Pitchayanan Kongkaew

The iShares U.S. Medical Devices ETF (NYSEARCA:IHI) is another pick that investors might consider while looking for recession resistant picks to weather the storm with. The economy is still not in a safe place with the Fed risking starting an unemployment spiral on top of demand destruction that may have just started taking effect, so thinking about resilient picks is still prudent and in the long-term profitable for investors. In the case of IHI, the proposition is that there are secular growth trends that support demand in the business, and most of the constituent companies are seeing fading demand headwinds in healthcare now. While generally a solid set of markets, the problem is Abbott Laboratories (ABT) which features highly and has a lot of EBIT and revenue at risk on account of a COVID-19 reversal. With the yield not being great on the ETF due to its constituents’ high multiples, we pass.

IHI Breakdown

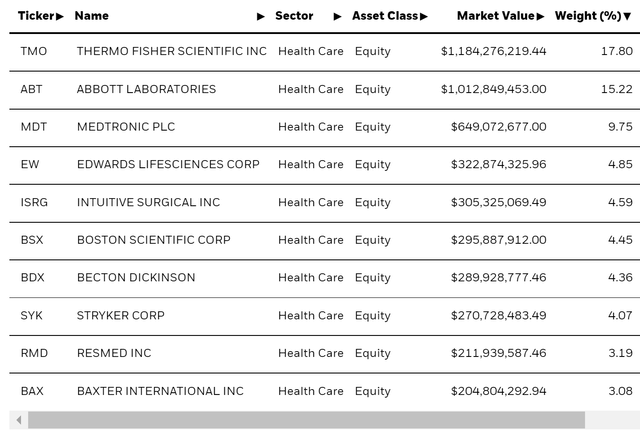

The IHI ETF is a rather weight balanced portfolio but is skewed to some key larger names that make an impact on total returns. The top 3 holdings account for 40% of the portfolio.

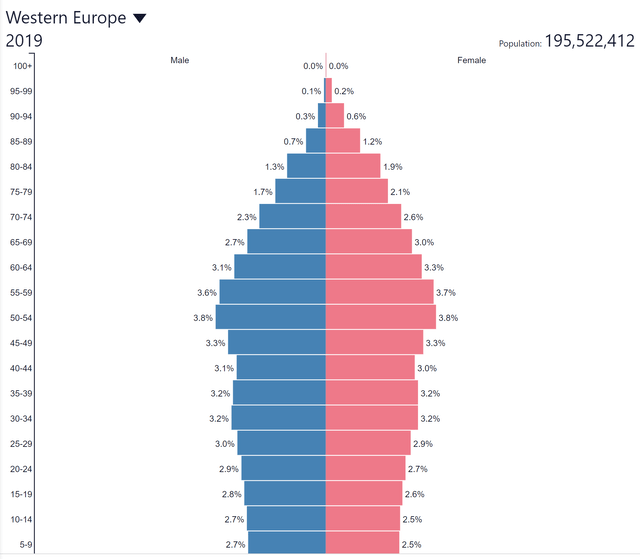

Across the portfolio there is a common theme that investors can rely on, which is good demographic exposure. As populations age in the west, where all these companies’ markets are, the intensity of demand for surgical products, especially cardiovascular and spine products but also implants for hip and ankle replacement like what Stryker (SYK) is up to, will increase. The population pyramid of western Europe is a nice way to understand the dynamics in modern markets, and the population bulge is quite firmly in the 40-60 age group. These people are just about to enter into the age where health problems will more rapidly mount. Moreover, with healthcare being what it is today and professional hazard and other causes of death declining quite a lot, the pyramid is likely to be more stubby at the top for these cohorts than it has been in the past. In other words, people are likely going to live longer. With a large cohort moving into a period of life that is now longer lasting where health issues will become more common, medical device companies as well as many other segments of healthcare are well poised.

Western Europe Population (populationpyramid.net)

Remarks

In particular, our top 3 holdings all benefit from these demographic trends, as do many companies that I can eye further down the list like Boston Scientific (BSX) and Stryker as previously mentioned. However, one is at risk due to its growth in reliance on pandemic related revenue.

Thermo Fisher (TMO) gets a lot of overseas revenues and is more diversified against regulatory risks. Its segments in lab testing, lab equipment and diagnostics have long been attractive to markets, like Quest Diagnostics (DGX) and Lab Corp of America (LH) as well as Stryker which have all long been high multiple and “premiumized” companies. With markets that depend also on non-commercial factors the company has market agnostic economics. Moreover, with labs needing to operate in sterile environments, the economics in many segments like lab products are highly recurring as they need to be replaced at every use. The downside with the company is that a hit to COVID-19 testing, as people essentially don’t care as much anymore, could be a problem for the business. Indeed, for companies like Gilead (GILD) who’ve come to depend on Veklury sales this new context of public response to COVID-19 is a bad thing. The exposure here is only about 10% to COVID-19 testing revenue, so we are happy with the relatively low amount of EBIT at risk, especially as the reduced concern around COVID-19 means that conditions that are more fatal can be properly treated again.

Abbott Laboratories is less safe with 28% of its sales now coming from COVID-19 related products. We feel that this could fall as much as 50% in the base case. Nonetheless, in terms of dividend contribution Abbott can be counted on. The issue is that the comprehensive dividend yield on the IHI is so low, and indeed Abbott’s dividend isn’t great either, so capital appreciation ends up being important in a market where it can’t be relied upon.

Finally, Medtronic (MDT) is likely to continue to be a solid contributor in its spine and cardiovascular markets with its products. Moreover, they are making their foray into surgical robotics, divisions that are usually taken very well by markets as in Stryker’s case which acquired Mako some years back, or indeed with MDT’s acquisition of Mazor. MDT will be supported by those demographic trends but also more normalized resumption of treatment of non-COVID related conditions.

Overall, the IHI yield is small at 0.45% which barely covers the fee. Therefore, capital appreciation or at least a solid value to the ETF is what investors will need to rely on. While the demographic forces are favorable on the businesses, with Abbott featuring highly and with revenues clearly at risk, we aren’t too crazy about this ETF after all.

Be the first to comment