PonyWang

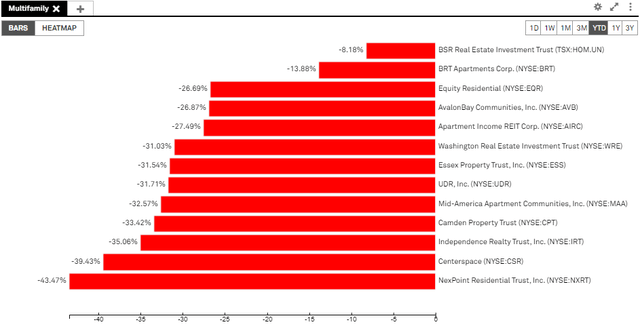

Looking at market pricing activity in multifamily REIT shares is a nausea-inducing experience. An asset class that, until recently, was deemed among the most promising, now has investors fleeing for the exits.

S&P Capital IQ as of 09/26/2022

The sector’s year-to-date total returns of ~-30% stand in stark contrast to the individual company’s operating performances and earnings guidance. One has to question the source of the disparity.

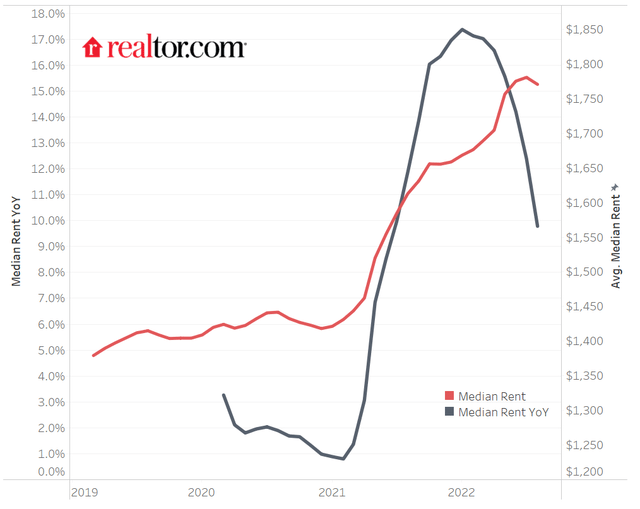

This morning, Realtor.com released its August Rental Report. A graphic at the top of the article may, at first glance, have been a cause for alarm.

The plunging (black line) Median Rent YoY shows a dramatic decline since the start of the year. But wait a minute, it shows that rents in August were, on average, 9.8% higher than a year ago. They just are not rising as fast as they were at the end of 2021. The graph might snap investors out of the euphoric extrapolation of double-digit rent growth, but I do not think it should make them sell shares.

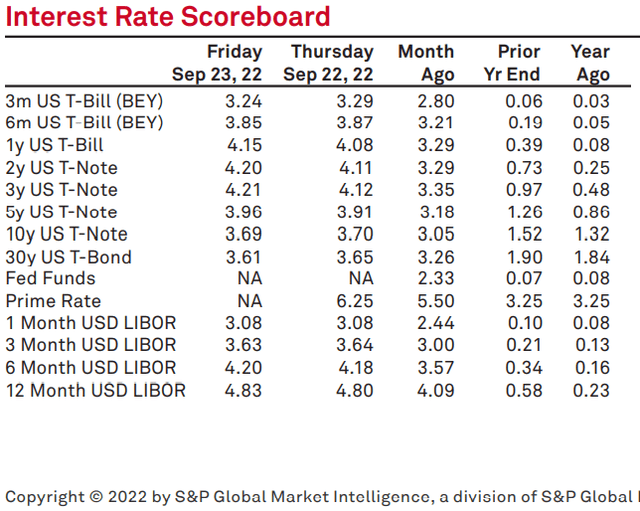

This is what is causing the sell-off of apartment REITs.

S&P Global Market Intelligence (S&P Capital IQ)

On 9/26/22 Treasury prices fell further, raising yields on each issue by as much as twenty basis points. A 4.20% yield on the “riskless “2y US T-Note is what is making people sell their multifamily REIT shares. It is also making them sell the S&P 500 ETF (SPY), the Invesco QQQ (QQQ), Treasuries, and almost any other liquid asset.

In this article, I will argue that multifamily REITs have become attractively cheap. I will describe that aspects of Independence Realty Trust (NYSE:IRT) may have unique appeal in today’s evolving economy.

