fstop123/E+ via Getty Images

Intro & Thesis

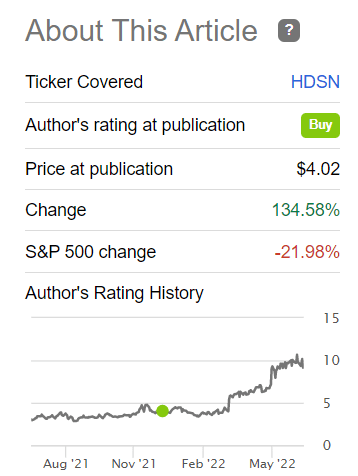

Over 190 days have passed since my bullish article on Hudson Technologies (NASDAQ:HDSN) stock was published, and in that time the stock has more than doubled in a down market:

Seeking Alpha, my article on HDSN (Dec 11, 2021)

This is probably my most successful stock call so far. Although HDSN has shown a tremendous price performance, I believe for several reasons that it can produce a similar return in the next year or two.

Why do I think so?

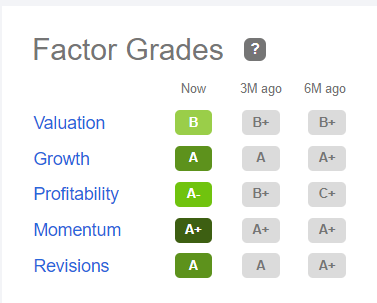

Recently, Hudson Technologies stock has been one of the top stocks in the Seeking Alpha Quant Ranking System due to its excellent factor grades:

Seeking Alpha

In the dynamics of the last 6 months, we see the following trends in these factors:

- The increase in quotations has somewhat compromised (just a little – from B+ to B) the quality of the “Valuation” Grade due to the multiple expansion;

- The “Growth” grade is now slightly lower than 6 months ago (from A+ to A), but still strong;

- The “Profitability” Grade improved significantly (from C + to A-) against the backdrop of the entire Industrials sector;

- The “Momentum” Grade remains consistently strong at the A+ level;

- The “Revisions” Grade is now slightly lower than 6 months ago (from A+ to A, just like the “Growth” Grade), but still looks strong against the backdrop of recession fears in the sector.

Let us take a closer look at the individual components of the above system to better understand how the company is doing after doubling its shares in less than six months.

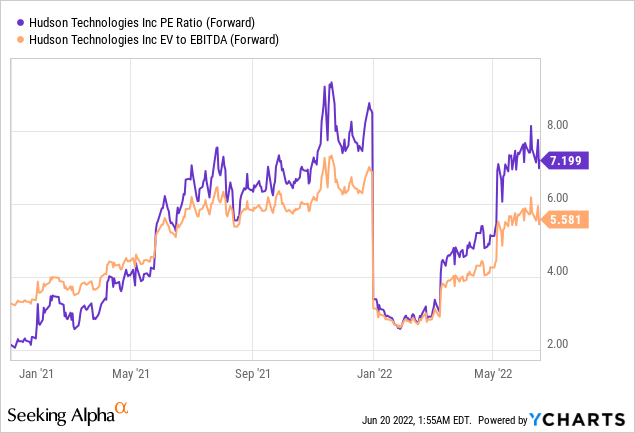

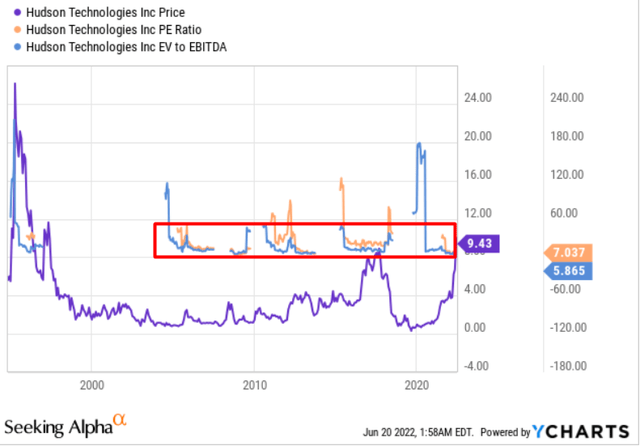

Today, HDSN stock trades at 7.2x forwarding earnings, and its EV/EBITDA (FWD) is ~5.6x – about 55% and 41% less than the sector median, respectively. In dynamics, however, these multiples values look about the same as in the middle of last year:

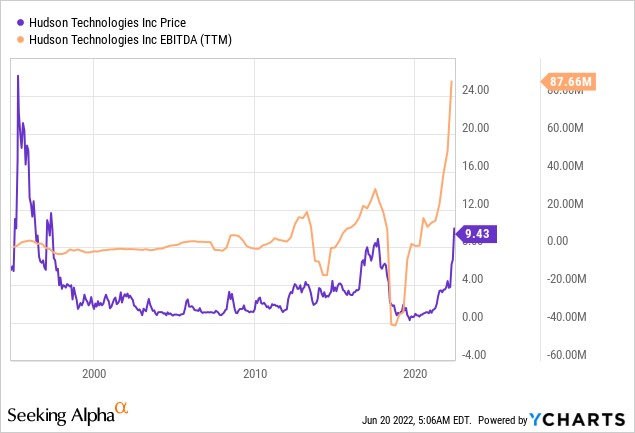

That is, these are roughly the levels at which the market “fairly” values the stock – a reference to a longer history also supports this statement:

In my opinion, all the company needs to do at its current valuation is to continue to grow EBITDA and earnings numbers so that share prices continue to rise due to the subsequent market re-rating. Due to the nature of the sector, I would not expect HDSN stock to grow thanks to multiple expansion – of course, it is possible, but it is unlikely to be the main driver of growth to be reckoned with.

Okay, but how can Hudson Technologies increase EBITDA and net income figures?

First, we must not forget the AIM Act, which directs EPA (the U.S. Environmental Protection Agency) to address reductions in virgin HFCs and gives the authority to do so in three ways:

-

Phase down the production and consumption of listed HFCs;

-

Manage these HFCs and their substitutes, and

-

Facilitate the transition to next-generation technologies.

Source: HDSN’s recent 10-Q

The implementation of this program assumed a 10% phase-out of HFCs in 2022 and a gradual phase-out of 85% by 2036. According to Hudson’s IR materials, HFOs and reclaimed HFCs will account for 70% of the total refrigerant market by 2029. And the company is the largest player in the US market with ~35% share.

A fairly sharp HFCs phase-down is planned for 2024 (40% reduction in virgin supply in 2024), so HDSN is likely to have a tailwind for another 2 years due to its market leadership – this should theoretically support the current historically rapid growth in EBITDA values.

The rapidness of the company’s growth will most likely slow down over time – but I think that’s already reflected in the market valuation. But by 2036, market conditions and regulation are likely to remain on the company’s side – that’s already a strong argument for management to continue working to improve margins.

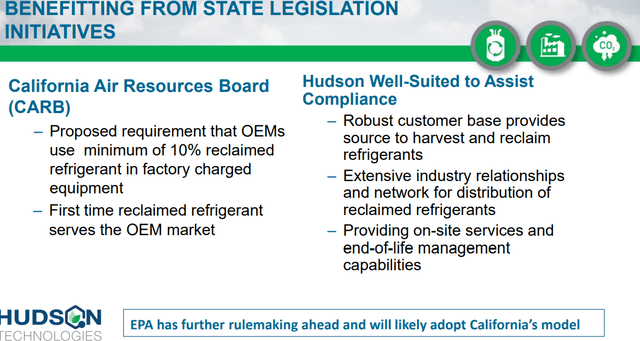

Second, without straying far from regulating the industry in which HDSN operates, there is a possibility that the recent requirements on California-based original equipment manufacturers ((OEMs)) could be applied to other states. If so, Hudson could significantly expand its addressable market.

Third, although the CEO warned us that the extremely high gross margin in Q1 2022 was an anomaly (54.33%), I am inclined to believe that the 30% GP long-term target may be too conservative an assumption going forward.

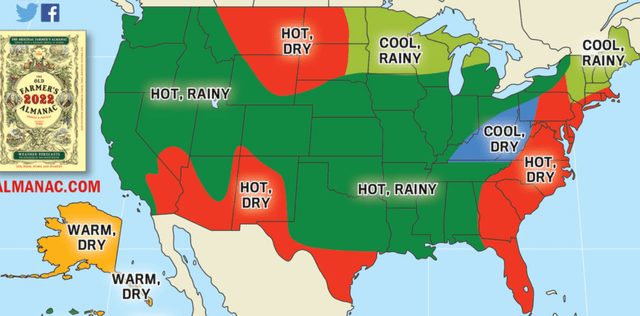

We know that market demand is really high – a) aftermarket demand for R-22 is expected to continue for about 20 years, and b) the AIM Act encourages reclamation, that’s where the company is the biggest player. Also, according to Almanac, this summer will be hotter and drier than usual – so refrigerants demand must be higher than usual.

At the same time, the supply of refrigerants remains quite tight. Price increases in chemicals used to make new refrigerant products have been successfully passed on to end-users by Hudson Technologies – I do not see why that ability would be lost soon.

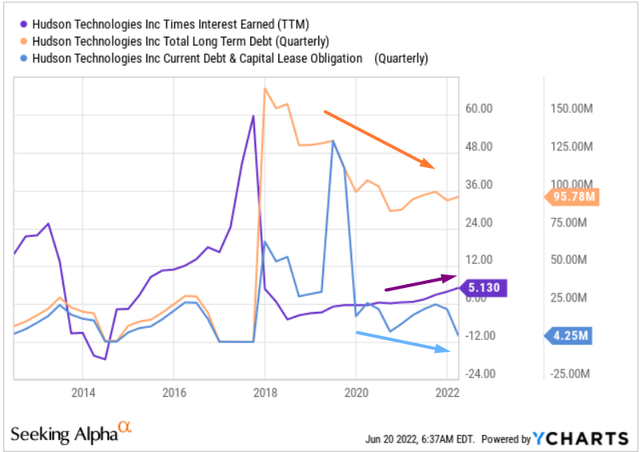

Fourth, management has made it clear that HDSN will continue to try to reduce its leverage – as excess earnings grow, the company will accelerate early repayments.

In my previous article, I wrote about the company’s debt problems in the past – those problems have been successfully resolved and now HDSN is actively working to reduce its debt load. If this continues, the actual value of the EPS figure in 2023 will be much larger than analysts expect.

The technical picture also looks strong

After the release of the last quarterly report, in which the extremely high gross margins surprised everyone (revenue and EPS beats were also massive ), HDSN shares opened with a gap of >13%, but this did not prevent the stock from continuing its explosive growth and closing almost 27% above the previous day’s closing price.

We saw something similar in March 2022 when the company reported on fiscal 2021 – after a meteoric rise following the report, the stock then found itself in an uptrend that brought investors another 30-35% by the date of the next quarter’s release.

All along, the 30-day exponential moving average has been reliable support for the established trend when we look at the daily chart. Now, after a short consolidation phase, the price has again supported itself on this line:

Investing.com, HDSN daily, author’s notes

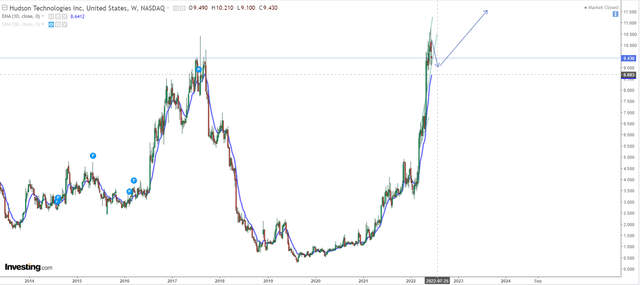

One of the possible scenarios is suggested by the weekly chart – the HDSN price dynamics have formed a clear “cup” that still lacks a “handle”. If the market continues to be pressured by fears of recession and high inflation as it has been in recent weeks, HDSN could correct 15-20% from current levels or enter a sideways trend. Q2 2022 results, to be announced in early August, are expected to be quite modest – EPS forecast is 39 cents, down 38% from Q1 2022 factual results (despite the start of the summer season). If Hudson can beat this expectation, which I assume it will, we will likely see another rally (like the previous 2) – this would be a welcome breakout on the weekly chart and would attract even greater investor demand.

Investing.com, HDSN weekly, author’s notes

Bottom Line

I admit that I may be misjudging the prospects for such a narrow niche of the industrial sector. HDSN’s leading position in its market is no guarantee of the company’s ever-growing financial performance – besides, management has warned that gross margin is likely to return to last year’s levels (31-32-33% of sales), which of course may already be included in next quarter’s EPS forecasts, but could still disappoint many investors and thus lead to selling in the market.

If the company cannot grow its earnings and EBITDA – my root assumption that justifies future stock growth – then HDSN’s valuation already looks generous enough. Again, I do not think multiple expansions is a potential growth driver.

However, despite the risks described above, I believe that HDSN has every chance of continuing to grow in the long term as it meets demand in a market that has no choice but to comply with the AIM Act and other regulations. I reaffirm my previous “Buy” rating.

Happy investing and stay healthy!

Be the first to comment