marchmeena29

Since the last time we covered the iShares Ultra Short-term Bond ETF (BATS:ICSH), it has delivered a small positive total return compared to a small negative total return for the S&P 500 index. Going forward we think it is likely that ICSH will continue to deliver a positive total return now that its yield is more significant and will likely overcome the negative effect that the still increasing interest rates have on its existing bond investments.

As time goes by more and more of ICSH’s portfolio should be in higher yielding investments as the ETF reinvests maturing bonds. There is a lag between the Federal Reserve increasing rates and ICSH’s portfolio becoming higher yielding. This is influenced by the ETF’s average duration, which fortunately in ICSH’s case is not very high.

Seeking Alpha

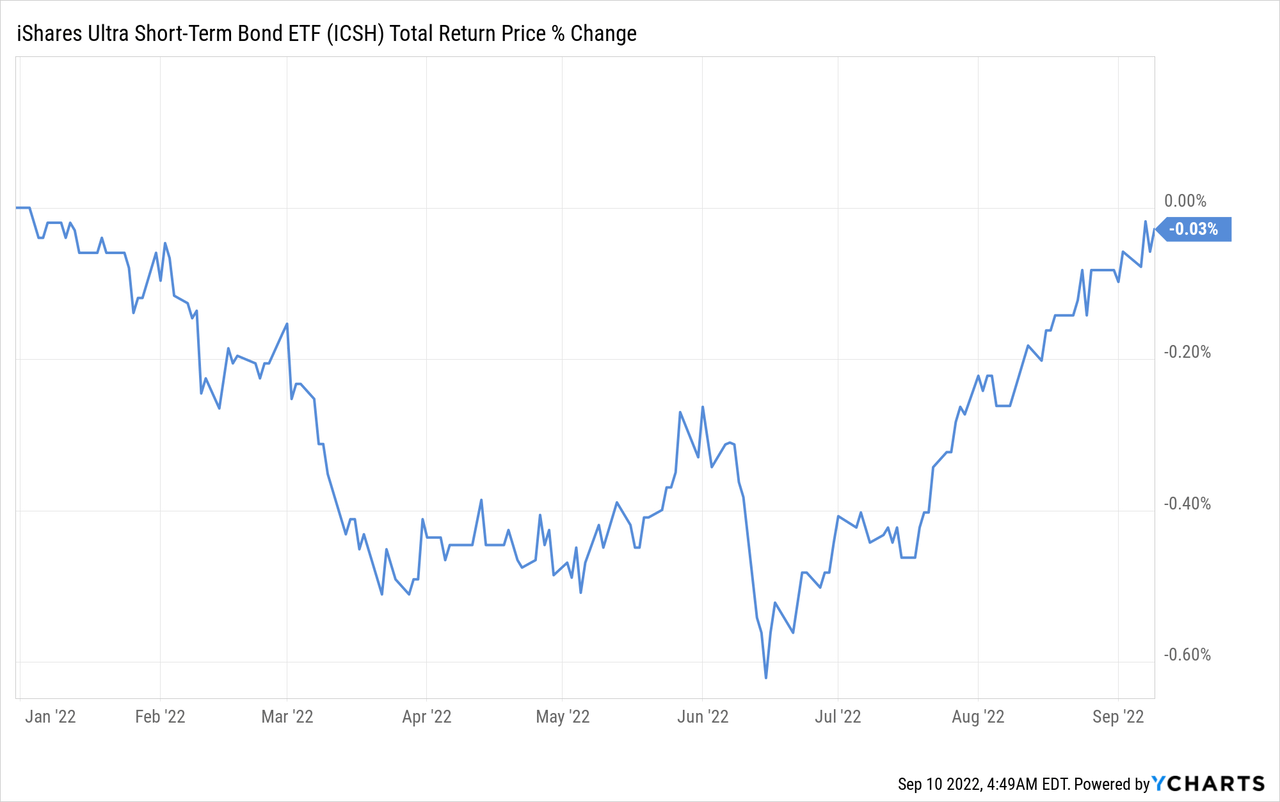

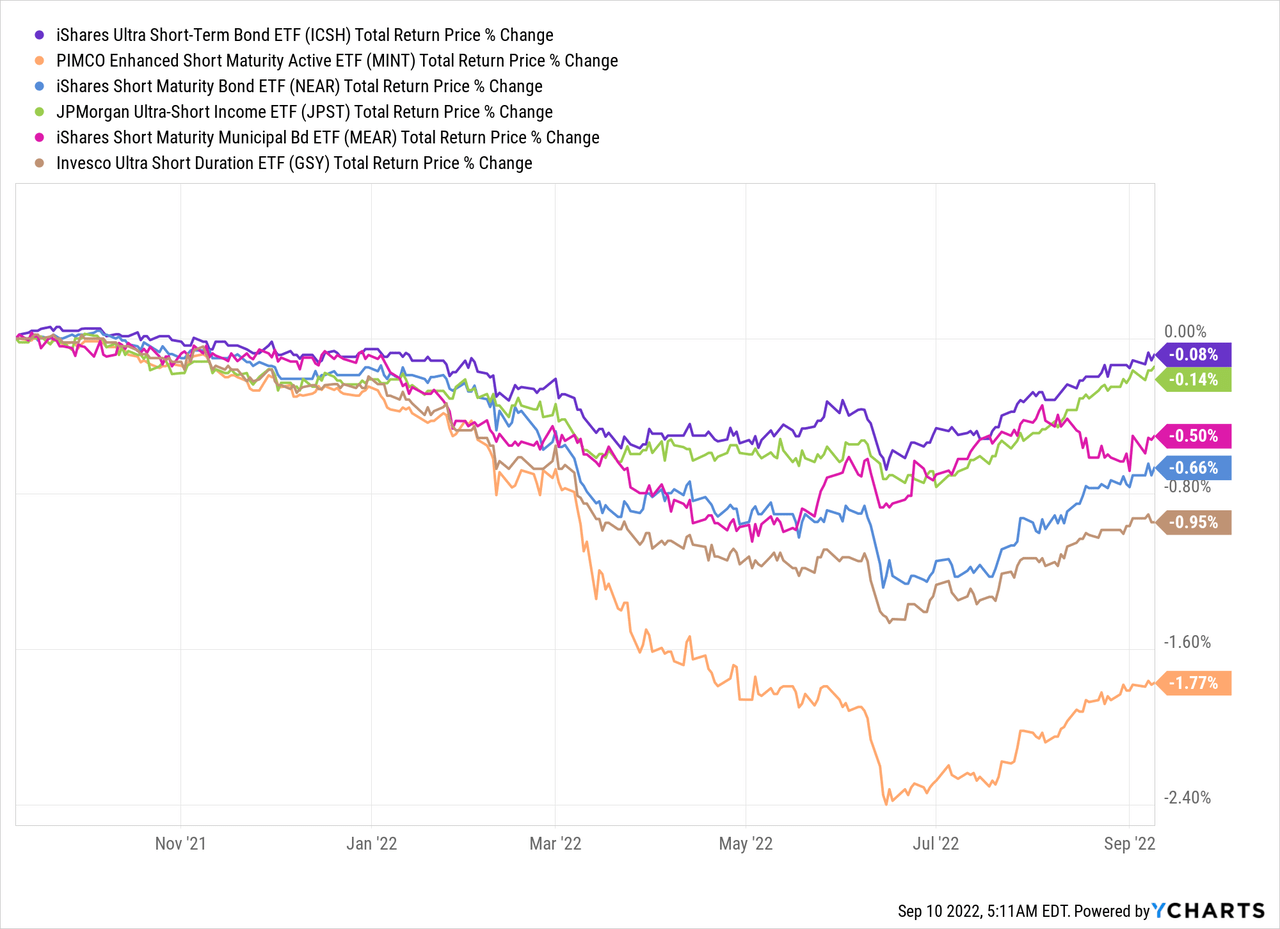

Looking at the YTD total return of the ETF, we can see the inflection point around the middle of the year, where the ETF’s yield started being bigger than the negative effect from interest rate raises, and since then the total return has trended positive.

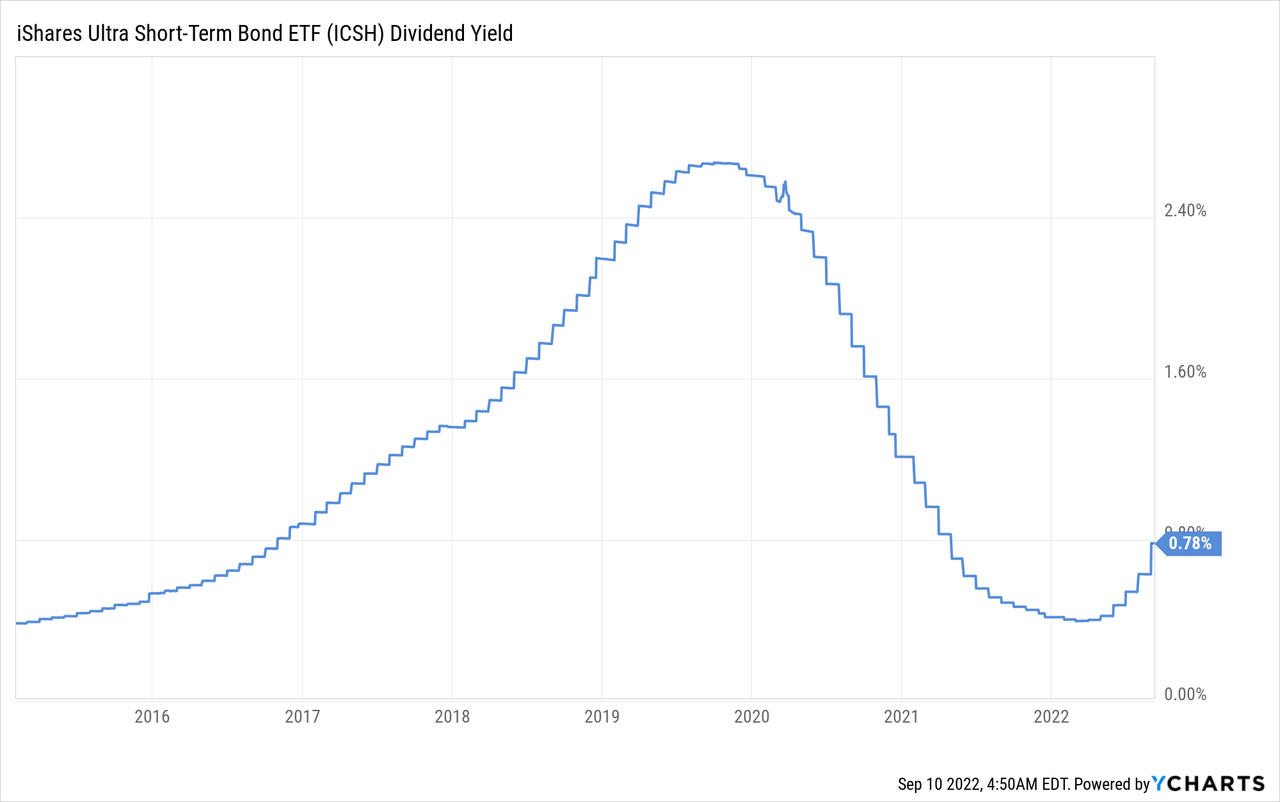

Another bit of good news for ICSH investors is that the dividend yield is now much more significant, and given the above-mentioned lag, plus the expectation of future interest rates, the yield should continue trending up in the short to medium term. Please note that the yield shown below is the 12-month yield, the 30-day SEC yield is currently 2.63%. Therefore an investor buying today can expect a much higher yield than what is shown below due to the time lag.

