DSCimage/iStock via Getty Images

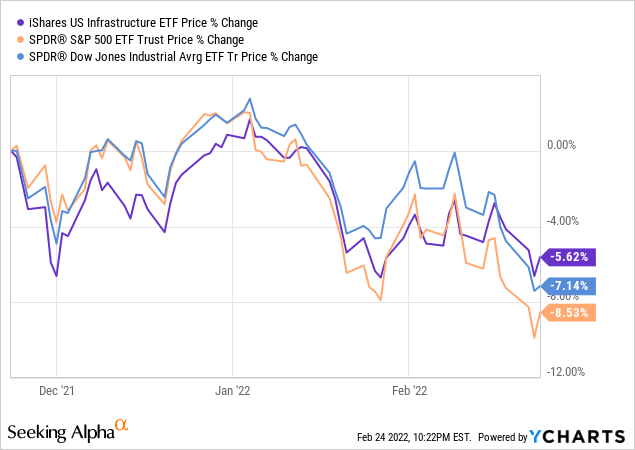

In my quest for infrastructure investments far from the turmoil in Europe, regulatory risks in China, and geopolitically sensitive East Asia, I came across the iShares U.S. Infrastructure ETF (IFRA). As its very name implies, this ETF invests in infrastructure assets in the United States. Its appeal at the current period which is characterized by high volatility is the fact that it has been less impacted than the broader market represented here by the SPDR S&P 500 Trust ETF (SPY), shown in the orange chart below.

At the same time, it has outperformed the Dow Jones Industrial Average (DIA) despite the fact that it has a 29% exposure to the Industrials sector. I now elaborate on the reasons for IFRA’s delivering better performance by dissecting its holdings.

First, I explore the reasons for which infrastructure investments have to be made in the context of a related bill approved by the Senate in November 2021.

The need for infrastructure

While we may not be aware or even take it for granted, infrastructure shapes our living environment and we depend on it practically every day, right after waking up to bedtime. In fact, deteriorating road conditions, century-old bridges, or aging cable networks, by not functioning optimally, affect both the lives of people and the productivity of the workforce.

Thus, economic growth and our standard of living depend on our ability to make the most of existing infrastructure. However, expansion and modernization are also key challenges not only in the U.S. but also internationally. According to an estimate done for the Group 20 (G20) countries which include the U.S. and China, governments and the private sector are lagging in investments and this lag should grow by $14 trillion by 2040. This signifies that trillions of dollars are actually required each year, and adding climate change objectives to the equation means that even more money is required to modernize transport, energy, water, and other infrastructures.

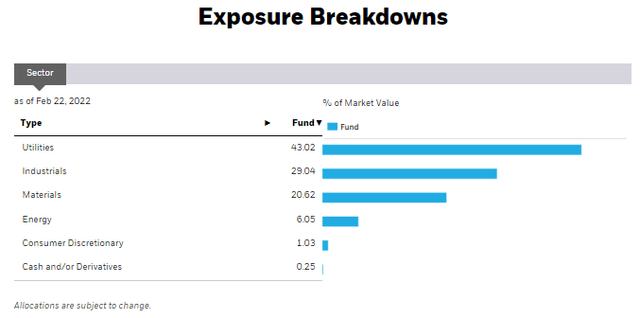

Taking the example of rail transport, about $66 billion has been earmarked as part of the infrastructure plan (after the bill was approved by the Senate) in new spending from 2022 to 2026. The bulk of this money should be received by Amtrack, the government-owned passenger railroad service whose CEO already has a clear vision for how to spend the money. Now, Amtrack is neither included in IFRA’s holdings nor is it a publicly-listed company, but the investment it will make to modernize and expand the rail infrastructure should benefit industrial and materials plays in its supply chain. These two sectors make up for a combined weight of 49.66% in IFRA’s total assets.

iShares (www.ishares.com/us/products/294315/)

Furthermore, IFRA is convenient for small investors who want to passively benefit from the gradual scaling of infrastructure assets over a five years period. Also, at this stage, it is not clear who is likely to be Amtrack’s specific suppliers for forthcoming upgrade projects. This is where the rationale to invest through an ETF including many construction and material companies makes more sense as it maximizes investors’ chances of benefiting from a big federal spend, instead of singling out individual names in the hope that they win some large contracts.

Exposure to utilities, materials, and energy

Pursuing further, according to iShares’ documentation, IFRA provides access not only to material and construction companies (referred to as the enablers) but also include owners and operators. These include railroad and utility companies.

