Sonja Filitz/iStock via Getty Images

Investment Thesis

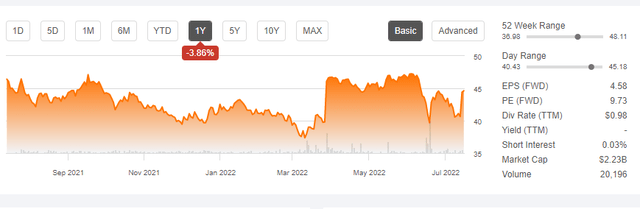

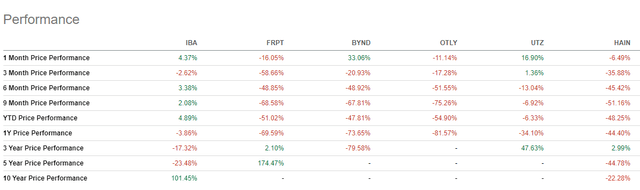

Mexico’s chicken producer Industrias Bachoco, S.A.B. de C.V. (NYSE:IBA) has lost nearly 4% in the previous 52 weeks but has gained 6.93% YTD. The stock is trading at $44.62, near its 52-week high of $48.11. The company has faced multiple headwinds, primarily inflation jacking up the cost of production, especially in chicken food.

Despite these uncertainties, IBA performed reasonably well, outperforming the market as well as its peers.

As food prices continue to rise, mostly due to inflation, people must make do with what they can afford. Mexican consumers are turning to chicken because it’s the cheapest protein option. Inflation is projected to remain a problem for the foreseeable future, which should boost IBA.

IBA is a buy for the following reasons:

- Despite increased costs due to inflation, chicken is resistant to decreases in demand because of its status as the cheapest source of protein.

- The acquisition of RYC Alimentos provides a substantial boost in the revenue of the company, in addition to meaningful synergies in the form of vertical integration.

- The tender offer presented by a majority shareholder, despite the likelihood of it transpiring unknown, serves as a strong vote of confidence that the stock is currently undervalued.

The Company

IBA is a Mexican company operating in Mexico and the United States. The company’s activities consist of:

- Producing feed

- Raising chickens

- Marketing chicken products

- Pig rearing

- Pet food

- Beef treatments

- Animal immunizations.

Their customers include wholesalers, retailers, supermarkets, and foodservice companies.

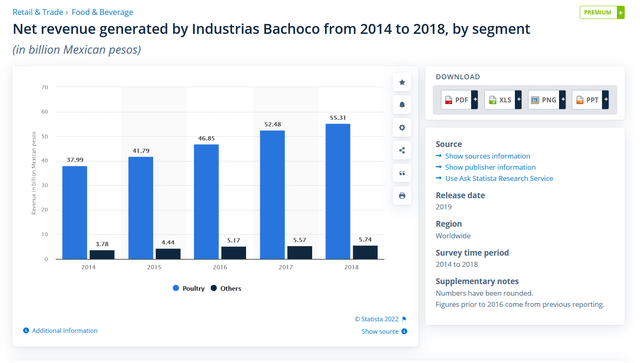

For the purpose of this article, I will direct almost all of my focus to the poultry segment, as it makes up the vast majority of its revenue.

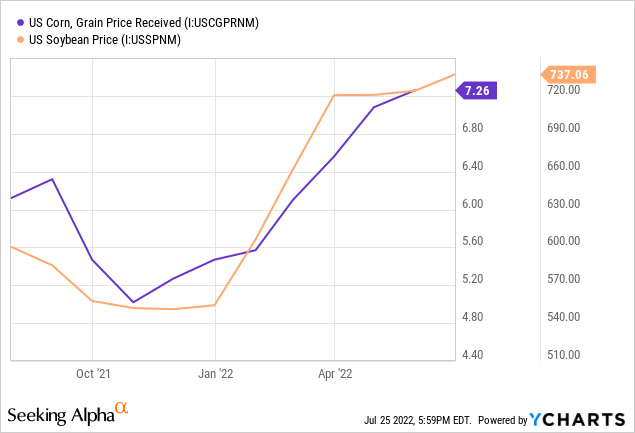

Current affairs

There is a lot of uncertainty surrounding the company’s future. For example, the company reported in its Form 20-F that the market they service is volatile, with rapidly rising prices. While answering questions, the CEO acknowledged that this could impact demand for the company’s products. Feed grains, such as sorghum and corn, appear to be the biggest problem. Soybeans are also an area of concern.

The rising cost of raw materials involved in creating chicken feed will spill over to the other aspects of the business. Chicken rearing involves a significant amount of chicken feed; an increase in that feed’s price will increase the cost of rearing chicken. The extent of this is not yet known, but I believe investors should not be overly concerned for the reasons below.

To begin, IBA can and will pass on some additional expenses to customers, splitting the burden between the corporation and the customer. The decision to pass costs to consumers could negatively influence demand. However, since the price of all meat has increased, replacing chicken with a cheaper option in light of price increases is impossible. As I have mentioned above, chicken remains the cheapest source of protein, and moderate price increases across the board will not change that. Therefore, the net effect may be insignificant or, in some cases, positive.

Secondly, as I will discuss later, the synergies relating to the vertical integration brought upon by the RYC Alimentos acquisition will help to offset some of these costs.

The integration of RYC Alimentos

During Bachoco’s Q1 ’22 transcript call, the company announced the integration of RYC Alimentos into their mix. RYC is a meat processor and distributor mainly of beef, pork, and chicken with annual net sales of $150 million. With this acquisition, valued at approximately $61 million in stockholder equity, IBA gained the facilities to process and distribute the chicken they produce. Further, due to the integration, the company’s overall sales grew 25.9 percent compared to the first quarter of 2021.

With this acquisition, not only we are adding to our portfolio product of higher value, but also entering the segment of properly owned stores. We are looking forward to captures, and they identified synergies as a result of the actions implementing that and mention that our total sales increased 25.9% compared to the first quarter of 2021.

The deal plans to buy two factories in Puebla and 21 stores in four states in Mexico. Beyond the increased assets on their balance sheet, I expect the acquisition will create substantial synergies for IBA. The two plants will allow IBA to handle meat processing internally, and the twenty-one stores will ensure easy and effective distribution throughout Mexico.

Thus, the acquisition of RYC Alimentos vertically integrates the company, enabling the processing and distribution of the chicken produced by their legacy operations to be handled internally. While the extent of these synergies is not yet clear, there is reason to be optimistic about margins moving forward.

Valuation

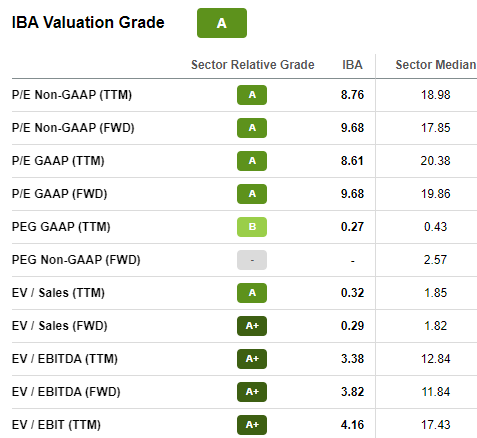

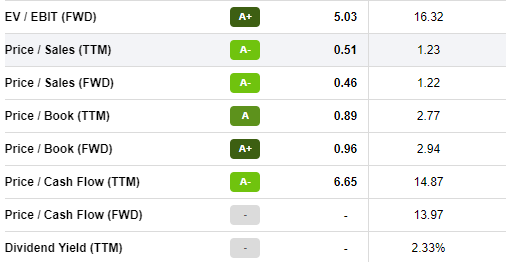

Despite solid business results, IBA share price has plateaued. Because of this, the company seems undervalued. Based on standard valuation approaches, nearly all pricing ratios are below the industry average, sometimes by as much as ½.

Seeking Alpha

Seeking Alpha

Its TTM-based P/E, P/S., P/B., P/CF, and PEG are much lower than their respective industries’ corresponding medians. In addition, its FWD-based valuation ratios also suggest that the stock is undervalued. With this valuation, potential investors should tap into this low valuation as it offers a cheap entry point to the company, which holds promising growth potential.

Tender offer

The Robinson Bours family controls 73.25% of Bachoco’s shares. In March of this year, the family announced a voluntary tender offer for the remaining 27% at a 20% premium to the current share price. If accepted, the company will be taken private.

There are two ways that an investor could look at this event.

The investor could assume that this offer will go through. In this case, the investor would buy the shares and wait until they are purchased at the agreed-upon price. After all, much of the share price jump that happened when the offer was announced has been sold off, leaving room for a 10% or more profit if the deal goes through.

Seeking Alpha

Another way an investor could look at this is to assume that the offer will not go through but take it as a vote of confidence from the majority owner that the stock is undervalued. After all, I have already discussed that the valuation multiples are low relative to similarly situated peers. This offer supports the point that the stock is undervalued at current prices.

Since the company has been quiet regarding updates to this situation, I cannot speculate on what will happen in the future. That being said, for an investor, the situation looks sunny. Either the stock gets bought in the tender offer for more than you paid, or you invest in a stock that is undervalued.

Conclusion

Bachoco has faced some problems, particularly in the cost of materials for their chicken feed. Fortunately, the company is in a position to resist these struggles.

Chicken is still the cheapest form of meat, therefore somewhat resistant to struggling consumers attempting to cut out more expensive forms of food. The acquisition of RYC Alimentos is another bullish factor, as it essentially fully vertically integrates the company in the chicken market, allowing them to internally process and distribute the meat that they harvest. Finally, the tender offer from the Robinson Bours family supports the notion that the company is undervalued at current share prices.

I don’t expect this company to do a multi-bagger, but I do think that IBA is well-positioned for the economic situation moving forward, and the tender offer supports that.

Be the first to comment