DSCimage/iStock via Getty Images

Investment thesis

Hudson Technologies (NASDAQ:HDSN), the leading refrigerant reclaimer in North America, delivered another exceptional quarter, crushing expectations and raising full year guidance. I believe there are several factors that make this investment enticing. The company operates in a well defined niche, it has a strong moat thanks to its patented machines, it plays a double role in its supply chain, and the environmental regulations will give strong tailwinds for the years to come. This is why I believe the company is a very interesting buy.

Summary of previous coverage

I wrote an article (Hudson Technologies: Green Ratings For A Green Play) about the company a few months ago. Here are the main points I tried to make:

- The company operates in the HVACR industry (Heating, Ventilation, Air Conditioning and Refrigeration) and focuses on supplying and/or reclaiming refrigerants. It has a 35% market share in the refrigerant reclaiming business in North America.

- Hudson Technologies owns a chemical and technological know-how that make it able to reclaim old refrigerants, clean and recycle them to resell them. This is particularly important as new regulations are banning and phasing out old kinds of refrigerants such as CFCs, HCFCs and, now HFCs. The company invented a highly performing machine, called the ZugiBeast after Kevin Zugibe (the founder) that gives the company a moat in its operations. The machine was inspired by kidney dialysis and enables building chillers to operate while the cleaning process is being carried out.

- Hudson Technologies has a double role in the supply chain: it is a reclaimer and a supplier at the same time, thus it holds a strategic position both at the beginning and at the end of the cycle. Actually, the end of the refrigerant cycle is the beginning of Hudson Technologies’ activity as it reclaims it and recycles them by removing moisture, oils and other contaminants.

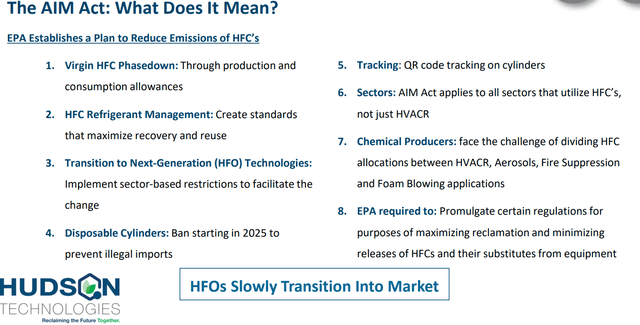

- The AIM act mandates a 10% step-down in production and consumption allowances for virgin HFCs in both 2022 and ’23 and a 40% baseline reduction in 2024. Additionally, the Act mandates an aggressive phasedown with the R-22 phaseout and promotes the use of reclaimed refrigerants to meet demand as virgin production steps down. This provides Hudson Technologies with strong tailwinds as it will be asked to fill the gap left by the absence of virgin refrigerants. The slide below explains well the implications of this law.

Hudson Technologies Investor Presentation

I also pointed out two risks:

- The company faced in 2017 a debt crisis, but it managed to refinance its debt and, thanks to its strong results, it is reducing it at a fast pace, as we will see.

- The bigger risk for the company is linked to reclaimed refrigerant prices. If the company builds up an inventory at high prices and then there is a sudden drop in refrigerant prices, the company ends up with a big loss. This happened in 2017 as the market saw many companies dump their virgin refrigerants before they were ruled out.

Q2 2022 Results

After an outstanding Q1 with a +149% revenue growth YoY, many investors were watchful to see if Hudson Technologies could have delivered strong Q2 results. The main concern was linked to the price of certain refrigerants. In fact, Hudson achieved huge profits in the first quarter because it was able to sell its recycled refrigerants at high prices with huge margins due to the fact that its inventories had been built up when prices were low. There were thus some fears that Hudson could have an inventory turnover that would have led to higher costs with the possibility that, in the meantime, refrigerant prices could drop.

The company however reported sustained strength in the price of certain refrigerants. The results were very pleasant for investors:

- Revenues of $103.9 million, a 72% increase YoY. Refrigerant selling prices still increased and this drove the top line growth.

- Gross margin increased to 55% compared to the 36% achieved a year ago. This result was achieved because, while selling price did increase, the company didn’t face a material appreciation in the cost basis of the sold refrigerants. Q2 had, in fact, the benefit that all throughout the quarter the reported pricing for HFCs was, on average at $14 a pound.

- Operating income was $49.8 million a 245% increase compared to the $14.4 million achieved in 2021.

- Reported net income was $39.8 million, which is equal to diluted EPS of $0.84. A year ago, net income was $11.3 million and the diluted EPS reached $0.24. This is a 252% increase YoY.

- The company has also very low expenses compared to its revenues with SG&A for the quarter being $7 million or 6.7% of revenue compared to $6.8 million or 11.2% of revenue in 2021. Capex is also very low and it rarely surpasses $2 million per year.

At the end of Q1, Hudson Technologies had cautioned investors to expect margins to decrease and settle in the low 30s. However, with the strong Q2 results, we see the company had been excessively cautious. I personally like a management that gives conservative estimates and then revises upwards its guidance as events and strategies unfold. During the earnings call, Brian Coleman, Hudson Technologies’ CEO, addressed this and said:

We continued to achieve exceptionally high gross margins, although we believe margin performance for the full year will moderate slightly due to increases in inventory costs and anticipated stabilization in the sales price during the balance of this season. With our visibility today, we’ve raised our expectations for the full year blended gross margin and believe it will be at least in the mid-40% range, with longer-term gross margins settling in around 35%.

