annatodica

Investment Thesis

The iShares U.S. Healthcare Providers ETF (NYSEARCA:IHF) is a 70-stock portfolio with high exposures to the Managed Health Care, Health Care Services, and Health Care Facilities industries. While other analysts previously expressed reservations about its valuation, this article demonstrates that it trades at a 2-3 point discount on forward earnings compared to the Health Care Select Sector ETF (XLV) and the SPDR S&P 500 ETF (SPY). IHF is also the best-performing U.S. Health Care ETF over the last three and five years and its key holdings are highly profitable and are viewed favorably on Wall Street. This article highlights the strategy and fundamentals for all three ETFs and presents an idea of how investors can efficiently corner the U.S. Health Care sector for just 25 basis points per year.

ETF Overview

Strategy Discussion and Top Ten Holdings

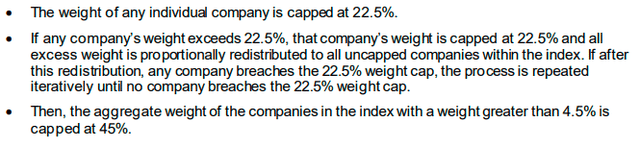

IHF tracks the Dow Jones U.S. Select Healthcare Providers Index, representing owners and operators of health maintenance organizations, hospitals, clinics, dentists, opticians, nursing homes, rehabilitation centers, and retirement centers. As one of Dow Jones’ Select Sector Specialty Indexes, it’s free-float market-cap-weighted and subject to the constraints described below.

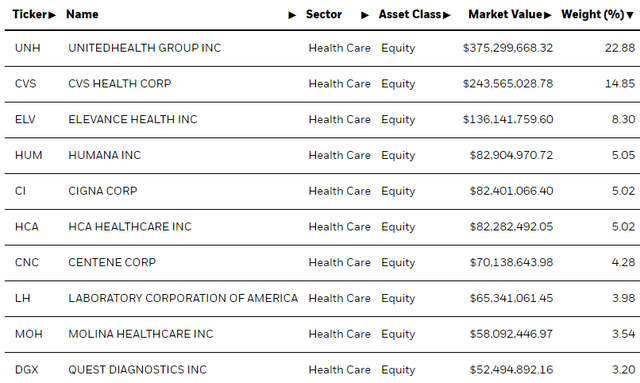

These constraints significantly impact IHF. Without them, UnitedHealth Group (UNH) and its $500 billion market capitalization would control roughly 40% of the portfolio. Instead, UNH has a 22.88% weighting that will be rebalanced quarterly to the 22.50% maximum for the foreseeable future. Next is CVS Health (CVS) at 14.85% and Elevance Health (ELV) at 8.30%. IHF’s top ten holdings total 76.12%, so it’s incredibly concentrated. However, that’s the purpose of specialty industry funds. They’re designed to target a particular market segment efficiently, so I have no issue with IHF’s poor diversification.

Performance Analysis

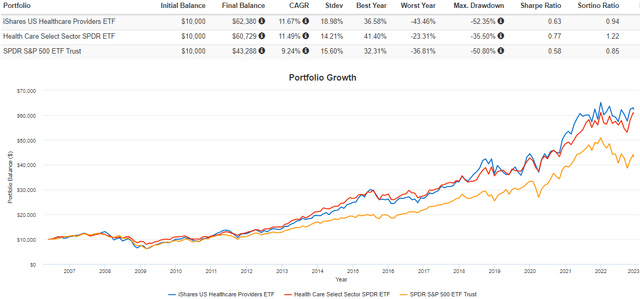

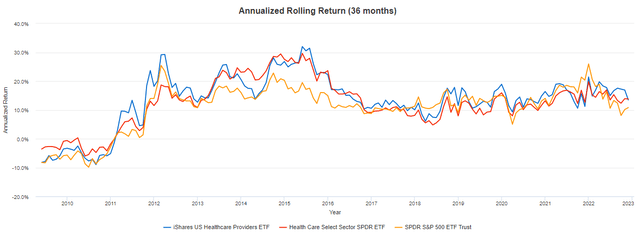

The total returns chart below suggests that owning IHF is a winning long-term strategy. Since May 2006, IHF has gained an annualized 11.67% compared to 11.49% and 9.24% for XLV and the SPDR S&P 500 ETF (SPY). The caveat is higher volatility, as indicated by IHF’s 18.98% annualized standard deviation. It’s a bit unusual for a Health Care ETF, but one reason is that IHF holds numerous high-beta Health Care Facilities stocks like HCA Health (HCA) and Universal Health Services (UHS).

A different way to view performance is by looking at an ETF’s rolling returns. The three-year chart below highlights how IHF and XLV rarely trail the market by much. Most times, they outperform despite their reputation as defensive products. The most significant period of underperformance was from February 2019 to January 2022, when IHF lagged SPY by an annualized 5.78% (14.82% vs. 20.60%). However, that’s still a terrific rate of return, and most would agree that it was through a period of unusually high market sentiment that’s unlikely to occur often.

