Florent Molinier

Investment Thesis

IDT Corporation (NYSE:IDT) is a pseudo “incubator” run by the Jonas family. They have a history of unlocking tremendous value via development of high growth businesses which are then spun out to investors, largely hidden behind the melting ice cube Traditional Communications business. Today IDT has three high growth segments whose operating success is largely ignored by the market. It is this article’s contention that even just one of these – National Retail Solutions – is likely worth more than IDT’s entire Enterprise Value today giving investors a free look at the other two growth businesses and free cash flow from the melting ice cube. Put together, IDT is clearly undervalued. With a multi-year time horizon, I have been buying IDT in the high 20s to low 30s.

Introduction

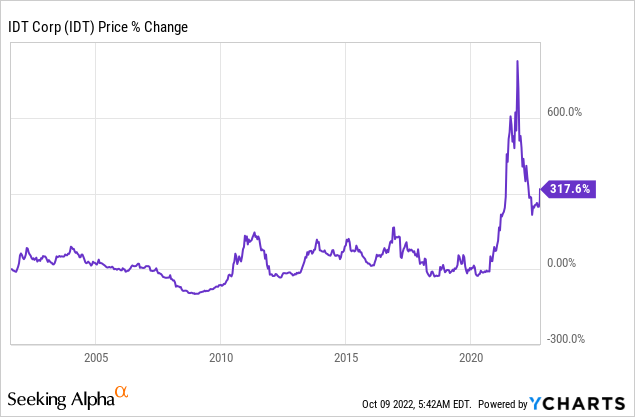

If you took a look at IDT’s stock performance for the last 22 years, you would probably be underwhelmed:

But for that last blip up (and then down…) in the last 20+ years, shares appear to have done remarkably little.

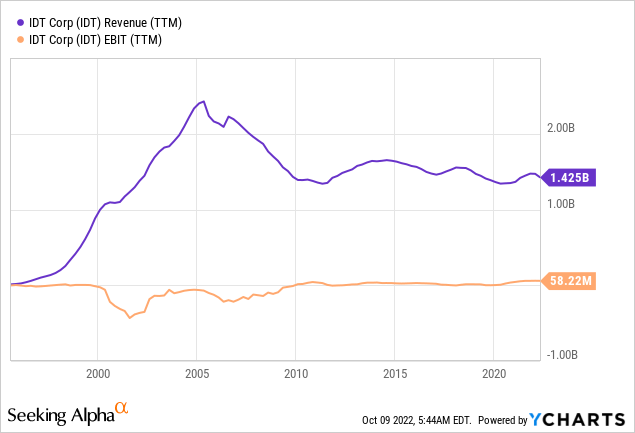

Similarly, a glance at revenue and EBIT fails to impress:

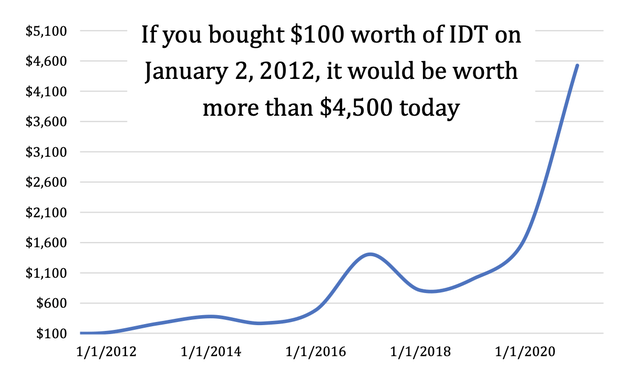

However, this cursory glance at IDT obscures how the company truly functions and is precisely why this opportunity exists. It is when you dig back through IDT’s history and incorporate the value of IDT’s various spinoffs you can see the tremendous value that has been unlocked:

Alta Fox Capital

Source: Alta Fox Capital’s excellent IDT Thesis (Author’s Note: both IDT and its spincos were trading at higher levels when this presentation was put together, so while you can probably haircut the 45x above, the value unlock remains obscene)

The company is operated by the brilliant Howard Jonas and son Shmuel Jonas who, along with other insiders, own nearly 30% of the company, and have lead IDT on this incredible value creation journey. If you are interested in learning more of the Jonas story, Howard Jonas wrote an autobiography detailing his start operating a hot dog stand to operating IDT as of time of writing, 1998.

