Darren415

Managing portfolios is not always easy. As a matter of fact, very few portfolios are actually easy to manage! Depending on how much you manage (speaking in Assets Under Management dollar terms), and what asset classes are included in your mandate, you can face tough decisions on an hourly basis. Sometimes these decisions are not fun, but they are always necessary.

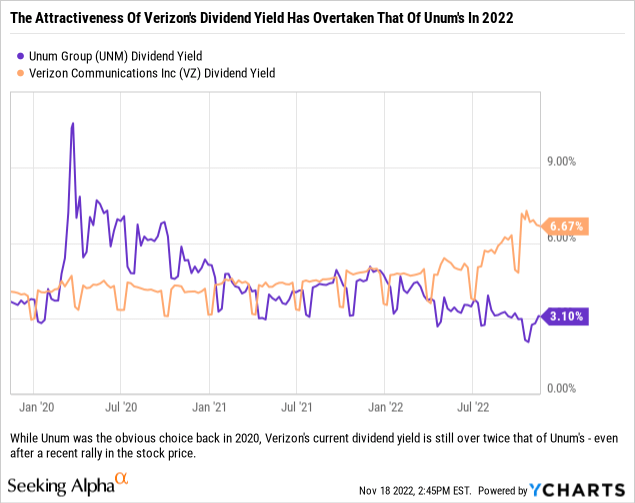

This particular decision was a tough one for us, because we really did still like Unum Group (NYSE:UNM) as a holding, however on two metrics (as an overall investment and a yield generating position) we had lowered it to ‘Hold’ from ‘Buy’. We had even had it at a ‘Strong Buy’ before that for both income portfolios and growth portfolios due to the upside we saw in the stock when we initially identified it as a buy back in late 2020.

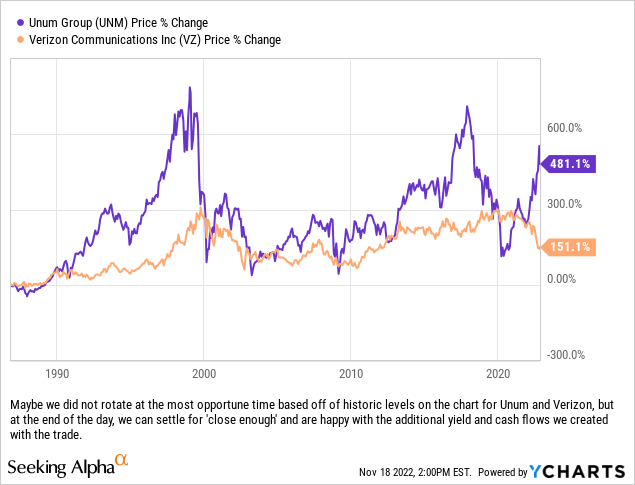

We spent days analyzing the situation because while we still had Unum as a ‘Hold’, there were other available names on the buy list which would significantly increase yield, looked capable of holding up better during a market pullback and could have some upside potential if the markets regained their footing. Unum had been a big winner for us, with a nearly 138% gain at the time of the sale (the gains would have been higher, however we did reinvest the dividends on this particular position), but even when factoring in tax consequences the correct trade was rotating from one of our favorite names over the last year or so into a name we have not owned in any meaningful manner for a while; Verizon Communications (NYSE:VZ).

Why Rotate?

So in our mind the ‘why’ is pretty simple; Unum went from a high yielding dividend stock with significant upside (with a high probability of delivering outsized total return for our income and growth portfolios) to an insurer which had grown into its yield and had the potential to pullback if the U.S. Federal Reserve was successful in its attempt to cool the job market. We saw Unum as a potential return destroyer in the next year or two and decided that locking in the capital gains made sense since we could rotate into Verizon and introduce additional income and potential gains to this particular portfolio.

With Unum trading at multi-year highs and Verizon trading at multi-year lows, the trade very much looks like a contrarian bet. In all honesty we think of it just as a rotation based on value with a yield kicker.

Our worry has been that as the Fed keeps trying to fight inflation, that their goal of attacking the strong employment market might eventually inflict some pain on Unum’s group business moving forward. Weak employment markets are tough on the insurer and is exactly what created the opportunity for us to go long the shares in the first place.

When one looks at Verizon, it is not all rosy in the current environment. The telecom giant faces large capital outlays to continue to build out its wireless infrastructure, a large debt load they will have to navigate through and further competition from Elon Musk’s Starlink as well as Dish’s (DISH) 5G offering. While there is not a lot to get excited about with what is happening at Verizon, we do think that in the current market adding an anchor to one’s portfolio makes sense. While volatility may be limited by doing this rotation (which is what we mean by anchoring this portion of our portfolio; the stock should not move too much in either direction), if the market rallies significantly because the Fed fights off inflation quickly and more efficiently than many are expecting, then this will cut both ways – meaning that it will act like an anchor on performance as Verizon should not outperform the general market in that type of environment.

With Unum, even though the stock looks quite cheap on numerous metrics and the company has done a great job of returning capital to shareholders, the upside in the stock looks minimal if a recession really is setting in... and when we look at certain data points, it feels like we are already in one. This particular portfolio is for generating income, and while we were able to lock in a healthy yield with Unum back in 2020, the stock price moved dramatically higher and made it necessary to lock in capital gains (which for this portfolio in 2022 will be offset with some losses) and rotate into something more attractive. Verizon not only yields more currently, it yields more than our initial yield on Unum, so the trade makes sense from a cash flow perspective, a tax perspective and for managing downside risk while also appearing quite attractive from a yield perspective.

Why We Like The Trade

This trade lightens up our risk profile on what is a conservative portfolio. It also has the benefit of locking in a dividend that at its current yield would give us about 70% of the expected return of the S&P 500 in any given year. While the S&P 500’s historic annual return has climbed in recent years due to the latest bull market, if returns reverted back to say 9%, then we would be close to 80% of expected returns just off of the dividend payments alone.

If we are getting paid that much to sit around and wait for a recovery in Verizon shares, then we believe that this position can help the overall portfolio potentially outperform in a bear market as well as a market which moves sideways for years. If we are in for relatively flat returns for an extended period of time as the world works through its debt problem, then the outsized dividend that Verizon offers will certainly come in handy.

Closing Thoughts

With portfolios which are focused on income, it is always important to take a step back and analyze a trade to make sure you are not a ‘yield-chaser’ (that is the G-Rated version of the term used on trading desks/floors!). Chasing yield just to add it to the portfolio is never a good exercise and can often lead to problems down the road. While this trade significantly increase the dividend yield and overall cash flows for the portfolio by rotating between these names, we think that in both cases the dividends are quite safe. Unum might have the ability in the near-term to raise their dividend at a faster rate, but we see little reason for either to be forced to cut their dividend. So we did not add yield at the risk of a potential dividend cut.

The underlying security also looks pretty solid at this point, and at the time of purchase we estimated that shares could move back up in the $40-$45/share range which would be closer to what we perceive as ‘fair value’. Long-term, we thought our downside was $7/share to about $30/share and potential upside of $13-$15/share to just over the $50/share level. We like situations where our potential upside (excluding dividends) is double our potential downside.

We held Unum for two years and the portfolio benefited dramatically, mostly from the strong move higher in the share price but also from the solid dividend yield, and think that Verizon is offering another compelling entry point for us. While the upside we see in Verizon’s shares is nowhere near what we expected with Unum early on, we do think that the potential upside is worth buying at this point, especially as Unum looked priced pretty close to perfection.

Be the first to comment