Portfolio Rebalancing

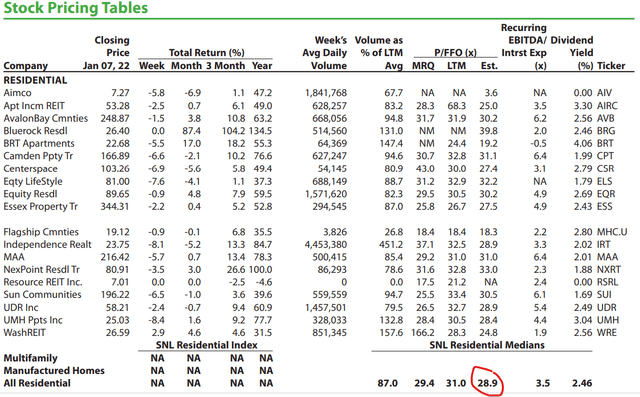

An examination of our year-end 2021 portfolio made me feel that we were underexposed to residential real estate. Looking at the sector’s valuations, however, made us unwilling to put new money into what looked like fully valued issues.

A Price/FFO multiple of almost twenty-nine does not present much upside potential and a 2.50% dividend yield is not compelling either.

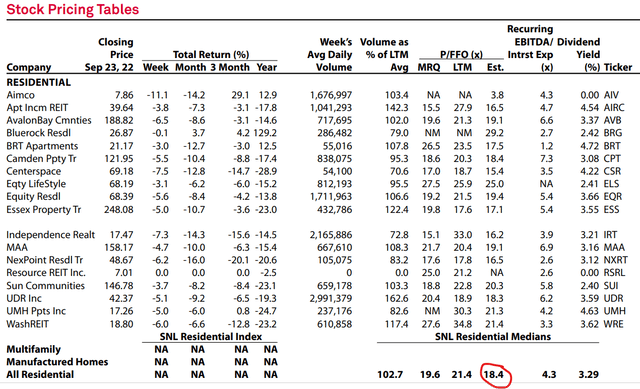

Nine months later, the metrics for new investment have improved dramatically.

The 3.3% dividend yield is still not exciting, but an 18.4x FFO multiple in a high-demand housing market is much more palatable. Despite strong operating results and raised guidance, apartment REIT shares have given back a significant portion of last year’s gains. At current pricing, the whole sector is more appealing, but I think Independence Realty Trust now presents a unique opportunity.

Rust Belt Middle America

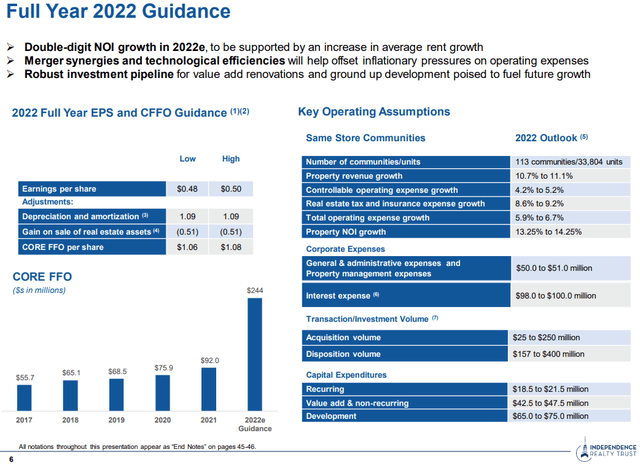

In a September Investor Presentation, IRT updated its 2022 guidance.

Same Store NOI growth of 13.75% at the midpoint is impressive. As is rent growth of 10.9%. Projected Core FFO per share of $1.07 puts them at a 15.6x FFO multiple when measured against today’s closing price of $16.73 (near the sector’s lowest).

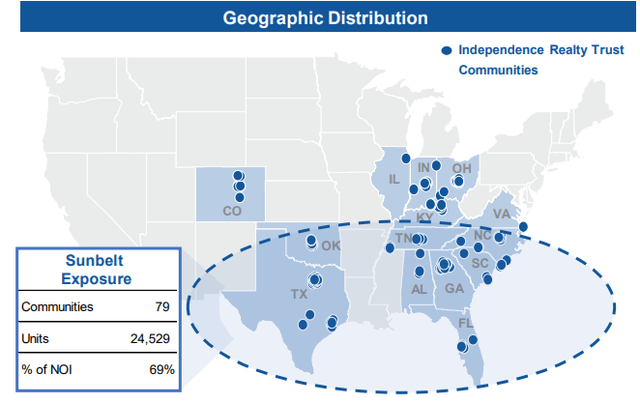

Those are great metrics, but IRT’s differentiating factor is its portfolio’s geography.

IRT management likes to talk up its Sunbelt Exposure, but you can get Sunbelt Exposure with NexPoint Residential (NXRT), Camden Property Trust (CPT), and BRT Apartments (BRT), among others. What you cannot so easily capture elsewhere is IRT’s potential in the expanding manufacturing activity of the Rust Belt and Middle America.