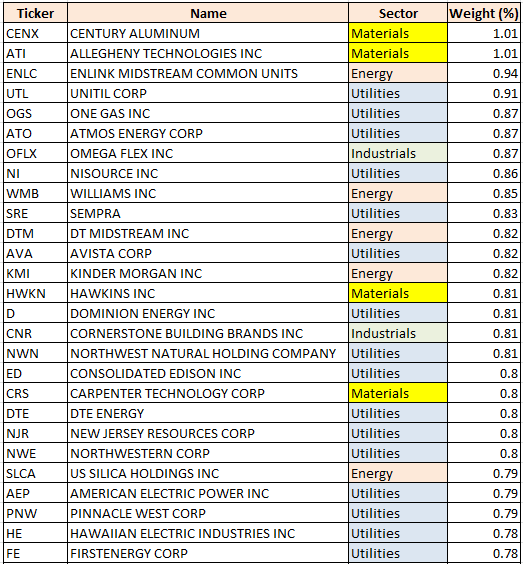

In this respect, utilities constitute 43% of the iShares’ ETF total assets with names like Unitil (UTL), ONE Gas (OGS), and Atmos Energy (ATO) as per the table below where only 27 holdings are shown. For this matter, IFRA has 153 holdings in total.

Together with utilities, the presence of energy sector stocks like EnLink Midstream LLC (ENLC) and Williams Companies (WMB) which pay relatively higher dividends explain why IFRA can pay dividends of 1.74%. Additionally, yields have been growing by a 9.8% CAGR during the last three years.

iShares (www.ishares.com/us/products/294315/)

Another factor that makes IFRA a useful ETF to hold on to in times of higher inflation is the fact that some of its Materials sector stocks provide exposure to industrial metals, namely Century Aluminum (CENX) and Allegheny Technologies (ATI) for steel. These two stocks have produced upsides of above 40% during the last three months, a period characterized by the status of inflation changing from transitory to persistent.

Now, most analysts will tell you to hold either gold or other precious metals, both as a hedge against inflation and for uncertain times, but we are still in an economic recovery where demand for industrial metals, which is more cyclical, should be sustained. Additionally, the building of bridges and laying of water pipes as part of the wider $1 trillion infrastructure plan require the use of tons of metals in addition to concrete.

Valuations and key takeaways

Consequently, I view the 20.62% of exposure to the Materials sector as a positive for IFRA going into 2022. Now, the U.S. construction materials market was estimated at $296.2 billion in 2021. Adding to this figure an amount of $110 billion earmarked for roads and bridges as part of the infrastructure plan leads us to a market size incrementing by 37% (110/296.2) which is significantly high.

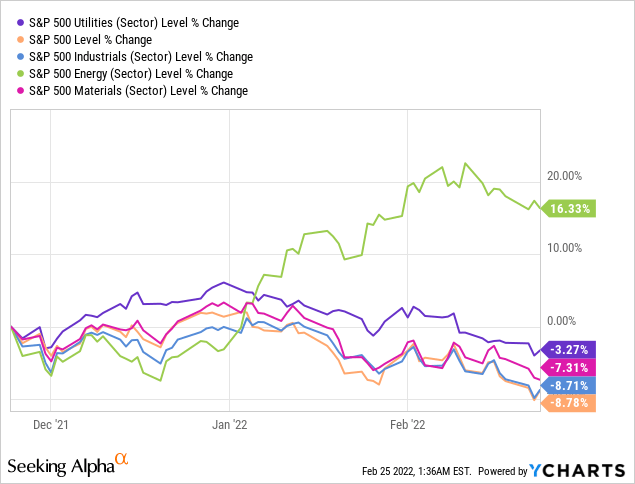

This in turn signifies that the S&P 500 Materials sector index in the pink chart below should rise as related companies beef up revenues by 2026, thereby increasing earnings and driving up IFRA’s share price. Quantifying the increase based on the additional market incrementing by 37% and considering that materials constitute a fifth of the ETF’s assets, I estimate an upside of 7.4% (37/5). Now, applying this percentage increase to IFRA’s current share price of $36.93, I obtain a target of $39-40.

In addition to Materials, the Industrials sector should also benefit from more infrastructure business through stocks like Cornerstone Building Brands (CNR). However, there should be some pains as persisting supply chain issues, together with wage increases should exacerbate inflation pressures.

To counteract the effects of higher inflation, IFRA’s can rely to some extent on its 6% exposure to energy for portfolio damage limitation purposes. In this respect, the S&P 500 Energy sector’s (green chart) 16.3% rally since November has taken a pause, but should resume due to the following three factors:

- A pickup in international travel amid the fading Omicron threat.

- Underinvestment in energy supply since the onset of the pandemic.

- Dragging of the Russia-Ukraine conflict likely to prove uncertain for Europe about where to source its natural gas from.

Thus, it is likely for oil prices to remain high in the foreseeable future.

Consequently, together with the growth prospects of the Material sector, a sustained energy demand, and the relative stability of utilities (less impacted as shown by the deep blue chart above), I maintain a target price of $39-40 for IFRA.

This remains a moderate target due to inflationary pressures, but it could all change in view of the lower geopolitical risks premiums in the U.S. with respect to other parts of the world. Here, I mean that U.S. real assets could attract more investments as a sort of safe haven during uncertain times with capital inflows driving the ETF above the $40 range.

Finally, looking for alternatives, I was able to find other ETFs, but these mostly provide exposure to water resources or global infrastructure. They also charge higher than IFRA’s 0.3% fees. This is the reason that I recommend the iShares ETF for exposure to U.S. assets and forthcoming infrastructure projects in a turbulent world.

Be the first to comment