martin-dm/E+ via Getty Images

In such a large and complex economy like what we have today, there exists a number of needs that need to be met, whether they be goods or services. Many of the companies that need the greatest support are industrial firms, solely because of how large they can become and the tremendous variety of activities they might engage in as part of their business models. One diverse company that’s focused on meeting many of the needs of industrial firms and other organizations is IDEX Corporation (NYSE:IEX). With the exception of the 2020 fiscal year because of the COVID-19 pandemic, the overall financial trajectory of the company has been quite positive recently. For the most part, the company’s strength on both its top and bottom lines has continued into the 2022 fiscal year and is likely to continue through the rest of it. Long term, the company will probably be quite a fine operator, but this doesn’t mean that it makes sense to buy into the stock right now, in my opinion. Although I have no doubt about the company’s prospects, I do also think that shares are likely more or less fairly valued at this time. Because of this fact and this fact alone, I’ve decided to rate the business a ‘hold’, reflecting my belief that it will likely generate returns that more or less match the broader market moving forward.

A diverse business with a nice track record

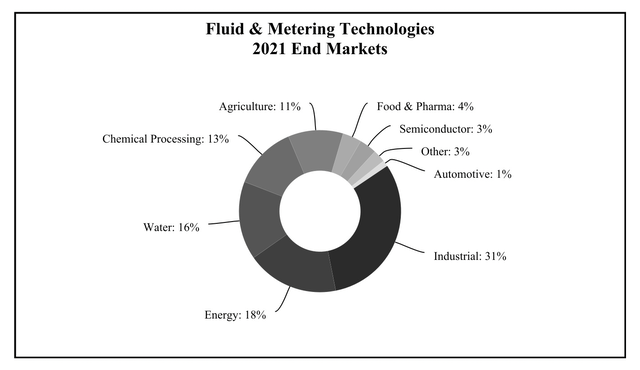

Describing IDEX in one or two words is very difficult. Instead, to truly understand the company, we should dig into the three key segments that it operates. The first of these is the Fluid & Metering Technologies segment. Through this, the company produces and sells positive displacement pumps, valves, small volume provers, flow meters, injectors, and other fluid handling pump modules and systems. In addition to this, the company also provides its customers with flow monitoring and other related services for a variety of industries, ranging from food, to chemical, to general industrial, to water, to agriculture, and even to energy firms. Least 2021 fiscal year, its largest exposure was to the industrial space, which accounted for 31% of its revenue. 18% of sales came from energy providers, while 16% came from firms in the water and wastewater handling businesses. In terms of overall exposure for the company more broadly, this particular segment was responsible for 36% of the company’s revenue and for 36% of its profits last year.

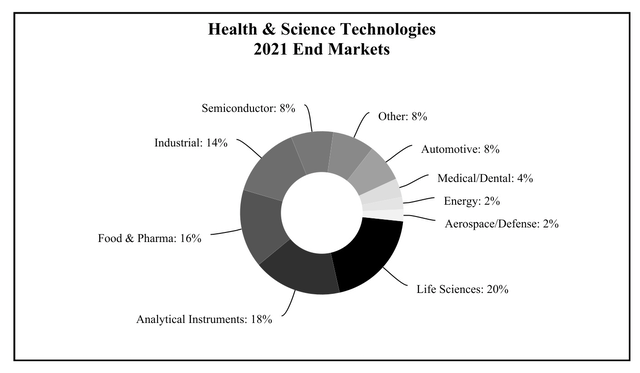

Next in line, we have the Health & Science Technologies segment. This is the largest portion of the company, accounting for 41% of revenue and for 40% of profits last year. Through this unit, the company produces a wide range of precision fluidics, rotary lobe pumps, centrifugal and positive displacement pumps, pneumatic components and sealing solutions, and a large number of other offerings for its customers. There is some overlap between the customer base of this segment and the aforementioned Fluid & Metering Technologies segment. However, an impressive 20% of sales from this segment came from companies in the life sciences space. 18% came from customers focused on analytical instruments, while 16% of revenue was distributable to food providers and pharmaceutical companies.

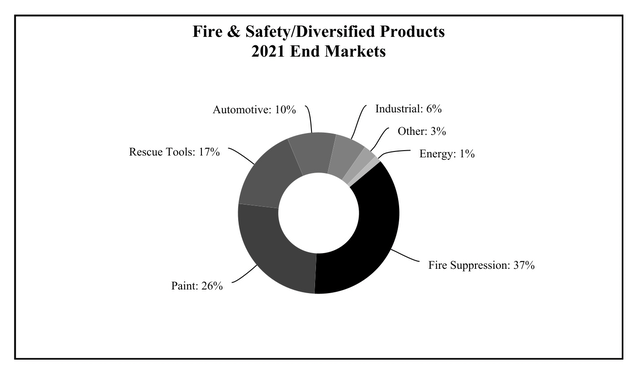

Finally, we have the Fire & Safety/Diversified Products segment. Responsible for 23% of the company’s revenue and 24% of its profits last year, this segment is the smallest of the three. However, it’s also very important because it focuses on the production and sale of firefighting pumps, valves and controls, rescue tools, lifting bags, and other components and systems for the Fire and Rescue industry. It also provides engineered stainless steel banding and clamping devices used in the automotive, energy, and industrial markets. On top of this, it’s also engaged in the production of precision equipment for dispensing, metering, and mixing colorants and paints that have a variety of uses themselves. During the 2021 fiscal year, 37% of the revenue from this segment related to the fire suppression category. 26% of sales related to paint, while 17% had some relation to rescue tools.

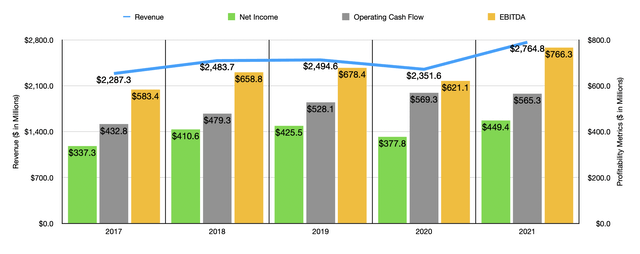

Over the past five years, the financial trajectory of IDEX has been pretty positive. Revenue rose between 2017 and 2019, climbing from $2.29 billion to $2.49 billion. In 2020, sales took a small step back, dropping to $2.35 billion for the year. But in 2021, the company saw revenue jump to $2.76 billion. This biggest increase, which was from 2020 to 2021, was driven largely by a 12% contribution from organic sales. The company also benefited to the tune of 4% from the various acquisitions that it engaged in and to the tune of 2% from foreign currency translation. The strongest growth for the company was in the international markets, with sales up by 20% compared to the 15% rise seen here at home.

On the bottom line, the company has also done well. From 2017 to 2019, net income rose from $337.3 million to $425.5 million. Its profit in 2020 was a more modest $377.8 million. But last year, profits rose further to $449.4 million. Other profitability metrics also warrant consideration. Between 2017 and 2019, operating cash flow rose from $432.8 million to $528.1 million. It continued to grow in 2020, hitting $569.3 million before dipping slightly to $565.3 million last year. And finally, EBITDA rose between 2017 and 2019, climbing from $583.4 million to $678.4 million. It dipped slightly to $621.1 million in 2020 before popping to $766.3 million last year.

