joebelanger

Introduction

Canada-based IAMGOLD Corporation (NYSE:IAG) reported the third quarter of 2022 on November 8, 2022.

Note: I have followed IAG quarterly since 2014. This new article is a quarterly update of my article published on August 9, 2022.

On October 22, 2022, IAMGOLD corp. announced that,

it has entered into a definitive agreement with Zijin Mining Group Co. Ltd. to sell its 95% interest in Rosebel Gold Mines N.V. for cash consideration of $360 million and release of IAMGOLD’s equipment lease liabilities amounting to approximately $41 million. Rosebel holds a 100% interest in the Rosebel Gold Mine and a 70% participating interest in the Saramacca Mine, located in Suriname. The remaining 5% interest in Rosebel will continue to be held by the Government of Suriname.

1 – 3Q22 results snapshot

The company recorded $343.3 million in revenues and posted a loss per share of $0.23 with a net loss of $108.3 million. The adjusted net loss was $0.03 per share.

Attributable production for 3Q22 was 184K Au oz compared to 153K Au oz produced in 3Q21.

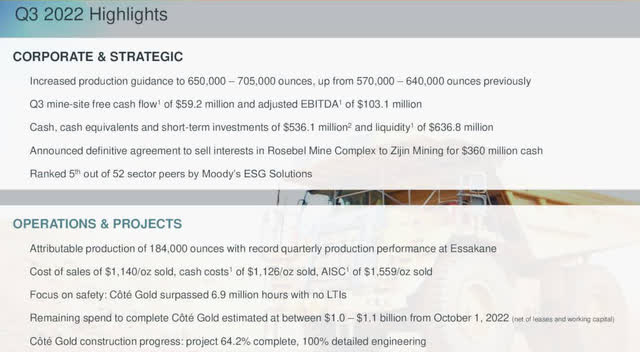

1.1 – 3Q22 Presentation Highlights

IAG operational results 3Q22 (IAG Presentation) IAG Cote Gold financing (IAG Presentation)

1.2 – Côté project discussion

The company currently estimates that its share of the remaining Côté project CapEx to completion as of October 1, 2022, is approximately $1,000 to $1,200 million. The project is now 64.2% completed.

Here are some numbers to grasp the Côté Gold:

-

Life of mine is 18 years, with initial production expected in early 2024;

-

Average annual production of 495k ounces (320,500 ounces attributable) during the first six years following commercial production and 365k ounces (236,000 ounces attributable) over the LOM;

-

LOM average cash costs of $693 per ounce of gold (“/oz Au”) sold, and all-in sustaining costs (“AISC”) of $854/oz Au sold;

-

Côté Gold LOM plan is based on Mineral Reserves of 7.2 million ounces.

IAG Cote Gold Schedule (IAG Presentation)

CEO Maryse Belanger said in the conference call:

The Côté Gold project saw a significant ramp-up in activity and is advancing well. It is following the schedule and cost rebase line provided to the market in the summer. Currently, Côté is over 64% complete and is nearing peak manpower capacity with approximately 1,500 workers at site. The site recently celebrated 6.9 million hours without a long-term injury, which is a testament to the safety commitment, skills and dedication of the Côté Gold team.

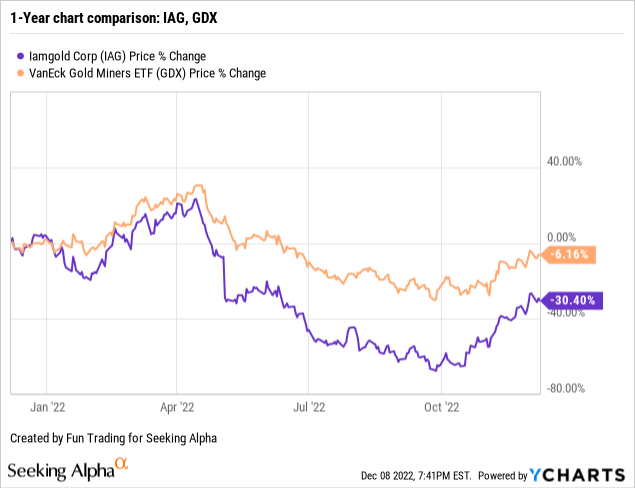

2 – Stock performance

IAMGOLD dropped precipitously in early May and is now down 46% on a one-year basis, underperforming the GDX and most of its peers. The news related to Cote Gold has been highly caustic for the stock.

3 – Presentation

IAMGOLD is a mid-tier gold mining company operating in three regions: North America, South America, and West Africa.

The company also owns the Côté Gold construction project in Canada and the Boto Gold development project in Senegal.

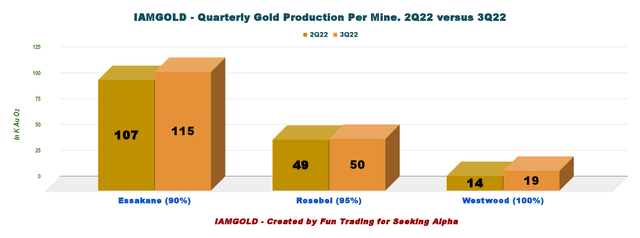

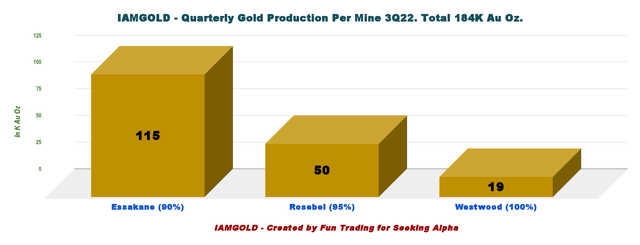

The flagship mine Essakane in West Africa represents 62.5% of the company’s total output in 3Q22. Production went up sequentially, with an attributable production of 184K Au Oz. All three mines performed well, as shown below:

IAG Quarterly Gold production per mine 2Q22 versus 3Q22 (Fun Trading)

4 – Investment thesis

The investment thesis for IAG continues to be a problematic one.

The company is struggling financially with completing its Côté Gold project, a massive project that will generate a tremendous increase in gold production starting in early 2024.

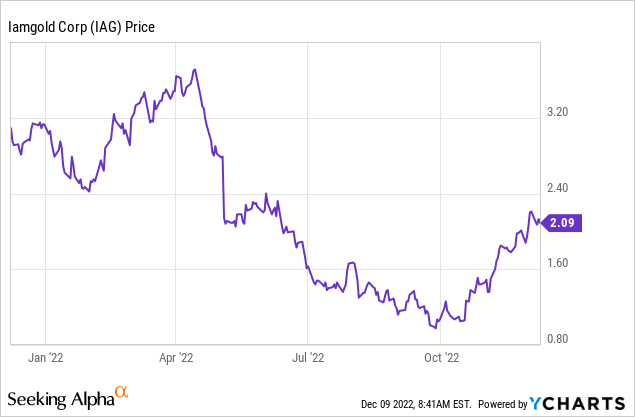

The stock corrected below $1 last quarter after the company indicated that the cost of building the Côté Gold project increased substantially. However, IAG recovered nicely after announcing the sale of Rosebel for a total cash consideration of $401 million.

Now what?

The stock will continue to be very volatile in 2023. The Côté Gold project’s complete financing is not secured yet, and the company will have to find a way to get about $300 million to $500 million in 2023.

IAG Financing in 2023 (IAG Presentation)

It will combine divestitures, a streaming deal, and secured or unsecured debt. Hopefully, IAG will avoid using its stock as a currency (ATM) to prevent dilution. The gold price now above $1,800 will help.

Hence, I recommend trading about 60% of your short-term LIFO and keeping a small core long-term position for a much higher target. Trading LIFO is the most adapted strategy that allows you to profit while waiting for a significant uptrend.

IAMGOLD Corp. – Financial Snapshot 3Q22 – The Raw Numbers

| IAMGOLD | 3Q21 | 4Q21 | 1Q22 | 2Q22 | 3Q22 |

| Total Revenues in $ Million | 294.1 | 294.6 | 356.6 | 334.0 | 343.3 |

| Net Income in $ Million | -75.3 | -194.1 | 23.8 | -9.6 | -108.3 |

| EBITDA $ Million |

15.8 |

-187.2 |

134.9 |

100.1 |

-44.4 |

| EPS diluted in $/share | -0.16 | -0.40 | 0.05 | -0.02 | -0.23 |

| Operating Cash flow in $ Million | 78.5 | 67.5 | 142.3 | 81.9 | 117.7 |

| Capital Expenditure in $ Million | 139.1 | 266.8 | 169.1 | 270.0 | 234.1 |

| Free Cash Flow in $ Million | -60.6 | -199.3 | -26.8 | -188.1 | -116.4 |

| Total cash $ Million | 748.3 | 552.5 | 524.4 | 452.9 | 536.1 |

| Long-term Debt in $ Million | 466.8 | 464.4 | 463.3 | 612.0 | 844.6 |

| Shares outstanding (diluted) in Million | 476.8 | 476.8 | 482.4 | 478.9 | 479.0 |

Data Source: Company release

Gold Production And Balance Sheet Details

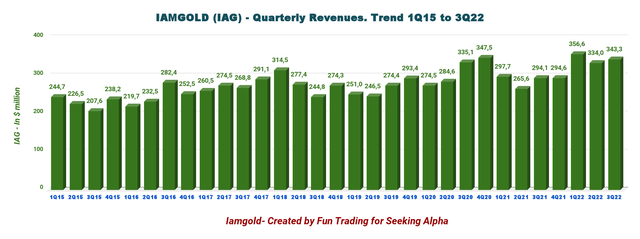

1 – Revenues were $343.3 million in 3Q22

IAG Quarterly revenue history (Fun Trading) For the third quarter that ended September 30, 2022, quarterly revenues came in at a record $343.3 million, up 16.7% from the same quarter last year. Net cash from operating activities for the third quarter of 2022 was $117.7 million, an increase of 50% from the prior year’s quarter. The net earnings and adjusted earnings per share attributable to equity holders were a loss of $0.23 and $0.03. Also, EBITDA was a loss of $44.4 million, and adjusted EBITDA was $103.1 million. However, most of the attention was directed to Côté Gold and its ability to finance it. The recent Rosebel Mine for $360 million in cash and $40 million in assumed liability has been a good move from the company to address concerns about the astronomical increase in costs of the project, which is now 64.2% completed.

CEO Maryse Belanger said in the conference call:

Financially, the company took a significant step in addressing its funding requirements for the Côté Gold project, with the announcement of the sale of our interest in the Rosebel Mine Complex to Zijin Mining for $360 million in cash and $40 million in assumed liability. The transaction also showed the strong support from our lenders as we provided consent to release Rosebel from their security package. The remaining funding alternatives are well advanced, and we expect to be able to provide further updates in the fourth quarter.

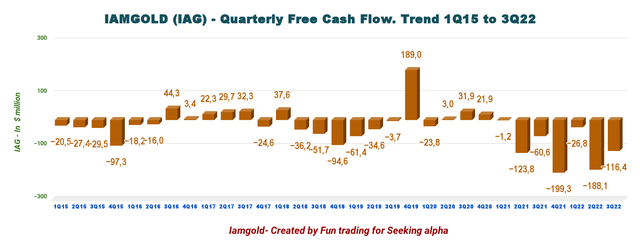

2 – Free cash flow was a loss of $116.4 million in 3Q22.

IAG Quarterly Free cash flow history (Fun Trading)

Free cash flow continues to be a recurring issue for IAMGOLD and will persist until the Côté Gold project is completed in early 2024.

Elevated CapEx affected free cash flow and was $234.1 million in 3Q22 or $933.3 million during the last four quarters.

IAG’s trailing 12-month free cash flow is now a loss of $523.9 million, with another loss of $116.4 million in the third quarter.

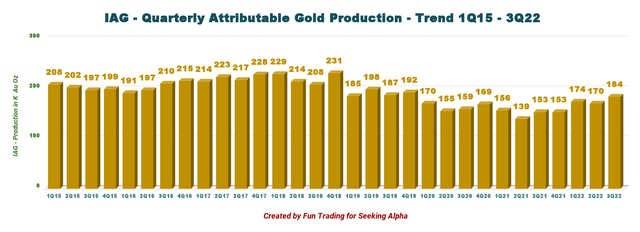

3 – Gold Production Details; Total Production was 184K Au Oz in 3Q22

3.1 – Gold production details

IAG Quarterly gold production history (Fun Trading)

IAMGOLD produced 184K Au oz attributable during the third quarter of 2022, compared to 153K Au oz during 3Q21, on continued strong performance from Essakane and Rosebel, as shown in the graph below.

IAG Production per mine in 3Q22 (Fun Trading) Cash cost per ounce sold in the third quarter was $1,126 per ounce.

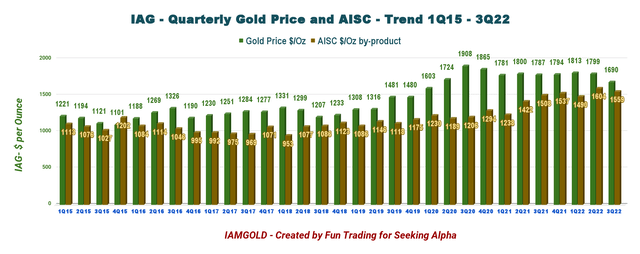

3.2 – Quarterly AISC and Gold price.

AISC is now $1,559 per ounce.

IAG Quarterly Gold price and AISC history (Fun Trading)

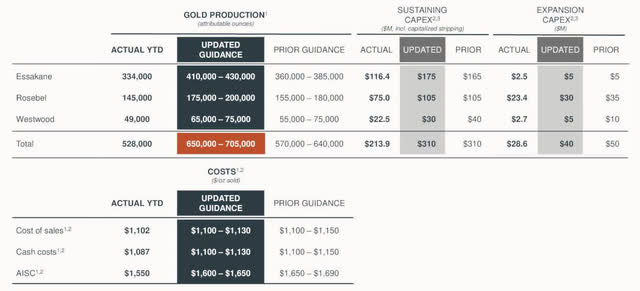

3.3.1 – 2022 Guidance revised.

The Company expects that annual production will exceed the top end of the previous guidance range of 570K to 640K ounces and is revising guidance upwards to 650K to 705K ounces.

Interim CEO Maryse Belanger said in the conference call:

Based on the exceptional performance of our operating teams, we forecast that 2022 production will exceed the top end of our guidance. Consequently, we increased our production guidance for the year to between 650,000 and 705,000 ounces up from 570,000 to 640,000 ounces as previously guided.

The Company expects AISC to be below the bottom end of the guidance range of $1,650 to $1,690 and revised guidance downwards to between $1,600 and $1,650 per ounce sold.

Cash costs guidance for 2022 is revised downwards to be between $1,100 and $1,130 per ounce sold from the previous guidance range of $1,100 to $1,150 per ounce.

IAG 2022 Guidance (IAG Presentation)

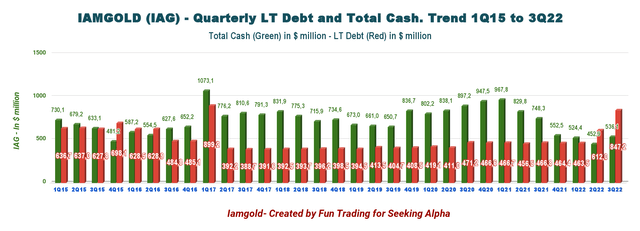

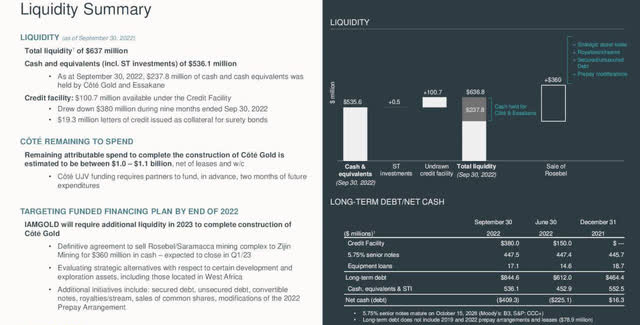

4 – The company had $311.8 million in net debt and strong liquidity of $636.8 million on September 30, 2022.

Note: The total debt includes the principal amount of the Notes of $450.0 million, a Credit Facility of $380.0 million, and equipment loans of $17.2 million.

IAG Quarterly Cash versus Debt history (Fun Trading) IAMGOLD has a net debt of $311.8 million and total liquidity of approximately $637 million as of September 30, 2022. Total cash is now $536.1 million. IAG Balance sheet (IAG Presentation)

Warning: The company indicates that additional financing will be necessary to complete the Cote Gold project in 2023. It could be other secured or unsecured debt, including unsecured and convertible notes, sales of common shares, etc.

Technical Analysis (Short Term) And Commentary

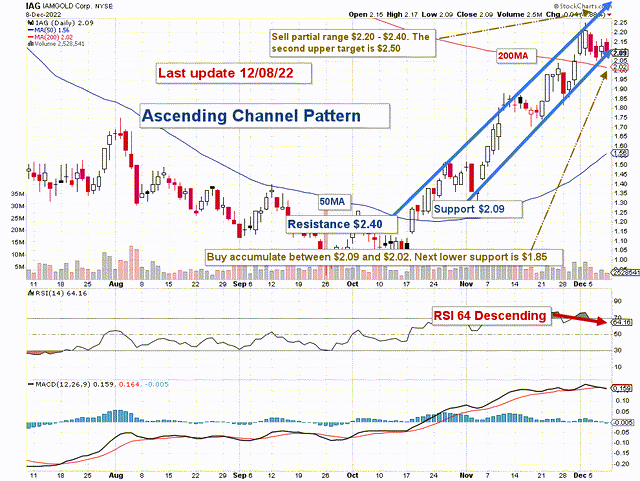

IAG TA Chart short-term (Fun Trading StockCharts)

IAG forms an ascending channel pattern with resistance at $2.40 and support at $2.09. Ascending channel patterns are short-term bullish moving higher within an ascending channel, but these patterns often form within longer-term downtrends as continuation patterns.

The short-term trading strategy is to trade LIFO for about 60% of your position. I suggest selling between $2.20 and $2.40 with higher resistance at $2.50 and waiting for a retracement between $2.09 and $2.02 with possible lower support at $1.85.

IAG has recovered nicely since mid-October and has reached a strong resistance at about $2.20, which indicates a temporary top.

However, depending on the FED’s action on December 14, IAG could either break out and reach $2.50 or break down and retest $1.85. Gold has rallied recently due to the expectation that the FED will raise interest by 50 points next week.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below to vote for support. Thanks.

Be the first to comment