IDT functionally operates as an incubator in which the declining cash flows from its Traditional Communications segment are used to develop and operate growth businesses that will ultimately be spun out to shareholders. The Traditional Communications segment is functionally in secular decline but remains highly cash generative.

IDT’s three growth businesses and a brief word on each:

-National Retail Solutions (NRS) – we will come back to this one as the main thesis of the article.

-net2phone Unified Communications as a Service – A cloud based UCaaS provider for small businesses and enterprises. net2phone had been growing seats served YoY at nearly 40% and then closer to 30% YoY in the most recent quarter (with a partial assist from an acquisition). UCaaS is an attractive industry as once a seat has been onboarded, IDT can collect a stable, predictable subscription stream vs relatively little incremental cost. Subscription revenue in the most recent quarter is up 37% to $15.1m and FY 2022 was up 38% to $53.6m YoY. UCaaS remains a remarkable growth industry with a large and attractive TAM. While revenue numbers here are relatively small compared to IDT’s overall valuation, the growth is exciting. Management continues to push this segment towards profitability. Its operating loss in the last quarter was $1.8m, and management projects profitability in 4Q2023. This is IDT’s second most attractive asset behind NRS.

-Boss Money – An international money transfer business. This business demonstrated 16% FY growth in 2022 to $57.5m and grew 56% in the most recent quarter (unfortunately management did not elaborate much on this spike on growth. Management also indicated on the conference call that Boss Money is close to breakeven and likely to shift towards profitable in the coming quarters.

and then there is also:

–Mobile Top-Up – This is a growing segment buried within Traditional Communications. I was previously quite excited about MTU, as it grew from a $70m quarterly run rate in revenue in 2020 to a quarterly run rate of ~$115-130m in 2021 and 2022. That said, the business appears to have suddenly hit headwinds with revenue decreasing YoY due to a “sudden, industry wide deterioration in a key corridor that was particularly impactful in the wholesale and retail channels” and marks its second straight quarter of meaningful YoY decline. IDT elaborated on this in the conference call, explaining that this is related to foreign exchange conditions in the black market in Cuba (this is worth a read!) and projecting stabilization of the business in 2023. I will take a wait and see approach here but, barring further significant deterioration, continue to consider this an exciting asset.

National Retail Solutions

While net2phone, Boss Money, and Mobile Top-Up are exciting businesses, NRS is clearly IDT’s best asset. It is my belief that NRS is worth somewhere around IDT’s full EV today.

NRS is a Point of Sale platform serving independent convenience, liquor, and tobacco stores. IDT would tell you that this is a niche market with unique needs (creating a moat as IDT is geared specifically towards these businesses), has an addressable market of 200k+ retailers, and that the platform is designed with a sort of product flywheel in mind.

The economics are very, very attractive.

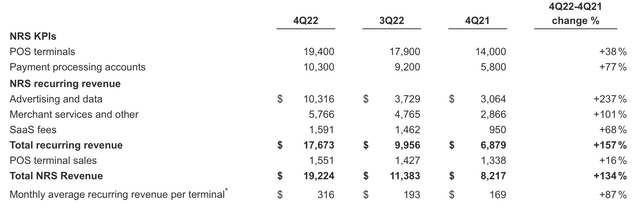

First, IDT sells the terminal for an upfront fee, which is nice or whatever. Terminals installed have grown from a base of ~8k installed in early 2020 to 19,400 installed as of Q4 with 38% YoY growth. Earlier in NRS’ life, terminal sales were a meaningful part of the story and contributed to 20%+ of NRS’s quarterly revenue. However, today the terminal sales are less driving revenue themselves but rather increasing the installed base to monetize. As of the most recent quarter, terminal sales was only 8% of NRS’ revenue.

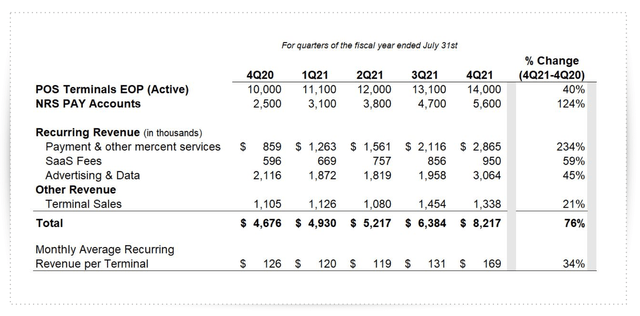

Where NRS really shines is in its recurring revenue from services it sells into its terminal base, consisting primarily of the monthly software subscription, parent processing services, and advertising and data. To give you an idea of how this breaks down, I took a screenshot from the – admittedly dated – most recent IDT Investor Presentation:

