Ethan Miller

We are bullish on International Business Machines Corporation (NYSE:IBM) based on our belief that the company is well-positioned to benefit from strong demand for hybrid cloud and AI. IBM is best known for producing and selling computer hardware and software, as well as cloud computing and data analytics. We expect IBM’s position within the digital media market to drive growth in its largest segments, Software, and Consulting.

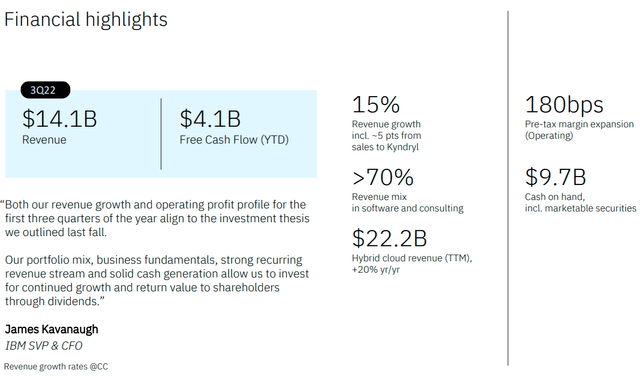

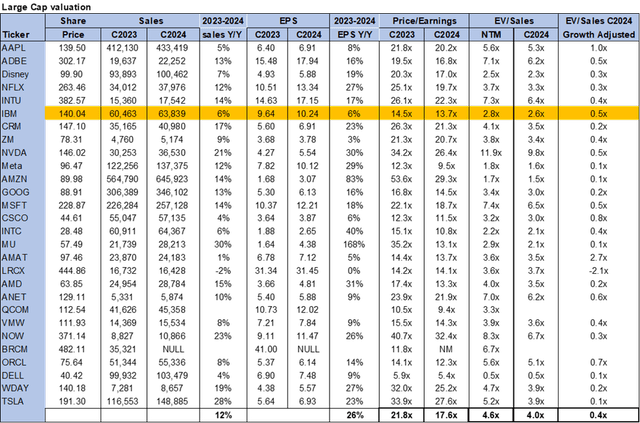

Despite inflationary pressures and foreign exchange headwinds, IBM reported a stellar 3Q22. The company witnessed growth in its Software, Consulting, and Infrastructure segments but came short in its Financing segment. YTD, the company is up around 6%. We expect IBM to continue to grow meaningfully in 2023 as it benefits from global digitization. We’re constructive on IBM as its addressable market in hybrid cloud, and artificial intelligence (AI) expands. IBM’s hybrid cloud platform, AI technology, and services capabilities support customers’ digital transformations and help them engage with their clients and employees in new ways. IBM is also relatively cheap, trading at 13.7x C2024 on a P/E basis compared to the average peer group of 17.6x. We recommend investors buy the stock at current levels.

Hybrid and AI demand tailwinds

IBM is essentially a technology company providing hybrid cloud and AI solutions. Our bullish sentiment is based on the expectation that IBM will benefit from the global shift to the cloud. The global hybrid cloud market size is expected to grow at a CAGR of 18.4% between 2021-2030. We believe IBM is evolving as a cloud and data platform provider, and we expect the company to ride the upward trend in the hybrid cloud market. IBM’s 3Q22 report showed particular strength in the company’s software and hybrid cloud business lines. The company’s evolving its cloud platforms, specifically with its Red Hat acquisition, and we believe this is being reflected in revenue. IBM reported revenue of $14.1B in 3Q22, beating estimates despite macroeconomic headwinds.

Around 70% of IBM’s annual revenue in 3Q22 was derived from its Software and Consulting segments. IBM’s software segment encapsulates a significant amount of the company’s hybrid platforms and solutions. We expect IBM to benefit from the increased digitalization of enterprises, as about 80% of all enterprises employ some sort of cloud computing.

The following image shows IBM’s Financial Highlights for 3Q22.

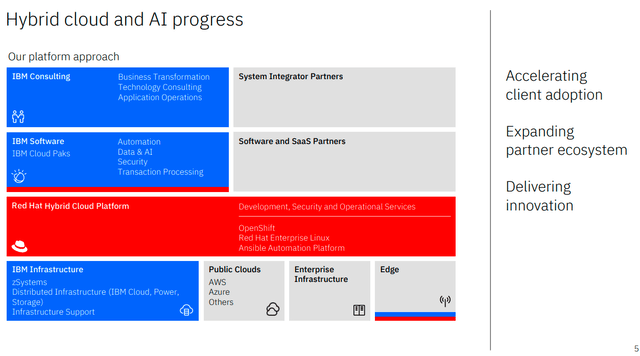

Red Hat acquisition serves as added leverage

We believe IBM’s Red Hat acquisition is a major advantage for the company in the cloud for the business market. We expect IBM will leverage Red Hat to build its place as the go-to hybrid cloud platform provider. We believe cloud platforms remain IBM’s winning ticket for growth in 2023. We expect the acquisition will improve IBM’s position in the cloud market. IBM now offers Linux operating system through Red Hat Enterprise Linux and a hybrid cloud platform through Red Hat OpenShift that helps enterprises with digital transformation. We expect Red Hat to bolster IBM’s TAM with a solid client base, including American Express, Bharti Airtel, Vodafone, and Banco Sabadell, among others.

The following image outlines IBM’s hybrid cloud and AI progress through segments.

