sanjeri

The ongoing market-wide sell-off has eroded valuations across the board, but the comprehensive selling has uncovered numerous opportunities for investors to initiate a position in a newly discovered ticker. Some of these tickers are now heavily discounted and present absurd risk-rewards prospects. iCAD (NASDAQ:ICAD) has not been exempt from blanket selling and has lost roughly 81% of its value over the past twelve months regardless of its long-term growth trends and heavily discounted valuation. I consider ICAD to be a leading candidate for the Compounding Healthcare “Bio Boom” portfolio at these values.

I intend to provide a brief background on iCAD and will discuss why ICAD is a Bio Boom candidate. In addition, I deliberate on some of ICAD’s downside risks and how they will impact my strategy for managing a speculative position. Lastly, I lay out my game plan for initiating a starter position in ICAD.

Background on iCAD

iCAD is a healthcare tech company that offers products and solutions for the treatment of cancer including image analysis, solutions, and radiation therapy. iCAD operates in the U.S. through two segments, Cancer Detection and Cancer Therapy that have a full array of computer-aided detection “CAD” and workflow solutions including AI algorithm solutions that handle the communications between imaging acquisition systems, and image storage and review systems.

The company’s SecondLook is a machine-learning cancer detection algorithm that analyzes digital mammography images. iCAD also offers automated density assessment solutions to improve workflow. Furthermore, the company has ProFound AI, another deep-learning algorithm intended to distinguish malignant soft-tissue densities and calcifications in digital breast tomosynthesis. The ProFound AI Risk provides breast cancer risk valuation using a screening mammogram. iCAD has magnetic resonance imaging applications for breast and prostate cancer detection. VeraLook is for the discovery of colonic polyps. Furthermore, the company has their Xoft Axxent electronic brachytherapy systems for the treatment of breast cancer, non-melanoma skin cancer, and gynecological cancers.

The company’s primary customers are university researchers, hospitals, cancer care clinics, veterinary facilities, and dermatology offices in the U.S. and around the globe. The company sells its products and services through direct sales organizations, in addition to partners, and distributors.

iCAD is a medical technology company in the growing global cancer therapy market. The company’s primary cancer markets include breast cancer, which has roughly 300K women diagnosed every year in the United States. In addition, iCAD works in the colon cancer market, which is one of the most common cancers, with greater than 1.1M new cases diagnosed worldwide in 2020. iCAD also services the NMSC market, which has roughly 3.5M cases diagnosed annually in the United States. The global endometrial cancer market has around 800K new cases each year. In addition, the company works in the brain and nervous system tumors market, which has about 297K new cases worldwide annually.

Recent Performance

For Q2, iCAD’s total revenue was $7.6M, which was a 3.2% decrease over Q2 of 2021. Cancer Detection revenue increased by 10.4% compared to Q2 of 2021. Therapy revenue decreased by 24.7%, compared to Q2 of 2021. Net loss for Q2 was $3.1M down from $3.3M in Q2 of 2021. In terms of cash, the company finished Q2 with $27.2M, down from $29.8M in Q1 and $37.9M in Q2 of 2021.

The company boasts strong gross profit margins at ~73%, however, the company has a long history of undulating earnings that have failed to generate positive earnings.

A “Bio Boom” Candidate

The Bio Boom Portfolio comprises healthcare companies that are typically not profitable and are very speculative, yet, they present considerable upside attributable to a potent upcoming catalyst, projected revenue growth, or a prospective turnaround. Typically, these are small to mid-cap companies with volatile tickers that will allow recurrent trading opportunities to help generate considerable profit while mounting a “house money” position. These tickers will be traded as long as it is in play or the company graduates to the Bioreactor Portfolio.

I am looking to put ICAD in the Bio Boom Portfolio at this time because I believe ICAD does have a number of Bio Boom characteristics that point to notable upside potential from these current prices. Primarily, I believe ICAD is trading at a discount for its current and projected revenues. ICAD is trading around a 1.5x price-to-sales for its projected 2022 revenues.

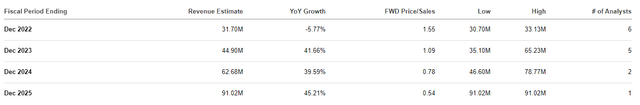

ICAD Revenue Estimates (Seeking Alpha)

The sector’s average is around 4x-5x and the industry’s average comes in around 4x, so we can say ICAD is trading at a significant discount to its peers. What is more, that ratio will only improve in the coming years as the company continues to grow, and is expected to drop below 1x price-to-sales. The Street’s revenue estimate for 2024 is $62.68M, which would be around $12 per share. Considering the stock is trading at around $2 per share, I would think it is safe to say that ICAD is trading at a huge discount for its forward revenue estimates.

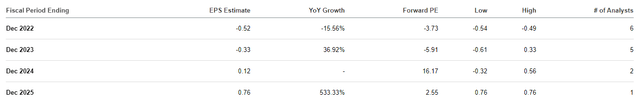

Indeed, the company is not reporting a positive EPS at this time, however, the company’s anticipated growth is projected to push over breakeven in the coming years, which could allow the ticker to be priced at a fair valuation.