IDT Investor Presentation

As of the most recent quarter, these numbers look even better:

IDT Q4 Press Release

FY 2022 recurring revenue for NRS was $45.3m, up 129% YoY, and total revenue $51.3m, up 107%. And keep in mind, this is for a company that is still growing its terminal base by 38% YoY, giving investors every indication that the growth will continue. I am particularly excited by just how well IDT has managed to continue to increase monthly average recurring revenue per terminal from ~$120 in 2020/2021 to the $193-316 range in the last two quarters (more on that in a moment). Last, NRS is profitable, pulling in probably somewhere in the realm of around ~$7m in EBITDA in the last quarter alone if you parse through comments in the conference call.

Take a moment to consider just how good these numbers are:

We are talking about a company with an EV of ~$670m with NRS growing at an extraordinary rate (again, more on that in a moment). Add in two other exciting growth businesses in net2phone and Boss Money. On top of that you get management with a tremendous track record of success and a history of spinning out businesses, freeing you of the perennial value investor unrealized SOTP value trap. Oh, and it has a cash generative melting ice cube Traditional Communications segment ($85m in FY 2022 EBITDA) that may have an embedded growth story within it in Mobile Top-Up.

All that said, I don’t want to view everything here with rose tinted glasses. It is impossible to ignore the enormous acceleration in NRS’ advertising revenue in the most recent quarter. This massively boosted both the recurring revenue number as well as the per terminal number. While advertising revenue is labeled as recurring by the company, as there is no incremental cost to the company to sell this into the terminal base, it is going to be the lumpiest component of NRS’ quarterly revenue. Unfortunately, this bump in advertising revenue is unlikely to be sustained.

In the conference call, the company offered more color on this, noting:

-Q4 was a seasonally strong advertising quarter

-There is macroeconomic pressure that is likely to depress advertising going forward

-Advertising is more likely to revert to around $6m per quarter in 2023.

In other words, we shouldn’t expect to see 100%+ YoY growth every quarter. Instead we may simply have to accept that this profitable, high growth, recurring revenue business may *only* grow in the realm of 30-40% in the coming years.

In fact, despite projecting advertising revenues to come back to Earth, on the conference call, management projects somewhere in the realm of $80m in revenue for NRS over the coming year (actually, they hint that it could be more) with approximately $30m in EBITDA.

With an EV of $670m and looking at NRS alone, we end up with a forward EV/EBITDA of 22.6x… for a business growing at ~40%!

If you then assume net2phone and Boss Money only marginally improve towards breakeven and assign ($5m) in 2023 EBITDA, and give Traditional Communications a punitive $75m in 2023 EBITDA (likely to be closer to $80m), we come to a rough 2023 estimate of $100m in EBITDA. At an EV of $670m, IDT trades at a forward EV/EBITDA of only 6.7x. And, again, this analysis gives essentially no credit to all of the embedded growth potential.

Why Does This Opportunity Exist?

-IDT is a small cap, with a market cap of ~$780m

-As mentioned in the introduction, while spinoffs have created tremendous value for shareholders, they also make IDT’s long term operating results and share price history look exceptionally underwhelming

-The good co(s)/bad co nature of IDT makes the stock screen very poorly

-No analysts follow the company

-With super-voting Class A shares, the Jonas family is in absolute control of IDT.

When Will Value Be Unlocked?

As mentioned, the wonderful thing about IDT’s management is that they are willing to spin out their high growth business to capture shareholder value, as opposed to empire building within IDT.

That said, anyone who has been paying attention knows that companies with buzz words like “high growth” or “fintech” or “Cloud” or “SaaS” are under pressure in today’s stock market.

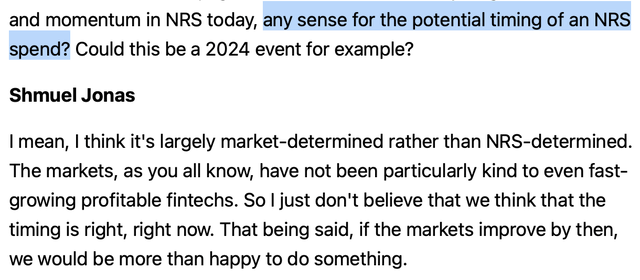

IDT’s management has made it clear that they plan to wait for a better environment for NRS before moving towards spinning it out:

IDT Q4 Conference Call

I, like everyone else, like to capture all my value as soon as possible and preferably yesterday. That said, I think it is smart of management to wait for a better capital environment and to continue to execute in the interim.