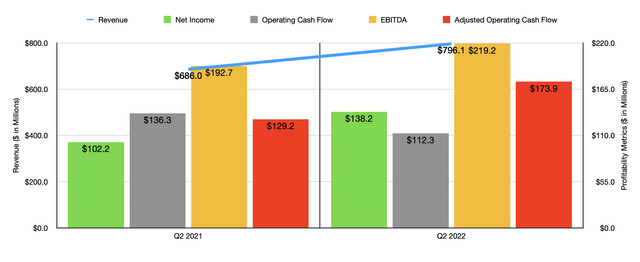

When it comes to the 2022 fiscal year, performance for the company continues to be strong. Revenue of $1.55 billion in the first half of the year beat out the $1.34 billion achieved the same time last year. Just as we saw last year, organic revenue in the first half of 2021 grew by 12%. The company also benefited to the tune of 6% from the various acquisitions it made, while being hit to the tune of 2% from unfavorable foreign currency translation. Domestic growth was particularly strong for the company, coming in at 28% compared to the 5% rise seen abroad. It is worth noting that management continues to make acquisitions at a pretty rapid pace. The latest such acquisition to be reiterated was the company’s decision to acquire Muon Group, a leader in precision technology manufacturing, for a cash purchase price of 700 million euros.

On the bottom line, performance has been largely positive as well. Net income in the first half of the year totaled $278.2 million. That compares to the $214.9 million seeing the same time last year. Operating cash flow did fall year over year, dropping from $245.6 million to $192 million. But if we adjust for changes in working capital, it would have risen from $271.6 million to $346.6 million. Meanwhile, EBITDA for the company also expanded, climbing from $373.5 million to $433.9 million.

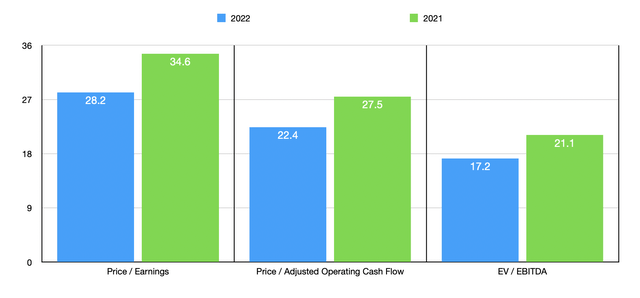

When it comes to the 2022 fiscal year as a whole, management expects revenue to be up about 10%, with organic growth in the second half of the year coming in at between 9% and 10%. Using midpoint expectations for earnings per share, the company should generate net income for 2022 of roughly $551 million. No guidance was given when it came to other profitability metrics. But if we were to assume a similar year-over-year increase in those, then we should anticipate operating cash flow of $693.1 million and EBITDA of $939.5 million. Using these figures, we can see that the company is trading at a forward price-to-earnings multiple of 28.2. The price to operating cash flow multiple should be 22.4, while the EV to EBITDA multiple should be about 17.2. These numbers compare to the 34.6, 27.5, and 21.1, respectively, that we get using data from 2021. Also as part of my analysis, I compared the company to five similar firms. On a price-to-earnings basis, these firms ranged from a low of 13.9 to a high of 40.2. Three of the five companies are cheaper than IDEX. Using the price to operating cash flow approach, the range is between 19.9 and 46.4, with one of the five being cheaper than our prospect. And when it comes to the EV to EBITDA approach, the range is between 11.2 and 22.9, with two of the firms being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| IDEX Corporation | 28.2 | 22.4 | 17.2 |

| Xylem (XYL) | 40.2 | 46.4 | 22.9 |

| Dover (DOV) | 15.4 | 19.9 | 11.2 |

| Nordson (NDSN) | 26.5 | 25.1 | 18.0 |

| Stanley Black & Decker (SWK) | 13.9 | 35.6 | 16.1 |

| Ingersoll Rand (IR) | 29.5 | 33.5 | 18.8 |

Takeaway

Fundamentally speaking, I see no problems with IDEX. The company seems to be a high-quality player in its space. It has a diverse business model and it’s a global player that is focused on acquiring other assets in order to grow quickly while also benefiting from strong organic expansion. In the long run, I fully expect the enterprise to create additional value for its shareholders. But it’s also true that shares look rather pricey at this time, even though they might be fairly valued compared to similar firms. Due to this, I think the best rating for the company right now is a ‘hold’.

Be the first to comment