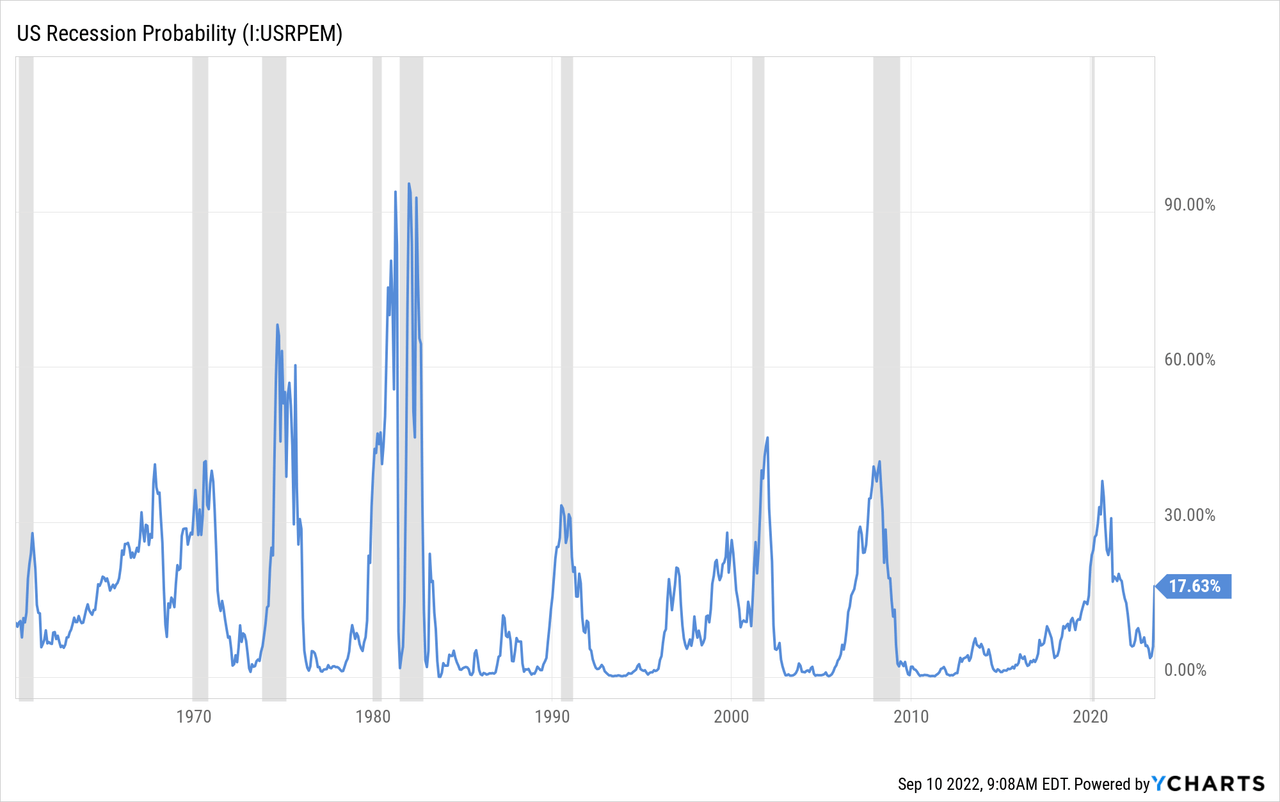

Some investors might be looking for places to park cash given the increased probability of a recession, and that is a good use for ICSH given its high credit quality and short duration. According to the Estrella and Mishkin model, the probability of a recession stands at 17%. That is much higher than it was just a few months ago, but still below the ~30% threshold after which a recession almost always happens.

Outperforming Similar ETFs

Compared to other similar ultra-short-term bond ETFs, ICSH continues delivering excellent performance. It has outperformed YTD, for example, the PIMCO Enhanced Short Maturity Active ETF (MINT), the BTC BlackRock Short Maturity Bond ETF (NEAR), the JPMorgan Ultra-Short Income ETF (JPST), the iShares Short Maturity Municipal Bond ETF (MEAR), and the Invesco Ultra Short Duration ETF (GSY).