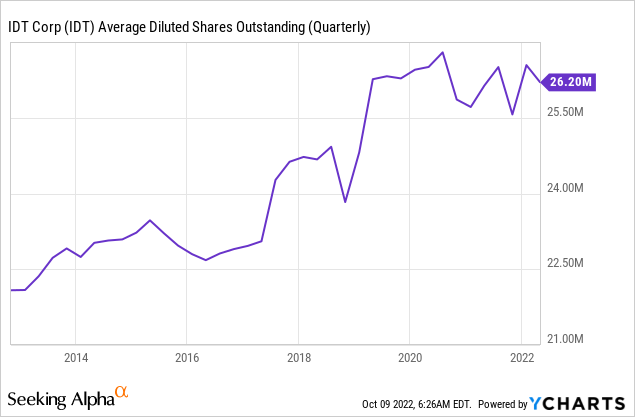

Share repurchases

IDT repurchased $13.m of shares in the latest quarter. It is my strong hope that IDT has continued to repurchase – and become more aggressive – since, as shares continue to trade at depressed levels. Additionally, despite controlling the company and having ample opportunity to enrich themselves, the Jonas family has been responsible with share issuance:

Risks

-If the Fed nukes the economy and everyone goes broke, NRS will obviously not do as well. Its main customers are capital cycle dependent as it captures revenue from retailer payment processing and advertising. I suspect NRS will be at last somewhat insulated due to its convenience/tobacco/liquor niche, as “sin” tends to be more economically resistant.

-The melting ice cube Traditional Communications segment begins to melt more quickly.

-Mobile Top-Up’s growth story continues to decay. While the remainder of IDT’s businesses are still readily undervalued in IDT’s EV, this would be a tremendous disappointment.

-The capital market environment continues to remain poor for years, lengthening time to NRS (and net2phone) spins and lowering investor IRR.

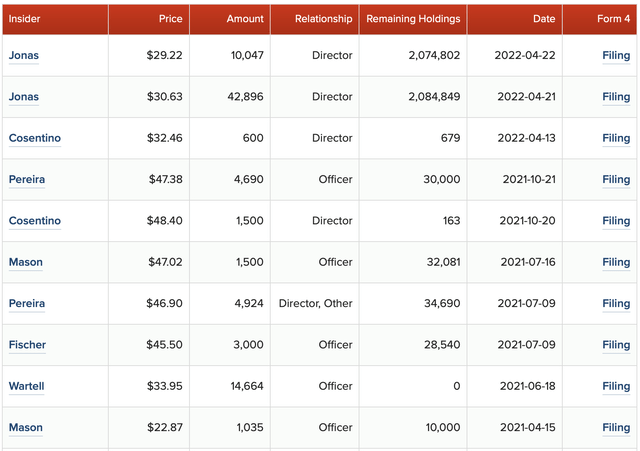

-Straight Path litigation – This is the hardest piece to handicap and likely a large overhang on shares today. On the downside, this litigation could represent a catastrophic risk to the company. On the upside, I could see IDT walking away with a relatively small payout. Reading IDT’s managements tea leaves would suggest confidence in their case. First, the company is repurchasing shares ~7 months in advance of the upcoming trial. If the company thought they would be on the hook for a large settlement, they would be more likely to conserve cash. Second, if management really felt that the lawsuit would be likely to severely impair IDT, I think they would have executed the NRS and net2phone spinoffs to eliminate risk to these growth assets. Last, if management lacked confidence in their case, I suspect we would have seen them aggressively dumping shares during IDT’s semi-euphoric run up to the $60s in late 2021. Instead we see only fairly typical trimming here and there:

Insider Monkey

Conclusion

IDT is a pseudo “incubator” run by the Jonas family. They have a history of unlocking tremendous value via development of high growth businesses which are then spun out to investors, largely hidden behind the melting ice cube Traditional Communications business. Today IDT has three high growth segments whose operating success is largely ignored by the market. It is this article’s contention that even just one of these – National Retail Solutions – is likely worth more than IDT’s entire Enterprise Value today giving investors a free look at the other two growth businesses and free cash flow from the melting ice cube. Put together, IDT is clearly undervalued. With a multi-year time horizon, I have been buying IDT in the high 20s to low 30s.

Be the first to comment