Introduction

In my last article, I was somewhat impressed by Hugo Boss (OTCPK:BOSSY). After a stable 2019 and a promising outlook for the future, the company has not only kept the dividend stable but also increased it slightly. At that time, the dividend yield would have been 7 percent. That is high and signals a possible dividend cut. However, the share had lost a lot of value due to the fear of COVID-19. In precisely this situation, the management announced an increase in the dividend at the beginning of March. I find the sequence of events here rather unfortunate. Especially the management did not cut a good figure here. I will not sell my shares, but I will not buy new ones either.

Initial Thoughts On The Dividend Cut

Looking at the sequence of events, management’s communication with shareholders was extremely unfortunate. Hugo Boss currently expected the effects of the coronavirus to be offset in the second half of the year. Of course, the company already noticed the effects of COVID-19 on its business in March and drew attention to the uncertainties associated with it. Nevertheless, it has communicated in its earnings statement (March 5, 2020) that it expects a normalization in the second half of the year:

Despite the prevailing high levels of uncertainty, as of today, HUGO BOSS expects a gradual normalization by the middle of the year. At the same time, HUGO BOSS expects the economic consequences of the spread of the coronavirus to have a significant impact on the Group’s sales and profit development in 2020, especially in the first quarter.

Furthermore, Hugo Boss expected revenue growth within a range of 0 percent to +2 percent for FY 2020. EBIT was expected to be between EUR 320 million and EUR 350 million. Only one month later (April 6), however, management issued the following press release:

Nevertheless, the negative effects of the pandemic are currently leading to a significant decline in sales, profitability, and cash flow. At present, it is not possible to predict how long this situation will last. Therefore, […] HUGO BOSS AG have decided today to propose […] that the dividend payment for fiscal year 2019 will be suspended.

In my view, the management has underestimated or misjudged the consequences of COVID-19 on its own business. Because the uncertainty and the clear effects on sales and profit were already foreseeable before. So if Hugo Boss had cut the dividend or issued a dividend warning as early as March, I think it would have been quite reasonable. As a retailer, Hugo Boss is particularly affected by the crisis, and even the best management could not have changed that. Instead, however, the company relied on the strong cash flow of 2019 and also held out the prospect of strong cash flow for the coming years (including 2020). And indeed, looking at the data from the 2019 financial year, this assessment was also correct, as the dividend was covered by cash flow more than twice:

(Source: Annual report 2019/previous article)

That said, it was rather expected that management would emphasize the current uncertainty in the earnings statement for FY 2019 in March 2020. Rather unexpectedly, management at the same time held out the prospect of normalization in the second half of the year and therefore saw itself in a position to increase the dividend again even if this would stretch the target payout ratio for a certain time. And well, usually, management knows best as I stated in my previous article:

The management will probably know best how far it wants to go. And if management has a positive view of the cash flow development for the next few years, then it is a reasonable approach to push the payout ratio a little bit for one or two years.

Just as surprising as the dividend cut, it was announced that CEO Mark Langer will leave the board at the end of September. He did a good job. Above all, he had to correct the years of mistakes. For example, Hugo Boss had invested a great deal of money in the expansion of stores and lost a lot of profitability as a result. The expansion of the online business was also seriously neglected. The CEO took action in the right places and was able to show some success with the return to growth.

However, the dividend increase in March and the optimistic outlook were a mistake and destroyed investor confidence. In this respect, it was perhaps a necessary step to signal to investors that conclusions had been drawn. However, he will continue to advise the company for some time to come. At least, this could ease the uncertainty in the meantime and the search for a new CEO.

Long-term outlook still intact

So the question now is what investors should do with their shares. I still think that the company is well-positioned for the long term. I have explained the reasons for this in more detail in my last analysis (click here). Above all, the focus on the four strategic imperatives (online business; Asia; retail sales productivity; and two-brand policy) has shown initial success. The increased involvement of major investors also shows that smart money thinks the same way. The Marzotto family has already increased its stake in Hugo Boss by almost 5 percent to over 15 percent. In the meantime, it became public that Swiss bank UBS holds around 9 percent of the voting rights.

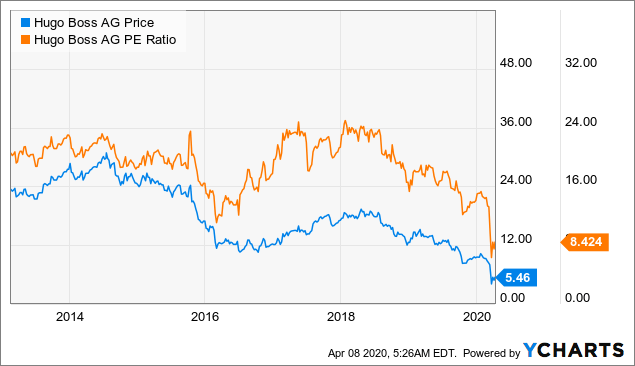

Looking at the share price losses and assuming that the company will return to normality once the crisis is over, there is certainly a high potential that it will make up its losses.

Data by YCharts

Data by YCharts

If (as already indicated in China and to some extent also in Europe) the economy should brighten up again in the second half of the year, then I also think that the company could pay a special dividend next year. This is of course highly speculative. But at the current level, I think it would be wrong to sell the shares. The long-term outlook is still intact, and there are already some lights on the horizon.

Conclusion

So far, Hugo Boss is the first company in my broadly diversified retirement portfolio that has completely canceled its dividend (Unibail Rodamco (OTCPK:UNBLF) has cut it by 50 percent). We will see which companies follow. In principle, it is also okay if companies try to maintain liquidity in extreme phases. After all, we are dealing with a systematic shock, and Hugo Boss, as a retailer, is one of the companies that suffer most from the shutdown measures of the governments. And as a shareholder, you are the owner and thus bear the same risk as the company itself.

The problem is therefore not so much a reduction in the dividend as the company’s communication with shareholders. A lot of trust was destroyed here. I will keep my shares because of the good, long-term outlook. However, as a cash flow-oriented investor, I will refrain from buying further shares.

Hugo Boss is part of my diversified retirement portfolio. If you enjoyed this article and wish to receive other long-term investment proposals or updates on my latest portfolio research, click “Follow” next to my name at the top of this article, and check “Get email alerts.”

Disclosure: I am/we are long BOSSY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment