AlexLMX/iStock via Getty Images

Identiv, Inc. (NASDAQ:INVE) is on a roll in both segments they’re reporting in, premises (secure access) as well as Identity. This latter segment mainly consists of the burgeoning RFID business, on which the company is at the forefront of technological development.

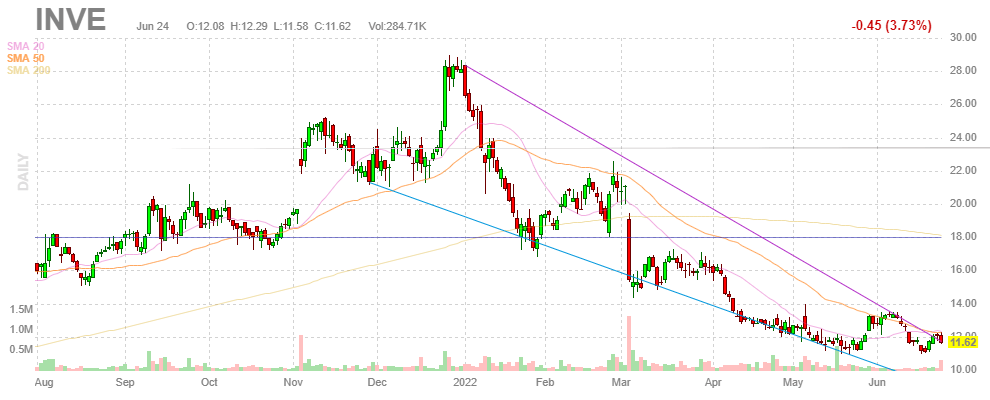

FinViz

Identity

RFID technology is replacing barcodes, as it has become cheap enough for the advantages to outweigh the costs in most supply chains. Identiv is at the forefront of this industry and taking this into a myriad of more complex IoT (Internet of Things) use cases (Q1/21CC):

Bike and scooter tire sensors, syringes and running shoes with accelerometers are all use cases that need multi-center devices, and have the potential to scale to hundreds of millions of units.

They’re doing a number of things right:

- Design and innovation, producing higher-margin specialty RFID devices that are custom solutions (requiring NRE or non-recurring engineering) or even a whole new category of devices like dual-frequency RFID and the ultra-low-power passive or active Bluetooth RFID devices.

- They rake in design wins and projects (see below for a few examples). They have over two dozen NRE projects going on and already finished about half in Q1.

- Proactive supply chain management (pre-ordering a lot of stuff, producing their own hardware) and having preferential treatment from partners like NXP has produced a competitive advantage in the present environment of shortages, taking share from competitors.

- The company has 90% of the next six months already covered by backlog and firm customer projections.

- They are receiving multiple awards for their innovative RFID tech.

Management argues that design wins drive a bit of a virtuous cycle (Q1/22CC):

If we lead in design wins, customers will always go to the company that’s proven they can deliver. That brings more scale, more experience in IP, more reputational leadership, and more of a moat around our lead in the market. It’s a classic first-mover advantage that expands as the market grows, which we’ve already established and we think we’re expanding.

And as an example how NPX is helping (Q1/22CC):

We’ve designed a specialty tag for asset tracking in their stores using our best in industry RFID on Metal technology. This is now going into pilot in Austria and Germany. This also got a lot of help from our partnership with NXP. They routed a special wafer to us for development and the pilots really giving us a boost to hit the customers’ goals.

RFID Projects

Just a few examples here, there are a lot more. We quote the conference calls at length as it gives an idea of the complexity of these projects (and hence the value-added, ASPs and margins), the numbers involved, and some quotes also mention other projects.

Medical: Identiv’s uTrust Sense SyringeCheck enables precise dosages at precise temperatures (Q1/21CC):

In this design, we’re incorporating multi-sensor features, including temperature and fluid dispensing measurements, as well as authenticity and data protection.

Cannabis: They have two projects for supply chain management, one in the U.S. and one in Canada. On the U.S. opportunity (Q1/22CC):

So that translates to a total U.S. cannabis market of about 1 to 1.5 billion units for our devices. Our customers cover 17 of the 33 states where cannabis is legal. So our specific opportunity with this customer is around 500 to 750 million units.

And about the Canada program (Q1/22CC):

Now, the cannabis program in Canada also is progressing with about 2,000 of our test units delivered an in-test production programmer tuning and converting is going well, including hologram inclusion in the finished product, which is a new Canada specific requirement we’ve incorporated. Now, we’d go into more details in Q&A, but this billion-plus unit program is moving as we expected. Our auto-injector project is still on track for 2022 ramp-up, with S scale volumes still projected ultimately to be in the 100 million unit range.

Some additional indications of the numbers involved from a year-earlier CC to give you an additional idea (Q1/21CC):

The cannabis program is projected to be over a billion units, syringes for just one vendor are over 100 million units at a high price point, and prescription bottles represent a half a billion-unit opportunity, just for the visually impaired. We think we’ll keep leading, because in this market of thousands of designs and hundreds of billions of units potentially, they’re huge first mover advantages. We’re adding to these advantages with a developer’s kit and the multi-sensor automation platform I mentioned earlier, building higher barriers to any competitors.

And some other projects and the margins involved (Q1/22CC):

In the healthcare and medical device category, projects for test kits and surgical accessories shipped to six different customers, all with margins of over 55% and a couple with margins over 70%. Wine bottle, gas bottle, and other intelligent tamper proved devices sold to five more customers, all with margins ranging from 40% to 60%. High-end authenticated consumables for robotic cleaners, printers and a couple of others with margins in the 40% to 55% range.

And then there is a large mobile customer, good for multiple simultaneous projects (Q1/22CC):

our largest mobile device customer has a new design ramping right now with higher volumes than we originally expected, over 10 million units of that design over the next six months. Most of their prior designs are continuing, resulting in more total demand than we had projected.

And more projects (Q1/22CC):

we’ve also got entry project going for eBay, Life Fitness through Promate, iRobot, a medical device for orthopedic surgery, the world’s largest provider of casino chips, several industrial applications, several different million-dollar-plus medical testing products across both humans and animals, high-end consumables for general appliances, spending everything from coffee buds to high-end refrigerator systems, and a lot more.

This all starts to add up to a serious opportunity with serious numbers, and these are just a few of the design wins and projects they have embarked upon. It’s no wonder that management concluded (Q1/22CC):

With this progress in Q1 RFID is positioned as our main growth driver in 2022 with upside volumes in just a few accounts that can transform our business.

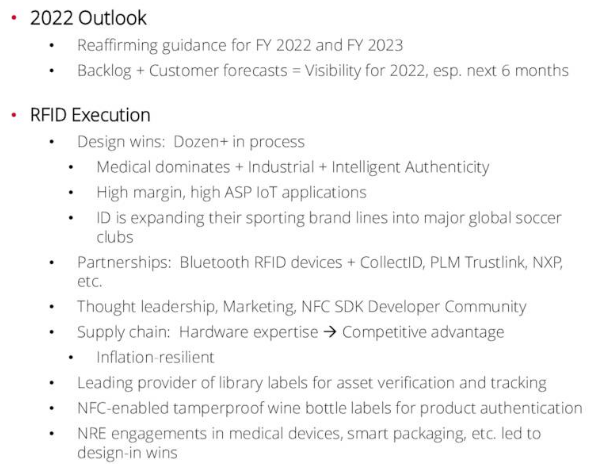

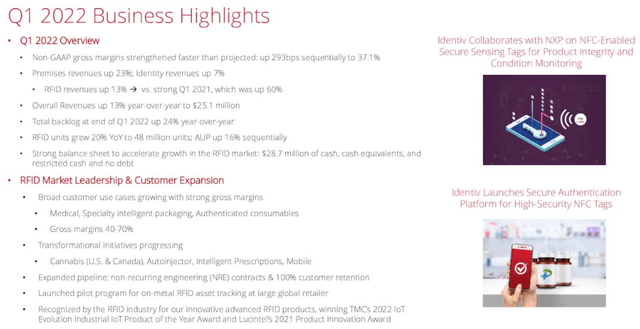

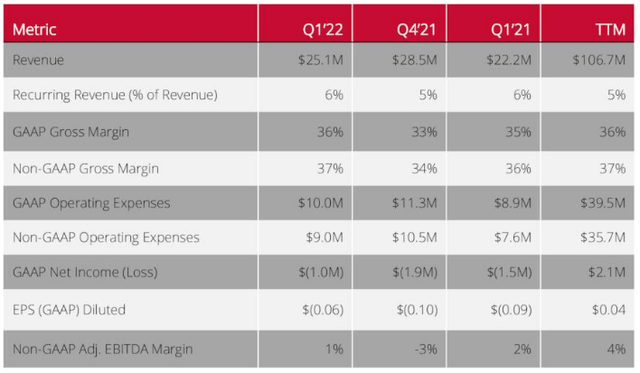

INVE Q1/22 earnings deck

Premises

The company, which is the leader in high-end-to-end premises, is also taking market share in premises, more especially in access cards, growing 3x faster than the market. Here, competitors are also suffering from supply constraints, but customer fear of technology lock-in is also playing in Identiv’s favor as their solutions are interoperable (Q1/22CC):

So we now are the only company that has readers, access, video, and credentials all across, and you can buy the whole thing from one vendor, but they’re also interoperable, so you’re not tied in