This is an upwards revision of something between 1,200 and 1,500 basis points.

Let’s take a look at the first six months of the year:

| in $ million except per share | 1H 2021 | 1H 2022 | % change YOY |

| Revenues | 94.3 | 188.3 | 100% |

| Gross margin | 33% | 55% | 66% (2,200 bps) |

| Operating income | 16.1 | 88.1 | 72% |

|

Net income |

10.2 | 69.4 | 580% |

| EPS (diluted) | 0.22 | 1.48 | 572% |

There is not much to say: this is staggering growth.

And this is why the company now expects at least $290 million in revenues for this year and is targeting gross margins at 35% for the next 3 years with revenues greater than $400 million by 2025 instead of the previous guidance of $350 million.

Furthermore, the significant growth in profits is enabling the company to pay down its debt. This is what Nat Krishnamurti, Hudson Technologies’ CFO, explained during the call about the use of its cash, underlining that Hudson has ample cash availability that it is used to reduce debt and improve significantly the leverage ratio of the company:

During the second quarter of 2022, the company also paid down an incremental $10 million of term loan debt, resulting from improved performance and increased cash flow, thus reducing its leverage ratio to 0.73:1 for the trailing 12 months ended June 30, 2022, declining significantly from a leverage ratio of 4.18:1 for the trailing 12 months ended June 30, 2021. The company’s availability, consisting of cash and revolver availability at June 30, 2022, was $93 million. As we continue to generate additional cash flow, we expect to: one, further delever our balance sheet; two, ensure we have adequate inventory on hand; and three, consider other opportunities as they arise. We have strong liquidity, and our term loan and revolving loan credit facilities provide us with a solid financial platform and flexibility as we look forward.

Deleveraging the balance sheet will protect Hudson Technologies from the problems it faced in 2017, making it stronger in case of unexpected economic downturns. During the earnings call, Mr. Coleman did say that he is expecting the company to pay down its whole debt (around $90 million after this quarter) by 2024.

Furthermore, I do expect the company to seek for opportunities like M&As which could make it an even larger leader in the U.S, thus strengthening its moat.

The deal with Lennox

Just a few days ago, Hudson Technologies announced an alliance with Lennox International Inc., (LII) a leader in climate control products in the HVACR markets. Under this agreement, Hudson will be the exclusive supplier of certified reclaimed refrigerants to Lennox for the aftermarket support of their residential HVAC systems. Thanks to Lennox dealers and its penetration of the residential market, Hudson will be able to address a larger market where it usually found some struggles, as it was easier for the company to address industrial and commercial buildings.

Valuation

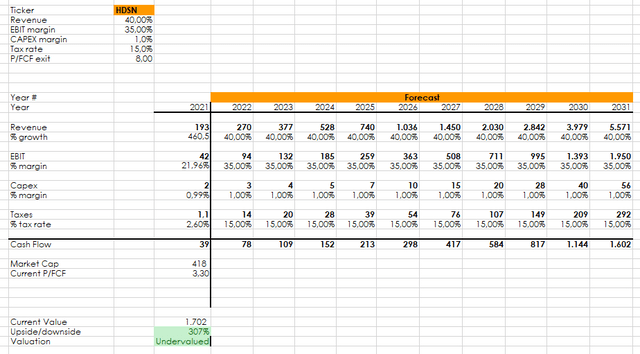

Let’s try to give some estimates. The company won’t grow its revenue 100% every year. Here is a bull case scenario where the growth rate over the next decade will average about 40% overdelivering the company’s forecasted 2024 revenue by $100 million. There are reasons to believe the company can go through such a scenario, given the strong tailwinds.

In this case, we are before a potential three-bagger.

Author, with data from Seeking Alpha

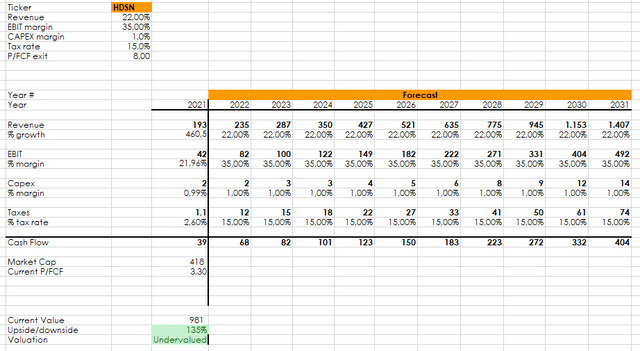

But let’s make a more conservative estimate, where the company doesn’t reach $400 million in revenue by 2024 and grows at a 22% rate, reaching the previous $350 million guidance.

This scenario still gives us an undervaluation of 135%.

Author, with data from Seeking Alpha

In both cases, I used a price/FCF multiple exit of 8, which I don’t think it is very high given the fact that the more Hudson grows its moat, the more reliable its FCF will be. However, the company has to prove to investors it is able to run through many market conditions, so I would stick to this multiple.

In any case, I see it as a buy and I consider it one of my investments with the highest potential.

Be the first to comment