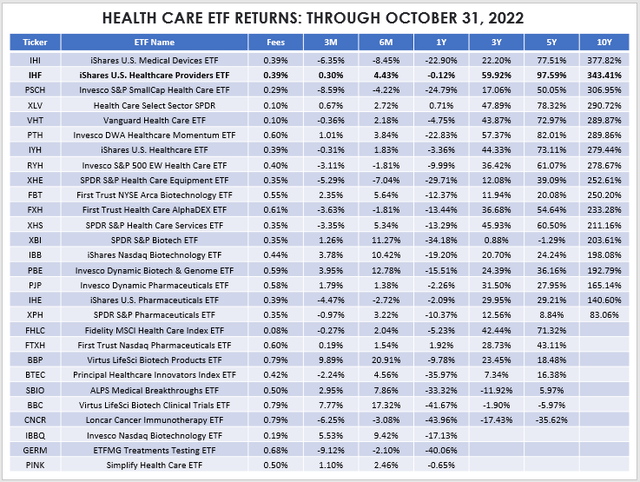

Finally, IHF has the second-best ten-year returns of any U.S. Health Care ETF trading today, second only to the iShares U.S. Medical Devices ETF (IHI). On a three- and five-year basis, IHF was the best performer. I’ve summarized these and other periodic returns in the table below.

A consistent theme is relatively high fees, except for plain vanilla market-cap-weighted ETFs like XLV, VHT, and FHLC. However, the performance indicates Health Care is one sector you should pay for. However, IHF’s 0.39% expense ratio is about as high as I’d want to go.

ETF Analysis

Company Fundamentals

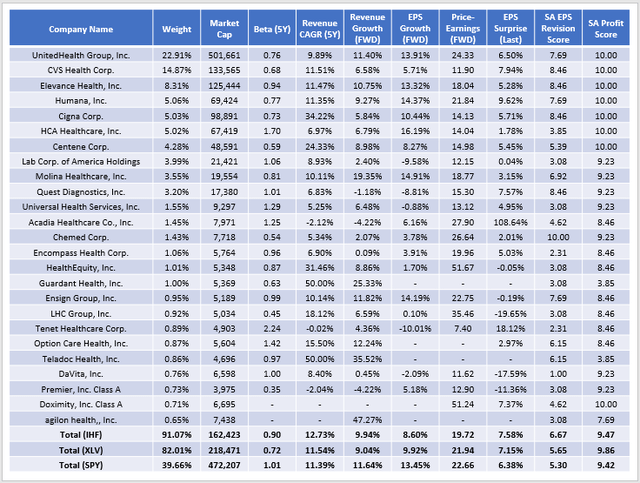

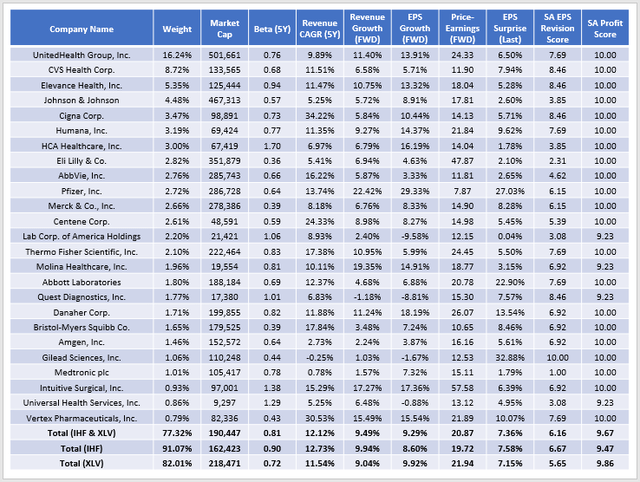

The following table highlights selected fundamental metrics for IHF’s top 25 holdings, which account for 91.07% of the ETF. As noted earlier, IHF is typically more volatile than XLV, and its higher 0.90 five-year beta suggests that it will continue.

However, many other factors are in IHF’s favor. For example, it trades at 19.72x forward earnings, or 2.22 and 2.94 points cheaper than XLV and SPY. IHF’s constituents are still highly profitable, with the first seven earning perfect 10/10 A+ Profitability Grades, according to Seeking Alpha. Its overall 9.47/10 Profitability Score is still better than SPY’s 9.42/10, which is impressive given the large-cap index’s quality. IHF’s estimated sales growth of 9.94% is also solid, and the table highlights a few key names driving this growth, like UnitedHealth Group at 11.40%. According to the CMS, National Health Expenditures are projected to grow approximately 62% from 2019 to $6.2 trillion in 2028. As a leader, as they’ve demonstrated historically, UNH will likely grow even faster.

