ablokhin

It’s been exactly five months since I put out my latest piece on Landstar System, Inc. (NASDAQ:LSTR), and in that time, the shares have returned a loss of about 3.4% against a loss of about 12.5% for the S&P 500. The company has reported results since, so I want to review the name again to see if it makes sense to buy or not. I’ll review the latest financials, and will look at the current valuation. Additionally, as is my wont, I’m going to spend some time bragging about the performance of my short put options, so get ready for that.

It’s that time again, dear readers. It’s the time when I post my “thesis statement” paragraph for your enjoyment and edification. It’s here where I offer you the gist of my thinking in a short, hopefully pithy, paragraph. This allows you to save time, and avoid the bragging that I threatened above. You’re welcome. Anyway, I think Landstar has had a magnificent time since I last wrote about the business. Sales and profits are up dramatically relative to both last year and the pre-pandemic period. Additionally, the very well-covered dividend has grown nicely. Debt has also grown dramatically but remains well below cash on hand, so there’s not much risk in the capital structure in my view. In spite of all of this, the shares are trading near multi-year low valuations. There will be a slowdown in the business at some point, as it’s clearly cyclical, but the market is overreacting in my view. The puts I wrote back in April have done very well, especially against the stock. This is yet another example of short puts offering better returns and lower risk. The puts expire next month and, assuming the world hasn’t changed dramatically, I’ll be buying the shares then. If it weren’t for these puts, I’d be buying the stock today. If you aren’t saddled by such commitments yourself, I would recommend picking up a few shares of this wonderful growth machine at a reasonable price.

Financial Snapshot

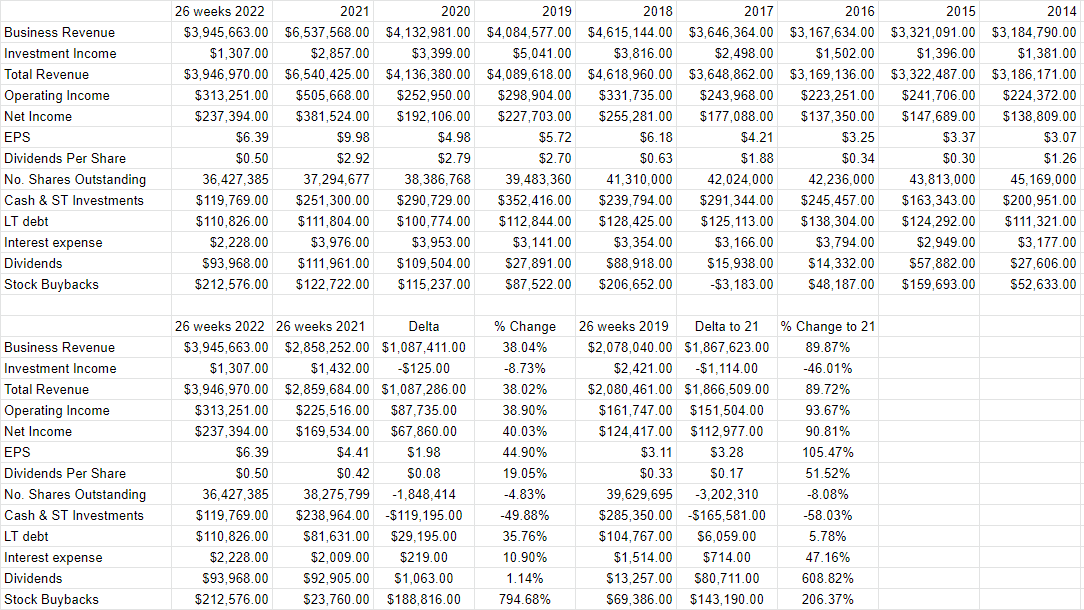

I think the latest financial results at Landstar have been mostly spectacular. For example, revenue and net income are up 38% and 40% respectively. The company saw fit to reward shareholders with this improvement in the business by increasing the dividend by fully 19%. When compared to the pre-pandemic period, things look even better. For instance, revenue for the first 26 weeks of 2022 was about 89% higher than the same period in 2019, and net income was up by 91%. In my estimation, this fits the definition of a “growth” company.

It’s not all sunshine and lollipops over at Landstar, though. The company has loaded up on debt over the past year as the business has grown. Specifically, long-term debt is now about 35% higher than it was this time last year. Unsurprisingly, interest expenses have also jumped by about 11% for the first 26 weeks of 2022 relative to the same period in 2021. I would normally be much more bothered about this than I am, but the company is sitting on an enormous cash hoard. Their cash and short-term investments are currently about $119.7 million against long-term debt of $110.8 million. Thus, I’m not too worried about leverage here, though I’d prefer to see the company clean up the capital structure somewhat.

I do think the dividend is reasonably well covered, and for that reason, I’d be very happy to buy the stock at the right price.

Landstar System Financials (Landstar System investor relations)

The Stock

As my regulars know, I consider the “business” and the “stock” to be quite different things. In case you’re new here, I’ll tell you also. I consider the “business” and the “stock” to be quite different things. My regulars know that I’ve talked myself out of some profitable trades with the words “at the right price” many times, but as we close in on the end of a week that’s seen a 6% decline in the S&P 500, I’m reminded that an instinct to preserve capital isn’t a bad one. I’d rather miss out on some gains than lose capital. To continue with the theme that businesses and stocks are distinct things, consider the following. Every business buys a number of inputs, performs value-adding activities on them and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, future demand for transportation and logistics services, changing input costs, and so on. It may be that some analyst decides that “future growth catalysts” for a related business like railroads are weaker than we once thought, and Landstar falls in price in sympathy, in spite of absolutely no change at the company. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. So, in some sense, the stock is buffeted by the crowds’ rapidly changing views about a given company, a series of related and obliquely related industries, and the crowd’s rapidly changing views about the overall stock market.

This is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations.

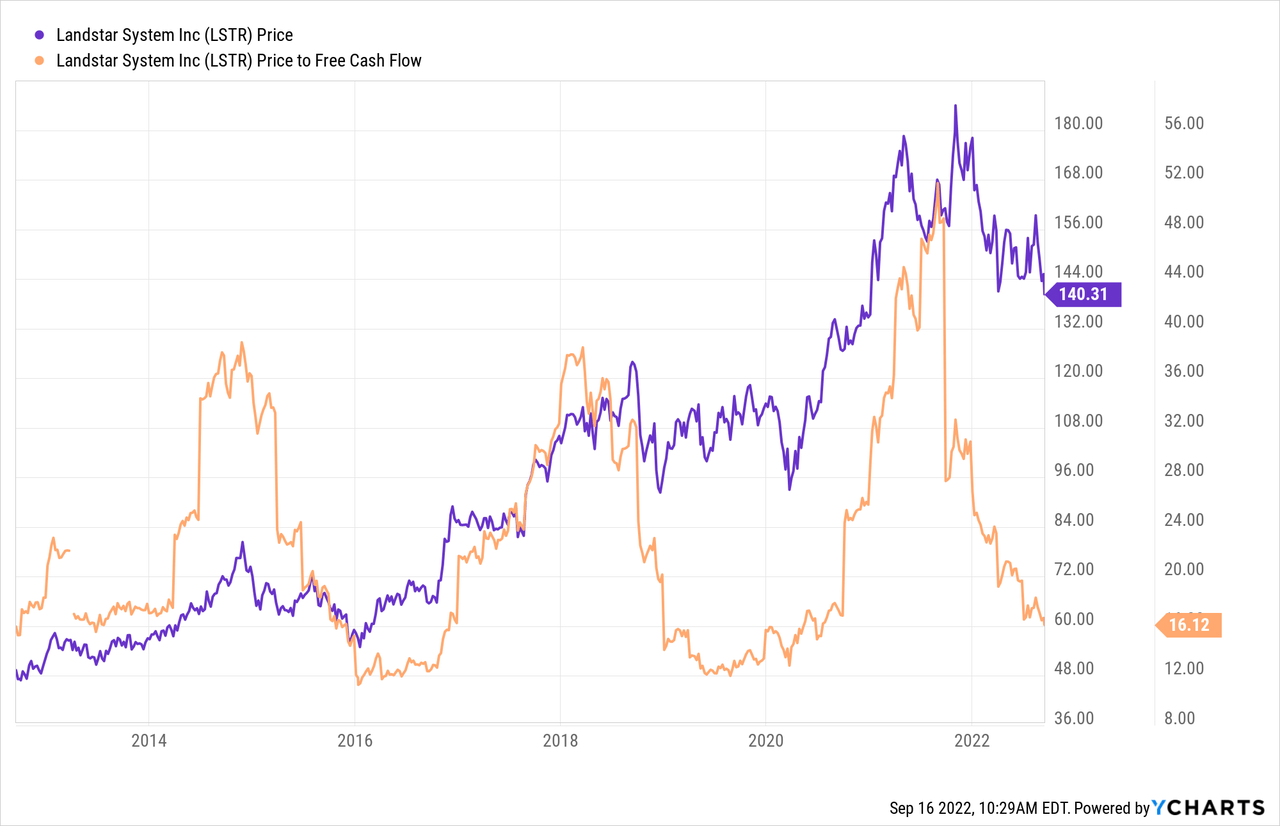

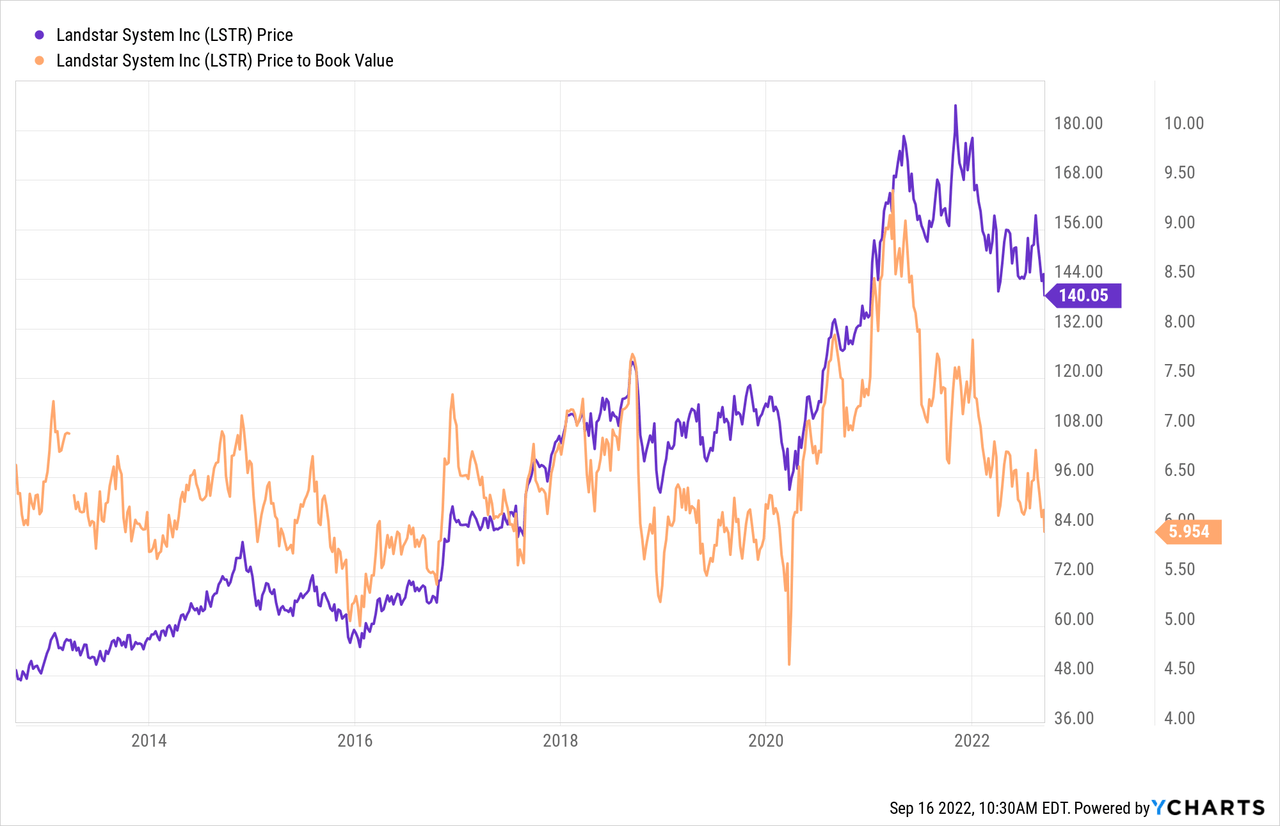

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. Previously, I was lukewarm on Landstar because the price to free cash flow was sitting around 21.8 times, and the price to book was stuck at 6.26 times. Fast-forward five months and the shares are about 26% cheaper on a price to free cash basis, and about 5.75% cheaper on a price to book basis. Additionally, shares seem to be close to a multi-year valuation low on a price to free cash basis.

In addition to looking at simple ratios, I actually use a large number of other, more complex valuation measures, one of which involves trying to understand the assumptions currently embedded in price. If you read me regularly, you know that I rely on the work of Professor Stephen Penman, and increasingly Mauboussin and Rappaport to do this. This approach uses the stock price itself as a source of information. It involves “reverse engineering” the assumptions that cause the current price by isolating the “g” (growth) variable in a standard finance formula. When I apply this approach to Landstar, it seems the market is assuming growth rate of about 4.9%, which is a slightly more optimistic forecast than the last time I reviewed the name when it was sitting at 4.8%. So there’s no movement on this front, but the shares are much cheaper on a price to free cash flow basis, which I find quite compelling.

Options Update

I find the current price level compelling, which prompts the question: am I a buyer at current levels? I certainly would be if it were not for my short put position. Way back in April, I wrote 10 Landstar puts with a strike of $115 for $2.55 each, and these are now bid at $0, so that trade’s worked out well in my view. That strike price lined up with a price to free cash ratio of about 17 times, when the company was generating far less cash. As of now, the strike now represents a price to free cash flow ratio of about 12.9 times, which would be a great entry price in my view.

I like this company a great deal, and were I not short these 10 puts, I would be buying today. The problem for me is that I’m exposed to quite a bit of this company with my short put position, so prudence demands that I hold off on buying before the puts expire.

So, if you’re just joining us, I think the current price is a great entry point. If you are short puts, I would recommend waiting for them to expire before buying aggressively. If the world of October resembles the current world, I will buy, and would recommend others do the same.

Conclusion

This is a wonderful business with a well-covered dividend. Although the debt load has grown, the company is sitting on an immense cash hoard that dwarfs it. Although the business may slow as the demand for transportation and logistics services moderates, the shares reflect that slowdown, in my view. For people who are just joining this party, I recommend buying the shares. If you have made some money on short puts over the past five months, congratulations. You did better than any of the shareholders over that time. The problem is that short puts provide exposure to the underlying, which means you can’t easily buy the stock, in my view.

Be the first to comment