Everyone talks about the opportunity that has developed from the work-from-anywhere migration to the Sunbelt. The wave of new manufacturing development that entails work at the new plant is where Independence Realty might truly shine.

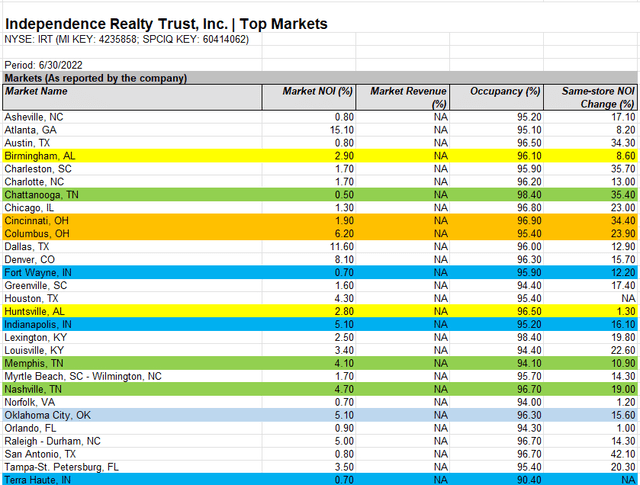

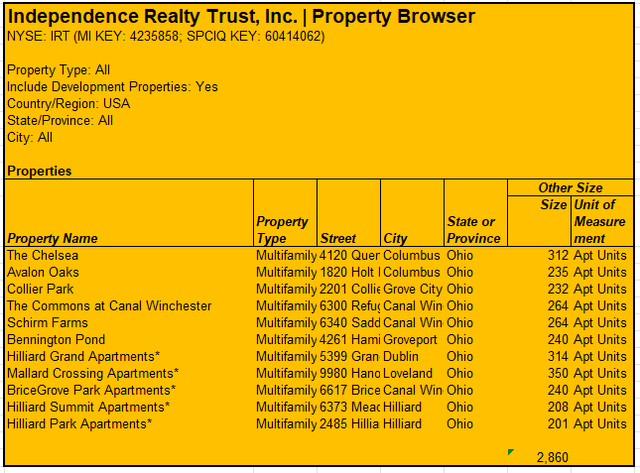

Table by 2MCAC. Data provided by S&P Capital IQ

Consider that Ford last week broke ground on its new Blue Oval City EV production plant near Memphis. In addition to 2MM electric vehicles annually, Blue Oval City creates 6,000 jobs that will drive demand for IRT’s more than 500 Memphis apartment units. Tennessee currently accounts for 9.3% of IRT’s Net Operating Income; Commercial Real Estate’s future is bright with growing investment from the automotive/EV industry across the state.

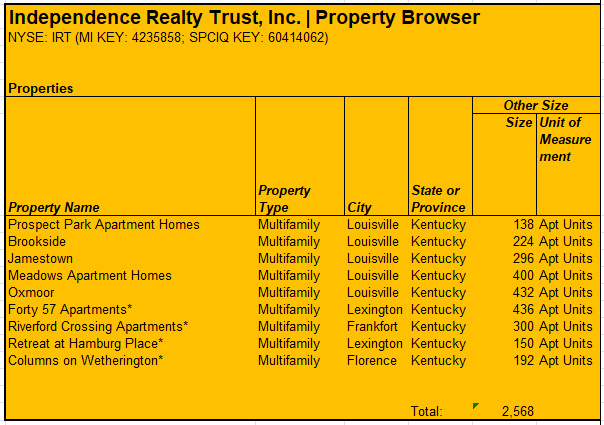

What about Kentucky? Same Ford, same EV focus; the Blue Oval SK Battery Park in Glendale, KY creates 5,000 jobs and IRT’s more than 2,500 apartment units stand ready to provide workforce housing for Ford and ancillary business employees.

Table by 2MCAC. Data provided by S&P Capital IQ

Not a week goes by without a new factory breaking ground in Ohio. After Congress authorized funding for the “CHIPS Act” in September, Intel (INTC) finally broke ground on its $20B investment in two new factories in Licking County, Ohio. These factories are anticipated to create 3,000 Intel jobs, 7,000 construction jobs during the building phase, and thousands of other ancillary jobs for businesses that complement the effort. This effort only layers on new Ohio plant openings by Honda, LG Electric, Lordstown Motors, GM, and others.

Table by 2MCAC. Data provided by S&P Capital IQ

IRT’s 2,800 Ohio units will enjoy demand and price support from all those new tech/manufacturing jobs.

Bottom Line

The severe market decline has made investing in apartments interesting again. IRT’s presence in new Heartland manufacturing markets gives it something special that other REITs do not offer.

Be the first to comment