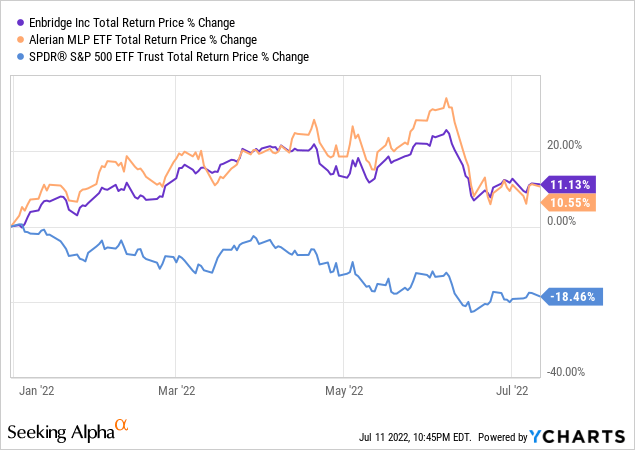

Despite generating strong year-to-date performance, ENB stock still looks relatively attractive at the moment.

On top of its attractive dividend yield and growth projections, its 12.66x EV/EBITDA ratio remains well below its historical average of 13.15x, implying that the company has little long-term downside risk.

Between its strong cash flow visibility and growth opportunities via its high return, low-risk investments in its existing midstream networks and renewable power generation assets, ENB should be able to create strong shareholder total returns and dividend growth for many years to come.

Like ENB, ACLLF is also a Canadian-based business with a 25+ year dividend growth streak (28 years, to be exact) that puts it in the prestigious company of the Dividend Aristocrats. ACLLF is a global infrastructure business with assets spread across the globe, but with a concentration in the Americas and Australia.

The company grew adjusted earnings per share at a ~9% pace in 2021 despite enduring some lingering headwinds from COVID-19, and is off to a strong start in 2022. Its Q1 FY2022 results included highlights such as:

- The company generated adjusted earnings per share of $1.17 in the first quarter of 2022, indicating robust 12.5% year-over-year growth thanks to strong performance in its Canadian Utilities (OTCPK:CDUAF) business as well as strong performance in its Structures business (23% year-over-year adjusted earnings growth) and Neltume Ports business.

- The company went into more depth on its long-term Structures business growth plan, where he highlighted recent contract wins as well as the business’ transformation towards a more stable earnings profile. We continue to believe the Structures business can drive strong earnings growth for ACLLF and is an important part of the thesis.

- Management also remained bullish on growth potential in the Neltume Ports business, citing a project pipeline that “is probably the deepest that we’ve seen since we entered that investment.”

In addition, it boasts an A- credit rating and has a wide moat core regulated utilities business that enjoys exceptional inflation protection and is very defensive against recessions. Its port business has inflation escalators in most of its contracts and also has several years in duration on its contracts, so it should generate fairly stable cash flows during a recession. Last, but not least, its structures business has strong growth momentum and has been able to pass along to customers its increased costs due to inflation. As the company stated in its recent annual meeting:

Fortunately, we have strong protection from the pressures of inflation within our diversified portfolio of companies. Our structures business, for example, has largely been able to maintain margins and pass on higher input costs. Our distribution utilities, in Alberta and Australia, have regulatory mechanisms that take inflation into consideration. Our ports business Neltume has inflationary protection in many of its contracts and has benefited from increasing global trade volumes.

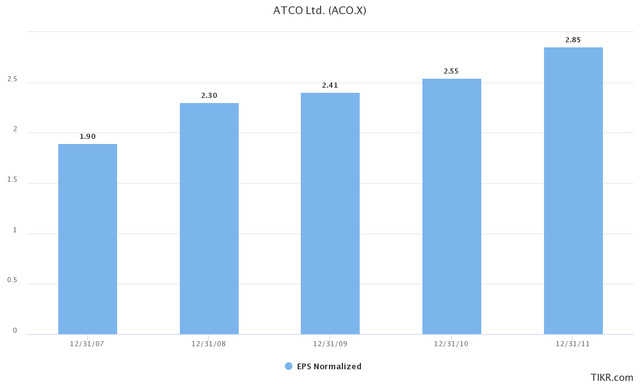

During the Great Recession, ACLLF continued to grow its earnings per share without interruption and continued to grow its dividend per share at a strong clip as well.

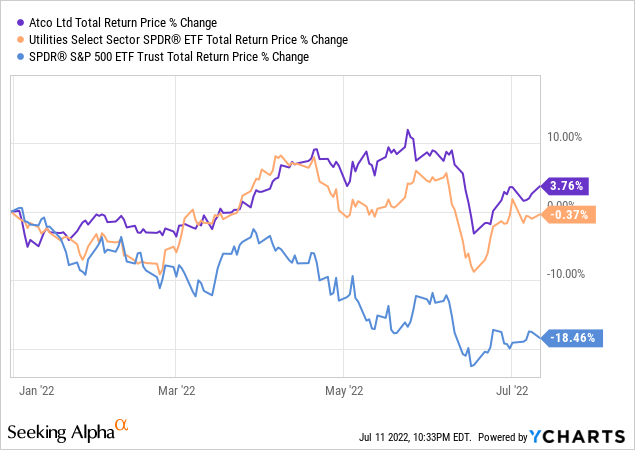

On top of that, despite being a very attractive holding during the current economic environment and holding up admirably thus far this year amidst a broader market sell-off, the stock remains quite cheap.

Its EV/EBITDA ratio is 8.39x, below its 5-year historical average of 8.81x, and its price to diluted earnings per share is 16.83x, below its 5-year historical average of 17.37x. Even more compelling is the fact that its current market cap implies that it is selling at a discount to the value of its CDUAF holdings, which means that shareholders get its rapidly growing structures business, real estate holdings, Neltume Ports business, and other miscellaneous investments completely for free.

With a forward dividend yield of ~4.3%, a very strong balance sheet and business model, strong growth momentum, and very low long-term downside risk, it is hard to imagine losing with this investment over the long-term. ACLLF is a very steady sleep well at night investment. It continues to pay out very reliably growing and attractive dividends, underpinned by a per share growth rate that is more than twice as strong as the dividend growth rate at the moment. You can read our full investment thesis here and our recent exclusive interview with ACLLF here.

Investor Takeaway

With inflation raging and chances of a recession rapidly rising, investors would be prudent to position their portfolios to weather these challenges. As we discussed during my recent interview on The Weekend Bite, we believe that sectors with defensive characteristics and stable cash flows like midstream (AMLP) are particularly well suited to an environment that is increasingly indicating a recession is near:

At High Yield Investor, we recently placed several trades to that effect and continue to look for further ways to strengthen our portfolio’s risk-reward in the current climate. We believe that ENB and ACLLF are great investments both for the current macroeconomic climate and over the long term.

Be the first to comment