peterschreiber.media

Two weeks ago, the leading biotech company ImmunoGen, Inc. (NASDAQ:IMGN) released its Q2-2022 results: financials were slightly worse than expected, but the company announced many relevant updates on its pipeline. In this article, I will review the financial results and I will reiterate my Buy recommendation.

If you have never heard of ImmunoGen, you can have a look at my previous article in which I provided a comprehensive review of the company highlighting the different research and development programs.

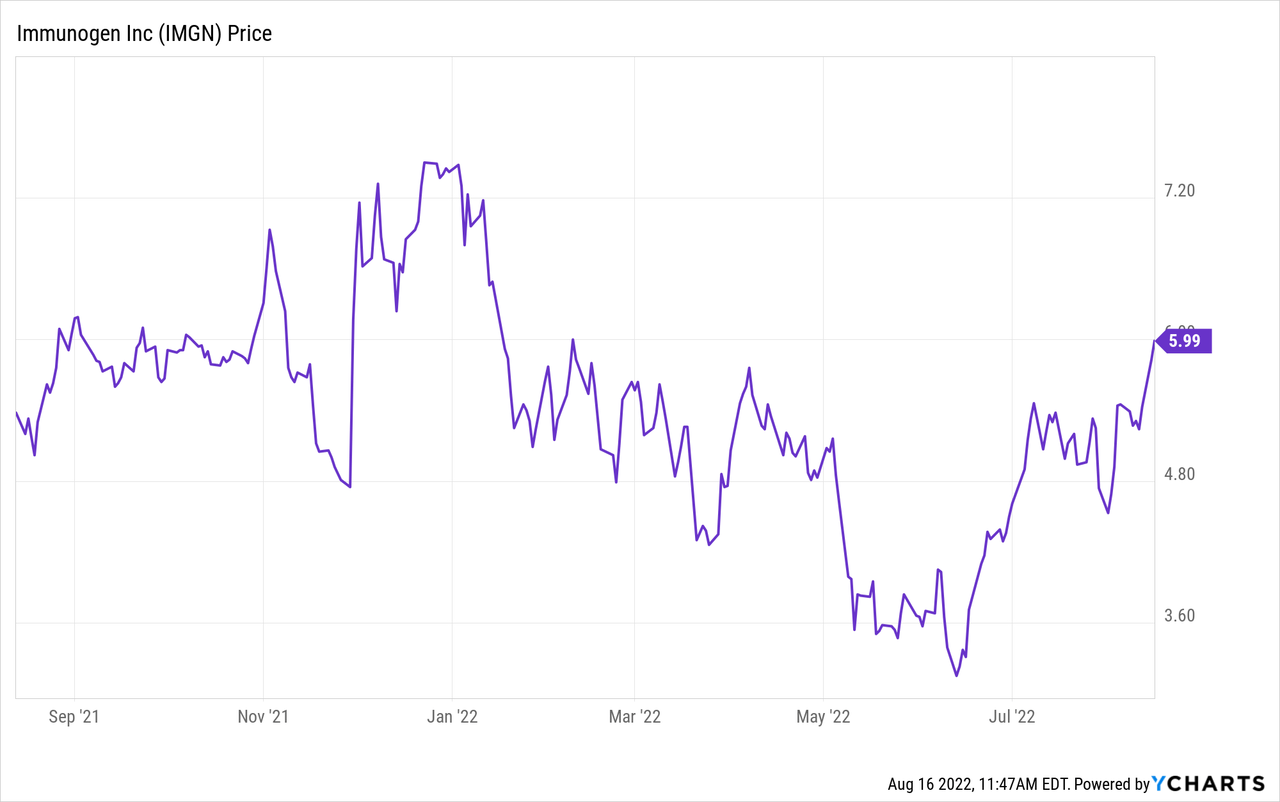

Stock performance

ImmunoGen is currently trading at $5.83/share, equivalent to a market cap of $1.29bn. The stock is down 21% year-to-date and it is up 13% year-on-year. The 52-week maximum is $7.5/share (December 23rd, 2021) while the 52-week minimum is $3.15/share (June 13th, 2022); therefore, the current trading price is at a 22% discount to the 52-week maximum and at a 85% premium to the minimum. Like most biotech stocks, ImmunoGen as well is characterized by some volatility with the 52-week standard deviation being $1.0/share, or 16% of the current trading price.

Financial results

Total revenues decreased by 17%, from $17M in Q2-2021 to $14M in Q2-2022. Revenues from “license and milestone fees” increased by $7M thanks to the recognition of a previously received and deferred fee from Huadong Medicine, however, this growth was more than offset by the decrease in “non-cash royalties” that dropped by $10M due to the lack of the KADCYCLA program tranche payment that was present in Q2-2021.

Despite decreasing revenues, total OpEx increased by 70% since ImmunoGen is in a growth mode. Almost 2/3 of the operating costs were represented by research and development costs ($51M, +49% year-on-year) while the remaining OpEx are mostly general and administrative expenses ($24M, +144% year-on-year). R&D costs increased mostly due to higher clinical trial costs, additional research costs to strengthen the antibody-drug conjugates (ADC) pipeline (including a $7.5M consideration to Oxford BioTherapeutics) and temporary staffing costs. On the other side, G&A costs increased because ImmunoGen has already started to build its commercial capabilities to be ready once the mirvetuximab will be authorized for marketing in the US, probably in the last quarter of 2022.

ImmunoGen reported a net loss of $62M, higher than the $30M loss of the same quarter of the previous year.

Look at the balance sheet, it should be pointed out that ImmunoGen has no outstanding debt and the cash balance is $374M. In the first six months of 2022, cash used for operating activities was $105M, and cash flow from investing activities was almost null ($0.5M) as was cash flow from financing ($1M). If the cash used in operations remains stable in the future, the current cash on the balance sheet should enable ImmunoGen to carry out its activities for almost 2 years without the need for additional capital raising.

SORAYA FDA approval expected for November 28th

On May 26th, 2022, ImmunoGen announced additional efficacy data for the SORAYA study. For investors that are not familiar with the SORAYA program, it might be worth looking at the SORAYA description provided by Immunogen:

“pivotal study evaluating mirvetuximab monotherapy in patients with folate receptor alpha (FRα)-high platinum-resistant ovarian cancer who have been previously treated with bevacizumab”.

The study was based on 106 patients with ovarian cancer who have previously been treated with bevacizumab and the results showed a 32.4% objective response rate (ORR) and a median duration of response (DOR) of almost 7 months. These results clearly show that the development of mirvetuximab is going in the right direction and it could soon become a life-changing medicine for treating platinum-resistant ovarian cancer.

During the call with analysts for Q2-2022 results, ImmunoGen announced that the FDA (US Food and Drug Administration) has filed the Biologics License Application for mirvetuximab in patients with ovarian cancer. The final decision should be announced on November 28th and, if positive, ImmunoGen should be allowed to launch the mirvetuximab in the US.

Deal with Oxford BioTherapeutics

ImmunoGen also announced a new multi-year collaboration with UK-based Oxford BioTherapeutics, a clinical-stage oncology company that is focused on first-in-class medications. The idea behind the deal is to join forces to develop new antibody-drug conjugates to fight cancers with high unmet needs: Oxford Biotechnology will leverage its ability in identifying new development antibodies targets while ImmunoGen will provide its large portfolio of payloads and linkers used to kill cancer cells. From a financial point of view, ImmunoGen will pay a $7.5M consideration to Oxford BioTechnologies to account for some preclinical programs which will be included in the partnership. After the first step of joint research, each of the two companies will have the possibility to choose some programs to develop on its own with milestones and royalties that will have to be paid to the other company in case the treatment gets commercialized.

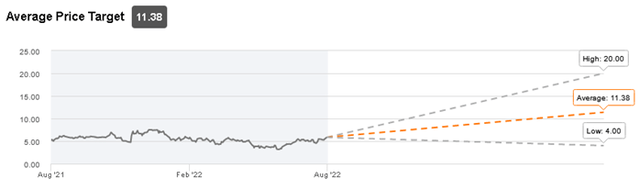

Target price

ImmunoGen is currently covered by 10 analysts, with 7 of them having a positive view (Buy/Strong Buy) and 3 analysts giving a Hold recommendation. The average target price is $11.38/share and it implies a potential 95% upside versus the current trading price ($5.83/share).

Conclusion

Overall, I believe that the current trading price represents an interesting entry point. ImmunoGen is a robust company with many different research programs that could become successful in the future. The mirvetuximab FDA approval expected for November 28th will act as a key catalyst and could generate strong price movements. The fact that ImmunoGen has already started to organize for commercialization is a clear indication of the potentially positive outcome.

Be the first to comment