peterschreiber.media/iStock via Getty Images

Incyte (NASDAQ:INCY) is a pharmaceutical company best known for Jakafi (ruxolitinib). Recently ruxolitinib has had its FDA approval expanded to additional indications, with more likely to come. Other approved Incyte drugs have not generated the kind of revenue we have seen from Jakafi, raising the question of whether the company has issues with its pipeline development. I believe that, on the whole, Incyte looks capable of ramping profits over the long term. Nevertheless, the article will take a critical look at the ramping of new drugs and indications, as well as the pipeline’s long-term potential.

Incyte Q4 2022 Results

Incyte reported Q4 2021 results on February 8, 2022. GAAP net income and EPS were inflated by a one-time $444 million income tax benefit in the quarter. I will start with GAAP numbers, but in this case the non-GAAP numbers are worse and reflect the reality better. Revenue in either case was $813 million, up 20% from $790 million year-earlier. GAAP net income was $564 million, resulting in EPS of $2.54. Non-GAAP net income was $23 million, for EPS of $0.10. Cash at the end of the quarter was $2.35 billion, up sequentially from $2.3 billion.

Most revenue was from sales or royalties on the various brands of ruxolitinib. Jakafi product revenue was $592 million, up 15% y/y. Jakavi royalty revenue was $96 million, up 10% y/y. Opzelura reported first revenue of $5 million.

Ruxolitinib

Ruxolitinib is a JAK (janus kinase) inhibitor. While initially developed as a cancer therapy, its mechanism of action has also resulted in its application for immune system related diseases. It is sold in the U.S. as Jakafi and in Europe by Novartis (NVS) as Jakavi. It is approved for myelofibrosis, polycythemia vera, and graft-versus-host disease. Additionally, in Q4 2021 it began to be sold in the U.S. as Opzelura for mild to moderate atopic dermatitis, applied topically. Incyte continues to conduct clinical trials with the aim of expanding the ruxolitinib label, including for vitiligo and chronic hand eczema. Vitiligo has an FDA PDUFA (decision deadline) of April 18, 2022.

New Commercial Drugs

The following table list the newer approved drugs with their revenue from sales or royalties:

|

Incyte Revenue by Type |

||||

|

(in $ millions) |

Q4 2021 |

Q3 2021 |

Q4 2020 |

y/y |

|

Iclusig product |

27 |

29 |

29 |

-5% |

|

Pemazyre product |

20 |

18 |

14 |

40% |

|

Minjuvi product |

4 |

1 |

0 |

na% |

|

Olumiant royalty |

66 |

87 |

31 |

113% |

|

Tabrecta royalty |

3 |

3 |

2 |

50% |

Source: data in Incyte Q4 2021 release

Iclusig is not exactly new, as it was approved by the FDA in 2012 to treat chronic myeloid leukemia and acute lymphoblastic leukemia. Unfortunately, it has a Black Box Warning and so has never been a huge seller. Pemazyre (pemigatinib) on the other hand, was approved in April 2020 in the U.S. for cholangiocarcinoma (bile duct cancer). It received EU approval in March 2021. It is another kinase inhibitor, in this case blocking FGRF receptors on the surface of cancer cells. While Incyte is not testing it for possible label expansion, it should continue to ramp sales for some time.

Minjuvi (tafasitamab) got off to a slow ramp in the second half of 2021. It was approved for relapsed or refractory diffuse large B-cell lymphoma, where it has a lot of competition including CAR-T cell therapies. Monjuvi is an FC-modified antibody to CD19, so it represents a different paradigm from JAK inhibitors. Its revenue potential could increase if clinical trials extend its label to follicular lymphoma, marginal zone lymphoma, CLL or non-Hodgkin’s lymphoma.

Tabrecta (capmatinib) has been approved for non-small cell lung cancers that have an exon 14 MET gene skipping mutation. It was approved in May 2020. So far it is a specialty item that is not ramping revenue significantly. It is in a clinical trial for liver cancer. Royalties are from partner Novartis.

