InspirationGP/iStock via Getty Images

In this economy, the picture for any individual company or industry can change rather rapidly. Some firms that earlier this year were struggling fundamentally may now be posting more robust results. And the opposite can also be true. One example of the former case playing out can be seen by looking at Fresh Del Monte Produce (NYSE:FDP), an enterprise focused on the production and sale of a variety of goods such as bananas, pineapples, avocados, and so much more. Although the company was negatively impacted by margin compression in the first half of this year, results more recently have shown a rebound in profitability and a continued incline in revenue. Shares of the business are most certainly not the cheapest in the space. But all things considered, they do look to be cheap enough to warrant a soft ‘buy’ rating at this time.

Getting more appetizing

The last time I wrote an article about Fresh Del Monte Produce was back in early September of this year. In that article, I talked about how well the company had done over the prior few months, particularly with attractive sales growth under its belt. At that same time, however, I did find myself to be a bit discouraged by the company’s bottom line, which had been impacted negatively by market conditions. Even with that pain, however, I could not help but to keep it at the ‘buy’ rating I had it at previously, reflecting my view that it should outperform the broader market for the foreseeable future. Since then, the company has not seen a great deal of upside. But with a rise of 2.6%, it is still outperforming the 0.9% increase experienced by the S&P 500 over the same window of time. And compared to the prior article I had written about the company in March of this year, shares are up roughly 4% compared to the 10% decline the S&P 500 has experienced.

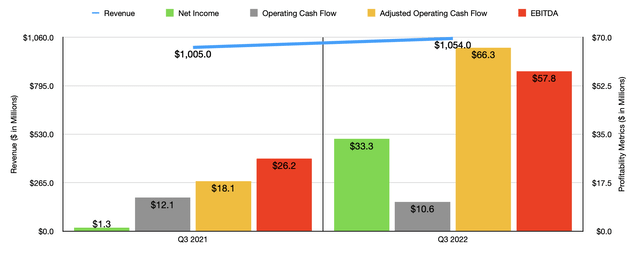

To understand why the company might be still outperforming the market, it would be wise to look at the most recent financial data available. This would be data covering the third quarter of the company’s 2022 fiscal year, which is the only quarter for which we have new results. During this time, revenue came in at $1.05 billion. This represents a 4.8% increase over the $1 billion the company generated the same time last year. Although the company suffered some because of foreign currency volatility, it did benefit from increased pricing aimed at combatting inflationary pressures.

With this rise in revenue came a rather significant improvement in bottom line results. During the quarter, the company generated net profits of $33.3 million. This dwarfs the $1.3 million profit generated the same time last year. This improvement on the company’s bottom line was driven by three primary factors. First and foremost, the increase in sales certainly helped. But in addition to that, the company benefited from the aforementioned pricing increases, which apparently did not have a material impact on volume. Because of this, the firm’s gross profit margin in the latest quarter totaled 8.35%. That compares to the 4.87% reported the same time last year. And finally, the company saw its selling, general, and administrative expenses drop from 4.78% of sales in the third quarter of 2021 to 4.44% at the same time this year. This, management said, was mostly a result of lower advertising expenses allocated by management. With this rise in profitability, we also saw other profitability metrics improved. Admittedly, operating cash flow did worsen year over year, dropping from $12.1 million to $10.6 million. But if we adjust for changes in working capital, it would have risen from $18.1 million to $66.3 million. And over that same window of time, EBITDA also improved, jumping from $26.2 million to $57.8 million.

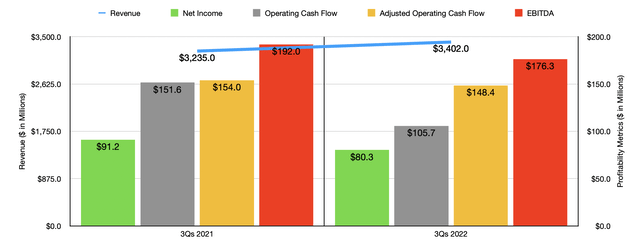

Despite this strong performance for the third quarter, results for the first nine months of the 2022 fiscal year as a whole do look a bit weak compared to what the company achieved last year. Yes, sales are still up, having risen from $3.24 billion to $3.40 billion. But net income of $80.3 million is lower than the $91.2 million reported the same time last year. Operating cash flow fell from $151.6 million to $105.7 million, while the adjusted figure for it declined from $154 million to $148.4 million. Even EBITDA it’s taken a step back, declining from $192 million to $176.3 million.

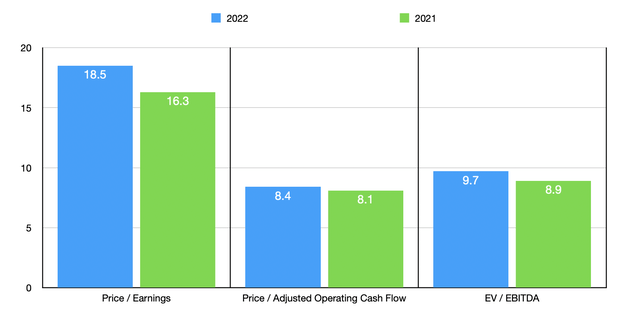

It’s difficult to know what to expect when it comes to the rest of the fiscal year. A case could be made that the strong third quarter could indicate further improvement in the fourth quarter. Instead though, I would prefer to be more conservative and simply annualize results experienced so far for the year. Following this approach, we would end up with net income of $70.4 million, adjusted operating cash flow of $154.5 million, and EBITDA totaling $189.9 million. Based on these figures, the company would be trading at a forward price to earnings multiple of 18.5, a forward price to adjusted operating cash flow multiple of 8.4, and a forward EV to EBITDA multiple of 9.7. For context, using the data from the 2021 fiscal year instead would give us multiples of 16.3, 8.1, and 8.9, respectively. As part of my analysis, I compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 7.5 to a high of 16. In this case, our prospect was the most expensive of the group. Using the price to operating cash flow approach, the range was from 13.2 to 13.3, with Fresh Del Monte Produce being cheaper than all four companies that had positive results. And finally, using the EV to EBITDA approach, the range would be from 6.4 to 10.9. In this scenario, four of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Fresh Del Monte Produce | 18.5 | 8.4 | 9.7 |

| Alico (ALCO) | 7.5 | 22.6 | 6.4 |

| Archer-Daniels-Midland (ADM) | 13.1 | 13.2 | 9.4 |

| Darling Ingredients (DAR) | 16.0 | 13.2 | 10.9 |

| Ingredion (INGR) | 14.4 | 30.1 | 9.1 |

| Bunge (BG) | 10.2 | N/A | 7.5 |

Takeaway

For the most part, relative to similar players, Fresh Del Monte Produce looks to be a bit lofty. But on an absolute basis, shares do look quite affordable at this time. It’s worth noting that my valuation of the company does not take into account the likelihood that the final quarter of the year could look more robust like the third quarter was. If this does come to pass, the company could get cheaper still. After seeing that solid quarter and factoring in the rest of the data provided, I still do feel as though the firm warrants a soft ‘buy’ at this time.

Be the first to comment