eyegelb/iStock via Getty Images

We’re nearing the end of the Q4 Earnings Season for the Gold Miners Index (GDX), and one of the first miners to report was IAMGOLD (NYSE:IAG). Not surprisingly, we saw another year of lower output at higher costs, with all-in sustaining costs coming in ~32% above the industry average. The 2022 outlook isn’t any better from a cost standpoint, and Iamgold has warned that capex could come in above the already upwardly revised estimate at Cote. Although a board shake-up is positive, the problem is that it’s more difficult to turn around a low-quality portfolio (Rosebel, Westwood). Hence I see no reason to chase Iamgold above $3.50.

Cote Gold – Construction Progress (Company Presentation)

Iamgold released its Q4 and FY2021 results last month, reporting attributable gold production of ~601,000 ounces at all-in sustaining costs [AISC] of $1,426/oz. This was a pathetic performance, to say the least, with gold production 9% below the guidance mid-point (665,000 ounces) and AISC coming in more than 13% above the guidance mid-point. While this was partially related to a non-cash write-down on ore stockpiles, the only real bright spot for the year was Essakane, which reported record production and picked up some of the slack from Westwood and Rosebel. Let’s take a closer look below:

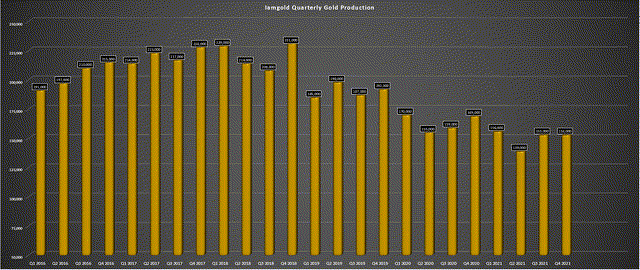

Iamgold – Quarterly Gold Production (Company Filings, Author’s Chart)

As shown above, Iamgold has seen a steady decline in production over the past few years, and if not for record production from Essakane in 2021, this trend would look even worse. In fact, the only two consistent up-trends for Iamgold have been rising capex estimates at its Cote Gold Project in Ontario and rising operating costs on a consolidated basis. The lower production in 2021 was attributable to Rosebel, where production fell 27% year-over-year to ~154,000 ounces, and Westwood, where annual production slid more than 50% with the underground in care & maintenance for H1 2021.

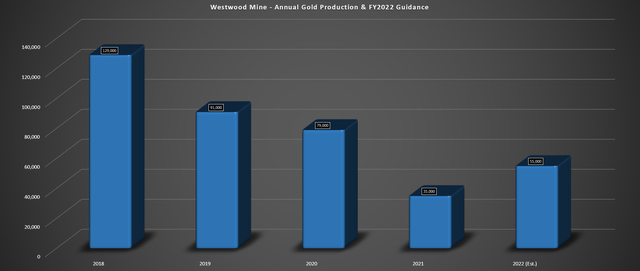

Westwood Operations – Annual Production & Guidance (Company Filings, Author’s Chart)

Looking at Westwood’s production above, we can see that this marked another consecutive year of lower production at the asset. As noted above, this was driven by a much lower contribution from the underground due to seismicity risks. The other headwind has been labor shortages, which, combined with COVID-19 headwinds led to increased absenteeism in Q1. During FY2021, just 106,000 tonnes were mined underground vs. 370,000 tonnes in 2020, explaining the lower grades (1.24 grams per tonne gold vs. 2.83 grams per tonne gold and much lower production for the asset. Given the higher throughput combined with lower grades/recovery rates, costs soared to $2,600/oz in FY2021 at Westwood.

Costs, Margins & Revenue

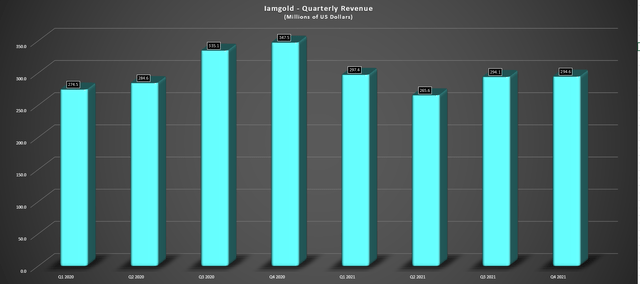

Moving over to revenue, costs, and margins, Iamgold posted lower revenue on a year-over-year basis, which was partially related to difficult year-over-year comps due to the higher gold price in Q4 2020 ($1,865/oz). However, the main reason for the decline in revenue on a full-year basis was fewer ounces sold (590,000 ounces vs. 646,000 ounces), which explains why Iamgold posted much weaker sales figures than its peers sector-wide. To put in perspective just how poor these revenue figures were, sector leaders like B2Gold (BTG) saw a 9% increase in revenue year-over-year in Q4.

Iamgold – Quarterly Revenue (Company Filings, Author’s Chart)

Unfortunately, the decline in revenue wasn’t helped by rising costs, which soared to $1,537/oz in Q4, and $1,426/oz year-over-year. This translated to an 18% and 15% increase, respectively, compared to 2020 levels. The major contributor to higher AISC was Rosebel, where cash costs increased ~50% year-over-year, and AISC increased to $1,859/oz, with a slight headwind due to increased sustaining capital expenditures. This was partially offset by Essakane, where all-in sustaining costs declined to $1,074/oz (FY2020: $1,098/oz). The decline in costs was helped by higher grades processed, and an increase in ounces sold and was despite slightly higher sustaining capital vs. 2020.

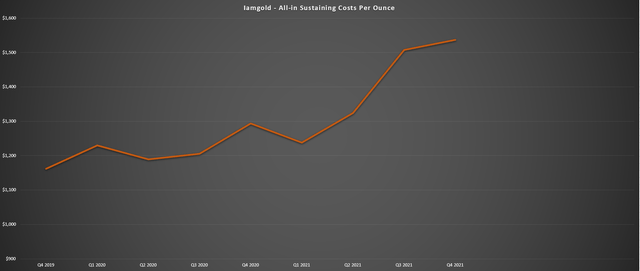

Iamgold – All-in Sustaining Costs Per Ounce (Company Filings, Author’s Chart)

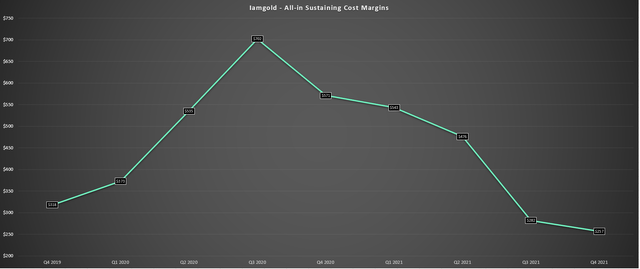

Given the sharp increase in costs, it’s no surprise that Iamgold’s AISC margins have fallen off a cliff, and they actually hit a new 2-year low in Q4 2021 at $257/oz. This is absolutely pathetic given that the gold price has increased significantly in the period, which should have been a tailwind to AISC margins. In fact, many producers have seen AISC margins increase more than 40% on a two-year basis (Q4 2021 vs. Q4 2019), like B2Gold. While the gold price should be a tailwind on a sequential basis in H1 2022 after lapping easy year-over-year comps, I don’t expect much margin expansion given the guidance for even higher operating costs in 2022.

Iamgold – AISC Margins (Company Filings, Author’s Chart)

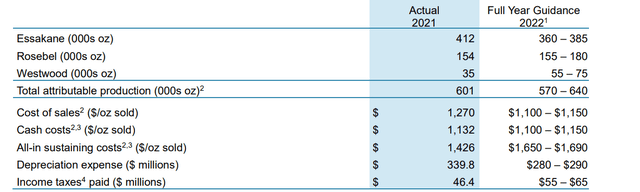

2022 Guidance & Valuation

Looking at the table below, we can see that while Iamgold is guiding for slightly higher production in FY2022 (~605,000-ounce mid-point), this figure is still well below the FY2021 guidance mid-point that the company missed by a mile (~665,000 ounces). Meanwhile, costs are expected to rise materially, related to inflationary pressures and higher sustaining capital due to stripping costs being classified as sustaining capital. This paints a bleak outlook because even if Iamgold meets the low end of guidance ($1,650/oz), its costs will still be 50% above my estimate for the industry average of ~$1,100/oz in FY2022.

2022 Guidance (Company News Release)

If Iamgold were priced at a massive discount to its peer group, this might provide an opportunity. This would be similar to when the stock was out of favor at $2.35 last August, and the risks looked more than priced into the stock. However, at a current market cap of ~$1.67 billion, Iamgold now trades at nearly 1.0x P/NAV. I would consider this an expensive valuation for a serial laggard that has industry-lagging margins and two operations in Tier-2 ranked jurisdictions (Burkina Faso, Suriname). In comparison, investors can buy a growth story like Alamos Gold (AGI) for ~0.85x P/NAV with a better margin outlook, better jurisdictional profile, and a great track record.

So, while I was willing to be optimistic about higher prices last August at $2.35, it’s much harder to justify owning Iamgold at current levels. In fact, I would argue that Iamgold is fully valued at current levels, based on what I believe to be a more fair P/NAV multiple of 0.90x P/NAV (post-Cote construction). To summarize, I don’t see any margin of safety here from a valuation standpoint, and I think this rally above $3.50 is a gift for investors that have been anxious to move to greener pastures.

Technical Picture

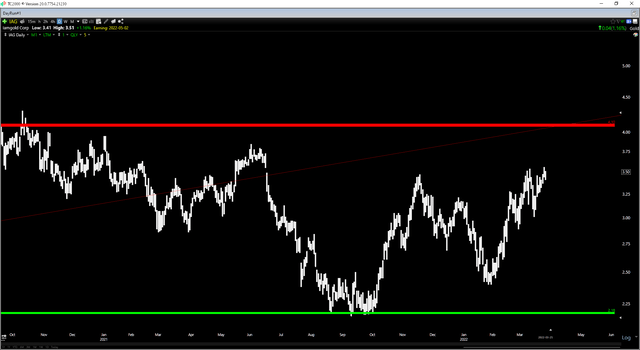

Moving to the technical picture, we can see that Iamgold has rallied sharply thus far in Q1, likely due to improved sentiment from a higher gold price and hopes of a potential turnaround with a new interim CEO and three new board members in place. This includes David Smith, Maryse Belanger (Chair), and Ian Ashby. I see this as a very positive development, given that it’s unclear that the company has been unable to make much progress the past few years under its previous leadership. However, the stock has now found itself in the upper portion of its trading range, with support at $2.17, and resistance at $4.10.

IAG – Daily Chart (TC2000.com)

Based on a current share price of $3.50, this translates to an unfavorable reward/risk ratio of 0.45 to 1.0 from a trading standpoint and suggests elevated risk to paying up for the stock at current levels. Obviously, if the gold price continues to climb, we could see Iamgold continue to melt higher towards resistance. However, with a low-quality asset base, risks of another miss on the updated capex budget at Cote, and industry-lagging margins, I see this as one of the least attractive ways to play the gold sector. For those unfamiliar, Iamgold recently noted that it could see capex increase above the $710 million- $760 million upwardly revised guidance to complete from January 2022 onwards.

Westwood Operations – Canada (Company Presentation)

Iamgold should have a better year ahead from a production standpoint, but the margin outlook leaves a lot to be desired, with costs expected to increase more than 15% year-over-year, offsetting the higher gold price. Meanwhile, though a new team can be a catalyst for a turnaround in many cases at underperforming companies, the issue in my view is Iamgold’s low-quality assets (ex-Cote/Essakane), which make it harder to complete a successful turnaround. Given the unfavorable reward/risk ratio after the recent rally and the stock looking fully valued, I continue to see Iamgold as uninvestable.

Be the first to comment