The best revenue generator so far is not a cancer therapy. Olumiant (baricitinib) is a JAK inhibitor optimized for immune system diseases, partnered with Eli Lilly (LLY), which pays royalties to Incyte. It is currently approved for rheumatoid arthritis. It is also being tested for atopic dermatitis. However, Lilly believes that the FDA could issue a complete Response Letter for atopic dermatitis due to lack of agreement on which patients should be included in the label. Also, the development program for lupus was discontinued in January after disappointing data.

Pipeline

Can an Incyte drug stop hair loss? According to data, released on March 26, from a Phase 3 clinical study of Olumiant (baricitinib) in alopecia areata patients, one can. In partnership with Lilly, the study showed almost 40% of patients treated in the study had 80% hair coverage of the scalp at the end of 52 weeks. How much can a company charge for a successful alopecia therapy? That depends on what insurers will be willing to pay. No guess from me.

But despite the relative lack of high revenues from its products other than ruxolitinib so far, Incyte has an impressive pipeline of therapies in clinical trials. Here I will comment on a few items but also refer readers to the full Incyte pipeline.

In December 2021, Incyte updated positive data from the Phase 1/2 trial evaluating axatilimab as a monotherapy in patients with recurrent or refractory chronic GVHD despite two or more prior lines of therapy. A 68% overall response rate and broad clinical benefit across multiple organs were observed in the pivotal AGAVE-201 trial. Additional trials of axatilimab are planned in patients with steroid-refractory chronic GVHD, including a Phase 2 trial in combination with a JAK inhibitor.

Incyte’s dermatology pipeline includes INCB54707, a JAK1 specific inhibitor, which is being evaluated across multiple indications. Phase 2 trials are currently ongoing in vitiligo, hidradenitis suppurativa and prurigo nodularis, with data in vitiligo and hidradenitis suppurativa expected later this year. The hope is that a drug more specific to JAK1, rather than JAKs in general, will yield improved results.

Incyte has a set of antibodies licensed from Agenus (AGEN) for solid tumors with GITR, OX40, LAG-3, and TIM-3 as targets. These would not likely be used as monotherapies, but in combination with other agents. It also has drugs targeting solid cancers expressing PD-L1, AXL/MER, ID01, A2A/A2B, and CD73. So, while the current pipeline news has mainly been about immunological diseases, there is likely more positive oncology data coming as early-stage trials are completed.

Conclusion

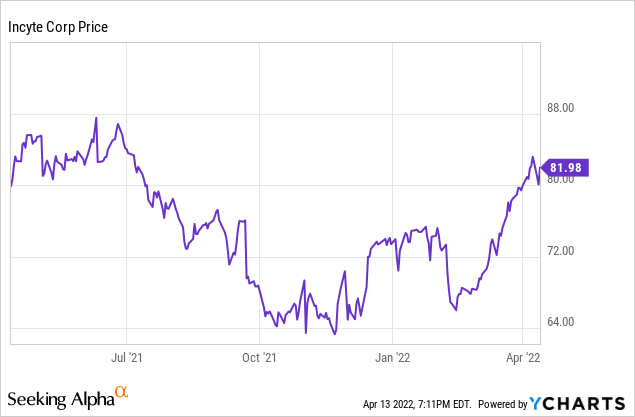

Incyte has scheduled its first quarter 2022 release and conference results for May 3rd. I see the company as undervalued based on the strength of ruxolitinib and Olumiant revenues. The pipeline is broad enough that as the decade progresses revenue and profits will ramp. In the next couple of years expect action in immunological indications. But the cancer pipeline has a lot of potential to report positive developments as highly targeted therapies complete trials and report data. The stock price has been highly volatile this last year. It closed at $81.99 on April 13, 2022, not that far below its 52-week high of $88.26. With a current forward PE of just 23.4, I feel the severe downside risk is low, while the long-term potential is high. I rate it a Buy for long-term investors.

Be the first to comment