Sundry Photography

Technology stocks have been battered for most of 2022. There are many names that I consider of the highest quality that have been absolutely destroyed this year, but that’s not the case for all tech stocks. In fact, IBM (NYSE:IBM) has bucked the trend and has actually outperformed the broader market by a wide margin in 2022.

I’ve made it no secret that I don’t see any reason to own IBM, including in my last update back in March. I said then the ~5% yield wasn’t good enough to warrant owning the shares, unless you are focused on income and nothing else. Today, even though IBM has returned -5% since that article against -18% for the S&P 500, I still don’t think this is one you want to own near a market bottom. The reason is simple; IBM is a defensive stock in tech – if there is such a thing – which is why it has outperformed this year during a horrendous bear market. When we turn higher, defensive names are the last thing you want to own, so I’m sticking to my sell call here.

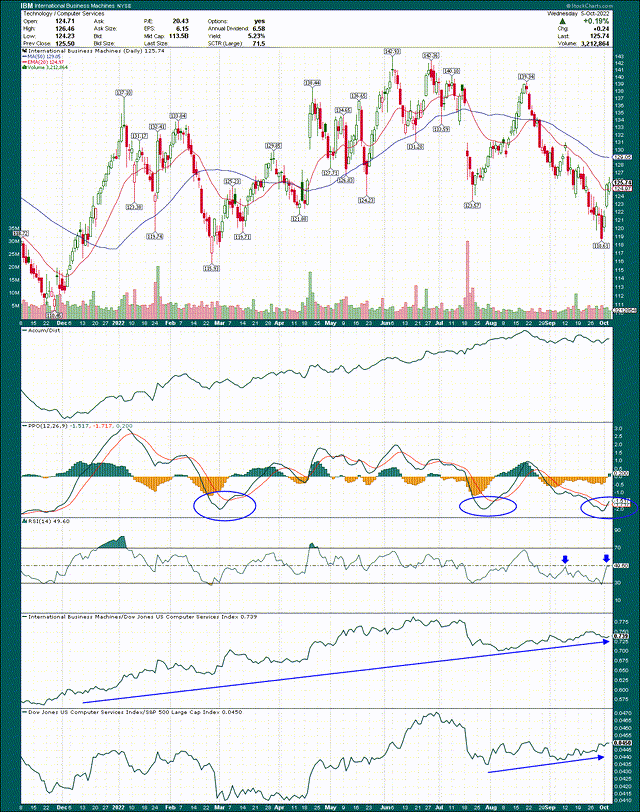

Looking at the daily chart, I don’t see a lot of cause for long-term optimism, although the stock is oversold on a short-term basis. We can see there have been several rally attempts, but all have ultimately resulted in another turn lower. This current rally attempt is the result of a long string of declines that produced a PPO reading near -2, which is where the stock has bounced in the past. This one is no different, but do not mistake a bounce for a rally.

The 14-day RSI, which is a shorter-term indicator than the PPO, hasn’t cleared the centerline in the past two rally attempts. That’s the sign of a stock with a lack of bullish momentum, and it’s why I said not to mistake a bounce for a rally; this is one of the ways you can tell the difference.

On a relative strength basis, as I said, IBM has been great this year. It’s convincingly outperformed its peer group, which in turn, has outperformed the S&P 500. That’s the kind of thing you want to see from your stocks, but as I said, given IBM is defensive in the tech group, this outperformance makes sense during a bear market. Rest assured this relative strength will flip on its head when we do turn higher, because Wall Street wants exposure to growth during bull markets, and IBM simply doesn’t have it.

Speaking of growth…

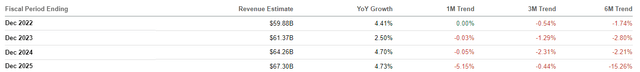

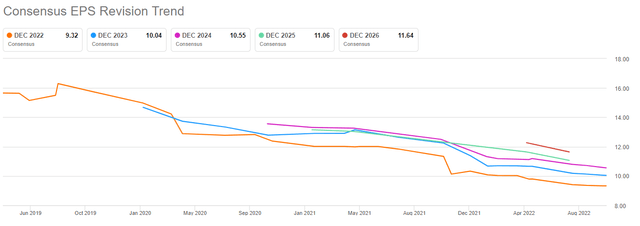

I’ve long maintained that IBM is a company that struggles to hit its own guidance, and therefore, estimates that Wall Street produces. This is, of course, highly undesirable because it means that when investors try to value the stock, they are doing so with shrinking estimates. Plus, there aren’t many investors that want a stock with shrinking estimates, given those stocks that perform the best are the ones consistently raising guidance and beating estimates. IBM hasn’t been one of those stocks in decades, literally, and today is no different.

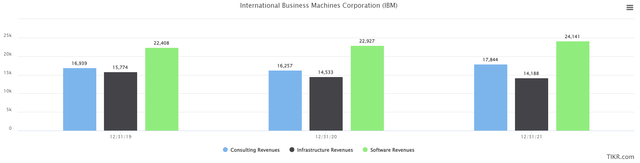

Let’s take a look at revenue, beginning with a historical view of its three major segments.

One of the things you must understand about IBM’s revenue is that it is choppy. All of its segments produce oscillating revenue – rather than steadily growing revenue – and that generates the same on a consolidated enterprise basis. This is not a desirable trait, and it means that even though there’s clear leadership from software, even that segment has struggled in the past to produce growth.

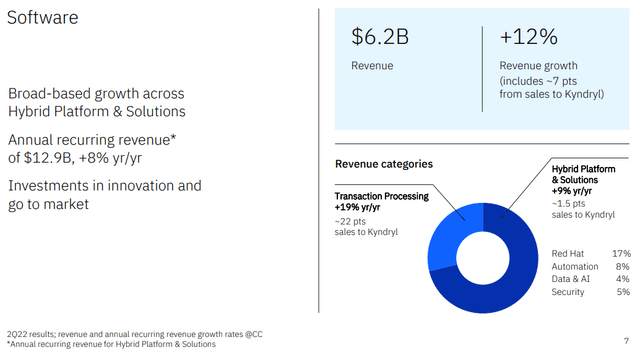

The most recent quarter saw software produces 8% growth in annual recurring revenue, which is fine, with the best growth from transaction processing. Red Hat continues to be a growth driver for IBM, and in my opinion, is one of the best things this company has ever done with its capital. The second best thing was spinning off Kyndryl (KD), which is now a significant customer of IBM. Kyndryl is obviously a captive audience when it comes to revenue for IBM, so as long as Kyndryl is around, IBM has some built-in software revenue growth.

But as we can see, that simply hasn’t been enough, and I don’t think it ever will be based on IBM’s history of missing its own guidance. Below are revenue estimates for the next few years, and the revision history of those estimates.

We’re looking at current estimates of 3% or 4% growth annually, but with nearly-constant revisions downward to those. The best the company can show is a lack of negative revisions on this year’s numbers in the past month; it’s a sad state of affairs. However, anyone that has followed IBM for any period of time knows one thing this company is always good for is missing estimates. This is not new.

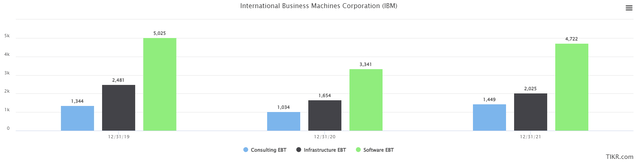

Moving to earnings, below we have the same chart as above, but with earnings before taxes instead of revenue.

Software’s dominance is very clear here, given margins are much better than the other segments. That means that if you insist on owning this stock for whatever reason, you want to keep a keen eye on software’s performance. The others simply don’t matter nearly as much when it comes to earnings and cash flow. The fact that IBM has some growth drivers in software is a good sign, but is it enough to overcome weakness elsewhere? You can be the judge of that.

Looking ahead

We’ve touched on two of the drivers of EPS growth – revenue and margins – but IBM has spent tens of billions of dollars buying back its own shares in the past couple of decades. The company’s “strategy” used to just be to milk as much cash from its business as possible and then spend almost all of it on repurchases, hoping financial engineering would work its magic into EPS growth. While I’m a fan of buybacks when they’re done correctly, IBM’s blunt force approach never worked because it forgot to stay competitive in the marketplace. Newer leadership is focusing more on the actual business rather than just buying as many shares as possible, but the end result doesn’t appear to be that different.

EPS revisions just continue to go lower, and it’s still happening today, as it has for many years. This makes it challenging to value IBM on a P/E basis because you simply don’t know how low the “E” part of the equation will go. That’s also why Wall Street prefers stocks with growing “E” values because it means the share price must rise in order to maintain the same valuation; IBM has the opposite issue.

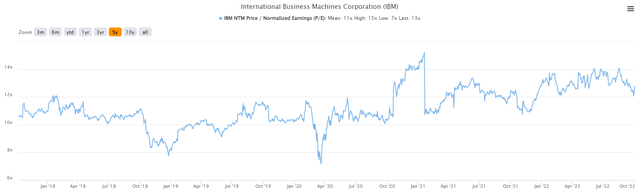

What’s interesting is that despite IBM’s complete inability to even meet estimates – let alone beat them – the stock is actually quite near its highs in terms of valuation. Below we have five years of history of forward P/E ratios to illustrate this point.

The stock trades today at 13X forward earnings, against a five-year average of 11X. It’s certainly in the upper echelons of historical valuations, which is perhaps understandable given 2022 has been awful for the markets, and therefore good for defensive names. However, this overvaluation (as I see it) should unwind pretty quickly once the bull market returns. I’m of the view that the bull market has either already begun again or is quite close to doing so, and given that, names like IBM will almost certainly be discarded to the back burner again.

One quick note on the dividend is that IBM’s yield is exemplary at 5.2%. It’s a proper income stock, and as we can see, the yield is very high by historical standards.

If you’re a pure income investor, maybe that’s good enough for you to own it. I’m not, and I see no reason to own this stock other than the yield, if that’s your thing.

We have a stock that is overvalued on a historical basis, has very little growth to speak of, years and years of declining revenue and earnings estimates, and no catalysts that I can see that would change any of those characteristics. The chart looks pretty weak to me, and this appears to be a bounce, and not a rally. I’m sticking to my sell recommendation for IBM as I think it’s relative outperformance in 2022 is coming to an end.

Be the first to comment