JJFarquitectos

After having commented on Enel’s Strategic Plan with a publication called 8.2% dividend yield in 2023 cannot go unnoticed, today we follow up on Iberdrola (OTCPK:IBDSF) (OTCPK:IBDRY). The Spanish energy conglomerate presented a three-year business plan in London and, as promised in our last analysis – Capital Market Day Next Supportive Catalyst – our team was back to analyze Iberdrola’s 2023-2025 forecasted financials as well as its ESG targets update.

Strategic Plan

All in all, the 2025 objectives disclosed were slightly ahead of us but much higher than Wall Street consensus expectations. Indeed, we are not surprised to see a positive stock reaction and consequently, our long-term thesis is playing out nicely. Since our last update, Iberdrola is up by more than 15% compared to the S&P 500 return at 3.56%.

Mare Evidence Lab’s previous publication

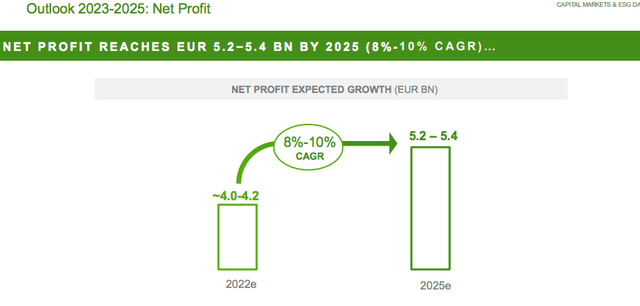

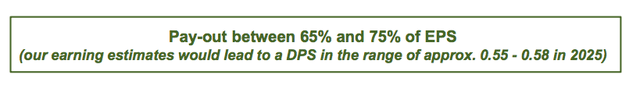

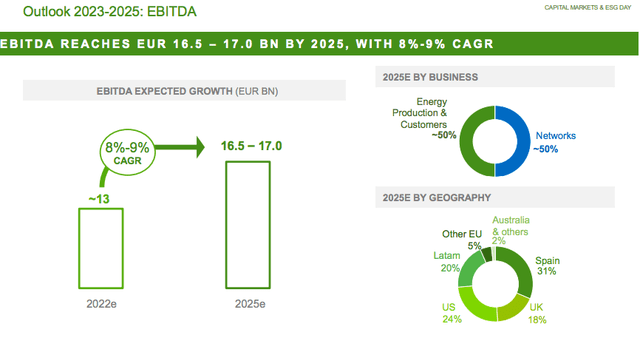

Speaking of numbers, Iberdrola’s 2025 EBITDA target was set in a range between €16.5 and €17 billion versus the consensus expectation of €16.2 billion (Fig 1). Iberdrola’s highest beat was in the Network division. Going down to the P&L, the company’s net income is expected to reach a number between €5.2 and €5.4 billion, and again Wall Street equity research analysts were pricing in an average of €5.0 billion (Fig 2). As already mentioned, we were slightly ahead of consensus estimates and slightly below Iberdrola’s expectations. The reason is execution risks, regulatory risks, and uncertainty in the current economic environment. One of the surprises was organic CAPEX which was set at €36 billion in the three-year period with a dividend per share estimate from €0.55 to €0.58 (compared to the expectation set at €0.55 in year three) (Fig 3). Aside from the CAPEX number consideration, Iberdrola is targeting 12GW additional renewable projects, with 25% coming from onshore Solar PV solutions. A few investors noted that logistic constraints and higher procurement costs will slow down Iberdrola’s activities; however, even if we believe that this is partially true, the new EU regulation fully supports renewable asset growth and regulatory risks are easing around the Globe. If we look at the company’s track record, we are impressed with Iberdrola’s newly installed capacity, and this was also emphasized in our previous publication (key takeaways number 4).

Fig. 1

Fig. 2

Iberdrola Net Profit estimates

Fig. 3

Iberdrola DPS estimates (Iberdrola Capital Market Day)

At Iberdrola’s analyst day, the company reported that it does not have trading gains incorporated in the guidance as other energy conglomerates do. Regarding the UK windfall taxes, the company has been working with the government and according to the latest rumors, it seems that the UK decided to drop both the RO-to-CfD scheme and the top-line sales cap. On the debt side, given the current rate environment, interest expenses are now much higher, and we should note that the Spanish company has an average debt maturity that is shorter compared to its peers (6.5 years duration). In detail, looking at the 10-year utility debt, marginal borrowing costs are at almost 6% in the UK and in the US, and approximately 4.5% in continental Europe. The hybrid debt market is even more expensive and asset rotation is surprisingly low. Compared to Enel, Iberdrola disposals are <15% than its CAPEX plan. This is why the company is preferring to work with equity-financed solutions rather than debt. According to the company business plan, the net debt/EBITDA target is at 3.4x, with a clear improvement in funds from operations/net debt over the period. Regarding Avangrid, Iberdrola’s US subsidiary, the company is confident that the PNM Resources acquisition will be completed in Q2 2023.

Conclusion and Valuation

Here at the Lab, we believe that this plan fully accommodates the current macroeconomic environment with high energy prices, and important interest rates to consider even looking at the inflation expectations. Looking at Iberdola’s track record and its continued work to diversify its operation at the global level, we continue to rate the stock with a buy target of €12 per share. As already mentioned, we are slightly ahead of Wall Street expectations, and our valuation is derived by a P/E of 15.2x on our 2023 expected numbers.

Be the first to comment