petrovv/iStock via Getty Images

Investment thesis

Industrial Logistics Properties Trust (NASDAQ:ILPT) was a stable income-producing company and a great choice for income investors. This status has changed since investors have seen the first quarterly results and the enormous dept ratios change due to the acquisition of Monmouth Real Estate Investment Corporation (MNR). The last straw that broke the camel’s back was the recently announced dividend cut when the management cut the dividend by 97% to $0.01 per share. The MNR acquisition added several great location properties to ILPT’s investment portfolio and diversified its previous “Hawaii-heavy” portfolio. Unfortunately, that is the one positive factor I can mention about the acquisition and its consequences, especially for income-seeking investors.

Business Model

Industrial Logistics is a REIT that owns and leases industrial and logistics properties throughout the United States. ILPT focuses on industrial properties used for the retail warehouse and distribution. The majority of ILPT’s portfolio is still in Hawaii where it owns 226 buildings, leasable land parcels, and easements with approximately 16.7 million square feet. The other 68 industrial and logistics properties are located in 33 states on the U.S. mainland. This ratio has changed since the acquisition of MNR because it added 126 properties to ILPT’s portfolio on the U.S. mainland. As of March 31st, 2022, the company has 412 properties containing approximately 59.7 million rentable square feet located in 39 states.

The company recognized its revenue from rental income and approximately 50% came from the mainland properties and the other 50% from Hawaii properties. This ratio has changed and Hawaii’s revenue declined to approximately one-third of the total income. I am happy with this part as I like to see REITs diversifying their holdings as much as possible. Unfortunately, this portfolio “upgrade” does not help ILPT shareholders who will suffer due to the acquisition of MNR.

Negative effects of MNR

The company maintained the great parts of its business such as the extremely high occupancy rate (98.9% as of March 31st, 2022). It was the same during and before the pandemic as well. I am also happy to see that the management could increase its average rental rates by 27.9% which is almost 12% more than a year ago. I am glad to see these numbers, especially in this high inflation environment, because this means ILPT can effectively deal with the inflation issue. Before the MNR acquisition, ILPT was a great and stable REIT for long-term income investors to provide a reliable income stream. This all has changed in the last months and the recent dividend cut was only the cherry on the top.

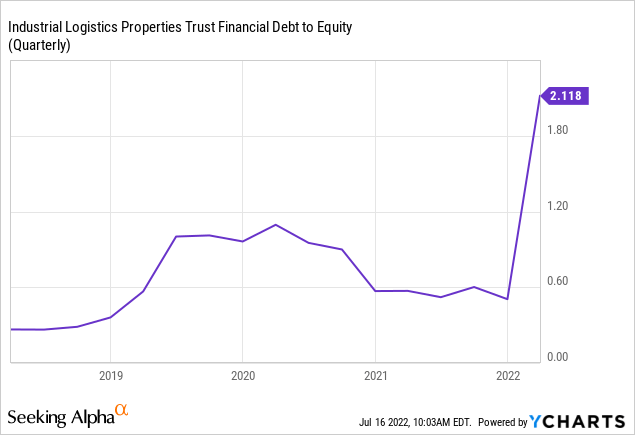

I am not going to go into details about the MNR deal and buyout but the main points are that their tenant diversification has changed and their debt ratios have skyrocketed which caused trouble to secure long-term financing for the company. Due to these liquidity issues the management had to significantly cut ILPT’s dividend. In their first quarterly results, investors could have already seen massive changes in the company’s debt profile. Their leverage ratios crashed, ILPT’s debt ratio has risen to almost 65% from the previous 39%, and the current ratio grew by 3.5% from 5.8 to approximately 6.02. Their debt-to-equity ratio has more than doubled due to the MNR acquisition from a stable 0.6-1.1 to an astonishing 2.1.

Valuation

Before the recent dividend cut, the company was slightly undervalued and the fair stock price would have been around $17.5-18 per share calculating an EPS of 1.43 and a very moderate 2% growth for the next 12 months. The above 9% dividend yield was not only attractive but due to their international corporate tenants and stable rental portfolio, it was sustainable. Well, things have changed radically in the last few days when the management announced a massive dividend cut. Not only has the stock fallen by approximately 27% since the announcement, but the slightly undervalued theory has changed drastically.

I am not convinced that ILPT will be able to deliver any shareholder return in the next years simply because they have to focus on reducing debt and improving the company’s leverage profile. In addition, a lot of investors buy REITs because of their strong income stream. I believe that the company is doomed for 2022 (at least) and there is only one way it can be a bargain for long-term investors: if the management fully reinstates the dividend in 2023. Then it would be a fantastic deal to buy at this price but income investors usually do not take this risk because dividend reinstatement is a very big if at the moment.

Company-specific Risks

At the moment I see more risks than ever before in the company’s existence. There are smaller risk factors such as their high exposure to a handful of tenants. The company receives almost 30% of its revenue from 2 key players in the logistics industry (FedEx and Amazon) so ILPT’s portfolio is highly dependent on these companies and their businesses. The high borrowing costs are not a distant risk anymore but a harsh reality as the company could not complete its long-term financing plans. However, in my opinion, the largest risk factor is the risk and dept profile of ILPT. It will not be medium risk, fairly leveraged, and great income producer company, anymore (not at least in the next 4-5 years). Income investors will be staying away from ILPT, and only a small portion of them will believe that the management will be able to fully reinstate the dividend next year.

My take on ILPT’s dividend

Current dividend

The company had a great dividend of 9% with a stable $0.33 per share quarterly dividend. The dividend coverage was sustainable, and due to their strong tenant base, the payout ratio was relatively safe. Now income investors do not have to worry about the payout ratio anymore because there is no more dividend (almost). The management announced that due to the current market conditions they could not secure the long-term financing plans after the MNR deal so they cut the dividend from $0.33 to $0.01 per share in the third quarter.

What the future holds

According to the management, they plan to reinstate the dividend sometime in 2023 but we have no further information yet. I am curious what they will say about this in their conference call on July, 27th. But looking at the current situation, realistically I do not expect any major changes in the dividend in the next 12-15 months. They might raise the dividend to $0.03-0.05 just to maintain their REIT status. I no longer see ILPT as a primary target for income investors not even after the possible future dividend reinstatement.

Summary

The game is over for ILPT from an income-seeking investor’s point of view. Their debt profile has changed radically, their leverage has skyrocketed and there is no more stable and secure income for income investors. Even if the management reinstates the dividend in 2023 I believe income investors will stay away from ILPT.

Be the first to comment