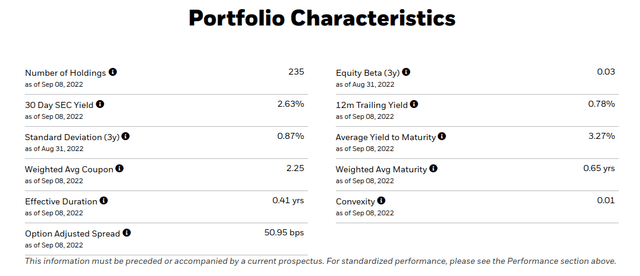

Portfolio Characteristics

The ETF portfolio characteristics are shown below, we would give particular importance to the average yield to maturity, which is currently 3.2%, and the 30-day SEC yield which is 2.6%. Effective duration remains quite low at ~0.41 years, and the portfolio is relatively well diversified with 235 holdings. It is important to remember that this is an actively managed ETF, so the composition of the ETF can change often. Also important to note, the distribution is paid monthly.

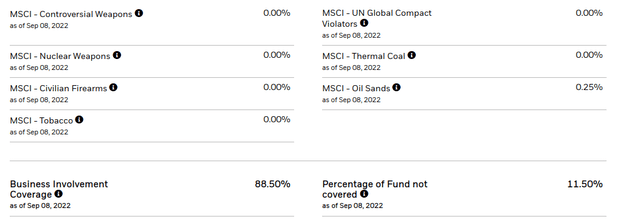

Sustainability Characteristics

One of the things we like about ICSH is that it is transparent about its sustainability, and that it avoids most controversial industries. The only one where it has a small allocation of 0.25% is oil sands, and we wish it would go all the way to 0%. Last time we covered the ETF, the allocation to oil sands was at 0.28%, so it is going in the right direction.

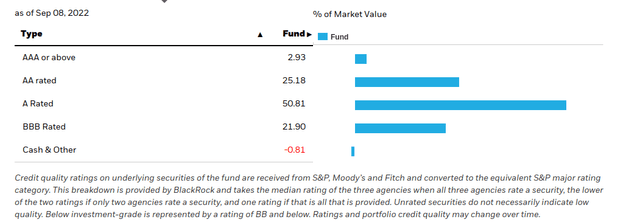

Exposure Breakdowns

The ETF has a very high average credit rating, and it has improved since the last time we covered it in May this year. Now only 21.9% of its bonds are BBB rated, last time, it was 23.4%. Meanwhile, AA-rated bonds have gone up from 24.4% to 25.1%, and AAA from 1.3% to 2.9%. We feel very comfortable about the overall credit quality of the ETF.

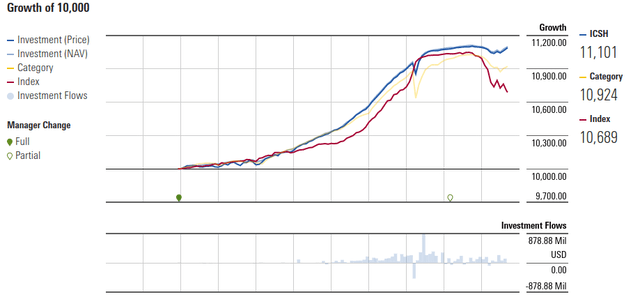

Morningstar Rating

Morningstar gives ICSH a four-star rating, and it shows that it has outperformed its category and its index since inception. It is interesting to note too that the fund has had significant inflows, and rare outflows, which means more investors are finding it attractive.

Risks

BlackRock’s iShares makes clear that ICSH is not a money market fund and that it is actively managed by BlackRock’s cash management team. While we believe the risk of significant permanent capital loss for long-term investors is very low, there is risk in that the ETF holds investments with a certain amount of risk. The broad diversification and credit quality of the ETF’s portfolio mitigate these risks. There is also interest rate risk and inflation risk when investing in ICSH.

Conclusion

Thanks to the Federal Reserve hikes, and enough time passing for ICSH to reinvest a large part of its portfolio, the ETF is yielding a very decent amount compared to May 2022. With a 30-day SEC yield of 2.6%, ICSH is again an attractive place to park cash. The average yield to maturity of the ETF’s portfolio is a bit higher at 3.2%. We are therefore very optimistic that the ETF can provide positive total returns to investors, even if the Federal Reserve continues increasing rates. For investors interested in parking some cash in a short-term investment vehicle, we believe ICSH is one of the best options to consider.

Be the first to comment