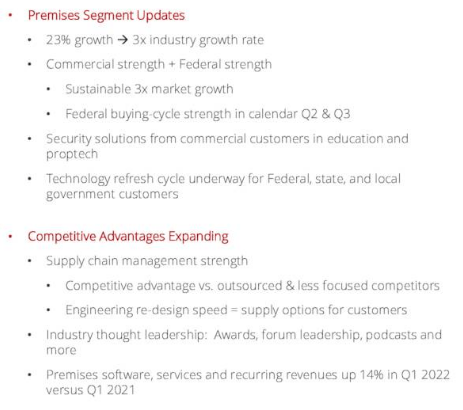

INVE Q1/22 earnings deck

Finances

Some data points:

- Revenue +13% to $25.1M

- Recurring 6% of revs (+1% on Q4/21)

- Identity $14.6M or 58% vs 51% Q1/21

- Gross margin 23% vs 21% Q4/21

- Premises $10.5M (42% of revenue) +23% on Q1/21; -5% on Q4/21

- Premises non-GAAP gross margin 57% vs 51% Q1/21

- GAAP gross margin 36% vs 35% Q1/21 and 33% Q4/21 primarily due to product mix, price increases, as well as operational efficiencies

- Non-GAAP gross margin 37% vs 36% Q1/21 and 34% Q4/21

- Long-term gross margin target 40%-45%

- GAAP OpEx $10M vs $11.3M Q4/21

- Non-GAAP OpEx $9M vs $10.5M Q4/21

- Non-GAAP OpEx margin 1% vs -4% Q4/21

- Long-term target for non-GAAP OpEx margin 15%-20%

- GAAP loss $1M ($0.06)

- $28.7M in cash (-$1.1M Q4/21)

- Backlog $32.4M +24% on Q1/21

Outlook

- FY22 Guidance reaffirmed at $130M-$135M (+25-30%)

- FY23 +30-35%

- GM will stay flat because higher-margin premises will go back from 42% of revenue to more historic 38-39%

- OpEx will still rise moderately on additional hiring

- Seasonality and the recent doubling of the sales team will produce a strong H2.

Risk

- Recession

- Inflation/supply chain

- Commoditization

The company is inflation-proof as they can maintain or even increase margins in the high-end RFID. They are also fairly recession-proof supplying many segments that sustain demand even in a recession like medical devices and cannabis, and the Federal Government.

On the commoditization risk, they are aware of this but they’re moving upmarket (Q1/21CC):

When you get more, I won’t say commoditized, but more low end, and then certainly when you get commoditized, then it can be a lower win rate. But frankly, more and more, we’re actually just trying to not be bidding in those categories where there’s not differentiation. So win rate is pretty high.

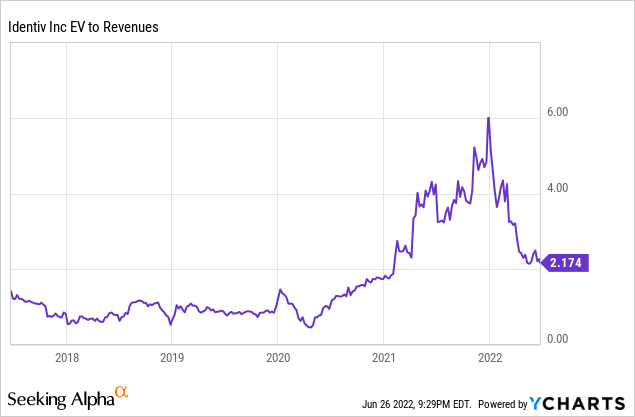

Valuation

Valuation metrics have come down, but for a company producing 35% gross margin and little in the way of profits yet these are still not cheap. Analysts expect EPS of $0.15 this year to rise to $0.45 next year.

But something remarkable is also visible, the sales multiple kept rising last year while those of most if not all other small growth companies we follow really reached their peak in February-March of 2021.

This indicates the market really acknowledging the fundamental improvement in the business outlook for the company, even if this year the multiple has come down substantially.

Conclusion

The company has multiple things going for it:

- Secular tailwind from RFID and Premises markets

- New focus on the commercial premises market, producing 3x the market growth

- The increasing sophistication of RFID solutions produces rising ASPs and margins

- Revenue growth is guided at 25-35% for this year and the next and accompanied by rising gross margins and operational leverage

- No supply chain issue and the company can thrive in a recession and/or inflationary climate

We think this is a long-term growth stock that has been sold off with the rest of the growth stocks, given the secular tailwinds from both segments. But they have to show they can produce decent earnings (which we have little doubt about). Won’t be an instant multi-bagger, more like a gradual compounder, and today’s prices offer a good entry.

Be the first to comment