ICAD EPS Estimates (Seeking Alpha)

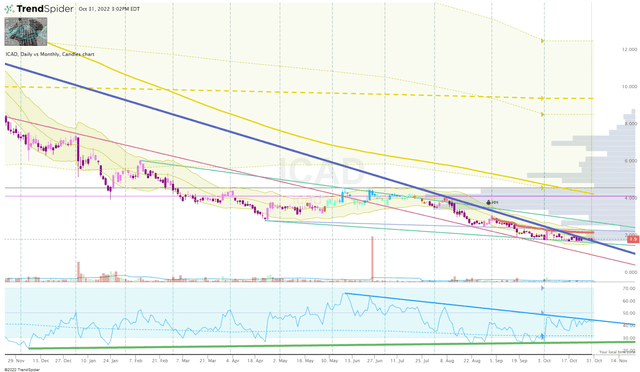

Another aspect to consider is the ticker’s oversold state thanks to the market-wide sell-off. Like many small-cap healthcare stocks, ICAD has lost more than 80% of its value over the past twelve months and is shockingly trading outside both the Daily and Monthly Keltner Channels. If these small-caps get a “snapback” mean reversion move in the coming months, ICAD might come along for the ride.

ICAD Daily Chart (Trendspider)

ICAD Daily Chart Enhanced View (Trendspider)

Indeed, we don’t know if or when a potential snapback move will occur and how much the ticker will rise. Considering the stock is trading around or just under $2 per share, we wouldn’t need a huge move to capture significant profit, which could allow an investor to move their position to a “house money” status.

Besides the fundamentally undervalued and technically oversold characteristics, iCAD also offers solid long-term investment potential. iCAD appears to have the prospects to be a strong competitor in medical technologies, with a comprehensive portfolio of clinical and workflow solutions as well as technologies for the detection and treatment of a variety of cancers. iCAD has also made the wise move of incorporating AI into the products and services, which can give them a competitive edge in growing addressable markets of the diagnostics medical technology industry. I would not claim that iCAD is perfectly positioned to become the clear market leader, however, being a competitive company in growing markets should bode well for the company’s long-term growth prospects, which could make it a great acquisition target for a suitor.

Essentially, iCAD has the ingredients to see a near-term bounce for a quick profit but has the potential to be a multi-bagger in the long term.

ICAD Risks

ICAD has multiple risks that investors should consider when establishing and managing their positions. First, is the competition who are operating in the same highly competitive markets as iCAD with their own cutting-edge products. Many of these competitors have superior resources than iCAD and are entrenched in the healthcare market. iCAD’s Cancer Detection segment has solid competition from Hologic (HOLX), Volpara Solutions (OTCPK:VPAHF), ScreenPoint Medical, Densitas, Therapixel, and Lunit. The company also has stiff competition from larger players including Siemens Medical (OTCPK:SEMHF), GE Healthcare (GE), and Philips Medical Systems. The company’s Cancer Treatment segment has to match up against Carl Zeiss Meditec (OTCPK:CZMWF), Sensus Healthcare (SRTS) Varian Medical Systems, Elekta (OTCPK:EKTAF), and IntraOp Medical Corporation. These competitors could simply outperform iCAD in the labs or on the market, thus, hurting iCAD’s likelihood of achieving its potential.

Second, iCAD is reporting losses with meager growth, which will most likely prevent the ticker from being valued in line with its peers. Investors need to accept there is a possibility the market will need to see definitive evidence that iCAD is a consistently profitable company and has established a steady growth trajectory before it starts bidding the ticker up.

Third, ICAD is an underfollowed micro-cap stock that has little-to-no hype around the ticker. Even if the company makes significant progress and starts reporting a positive EPS, it is possible the market gives the ticker an underwhelming response. It is conceivable that ICAD will never trade at a fair… much less a premium.

Finally, the company’s $27.2M cash position could eventually become a concern. Indeed, iCAD is only burning a few million a quarter at their current burn rate, but that could change if the company needs to develop or acquire new products in order to facilitate some growth. Clearly, the company would either have to take on some debt or execute some dilutive funding to raise the capital needed to extract additional growth while keeping the lights on.

Considering these points above, I have set ICAD’s conviction level to 2 out of 5.

My Plan for ICAD

Admittedly, I don’t expect to make ICAD a major component of the Bio Boom portfolio, however, I am willing to initiate a position in the immediate term to take advantage of the current share price ahead of their Q3 earnings on November 10th. I will look to accumulate a respectable position in the coming months in anticipation we will see a snapback move that could provide an opportunity to book significant profit, and possibly move my ICAD position into a “house money” state for a long-term investment. This will allow me to have exposure to ICAD upside potential, but the position will be de-risked with only profits left on the table.

Keep in mind, ICAD is a speculative micro-cap stock with significant risks. It is possible an investor could lose the majority or the entirety of their investment.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment