Nikada/E+ via Getty Images

An analyst in social media observed the wide divergence in performance between Exxon (XOM) and Salesforce (CRM) since the latter replaced the former in the Dow index (DJI). The stock of Exxon is up 174% while the stock of Salesforce is down 34%.

The particular divergence does not reflect the effectiveness and impact of rebalancing on the Dow index. It can create a false impression for those who rely on limited information and selection bias.

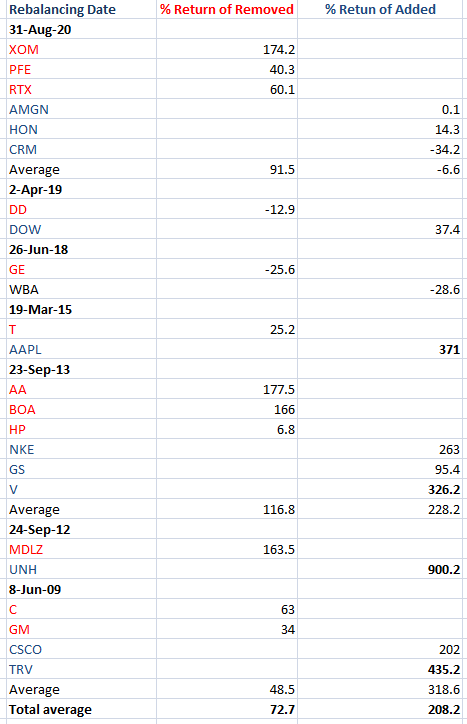

Below is a table that shows all rebalancing actions in the Dow index since the bottom of the GFC. Removed stock tickers are shown in red, and added tickers in blue. I also calculate the return of the stocks from the rebalancing date to June 10, 2022. If there is more than one replacement on a specific date, I also calculate the average performance of the group.

Dow Jones Industrial Average Rebalancing With Performance (Price Action Lab Blog – Norgate Data)

I have marked the best introductions to the Dow index in bold: UnitedHealth Group (UNH) +900.2%, Apple (AAPL) + 371%, The Travelers (TRV) + 435.2%, and Visa (V) +326.2%.

All in all, the average performance of stocks removed to June 10, 2020, is 72.7% versus 208.2% for stocks added to replace them.

Conclusion: Those who rebalance the Dow Jones Industrial Average have done a good job. The Exxon example is based on selection bias. The average performance of added stocks is higher than that of the removed stocks by nearly a factor of 3. This is a quite significant result.

Caveat emptor: There is a certain reflexivity effect when a stock is added to a major index such as the Dow. A good fraction of the outperformance of an added stock versus a removed stock could be due to portfolio rebalancing. Yet, the effect shown in the above table is too large to be solely due to reflexivity. A counterexample is Raytheon (RTX), which is up 60% since being replaced in the Dow index, versus 14.3% for the best performance by Honeywell (HON), which was added.

Be the first to comment