z1b

Dear readers/followers,

Hyundai (OTCPK:HYMTF) is an interesting sort of business, even if the company’s performance for the past few months has been very underwhelming. There are reasons for the underperformance. Aside from looking at these reasons, and making sure that we’re buying at a good price, there’s nothing more we can really do. Hyundai is certainly not going anywhere, and the company is not in any sort of danger, as I see it.

So, let’s see where the most recent quarterlies find us as we review Hyundai Motor Company.

Revisiting Hyundai Motor company – an upside potentially worth considering.

So, as mentioned in my base article on the stock, this is a South Korean car manufacturer headquartered in Seoul. With over 50 years of tradition and history under its belt, there is much to like about both the company’s history and where it’s going in the future.

Hyundai has an annual production output of over 3.5M-4.5M units per year and 2021 sales of 3.9M vehicles, and revenues of 117T Won, or just south of $90B, making them one of the largest manufacturers around. On that 117T, they make around 6.7T worth of operating income, and 5.7T worth of net income.

The company is very well-known in the USA as well, and owns some of the more popular hybrid and EV models that are being sold. It’s also, unlike Honda, very popular in Europe, and really hasn’t lost the market in the same way that its Japanese colleagues have done.

Hyundai Motors is BBB+ rated, and as such is one of the best-rated automotives out there.

The ownership is also attractively structured, with some of the specifics reminding me of Scandinavian or European companies. There are government interests in the form of the largest public pension fund in the country, with 21.4% owned by Hyundai Mobis, the parts business, and a few percent owned by individuals known by the former CEO and the current “heir apparent” to the business, together about 7-8% worth of ownership. The company’s political influence stretches far and wide, and it being the second-largest conglomerate in the entire country, its importance to South Korea cannot be overstated, as it also manages 54 different subsidiaries in various industries.

These subsidiaries include what you get exposure to when you invest in Hyundai – the automotive business being very attractively diversified across the globe, with specific sales exposure in Europe and NA.