Earnings Momentum

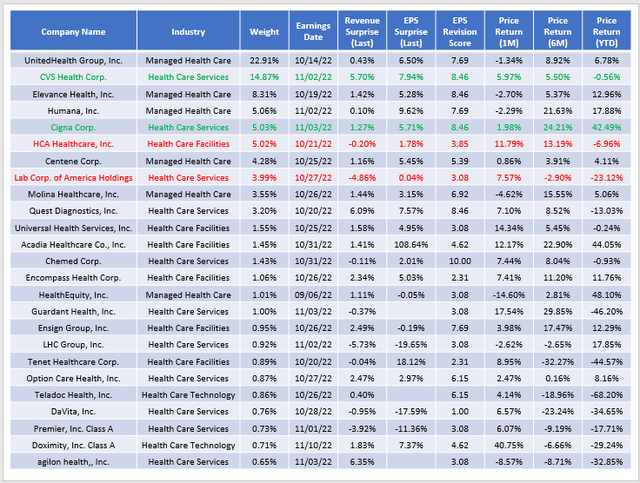

IHF will likely succeed in the short term because of solid earnings momentum. The above table shows that IHF’s Earnings Surprise Score of 6.67/10 easily beats XLV’S 5.65/10 and SPY’s 5.30/10. Health Care Providers remain resilient in a market where sentiment is primarily negative. I’ve summarized the most recent sales and earnings surprises for IHF’s top 25 holdings in the following table. Retail investors should listen to what Wall Street analysts say about a particular group of stocks, as they significantly influence what happens in the near term.

Based on their EPS Revision Scores and most recent sales and earnings surprises, CVS Health (CVS) and Cigna (CI) are two examples of companies with strong earnings momentum. At the same time, HCA Healthcare and Laboratory Corporation of America Holdings (LH) have negative earnings momentum. Many stocks have poor scores, but fortunately, they have much lower weightings. The largest Health Care provider companies look like the best bet, and since it’s such a concentrated market, a viable option is to skim IHF’s top ten holdings to save the 0.39% annual fee.

IHF As A Complementary Product

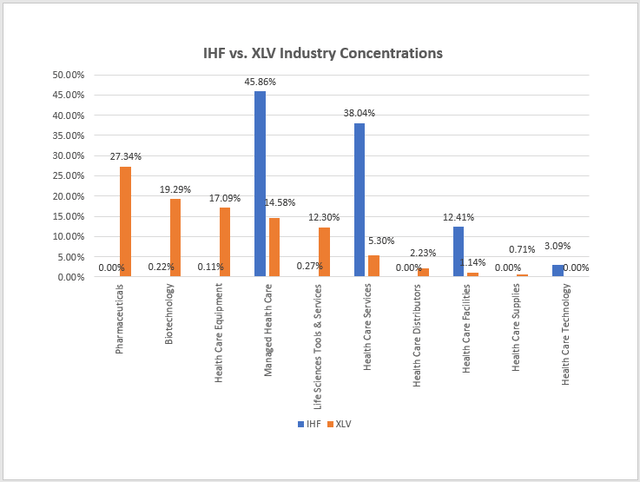

For investors wanting to keep it simple with ETFs, IHF is an excellent complement to cheaper, broad-based funds like XLV because its composition is vastly different. To illustrate, consider the graph below highlighting each ETF’s industry concentrations.

While IHF has 96.31% exposure to its top three industries (Managed Health Care, Health Care Services, and Health Care Facilities), that exposure is only 21.03% in XLV. If you decided to hold both ETFs in equal weight, the result would be a portfolio that efficiently cornered nearly all of the U.S. Health Care market for a net 0.245% expense ratio. Below are the fundamentals for that hypothetical portfolio.

UnitedHealth Group, CVS Health, and Elevance Health are still the top three holdings, and several of XLV’s Pharmaceutical and Biotechnology stocks round out the top ten. They include Johnson & Johnson (JNJ), Eli Lilly (LLY), AbbVie (ABBV), and Pfizer (PFE). These companies also have excellent profitability scores and defensive qualities. However, my hesitation is that these companies have poor EPS Revision Scores, so the timing may not be optimal. Still, this approach works well if you’re looking to diversify and hold the highest-quality U.S Health Care stocks.

Investment Recommendation

Previous articles on IHF have expressed concern about its valuation. I don’t see it that way, as the U.S. Health Care providers are trading at a discount relative to XLV and SPY. Furthermore, IHF’s constituents deserve a premium as they have excellent earnings momentum and profitability backed by solid expected earnings and industry growth. IHF also has an excellent long-term track record and is the best-performing U.S. Health Care ETF over the last three and five years.

One concern is IHF’s high 0.39% expense ratio. However, the performance justifies it, and investors can lower their fees by taking a reduced position and pairing it with XLV, another high-quality ETF with an excellent track record. Therefore, I’m confident in my buy rating for IHF, and I look forward to discussing this further with you in the comments below.

Be the first to comment