A hand in blockchain technology, too

We’re excited about IBM’s position as a blockchain technology provider. We believe the company is positioned to benefit from robust adoption and broad-based availability in IBM Blockchain World Wire – a blockchain-driven global payments network. The network is aimed at accelerating and optimizing cross-border payments. It means that funds can be transferred at a fraction of the cost and time compared to traditional correspondent banking. We believe that this segment will become another significant growth catalyst in 1H23.

Risks to our bullish thesis

While IBM operates in the booming cloud computing market, this makes it highly exposed to competition. IBM faces stiff competition from giants like Amazon’s (AMZN) Amazon Web Services (AWS) and Microsoft’s (MSFT) Azure. In the hardware enterprise servers and storage segment, the company faces competition from Dell (DELL) and Oracle (ORCL), among others. In the IT services business, IBM is facing pricing pressure from HP (HPQ). IBM is facing competition on all fronts, but we believe the company’s taking the necessary steps to support its growth in 2023.

IBM is also at risk from the nature of the business’ time-consuming transition to the cloud. Foreign exchange volatility also remains a significant concern. We expect that the company has been cutting costs to maintain profits based on a higher profit on lower revenues. The company ended its 3Q22 with a $3.21B loss from continuing operations.

Despite these risks, IBM has been returning cash to shareholders for over a decade. We believe that IBM’s strong free cash flow generation is expected to provide the financial flexibility required for strategic investments in the current changing business environment.

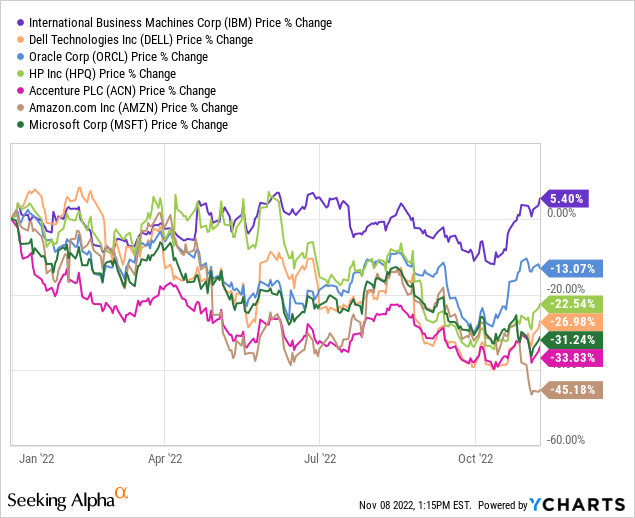

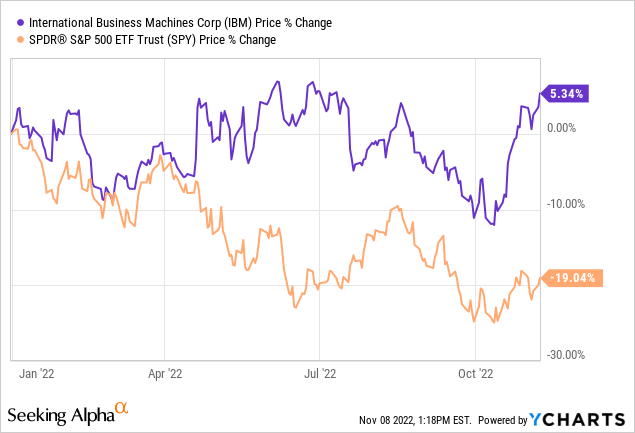

Stock Performance

IBM is up around 6% YTD, which cannot be said for most of its competition in the tech space. The company outperforms the competition on the YTD metric, with Dell down about 27%, Oracle around 14%, HP approximately 23%, Accenture around 34%, Amazon around 46%, and Microsoft about 32%. YTD, IBM has also been outperforming the S&P index, down around 19%.

The following graphs show Adobe’s performance among competitors and the index YTD.

TechStock Pros

TechStock Pros

Valuation

We believe IBM is relatively cheap. On a P/E basis, IBM is currently trading at 13.7x C2024 EPS of $10.24 compared to the average peer group of 17.6x. On an EV/Sales, IBM is trading at 2.6x C2024 sales versus the peer group average of 4.0x. We believe IBM is a value stock and recommend investors buy the stock at current levels.

The following chart illustrates IBM’s valuation relative to its peer group.

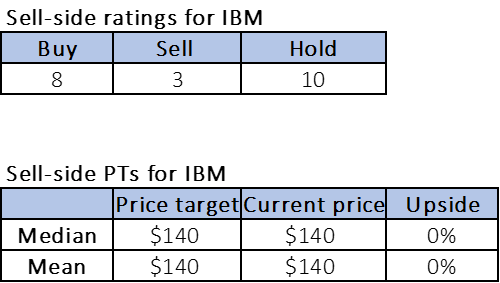

Word on Wall Street

Of the 21 analysts covering the stock, eight are buy-rated, ten are hold-rated, and the remaining are sell-rated. IBM is currently trading at around $140. The median price target is $140, and so is the mean price target with no potential upside. The following chart indicates the sell-side ratings and price targets.

TechStockPros

What to do with the stock

We are bullish on IBM as the company outperformed estimates and the peer group despite macroeconomic headwinds. We expect that increased global digitization of business and enterprise will drive demand for hybrid cloud and AI and believe this will be a major growth catalyst for IBM. We recommend investors buy IBM stock at current levels.

Be the first to comment