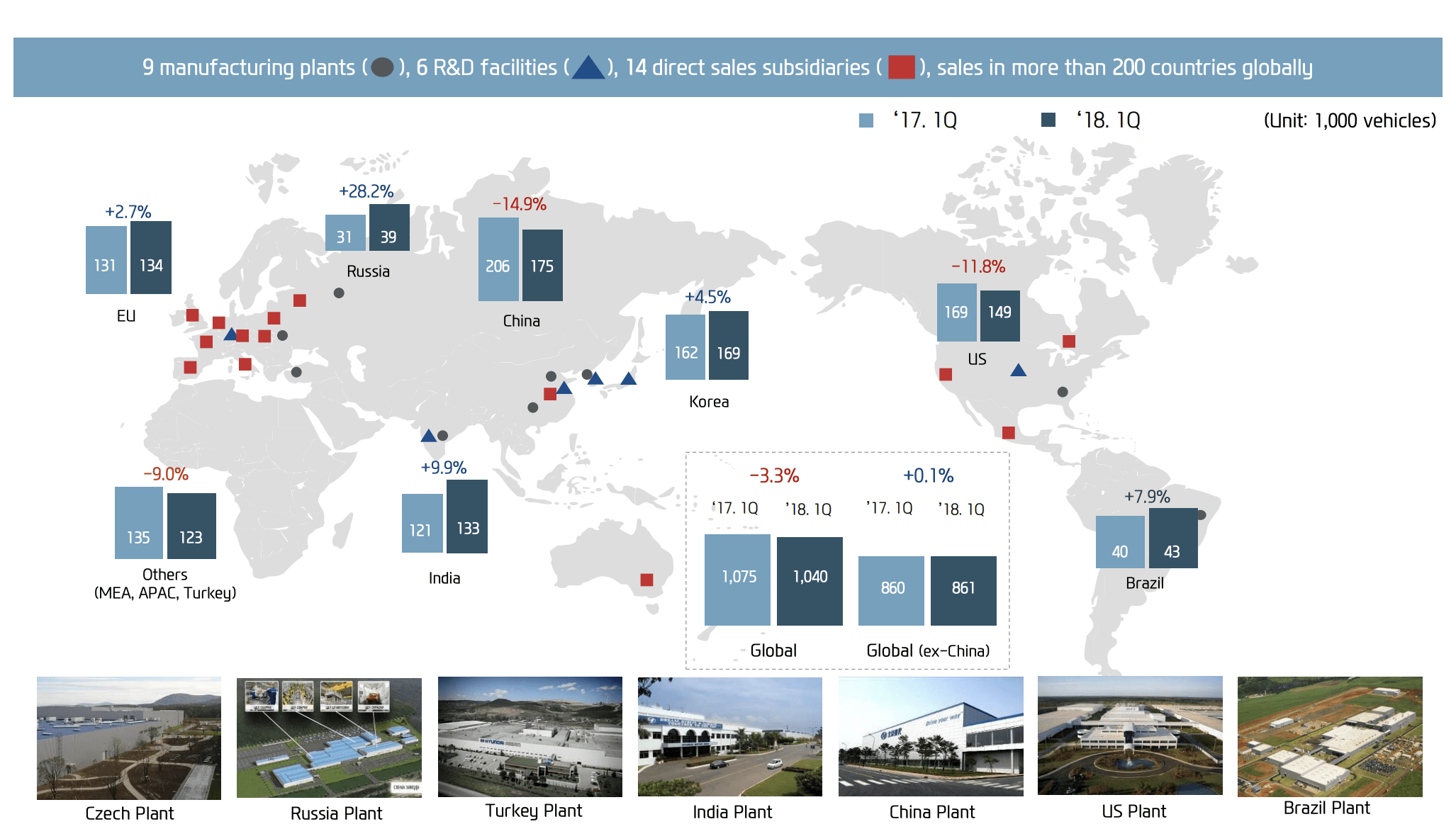

Hyundai IR (Hyundai IR)

As I pointed out in my first article, and I think it bears repeating here, the company is better diversified than any of its European, Japanese and American competitors. And this strategy seems to be working very well for them. I myself do not drive a Hyundai – I’m too much of a Benz (OTCPK:MBGAF) loyalist to drive anything that doesn’t have a star or comes out of Zuffenhausen (OTCPK:POAHY), but the Hyundais I’ve test-driven have been seemingly reliable and solid automobiles – and the friends I have that use them are very pleased with their vehicles.

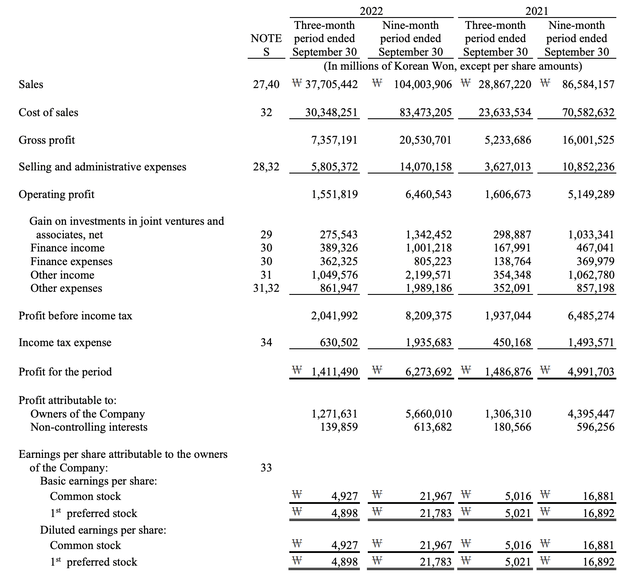

The latest results we have for Hyundai are the 3Q22 results. For that period and for the 9M22 compared to the YoY-periods, the company’s results are up significantly for the top line, with a sales performance that’s nearly 10B KWON up for the 3-month, and 14B KWON on the 9M-period. The company’s SG&A has also increased, but on a gross profit margin perspective, the company has kept ahead of its COGS development by increasing profits more than costs. Operating profit after SG&A is broadly similar, almost flat for the 3Q22 YoY, and up by 1.5B KWON for the 9M22 period.

This translates into a roughly flat 3Q22 YoY EPS result, and a significantly improved 9M22 EPS result.

When considering the sort of administrative and cost-related pressures the company has been under, those results can be considered relatively impressive overall. The November 2022 sales results, which is what we have in terms of the latest results (even better than 3Q22), show continued demand for the company’s cars, with both domestic and overseas sales improvements on a month-to-month basis.

For the full year, things look slightly different – total sales are up 1.2% so far with 1 month left of the year, but Domestic sales are down 6.4% for South Korea.

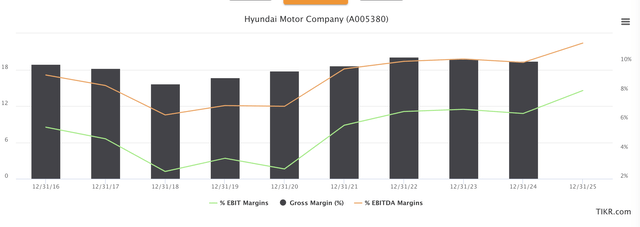

The company’s native share ticker is known as A005380, and is down significantly for the year. We’ll go into analyst upside a bit later in the article. For the time being, it’s important to point out that as far as gross margins and profit margins go, these are absolutely solid for the company and are expected to remain this way for the next few years.

In the same trend, EBIT and EBITDA margins have been improving for the past couple of years since we saw COVID-19 and other impacts.

Now, when a company improves its top-line growth, that’s cause for interest and sometimes even celebration. However, when it also improves its margins, as we’ve seen and as are forecasted to continue, that’s cause for some real excitement – especially in this segment. Hyundai has been successful in pushing price increases and premiumizing some of its overall segments and cars across the globe.

Like most automotive businesses, the company focuses on clean, connected, and free mobility. Its EVs, Hybrids, and other new technologies are all on the market, and while I am not a Hyundai driver, I’ve tried their products and consider them to be qualitative for the consumers that want such a car. By 2025, the company wants to have more than 35 “green” models on the market.

Some risks do remain though because South Korean investing is somewhat different from domestic investing here – especially in some of these massive Chaebols.

Businesses like Hyundai are criticized for its shareholder remuneration policy, which along the lines of most South Korean companies and chaebols has been focused on rewarding majority owners and the family/individuals as opposed to shareholders. However, that’s why I focus on businesses like Hyundai, which are actively seeking to change the reward and remuneration structure.

The company is allocating 30-50% of the company’s annual FCF to shareholder returns with combinations of buybacks and dividends.

Its stated target is to increase its payout ratio to be competitive on an international basis, and as an international investor, this is of course news that I welcome. That is a big part of the reason I felt comfortable investing in Hyundai in the first place.

Pushing aside dividend lag and the fact that you need to really understand markets that most people here only have a limited understanding of (South Korea), the company has considerable upside and strength. The impact of higher product pricing and low spending/cost control outweighed the global issues of commodity pricing and labor cost increases.

We should be very wary of the impact of these shifts, especially in a company like this.

That being said, valuation trends at this point are downright amazing, when we consider where the company has gone.

Let me show you what I mean here.

Hyundai’s updated valuation for December

Since my last article, the company is down double digits – not a small amount, and this means that I’m currently considerably in the red. Short-term, being in the red rarely bothers me unless I see a fundamental reason to be worried about the underlying company I’ve bought.

In this case, this is obviously not what I see or what I am worried about.

Because, in a trend similar to most automotive businesses, especially today (excepting premium brands like Ferrari (RACE) and similar), Hyundai has a tendency to trade at low earnings multiples. Over a 10-year period, the company’s average is now down to 5.1X, with a maximum of 12X and a low of 4X. These numbers are for the native Seoul-listed ticker.

The company is now down 30% for the year – that’s a significant decline. It also means that based on its 2022E dividend, it trades at a high yield for a Korean company – nearly 3.25% at this time.

Hyundai is still being discounted pretty heavily even to most of their closest peers. Some might call it a stretch to compare Hyundai to say, BMW (OTCPK:BMWYY). I say a comparison to Porsche would be too far, but BMW is somewhat valid for most of the model lineup.

Forecasts for the company remain positive, and not at all reflective of what’s been going on with the share price.

The bullish thesis here hinges on a continued ability to charge premium prices for good products – and I see the company being able to do this, especially with Genesis in the mix. There is much to like about the lineup, as well as the coming few years. While analysts following the company are no longer as positive on the share price as they were back in my article of 6 months back, we have 26 analysts going between 170,000 KWON and 300,000 KWON, to a price target of 230,000 KWON. This implies a current upside for the stock, and for the ADR, of at least 40% or above – again, significant.

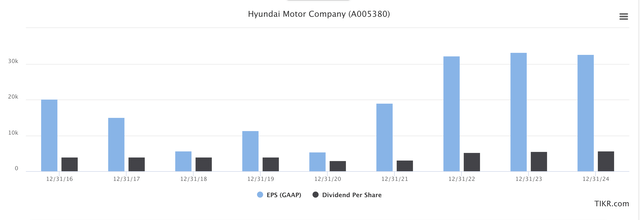

Analyst estimates for the coming year call for positive earnings trends, with GAAP improvements for the next 2-3 years at least, and corresponding increases in the company dividend.

Hyundai Earnings/Dividends (TIKR.com)

Buying Hyundai remains a complex venture if you want the native. Even I have only limited access to the South Korean market, which leaves me with ADRs and similar avenues – so I’ve gone for the ADR at this time. Hyundai’s ADR is HYMTF, and it’s relatively illiquid here on the US market. I found an avenue with telephone brokers to invest in the company natively, but it requires a steep minimum investment amount that I am currently unwilling to put down – so a small position is all I have at this time.

However, as of this article, I’m expanding it.

Here is my updated Hyundai thesis.

Thesis

My thesis for Hyundai is as follows:

- Hyundai is perhaps one of the better automotive investments available due to its conservative nature and its home-field exposure to Asia, with an extremely well-diversified sales portfolio of attractive cars in every segment from semi-luxury to common.

- The company has a not-insignificant upside of 30-40%, and very few analysts currently following the company consider this anything except a “BUY” here.

- The relative complexity of making a “BUY” here means that I won’t invest in a company until I see a sector-beating and absolutely massive upside with a great dividend.

- That time, for me, is now – I’m investing more.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicised).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment